TIDMPAGE

RNS Number : 9265H

PageGroup plc

09 August 2021

9 August 2021

PageGroup plc

Half Year Results for the Period Ended 30 June 2021

Strong Financial and Operational Performance

PageGroup plc ("PageGroup"), the specialist professional

recruitment company, announces its unaudited half year results for

the period ended 30 June 2021.

Note: Given the magnitude of the impact of COVID-19 in 2020, we

are providing comparisons in constant currencies against 2019, to

ensure the most appropriate representation of current trading.

Comparisons to 2020 are also given in the tables.

Financial summary

(6 months to 30 June Reported CC vs CC vs

2021) 2021 2020 2019 vs. 2020 2020* 2019*

Revenue GBP766.4m GBP655.0m GBP820.5m +17.0% +19.7% -4.2%

---------- ---------- ---------- ---------- ------- --------

Gross profit GBP404.2m GBP300.7m GBP433.5m +34.4% +38.3% -3.7%

---------- ---------- ---------- ---------- ------- --------

Operating profit GBP64.3m GBP0.4m GBP75.6m >100% >100% -12.5%

---------- ---------- ---------- ---------- ------- --------

Profit/(Loss) before

tax GBP63.7m -GBP0.8m GBP74.6m >100%

---------- ---------- ---------- ----------

Basic earnings/(loss)

per share 12.2p -0.5p 16.8p >100%

---------- ---------- ---------- ----------

Diluted earnings/(loss)

per share 12.1p -0.5p 16.8p >100%

---------- ---------- ---------- ----------

Interim dividend per

share 4.70p - 4.30p

---------- ---------- ----------

Special dividend per

share 26.71p - 12.73p

---------- ---------- ----------

H1 Summary

-- Group operating profit of GBP64.3m (H1 2020: GBP0.4m; H1 2019: GBP75.6m)

-- Conversion rate** increased to 15.9% (H1 2020: 0.1%; H1 2019: 17.4%)

-- Gross profit per fee earner up 10.7% on H1 2019 to GBP75.8k

(H1 2020: GBP53.2k, H1 2019: GBP70.7k)

-- Total headcount increased by 381 (5.7%) to 7,075 at the end

of June, but remains down c. 8% on pre COVID-19 levels at the end

of 2019

-- Strong Balance Sheet, with net cash of GBP163.8m (H1 2020: GBP161.7m, H1 2019: GBP81.7m)

-- Returning to dividend policy, interim dividend of 4.70 pence

per share and special dividend of 26.71 pence per share, together

totalling GBP100m

-- Outlook upgraded on 7 July 2021, full year operating profit

expected to be within the range of GBP125m - GBP135m

* in constant currencies

** operating profit as a percentage of gross profit

Commenting, Steve Ingham, Chief Executive Officer, said:

"Throughout the pandemic we have continued to focus on the

protection and wellbeing of our employees, candidates and clients,

whilst progressing strategic investments in our platform to take

advantage of the recovery. The tough and challenging year in 2020

has strengthened our culture, diversity and the values in the

business which are now re-affirmed at the forefront of our

operations. I am immensely proud of the spirit, resilience, and

commitment of all our people. This, I believe, is reflected in our

results.

"Gross profit for the first half was down just 3.7% on H1 2019,

our record year, and we have delivered operating profit of GBP64.3m

in H1 2021, at a conversion rate of 15.9%.

"We remain confident in our strategy of maintaining and

investing in our platform. We continued to invest carefully in

headcount, demonstrated by the c. 400 experienced hires we added in

2020, and around a further 400 in H1 2021, as well as rolling-out

new technology and innovation. Our headcount is currently down c.

8% on the pre-pandemic level at the end of 2019. As a result of the

more favourable trading conditions in H1, as well as this reduction

in our fee earner headcount, our gross profit per fee earner is up

10.7% on H1 2019.

"Due to the uncertain trading conditions caused by COVID-19 last

year, we chose to temporarily suspend our dividend policy and

cancel our 2019 final dividend. Given the improvement in trading

conditions in H1, as well as our strong liquidity position, the

Board has decided to reinstate our dividend policy. As such, we are

announcing today an interim dividend of 4.70 pence per share, an

increase of 9.3% on the 2019 interim dividend. In addition, in line

with our policy of returning surplus capital to shareholders, we

are also pleased to announce a special dividend of 26.71 pence per

share, totalling GBP85m. Taking both dividends together, this

amounts to a cash return to shareholders of GBP100m, payable on 13

October.

"Looking ahead, there continues to be a high degree of global

macro-economic uncertainty as COVID-19 remains a significant issue

and restrictions continue in a number of the Group's markets.

Additionally, at this stage of the recovery, it is not clear

whether the improved performance is still the result of pent-up

supply and demand, or a sustainable trend. However, as stated on 7

July 2021, the strength of our performance in H1, notably in June,

and absent any unexpected events, we expect full year operating

profit to be within the range of GBP125m - GBP135m.

"We are the clear leader in many of our markets, with a highly

experienced senior management team, which, we believe, positions us

well to take advantage of opportunities to grow and improve our

business. We have maintained our focus on driving progress towards

our long-term strategic goals."

INTERIM MANAGEMENT REPORT

GROUP RESULTS

GROSS PROFIT GBPm Growth Rates

% of Group H1 2021 H1 2020 H1 2019 Reported vs. 2020 CC vs 2020 CC vs 2019

----------- -------- -------- -------- ------------------ ----------- -----------

EMEA 51% 203.5 154.5 213.1 +31.7% +33.5% -3.7%

----------- -------- -------- -------- ------------------ ----------- -----------

Asia Pacific 20% 81.8 56.9 81.8 +43.8% +48.6% +3.5%

----------- -------- -------- -------- ------------------ ----------- -----------

Americas 15% 61.3 46.9 69.2 +30.6% +44.2% +1.6%

----------- -------- -------- -------- ------------------ ----------- -----------

UK 14% 57.6 42.4 69.4 +35.9% +35.9% -17.0%

----------- -------- -------- -------- ------------------ ----------- -----------

Total 100% 404.2 300.7 433.5 +34.4% +38.3% -3.7%

----------- -------- -------- -------- ------------------ ----------- -----------

Permanent 77% 311.3 211.8 330.6 +47.0% +51.9% -2.2%

----------- -------- -------- -------- ------------------ ----------- -----------

Temporary 23% 92.9 88.9 102.9 +4.5% +6.0% -8.4%

----------- -------- -------- -------- ------------------ ----------- -----------

The Group's revenue for the six months ended 30 June 2021

increased 17.0% to GBP766.4m (2020: GBP655.0m; 2019: GBP820.5m) and

gross profit increased 34.4% to GBP404.2m (2020: GBP300.7m; 2019:

GBP433.5m). In constant currencies, the Group's revenue increased

19.7% and gross profit increased 38.3%. In constant currencies vs.

2019, the Group's revenue decreased 4.2%, with gross profit down

3.7%. The Group's revenue mix between permanent and temporary

placements was 41:59 (2020: 33:67; 2019: 41:59) and for gross

profit was 77:23 (2020: 70:30; 2019: 76:24), as the recovery in

2021 has been driven by permanent recruitment.

Revenue from temporary placements comprises the salaries of

those placed, together with the margin charged. Overall, pricing

has remained relatively stable across all regions. Fee earner

productivity increased by 10.7% vs H1 2019 and 46.6% vs H1 2020.

This was due to gross profit being down only 3.7%, but with fee

earner headcount having decreased from 6,035 in H1 2019 to 5,443 in

H1 2021.

