TIDMPAT

RNS Number : 5085N

Panthera Resources PLC

30 September 2021

30 September 2021

Panthera Resources Plc

("Panthera" or "the Company")

Audited Financial Results and Management Update for the 12

Months Ended March 31, 2021

Panthera Resources PLC (AIM: PAT), the gold exploration and

development company with assets in India and West Africa, is

pleased to provide a summary of the Company's audited financial

results for the year ended March 31, 2021.

Highlights of 2020-21 Financial Year

Panthera Resources PLC ("Panthera", "PAT" or the "Company") has

navigated its third full year as an AIM-listed exploration and

mining company. During this period, we have refocused the Company

towards its gold projects in West Africa while continuing our

efforts to unlock the significant potential value of the Bhukia

Project (Bhukia) in Rajasthan, India.

Growing High Potential West Africa Gold Portfolio

-- The Bassala Project has been the key focus of Panthera's work

in West Africa during and after the financial year. The Bassala

gold project is located within a very well gold endowed Birimian

greenstone belt in southwest Mali, within 7km of the 3.7Moz Kalana

gold mine (Endeavour Resources) and 5km of the 2.4Moz Kodieran gold

mine (Wassoul'or). During the year, the Company completed an

extensive gold in soil and ground magnetic survey followed by an IP

survey in May 2021. This work has resulted in the identification of

22 high priority exploration targets, 13 of which were drilled

after the end of the financial year. The Company completed an

air-core (AC) drilling programme of 9,997 metres for 164 drill

holes and a reverse circulation (RC) drilling programme of 392m for

4 drill holes. Partials assays results (38% of the drilled metres)

received to date have been very encouraging with the remaining

assays expected shortly. The AC drilling programme is proposed to

continue after the wet season in the fourth quarter of this

calendar year. In addition, several direct targets for deeper

drilling have already been identified and a larger RC rig or a

diamond drill rig will also be secured for drilling these targets

following the completion of shallower AC drilling.

-- The Bido gold project (formerly known as Naton) is located

within