The Group's organic growth model and profit-based team bonus

ensures costs remain tightly controlled. 79% of first half costs

were employee related, including salaries, bonuses, share-based

long-term incentives, and training and relocation costs.

In total, administrative expenses in the first half decreased

5.0% in reported rates compared to 2019 to GBP339.9m (2020:

GBP300.3m; 2019: GBP357.9m), driven by the decrease in headcount.

In constant currency compared to 2019, administrative expenses were

down 1.8% and operating profit decreased 12.5% to GBP64.3m (2020:

GBP0.4m; 2019: GBP75.6m). This was an increase of over 100%

compared to 2020 in both reported rates and constant currency.

The Group's conversion rate, which represents the ratio of

operating profit to gross profit, was 15.9% (2020: 0.1%; 2019:

17.4%) due to the combination of an increase in gross profit and

the reduction in our headcount of c. 8% on pre COVID-19 levels,

offset by tougher trading conditions at the start of the year.

FOREIGN EXCHANGE

Movements in foreign exchange reduced the Group's gross profit

and operating profit by c. GBP12m and c. GBP2m respectively.

OTHER ITEMS

Interest received and interest paid was broadly consistent with

H1 2020. The charge for taxation for the half year was an effective

tax rate of 39.4% (H1 2020: -107.6%, H1 2019: 27.5%).

The effective tax rate for the first half is significantly lower

than the prior year, as the global pandemic materially impacted

trading in H1 2020. Last year, this resulted in changes in deferred

tax asset recognition on losses and other timing differences due to

uncertainty over the availability of future taxable income in

certain territories. The CVAE tax in France, which is linked to

revenue rather than profit, has also had a disproportionate impact

on the rate in 2020.

Basic earnings per share and diluted earnings per share for the

six months ended 30 June 2021 were 12.2p and 12.1p respectively

(2020: basic and diluted loss per share -0.5p; 2019: basic and

diluted earnings per share 16.8p).

CASH FLOW

The Group started the year with net cash of GBP166.0m. In H1,

GBP56.7m was generated from operations due to improved trading

conditions, offset by an increase in the permanent placements'

debtor receivable. Tax paid was GBP2 1.8 m and net capital

expenditure was GBP 10.7 m. During the first half, GBP6.9m was

received from exercises of share options (2020: GBP0.1m) and

GBP10.4m was spent on the purchase of shares into the Employee

Benefit Trust (2020: GBP1.6m, 2019: nil). As a result, the Group

had net cash of GBP163.8m at 30 June 2021, broadly in line with the

prior year of GBP161.7m.

CAPITAL ALLOCATION POLICY

It is the Directors' intention to continue to finance the

activities and development of the Group from retained earnings and

to maintain a strong balance sheet position.

The Group's first use of cash is to satisfy operational and

investment requirements, as well as to hedge its liabilities under

the Group's share plans. The level of cash required for this

purpose will vary depending upon the revenue mix of geographies,

permanent and temporary recruitment, and point in the economic

cycle.

Our second use of cash is to make returns to shareholders by way

of an ordinary dividend. Our policy is to grow the ordinary

dividend over the course of the economic cycle in a way that we

believe we can sustain the level of ordinary dividend payment

during downturns, as well as increasing it during more prosperous

times.

Cash generated in excess of these first two priorities will be

returned to shareholders through supplementary returns, using

special dividends and/or share buybacks.

Due to the uncertain trading conditions caused by COVID-19 last

year, we chose to temporarily suspend our dividend policy and

cancel our 2019 final dividend. Given the improvement in trading

conditions in H1, as well as our strong liquidity position, the

Board have decided to reinstate our dividend policy. As such, we

are announcing today an interim dividend of 4.70 pence per share,

an increase of 9.3% over the 2019 interim dividend. In addition, in

line with our policy of returning surplus capital to shareholders,

we are also pleased to announce a special dividend of 26.71 pence

per share, totalling GBP85m. Taking both dividends together, this

amounts to a cash return to shareholders of GBP100m, payable on 13

October to shareholders on the register as at 3 September.

GEOGRAPHICAL ANALYSIS ( All growth rates given below are in

constant currency vs. 2019 unless otherwise stated )

EUROPE, MIDDLE EAST AND AFRICA (EMEA)

EMEA GBPm Growth rates

(51% of Group in

H1 2021) H1 2021 H1 2020 H1 2019 Reported CC vs. 2020 CC vs. 2019

-------- -------- -------- --------- ------------ ------------

Gross Profit 203.5 154.5 213.1 +31.7% +33.5% -3.7%

-------- -------- -------- --------- ------------ ------------

Operating Profit 35.9 10.6 45.6 >100% >100% -20.0%

-------- -------- -------- --------- ------------ ------------

Conversion Rate

(%) 17.6% 6.8% 21.4%

-------- -------- -------- --------- ------------ ------------

EMEA is the Group's largest region, contributing 51% of Group

first half gross profit. In constant currencies vs. 2019, revenue

was down 3.9% and gross profit was down 3.7%. Against 2020, in

reported rates, revenue in the region increased 15.9% to GBP408.9m

(2020: GBP352.9m) and gross profit increased 31.7% to GBP203.5m

(2020: GBP154.5m). In constant currencies, revenue increased 17.0%

on the first half of 2020 and gross profit increased by 33.5%.

Trading conditions in EMEA started improving towards the end of

March and this improvement continued into the second quarter.

Michael Page grew 9% vs. 2019. However, our more temporary focused

Page Personnel business, was down 19%. France, 14% of the Group and

around a third of the region, was down 15%. Germany, the Group's

third largest market, delivered a record first half and was up 19%.

This was driven by a standout performance from our Technology

focused Interim business, up 47%. Southern Europe grew 3%, with

Italy flat and Spain up 4%. Benelux declined 11%, however Belgium

delivered a record performance, up 3%. Middle East and Africa

declined 10%.

Operating profit for H1 was GBP35.9m (2020: GBP10.6m; 2019:

GBP45.6m) with a conversion rate of 17.6% (2020: 6.8%; 2019:

21.4%). Profitability improved significantly on 2020 due to the

improvement in trading conditions. We remain below 2019 operating

profit and conversion rate, primarily due to the slower recovery in

France, our largest country in the region. Headcount across the

region increased by 164 (5.5%) in the first half, to 3,143 at the

end of June 2021 (2,979 at 31 December 2020).

ASIA PACIFIC

Asia Pacific GBPm Growth rates

(20% of Group in

H1 2021) H1 2021 H1 2020 H1 2019 Reported CC vs. 2020 CC vs. 2019

-------- -------- -------- --------- ------------ ------------

Gross Profit 81.8 56.9 81.8 +43.8% +48.6% +3.5%

-------- -------- -------- --------- ------------ ------------

Operating Profit 15.3 -3.6 8.8 >100% >100% +81.2%

-------- -------- -------- --------- ------------ ------------

Conversion Rate

(%) 18.8% -6.3% 10.8%

-------- -------- -------- --------- ------------ ------------

In Asia Pacific, representing 20% of Group first half gross

profit, revenue declined 1.9% vs. 2019 in constant currency.

However gross profit was up 3.5%, a record first half. Against

2020, revenue increased 22.7% in reported rates to GBP129.2m (2020:

GBP105.3m) and gross profit increased 43.8% to GBP81.8m (2020:

GBP56.9m). In constant currency against 2020, revenue increased

24.8% in the first half and gross profit increased by 48.6%.

In Mainland China, where nearly all of our people are back in

the office, we delivered a record first half, up 23% and exited

June strongly, up 46%. Hong Kong, where trading conditions remain

challenging, was down 25%. Overall, Greater China grew 3% for the

first half. South East Asia, one of our Large High Potential

markets, delivered a record performance, up 21%. Singapore was down

1%, although exited June strongly, up 22%. The other five countries

in the region grew 44%, collectively. Japan delivered a record

first half, growing 10%, largely driven by a strong performance

from our contracting business. India, despite being one of the

worst affected countries by COVID-19, delivered a record

performance up 39%. Overall for the first half, Australia was down

15%, although we saw an improvement in June, exiting down just

2%.

Operating profit increased to GBP15.3m (2020: -3.6m; 2019:

GBP8.8m) and our conversion rate increased to 18.8% (2020: -6.3%;

2019: 10.8%). Asia Pacific has been our strongest performing

region, which, combined with a large reduction in headcount, has

driven a significant improvement in profitability compared to 2019.

Headcount across the region increased by 153 in the first half

(11.0%) to 1,538 at the end of June 2021 (1,385 at 31 December

2020).

THE AMERICAS

Americas GBPm Growth rates

(15% of Group in

H1 2021) H1 2021 H1 2020 H1 2019 Reported CC vs. 2020 CC vs. 2019

-------- -------- -------- --------- ------------ ------------

Gross Profit 61.3 46.9 69.2 +30.6% +44.2% +1.6%

-------- -------- -------- --------- ------------ ------------

Operating Profit 8.8 -4.9 8.7 >100% >100% +8.6%

-------- -------- -------- --------- ------------ ------------

Conversion Rate

(%) 14.3% -10.5% 12.5%

-------- -------- -------- --------- ------------ ------------

In the Americas, representing 15% of Group first half gross

profit, despite being one of the worst COVID-19 affected regions,

revenue increased by 18.6% and gross profit increased 1.6% vs. 2019

in constant currencies. Against 2020, revenue increased 30.4% in

reported rates to GBP102.6m (2020: GBP78.7m), while gross profit

increased 30.6% to GBP61.3m (2020: GBP46.9m). In constant

currencies against 2020, revenue increased by 44.6% and gross

profit increased by 44.2%.

North America was flat overall, with the US up 2%, a record

first half. Whilst conditions remain challenging in our largest

discipline, Property & Construction, we have seen strong growth

in other areas, such as Technology. The US was up 19% in June.

For the first half, Latin America was up 5%, a record first

half, with Brazil up 18%. Mexico, our largest country in the

region, was down 10%, but exited June +3%. Elsewhere in Latin

America, our other five countries in the region grew 11%,

collectively.

Operating profit was GBP8.8m (2020: -GBP4.9m; 2019: GBP8.7m),

with a conversion rate of 14.3% (2020: -10.5%; 2019: 12.5%).

Trading conditions improved significantly in the first half

throughout the region, which means the conversion rate is now

higher than in 2019. Headcount in the Americas was up 30 (2.6%) in

the period, to 1,185 at the end of June 2021 (1,155 at 31 December

2020).

UNITED KINGDOM

UK GBPm Growth rate

(14% of Group in

H1 2021) H1 2021 H1 2020 H1 2019 vs. 2020 vs. 2019

-------- -------- -------- --------- ---------

Gross Profit 57.6 42.4 69.4 +35.9% -17.0%

-------- -------- -------- --------- ---------

Operating Profit 4.3 -1.7 12.5 >100% -65.4%

-------- -------- -------- --------- ---------

Conversion Rate (%) 7.5% -3.9% 18.0%

-------- -------- -------- --------- ---------

In the UK, representing 14% of Group first half gross profit,

revenue decreased 20.1% vs. 2019 to GBP125.7m (2020: GBP118.1m;

2019: GBP157.4m) and gross profit declined 17.0% to GBP57.6m (2020:

GBP42.4m; 2019: GBP69.4m).

Our Michael Page business was down 12%, whereas our more

Temporary focused Page Personnel business was down 30%. We saw a

sequential improvement throughout the first half as lockdowns

eased, exiting June down just 2%, with our Michael Page business up

7% on June 2019.

Operating profit was GBP4.3m (2020: -GBP1.7m; 2019: GBP12.5m)

and our conversion rate was 7.5% (2020: -3.9%; 2019: 18.0%). This

was after the furlough repayment of GBP3.4m to HMRC and excluding

this one-off item, our conversion rate was 13.3%. Headcount was up

by 34 (2.9%) during the first half to 1,209 at the end of June 2021

(1,175 at 31 December 2019).

KEY PERFORMANCE INDICATORS ("KPIs")

We measure our progress against our strategic objectives using

the following key performance indicators:

KPI Definition, method of calculation and analysis

Gross profit How measured: Gross profit represents revenue less

growth cost of sales and consists of the total placement

fees of permanent candidates, the margin earned on

the placement of temporary candidates and the margin

on advertising income, i.e. it represents net fee

income. The measure used is the increase or decrease

in gross profit as a percentage of the prior year

gross profit.

Why it's important: The growth of gross profit relative

to the previous year is an indicator of the growth

in net fees of the business as a whole. It demonstrates

whether we are in line with our strategy to grow the

business.

How we performed in H1 2021: Trading conditions continued

to improve throughout the first half of 2021 which

resulted in gross profit declining just -3.7% vs.

H1 2019 in constant currencies. Against H1 2020 this

represented an increase of +34.4% at reported rates

and +38.3% in constant currencies

Relevant strategic objective: Organic growth

--------------------------------------------------------------

Gross profit How measured: Total gross profit from a) geographic

diversification regions outside the UK; and b) disciplines outside

of Accounting and Financial Services, each expressed

as a percentage of total gross profit.

Why it's important: These percentages give an indication

of how the business has diversified its revenue streams

away from its historic concentrations in the UK and

from the Accounting and Financial Services discipline.

How we performed in H1 2021: Geographies: the percentage

outside the UK was broadly in line with 2020 at 85.7%

(H1 2020: 85.9%; H1 2019: 84.0%), but remains up on

2019, largely as a result of the UK being impacted

more severely by COVID-19.

Disciplines: the percentage outside of Accounting

and Financial Services increased to 67.8% (H1 2020:

64.9%; H1 2019: 65.3%), due to stronger growth in

our other disciplines such as Technology, Healthcare

& Life Sciences and Digital.

Relevant strategic objective: Diversification

--------------------------------------------------------------

Ratio of gross How measured: Gross profit from each type of placement

profits generated expressed as a percentage of total gross profit.

from permanent

and temporary Why it's important: This ratio helps us to understand

placements where we are in the economic cycle, since the temporary

market tends to be more resilient when the economy

is weak. However, in several of our core strategic

markets, working in a temporary role or as a contractor

or interim employee is not currently normal practice,

for example Mainland China.

How we performed in H1 2021: 77% of our gross profit

was generated from permanent placements, above the

70% in 2020 and 76% in 2019. The recovery seen in

H1 2021 has been driven by permanent recruitment,

with conditions more challenging in temporary, particularly

at lower salary levels.

Relevant strategic objective: Organic growth

--------------------------------------------------------------

Gross profit How measured: Gross profit for the year divided by

per fee earner the average number of fee earners in the year.

Why it's important: This is a key indicator of productivity.

How we performed in H1 2021: Gross profit per fee

earner of GBP75.8k was up 10.7% vs. 2019 and up 46.6%

vs. 2020 in constant currencies. The improvement was

driven by a decrease in fee earner headcount from

6,035 in H1 2019 to 5,443 in H1 2021, as well as the

overall improvement in trading conditions.

Relevant strategic objective: Organic growth

--------------------------------------------------------------

Conversion rate How measured: Operating profit (EBIT) as a percentage

of gross profit.

Why it's important: This demonstrates the Group's

effectiveness at controlling the costs and expenses

associated with its normal business operations. It

will be impacted by the level of productivity and

the level of investment for future growth.

How we performed in H1 2021: Operating profit as

a percentage of gross profit increased to 15.9% compared

to the prior year (H1 2020: 0.1%; H1 2019: 17.4%)

as a result of improvements in trading conditions,

as well as our headcount being down c. 8% on pre COVID-19

levels, offset by tougher trading conditions at the

start of the year.

Relevant strategic objective: Build for the long-term

--------------------------------------------------------------

Basic earnings How measured: Profit for the year attributable to

per share the Group's equity shareholders, divided by the weighted

average number of shares in issue during the year.

Why it's important: This measures the overall profitability

of the Group.

How we performed in H1 2021: Earnings per share (EPS)

in H1 2021 was 12.2p, a significant increase on the

EPS in 2020 of -0.5p but still below 2019 EPS of 16.8p.

The increase on 2020 is driven by the significant

increase in profits as trading conditions have continued

to recover, as well as our lower fee earner headcount.

Relevant strategic objective: Build for the long-term,

organic growth

--------------------------------------------------------------

Fee-earner: operational How measured: The percentage of fee-earners compared

support staff to operational support staff at the period-end, expressed

headcount ratio as a ratio.

Why it's important: This reflects the operational

efficiency in the business in terms of our ability

to grow the revenue-generating platform at a faster

rate than the staff needed to support this growth.

How we performed in H1 2021: The ratio was 77:23

(H1 2020: 77:23; H1 2019: 78:22). In line with our

strategy of maintaining and investing in our platform,

we have added a further c. 400 experienced fee earners

in the first half of this year. These, plus those

who have joined from outside recruitment, net of attrition,

mean that we have added 298 fee earners in the first

half of 2021. Our operational support headcount rose

by 83 in H1, and, as such, our ratio of fee earners

to operational support staff was maintained at 77:23.

Relevant strategic objective: Sustainable growth

--------------------------------------------------------------

Fee-earner headcount How measured: Number of fee-earners and directors

growth involved in revenue-generating activities at the period

end, expressed as the percentage change compared to

the prior year.

Why it's important: Growth in fee-earners is a guide

to our confidence in the business and macro-economic

outlook, as it reflects expectations as to the level

of future demand above the existing capacity within

the business.

How we performed in H1 2021: Net fee earner headcount

increased by 298 in H1 2021, resulting in 5,443 fee

earners at the end of June. We have continued to invest

in those disciplines where we have seen the strongest

growth, such as Technology, Contracting, Healthcare

& Life Sciences and Digital.

Relevant strategic objective: Sustainable growth

--------------------------------------------------------------

Net cash How measured: Cash and short-term deposits less bank

overdrafts and loans.

Why it's important: The level of net cash is a key

measure of our success in managing our working capital

and determines our ability to reinvest in the business

and to return cash to shareholders.

How we performed in H1 2021: Net cash at 30 June

2021 was GBP163.8m (H1 2020: GBP161.7m; H1 2019: GBP81.7m).

The closing cash position is broadly in line with

2020, with increased profitability offset by an increase

in the permanent placements debtor receivable. GBP6.9m

was received from exercises of share options (H1 2020:

GBP0.1m) and GBP10.4m was spent on the purchase of

shares into the Employee Benefit Trust (H1 2020: GBP1.6m,

H1 2019: nil).

Relevant strategic objective: Build for the long-term

--------------------------------------------------------------

The source of data and calculation methods year-on-year are on a

consistent basis. The movements in KPIs are in line with

expectations. Disclosure for GHG emissions and People KPIs is

provided annually.

PRINCIPAL RISKS AND UNCERTAINTIES

The management of the business and the execution of the Group's

strategy are subject to a number of risks.

The main risks that PageGroup believes could potentially impact

the Group's operating and financial performance for the remainder

of the financial year remain those as set out in the Annual Report

and Accounts for the year ending 31 December 2020 on pages 41 to

48.

TREASURY MANAGEMENT, BANK FACILITIES AND CURRENCY RISK

The Group operates multi-currency cash concentration and

notional cash pools, and an interest enhancement facility. The

Eurozone subsidiaries and the UK-based Group Treasury subsidiary

participate in the cash concentration arrangement. The Group

Treasury subsidiary and UK business utilise the notional cash pool

and the Asia Pacific subsidiaries operate the interest enhancement

facility. The structures facilitate interest compensation for cash

whilst supporting working capital requirements.

PageGroup maintains a Confidential Invoice Facility with HSBC

whereby the Group has the option to discount receivables in order

to advance cash. The Group also has a Revolving Credit Facility

with BBVA, expiring in 2023, with a total drawable amount of

GBP30m. Neither of these facilities were in use as at 30 June.

These facilities are used on an ad hoc basis to fund any major

Group GBP cash outflows.

In May 2019 PageGroup entered into a GBP30m revolving credit

facility (RCF) with BBVA. To ensure the RCF remains compliant with

regulations (specifically Libor transition), we have amended the

original terms and at the same time took the opportunity to enhance

other terms, providing further strength and resilience to the

Group. The revised terms are:

-- Incorporation of Libor transition clauses

-- Executed the first of two right of extensions, meaning the RCF now expires in May 2023

-- Linked the BBVA RCF to sustainable finance KPI's and

-- Reduced the covenants and half year reporting requirements.

The Group has also successfully transitioned 100% of our cash

investments into ESG (sustainable) Money Market funds, further

enhancing our sustainability vision.

In line with the Group's investment policy, excess cash is

invested in a range of products; including call accounts, money

market deposits and money market funds. The Group actively monitors

its counterparty exposure to protect its capital investments and

reduce risk. Accordingly, the Group opened two additional money

market funds, both of which hold an AAA rating.

The main functional currencies of the Group are Sterling, Euro,

Chinese Renminbi, US Dollar, Singapore Dollar, Hong Kong Dollar and

Australian Dollar. The Group does not have material transactional

currency exposures. The Group is exposed to foreign currency

translation differences in accounting for its overseas operations.

The Group policy is not to hedge translation exposures.

In certain cases, where the Group gives or receives short-term

loans to and from other Group companies that differ from the

Group's reporting currency, it may use short-dated foreign exchange

swap derivative financial instruments to manage the currency and

interest rate exposure that arises on these loans.

ESG

The Group is committed to become carbon net zero within five

years. We are now securing over fifty percent of our global energy

from renewable sources and we look forward to working with our

remaining landlords and energy suppliers to transition the

remaining offices to renewable energy. We have also increased our

reporting capability and we have engaged with the Carbon Disclosure

Project (CDP) for the first time this year.

The Group is announcing today our commitment to change over one

million lives within ten years, by giving back to society using our

skills as a recruiter. We will do this by working with people in

need through charities, community groups, schools and every day as

a recruiter, hosting webinars and placing people in the next stages

of their careers. Our social impact work is integral to who we are,

and to the communities in which we operate. This work re-enforces

our commitment to the United Nationals Sustainable Development

Goals: to increase gender equality; provide decent work and

economic growth; and reduce inequalities within society.

To further re-enforce our commitment to sustainability, we

recently renegotiated our debt financing with BBVA, linking our

revolving credit facility to environmental and social

sustainability KPIs. We are also launching today our inaugural

sustainability report, a copy of which can be downloaded on our

website.

GOING CONCERN

The Board has undertaken a review of the Group's forecasts and

associated risks and sensitivities, considering the expected impact

of COVID-19 on trading in the period from the date of approval of

the interim financial statements to August 2022 (review

period).

The Group had GBP163.8m of cash as at 30 June 2021, with no debt

except for IFRS 16 lease liabilities of GBP91.0m. Debt facilities

relevant to the review period comprise a committed GBP30m BBVA RCF

(May 2023 maturity), an uncommitted UK trade debtor discounting

facility (up to GBP50m depending on debtor levels) and an

uncommitted GBP20m UK bank overdraft facility.

Throughout the first half of the year, the activity levels

picked up in most of the Group's markets and the cost control and

cash preservation methods used in 2020 were not repeated. However,

due to the pandemic there remains reductions in travel and

entertaining expenses. There continues to be a high degree of

global macro-economic uncertainty, as COVID-19 remains a

significant issue and restrictions remain in a number of countries

across the Group.

However, given the analysis performed, there are no plausible

downside scenarios that would cause an issue. As a result, given

the strength of performance in H1, the level of cash in the

business and Group's borrowing facilities, the geographical and

discipline diversification, limited concentration risk, as well as

the ability to manage the cost base, the Board has concluded that

the Group has adequate resources to continue in operational

existence for the period through to August 2022.

CAUTIONARY STATEMENT

This Interim Management Report ("IMR") has been prepared solely

to provide additional information to shareholders to assess the

Group's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose. This IMR contains certain forward-looking

statements. These statements are made by the directors in good

faith based on the information available to them up to the time of

their approval of this report and such statements should be treated

with caution due to the inherent uncertainties, including both

economic and business risk factors, underlying any such

forward-looking information.

This IMR has been prepared for the Group as a whole and

therefore gives greater emphasis to those matters that are

significant to PageGroup plc and its subsidiary undertakings when

viewed as a whole.

Page House

The Bourne Business Park

1 Dashwood Lang Road

Addlestone

Weybridge

Surrey

KT15 2QW

By order of the Board,

Steve Ingham Kelvin Stagg

Chief Executive Officer Chief Financial Officer

6 August 2021 6 August 2021

PageGroup will host a conference call, with on-line slide

presentation, for analysts and investors at 9.00am on 9 August

2021, the details of which are below.

Link:

https://www.investis-live.com/pagegroup/60eea0d40ed69a0a004ac932/plas

Please use the following dial-in number to join the

conference:

United Kingdom (Local) 020 3936 2999

All other locations +44 20 3936 2999

Please quote participant access code 54 14 22 to gain access to

the call.

A presentation and recording to accompany the call will be

posted on the PageGroup website during the course of the morning of

9 August 2021 at:

http://www.page.com/investors/investor-library.aspx

Enquiries:

PageGroup +44 (0)20 3077 8425

Steve Ingham, Chief Executive Officer

Kelvin Stagg, Chief Financial Officer

FTI Consulting +44 (0)20 3727 1340

Richard Mountain / Susanne Yule

This announcement contains inside information for the purposes

of article 7 of EU Regulation 596/2014 and Article 7 of Onshore

Regulation (EU) 596/2014 as it forms part of domestic law by virtue

of the EUWA. The person responsible for making this announcement on

behalf of PageGroup is Kelvin Stagg, Chief Financial Officer.

INDEPENT REVIEW REPORT TO PAGEGROUP PLC

Conclusion

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2021 which comprises the condensed

consolidated income statement, the condensed consolidated statement

of comprehensive income, the condensed consolidated balance sheet,

the condensed consolidated statement of changes in equity, the

condensed consolidated statement of cash flows and the related

notes 1 to 12. We have read the other information contained in the

half yearly financial report and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2021 is not prepared, in all material respects, in accordance

with UK adopted International Accounting Standard 34 and the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements 2410 (UK and Ireland), "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Auditing Practices Board. A review of

interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures. A

review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the

Group will be prepared in accordance with UK adopted IFRSs. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with UK adopted

International Accounting Standard 34, "Interim Financial

Reporting".

Responsibilities of the directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

Auditor's Responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, is based on procedures that are less extensive than

audit procedures, as described in the Basis for Conclusion

paragraph of this report.

Use of our report

This report is made solely to the company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK and Ireland), "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity", issued by the

Auditing Practices Board. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than the

company, for our work, for this report, or for the conclusions we

have formed.

Ernst & Young LLP

London

6 August 2021

Condensed Consolidated Income Statement

For the six months ended 30 June 2021

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Revenue 3 766,412 654,989 1,304,791

Cost of sales (362,228) (354,282) (694,542)

Gross profit 3 404,184 300,707 610,249

Administrative expenses (339,855) (300,344) (593,221)

---------- ---------- ------------

Operating profit 3 64,329 363 17,028

Financial income 4 194 85 588

Financial expenses 4 (850) (1,199) (2,072)

Profit/(Loss) before tax 3 63,673 (751) 15,544

Income tax expense 5 (25,062) (809) (21,286)

---------- ---------- ------------

Profit/(Loss) for the period 38,611 (1,560) (5,742)

---------- ---------- ------------

Attributable to:

Owners of the parent 38,611 (1,560) (5,742)

---------- ---------- ------------

Earnings per share

Basic earnings per share (pence) 8 12.2 (0.5) (1.8)

Diluted earnings per share (pence) 8 12.1 (0.5) (1.8)

---------- ---------- ------------

The above results all relate to continuing operations

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2021

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit/(Loss) for the period 38,611 (1,560) (5,742)

Other comprehensive income/(loss) for

the period

Items that may subsequently be reclassified

to profit and loss:

Currency translation differences (7,221) 12,752 5,945

Total comprehensive income for the period 31,390 11,192 203

---------- ---------- ------------

Attributable to:

Owners of the parent 31,390 11,192 203

---------- ---------- ------------

Condensed Consolidated Balance Sheet

As at 30 June 2021

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 9 23,294 29,966 26,401

Right-of-use assets 83,795 110,774 95,414

Intangible assets - Goodwill and

other intangible 2,082 2,062 2,097

- Computer software 43,522 39,381 39,708

Deferred tax assets 17,927 24,405 17,688

Other receivables 10 11,374 15,037 13,169

181,994 221,625 194,477

---------- ---------- ------------

Current assets

Trade and other receivables 10 305,700 266,759 252,476

Current tax receivable 23,761 26,810 16,889

Cash and cash equivalents 12 163,758 161,651 165,987

493,219 455,220 435,352

---------- ---------- ------------

Total assets 3 675,213 676,845 629,829

---------- ---------- ------------

Current liabilities

Trade and other payables 11 (200,352) (188,631) (184,022)

Lease liabilities (30,157) (37,097) (32,711)

Current tax payable (18,724) (16,905) (12,365)

(249,233) (242,633) (229,098)

---------- ---------- ------------

Net current assets 243,986 212,587 206,254

---------- ---------- ------------

Non-current liabilities

Other payables 11 (12,977) (10,410) (12,483)

Deferred tax liabilities (5,953) (3,962) (1,589)

Lease liabilities (60,875) (83,880) (70,758)

(79,805) (98,252) (84,830)

---------- ---------- ------------

Total liabilities 3 (329,038) (340,885) (313,928)

---------- ---------- ------------

Net assets 346,175 335,960 315,901

---------- ---------- ------------

Capital and reserves

Called-up share capital 3,286 3,287 3,286

Share premium 99,564 99,564 99,564

Capital redemption reserve 932 932 932

Reserve for shares held in the

employee benefit trust (52,683) (43,016) (55,498)

Currency translation reserve 18,099 32,127 25,320

Retained earnings 276,977 243,066 242,297

Total equity 346,175 335,960 315,901

---------- ---------- ------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2021

Reserve

for shares

held in

Called-up Capital the Currency

share Share redemption employee translation Retained Total

benefit

capital premium reserve trust reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2020 3,286 99,507 932 (47,662) 19,375 248,949 324,387

---------- -------- ----------- ----------- ------------ --------- ---------

Currency

translation

differences - - - - 12,752 - 12,752

---------- -------- ----------- ----------- ------------ --------- ---------

Net income

recognised

directly in equity - - - - 12,752 - 12,752

Loss for the six

months ended 30

June

2020 - - - - - (1,560) (1,560)

Total comprehensive

income/(expense)

for the period - - - - 12,752 (1,560) 11,192

---------- -------- ----------- ----------- ------------ --------- ---------

Purchase of shares

held in the

employee

benefit trust - - - (1,609) - - (1,609)

Exercise of share

plans 1 57 - - - - 58

Transfer from

reserve for shares

held

in the employee

benefit trust - - - 6,255 - (6,255) -

Credit in respect

of share schemes - - - - - 1,932 1,932

1 57 - 4,646 - (4,323) 381

---------- -------- ----------- ----------- ------------ --------- ---------

Balance at 30 June

2020 3,287 99,564 932 (43,016) 32,127 243,066 335,960

---------- -------- ----------- ----------- ------------ --------- ---------

Currency

translation

differences - - - - (6,807) - (6,807)

---------- -------- ----------- ----------- ------------ --------- ---------

Net expense

recognised

directly in

equity - - - - (6,807) - (6,807)

Loss for the six

months ended 31

December

2020 - - - - - (4,182) (4,182)

Total comprehensive

expense for the

period - - - - (6,807) (4,182) (10,989)

---------- -------- ----------- ----------- ------------ --------- ---------

Purchase of shares

held in employee

benefit trust - - - (12,760) - - (12,760)

Exercise of share

plans (1) - - - - 330 329

Transfer from

reserve for shares

held

in the employee

benefit trust - - - 278 - (278) -

Credit in respect

of share schemes - - - - - 3,343 3,343

Credit in respect

of tax on share

schemes - - - - - 18 18

(1) - - (12,482) - 3,413 (9,070)

---------- -------- ----------- ----------- ------------ --------- ---------

Balance at 31

December 2020 3,286 99,564 932 (55,498) 25,320 242,297 315,901

---------- -------- ----------- ----------- ------------ --------- ---------

Balance at 1 January 2021 3,286 99,564 932 (55,498) 25,320 242,297 315,901

------ ------- ---- --------- -------- --------- ---------

Currency translation differences - - - - (7,221) - (7,221)

------ ------- ---- --------- -------- --------- ---------

Net expense recognised directly in

equity - - - - (7,221) - (7,221)

Profit for the six months ended 30

June

2021 - - - - - 38,611 38,611

------ ------- ---- --------- -------- --------- ---------

Total comprehensive (expense)/income

for the period - - - - (7,221) 38,611 31,390

------ ------- ---- --------- -------- --------- ---------

Purchase of shares held in employee

benefit trust - - - (10,369) - - (10,369)

Exercise of share plans - - - - - 6,938 6,938

Transfer from reserve for shares held

in the employee benefit trust - - - 13,184 - (13,184) -

Credit in respect of share schemes - - - - - 2,447 2,447

Debit in respect of tax on share

schemes - - - - - (132) (132)

- - - 2,815 - (3,931) (1,116)

------ ------- ---- --------- -------- --------- ---------

Balance at 30 June 2021 3,286 99,564 932 (52,683) 18,099 276,977 346,175

------ ------- ---- --------- -------- --------- ---------

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2021

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Note

Profit/(Loss) before tax 63,673 (751) 15,544

Depreciation and amortisation charges 26,238 30,086 61,782

Loss on sale of property, plant

and equipment, and computer software 21 120 262

Share scheme charges 2,447 1,932 5,275

Net finance costs 656 1,114 1,484

---------- ---------- ------------

Operating cash flow before changes

in working capital 93,035 32,501 84,347

(Increase)/Decrease in receivables (59,840) 113,411 124,370

Increase/(Decrease) in payables 23,519 (40,335) (39,760)

---------- ---------- ------------

Cash generated from operations 56,714 105,577 168,957

Income tax paid (21,830) (20,183) (31,747)

---------- ---------- ------------

Net cash from operating activities 34,884 85,394 137,210

---------- ---------- ------------

Cash flows from investing activities

Purchases of property, plant and

equipment (2,688) (2,474) (4,892)

Purchases and capitalisation of

intangible assets (8,923) (8,526) (17,770)

Proceeds from the sale of property,

plant and equipment, and computer

software 906 434 918

Interest received 194 85 588

---------- ---------- ------------

Net cash used in investing activities (10,511) (10,481) (21,156)

---------- ---------- ------------

Cash flows from financing activities

Interest paid (183) (290) (413)

Lease liability repayment (18,719) (18,034) (39,234)

Issue of own shares for the exercise

of options 6,938 58 387

Purchase of shares into the employee

benefit trust (10,369) (1,609) (14,369)

Net cash used in financing activities (22,333) (19,875) (53,629)

---------- ---------- ------------

Net increase in cash and cash equivalents 2,040 55,038 62,425

Cash and cash equivalents at the

beginning of the period 165,987 97,832 97,832

Exchange (loss)/gain on cash and

cash equivalents (4,269) 8,781 5,730

Cash and cash equivalents at the

end of the period 12 163,758 161,651 165,987

---------- ---------- ------------

Notes to the condensed set of interim results

For the six months ended 30 June 2021

1. General information

The information for the year ended 31 December 2020 does not

constitute statutory accounts as defined in section 435 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditors

reported on those accounts: their report was unqualified, did not

draw attention to any matters by way of emphasis and did not

contain a statement under section 498(2) or (3) of the Companies

Act 2006.

The unaudited interim condensed consolidated financial

statements of PageGroup plc and its subsidiaries (collectively, the

Group) for the six months ended 30 June 2021 were authorised for

issue in accordance with a resolution of the directors on 6 August

2021.

2. Accounting policies

Basis of preparation

The unaudited interim condensed consolidated financial

statements for the six months ended 30 June 2021 have been prepared

in accordance with UK adopted International Accounting Standard 34

'Interim financial reporting' and with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

The unaudited interim condensed consolidated financial

statements do not constitute the Group's statutory financial

statements. The Group's most recent statutory financial statements,

which comprise the annual report and audited financial statements

for the year ended 31 December 2020, were approved by the directors

on 2 March 2021. The interim condensed consolidated financial

statements should be read in conjunction with the Annual Report and

Accounts for the year ended 31 December 2020, which have been

prepared in accordance with International Accounting Standards in

conformity with the requirements of the Companies Act 2006 and

International Financial Reporting Standards adopted pursuant to

Regulation (EC) No.1606/2002 as it applies in the European

Union.

Going concern

The Board has undertaken a review of the Group's forecasts and

associated risks and sensitivities, considering the expected impact

of COVID-19 on trading in the period from the date of approval of

the interim financial statements to August 2022 (review

period).

The Group had GBP163.8m of cash as at 30 June 2021, with no debt

except for IFRS 16 lease liabilities of GBP91.0m. Debt facilities

relevant to the review period comprise a committed GBP30m BBVA RCF

(May 2023 maturity), an uncommitted UK trade debtor discounting

facility (up to GBP50m depending on debtor levels) and an

uncommitted GBP20m UK bank overdraft facility.

Throughout the first half of the year, the activity levels

picked up in most of the Group's markets and the cost control and

cash preservation methods used in 2020 were not repeated. However,

due to the pandemic there remains reductions in travel and

entertaining expenses. There continues to be a high degree of

global macro-economic uncertainty, as COVID-19 remains a

significant issue and restrictions remain in a number of countries

across the Group.

However, given the analysis performed, there are no plausible

downside scenarios that would cause an issue. As a result, given

the strength of performance in H1, the level of cash in the

business and Group's borrowing facilities, the geographical and

discipline diversification, limited concentration risk, as well as

the ability to manage the cost base, the Board has concluded that

the Group has adequate resources to continue in operational

existence for the period through to August 2022.

New accounting standards, interpretations and amendments adopted

by the Group

The Group has not adopted or early adopted any standard,

interpretation or amendment that has been issued but is not yet

effective. The same accounting policies and methods of computation

as were followed in the most recent annual financial statements

3. Segment reporting

All revenues disclosed are derived from external customers.

The accounting policies of the reportable segments are the same

as the Group's accounting policies. Segment operating profit

represents the profit earned by each segment including allocation

of central administration costs. This is the measure reported to

the Group's Board, the chief operating decision maker, for the

purpose of resource allocation and assessment of segment

performance.

(a) Revenue, gross profit and operating profit by reportable segment

Revenue Gross Profit

--------------------------------- ---------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2021 2020 2020 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 408,874 352,888 717,294 203,531 154,540 319,360

Asia Pacific 129,170 105,263 215,959 81,762 56,852 121,113

Americas 102,647 78,716 154,257 61,285 46,926 88,791

United Kingdom 125,721 118,122 217,281 57,606 42,389 80,985

766,412 654,989 1,304,791 404,184 300,707 610,249

--------- -------- ------------ --------- -------- ------------

Operating Profit

---------------------------------

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

EMEA 35,862 10,565 30,605

Asia Pacific 15,347 (3,596) 3,789

Americas 8,793 (4,946) (7,021)

United Kingdom 4,327 (1,660) (10,345)

Operating profit 64,329 363 17,028

Financial expense (656) (1,114) (1,484)

Profit/(Loss)

before tax 63,673 (751) 15,544

--------- -------- ------------

The above analysis by destination is not materially different to

analysis by origin.

The analysis below is of the carrying amount of reportable

segment assets, liabilities and non-current assets. Segment assets

and liabilities include items directly attributable to a segment as

well as those that can be allocated on a reasonable basis. The

individual reportable segments exclude current income tax assets

and liabilities. Non-current assets include property, plant and

equipment, computer software, goodwill and other intangibles.

(b) Segment assets, liabilities and non-current assets by reportable segment

Total Assets Total Liabilities

------------------------------------ --------------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2021 2020 2020 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 231,607 233,400 230,350 159,076 184,243 163,961

Asia Pacific 113,690 109,775 111,090 50,776 46,976 54,899

Americas 78,928 94,012 80,662 39,615 45,164 41,071

United Kingdom 227,227 212,848 190,838 60,847 47,597 41,632

-------- -------- -------------- -------- -------- ----------------

Segment assets/liabilities 651,452 650,035 612,940 310,314 323,980 301,563

Income tax 23,761 26,810 16,889 18,724 16,905 12,365

675,213 676,845 629,829 329,038 340,885 313,928

-------- -------- -------------- -------- -------- ----------------

Property, Plant & Equipment Intangible Assets

------------------------------------ --------------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2021 2020 2020 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 9,186 12,409 10,810 2,399 2,862 2,666

Asia Pacific 3,954 4,851 4,451 274 431 371

Americas 5,504 7,115 6,052 2 184 120

United Kingdom 4,650 5,591 5,088 42,929 37,966 38,648

23,294 29,966 26,401 45,604 41,443 41,805

-------- -------- -------------- -------- -------- ----------------

Right-of-use Assets Lease Liabilities

------------------------------------- ---------------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2021 2020 2020 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 42,211 60,538 47,941 44,841 63,699 51,070

Asia Pacific 12,904 10,291 13,924 13,583 11,222 14,532

Americas 12,637 18,533 14,862 15,369 21,557 17,590

United Kingdom 16,043 21,412 18,687 17,239 24,499 20,277

83,795 110,774 95,414 91,032 120,977 103,469

--------- -------- -------------- -------- -------- ------------

The below analyses in notes (c) and (d) relates to the

requirement of IFRS 15 to disclose disaggregated revenue

streams.

(c) Revenue and gross profit generated from permanent and temporary placements

Revenue Gross Profit

--------------------------------- ---------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2021 2020 2020 2020 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Permanent 315,079 213,525 441,467 311,320 211,805 436,689

Temporary 451,333 441,464 863,324 92,864 88,902 173,560

766,412 654,989 1,304,791 404,184 300,707 610,249

--------- -------- ------------ --------- -------- ------------

(d) Revenue generated from permanent and temporary placements by reportable segment

Permanent Temporary

------------------------------------ ---------------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2021 2020 2020 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 144,845 101,395 213,209 264,029 251,493 504,085

Asia Pacific 71,891 47,049 102,044 57,279 58,214 113,915

Americas 54,912 39,483 74,620 47,735 39,233 79,637

United Kingdom 43,431 25,598 51,594 82,290 92,524 165,687

315,079 213,525 441,467 451,333 441,464 863,324

-------- -------- -------------- -------- -------- ------------

The below analyses in notes (e) revenue and gross profit by

discipline (being the professions of candidates placed) and (f)

revenue and gross profit by strategic market have been included as

additional disclosure over and above the requirements of IFRS 8

"Operating Segments".

(e) Revenue and gross profit by discipline

Revenue Gross Profit

--------------------------------- ---------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2021 2020 2020 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Accounting

and Financial

Services 289,822 266,783 528,202 130,208 105,528 212,243

Legal, Technology,

HR, Secretarial

and Other 230,847 188,805 374,406 117,411 81,087 166,249

Engineering,

Property &

Construction,

Procurement

& Supply Chain 165,156 134,933 273,771 96,869 70,181 141,829

Marketing,

Sales and Retail 80,587 64,468 128,412 59,696 43,911 89,928

766,412 654,989 1,304,791 404,184 300,707 610,249

--------- -------- ------------ --------- -------- ------------

(f) Revenue and gross profit by strategic market

Revenue Gross Profit

--------------------------------- ---------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2021 2020 2020 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Large, Proven

markets 411,453 371,589 728,736 190,996 142,322 289,202

Large, High

Potential markets 251,418 194,297 397,166 149,387 107,483 218,196

Small and Medium,

High Margin

markets 103,541 89,103 178,889 63,801 50,902 102,851

766,412 654,989 1,304,791 404,184 300,707 610,249

--------- -------- ------------ --------- -------- ------------

4. Financial income / (expenses)

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Financial income

Bank interest receivable 194 85 588

-------- -------- ---------------

Financial expenses

Bank interest payable (183) (290) (413)

Interest on lease liabilities (667) (909) (1,659)

(850) (1,199) (2,072)

-------- -------- ---------------

5. Taxation

Taxation for the six-month period is charged at GBP25.1m or

39.4% (six months ended 30 June 2020: -107.6%; year ended 31

December 2020: -136.9%), representing the best estimate of the

average annual effective tax rate expected for the full year

together with known prior year adjustments applied to the pre-tax

income for the six-month period.

6. Dividends

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Amounts recognised as distributions to equity

holders in the year:

Final dividend for the year ended 31 December

2020 of 0p per ordinary share (2019: 0p) - - -

Interim dividend for the year ended 30 June

2020 of 0p per ordinary share (2019: 4.30p) - - -

Special dividend for the year ended 31 December

2020 of 0p per ordinary share (2019: 12.73p) - - -

- - -

--------- -------- --------------

Amounts proposed as distributions to equity

holders in the year:

Proposed interim dividend for the period

ended 30 June 2021 of 4.70p per ordinary

share (2020: 0p) 14,957 - -

--------- -------- --------------

Proposed special dividend for the year ended

31 December 2021 of 26.71p per ordinary share

(2020: 0p) 85,000 - -

--------- -------- --------------

The proposed final dividend for 2019 of 9.40p per ordinary

share, or GBP30.2m, which was due for payment in June 2020, was

cancelled as a result of the ongoing uncertainty as a result of the

COVID-19 pandemic.

The proposed interim and special dividends have not been

approved by the Board at 30 June 2021 and therefore have not been

included as a liability.

The proposed interim dividend of 4.70p (2020: nil; 2019: 4.30p)

per ordinary share and special dividend of 26.71p (2020: nil; 2019:

12.73p) per ordinary share will be paid on 13 October 2021 to

shareholders on the register at the close of business on 3

September 2021.

7. Share-based payments

In accordance with IFRS 2 "Share-based Payment", a charge of

GBP3.4m has been recognised for share options and other share-based

payment arrangements (including social charges) (30 June 2020:

GBP1.4m; 31 December 2020: GBP4.3m).

8. Earnings per ordinary share

The calculation of the basic and diluted earnings per share is

based on the following data:

Six months ended Year ended

30 June 30 June 31 December

Earnings 2021 2020 2020

Earnings for basic and diluted earnings per

share (GBP'000) 38,611 (1,560) (5,742)

--------- -------- ------------

Number of shares

Weighted average number of shares used for

basic earnings per share ('000) 317,383 320,650 319,664

Dilution effect of share plans ('000) 859 1,096 925

Diluted weighted average number of shares

used for diluted earnings per share ('000) 318,242 321,746 320,589

--------- -------- ------------

Basic earnings per share (pence) 12.2 (0.5) (1.8)

Diluted earnings per share (pence) 12.1 (0.5) (1.8)

The above results all relate to continuing operations.

9. Property, plant and equipment

Acquisitions

During the period ended 30 June 2021 the Group acquired

property, plant and equipment with a cost of GBP2.7m (30 June 2020:

GBP2.5m, 31 December 2020: GBP4.9m).

10. Trade and other receivables

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Current

Trade receivables 217,500 203,711 197,195

Less allowance for expected credit losses

and revenue reversals (9,930) (13,561) (11,061)

-------- --------- ------------

Net trade receivables 207,570 190,150 186,134

Other receivables 3,720 20,012 4,393

Accrued income 77,449 36,789 51,282

Prepayments 16,961 19,808 10,667

305,700 266,759 252,476

-------- --------- ------------

Non-current

Other receivables 11,374 15,037 13,169

-------- --------- ------------

11. Trade and other payables

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Current

Trade payables 3,949 6,317 3,993

Other tax and social security 29,954 63,214 44,890

Other payables 45,385 23,259 35,664

Accruals 121,064 95,841 99,475

200,352 188,631 184,022

-------- -------- ------------

Non-current

Accruals 11,466 9,574 11,836

Other tax and social security 1,511 836 647

12,977 10,410 12,483

-------- -------- ------------

12. Cash and cash equivalents

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Cash at bank and in hand 79,550 86,651 108,849

Short-term deposits 84,208 75,000 57,138

-------- -------- ------------

Cash and cash equivalents 163,758 161,651 165,987

Cash and cash equivalents in the statement

of cash flows 163,758 161,651 165,987

-------- -------- ------------

The Group operates multi-currency cash concentration and

notional cash pools, and an interest enhancement facility. The

Eurozone subsidiaries and the UK-based Group Treasury subsidiary

participate in the cash concentration arrangement. The Group

Treasury subsidiary and UK business utilise the notional cash pool

and the Asia Pacific subsidiaries operate the interest enhancement

facility. The structures facilitate interest compensation for cash

whilst supporting working capital requirements.

PageGroup maintains a Confidential Invoice Facility with HSBC

whereby the Group has the option to discount receivables in order

to advance cash. The Group also has a Revolving Credit Facility

with BBVA, expiring in 2023, with a total drawable amount of

GBP30m. Neither of these facilities were in use as at 30 June.

These facilities are used on an ad hoc basis to fund any major

Group GBP cash outflows.

In May 2019 PageGroup entered into a GBP30m revolving credit

facility (RCF) with BBVA. To ensure the RCF remains compliant with

regulations (specifically Libor transition), we have amended the

original terms and at the same time took the opportunity to enhance

other terms, providing further strength and resilience to the

Group. The revised terms are:

-- Incorporation of Libor transition clauses

-- Executed the first of two right of extensions, meaning the RCF now expires in May 2023

-- Linked the BBVA RCF to sustainable finance KPI's and

-- Reduced the covenants and half year reporting requirements.

The Group has also successfully transitioned 100% of our cash

investments into ESG (sustainable) Money Market funds, further

enhancing our sustainability vision.

In line with the Group's investment policy, excess cash is

invested in a range of products; including call accounts, money

market deposits and money market funds. The Group actively monitors

its counterparty exposure to protect its capital investments and

reduce risk. Accordingly, the Group opened two additional money

market funds, both of which hold an AAA rating.

The main functional currencies of the Group are Sterling, Euro,

Chinese Renminbi, US Dollar, Singapore Dollar, Hong Kong Dollar and

Australian Dollar. The Group does not have material transactional

currency exposures. The Group is exposed to foreign currency

translation differences in accounting for its overseas operations.

The Group policy is not to hedge translation exposures.

In certain cases, where the Group gives or receives short-term

loans to and from other Group companies that differ from the

Group's reporting currency, it may use short-dated foreign exchange

swap derivative financial instruments to manage the currency and

interest rate exposure that arises on these loans.

RESPONSIBILITY STATEMENT

The Directors confirm that to the best of their knowledge:-

a) the condensed set of interim financial statements has been

prepared in accordance with UK adopted IAS 34 "Interim Financial

Reporting"

b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

On behalf of the Board

S Ingham K Stagg

Chief Executive Officer Chief Financial Officer

6 August 2021

Copies of the condensed interim financial statements are now

available and can be downloaded from the Company's website

https://www.page.com/presentations/year/2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKFBKOBKDQFK

(END) Dow Jones Newswires

August 09, 2021 02:00 ET (06:00 GMT)

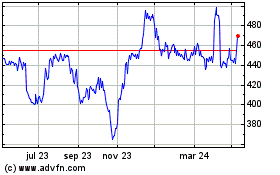

Pagegroup (LSE:PAGE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

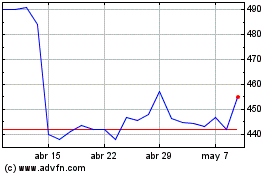

Pagegroup (LSE:PAGE)

Gráfica de Acción Histórica

De May 2023 a May 2024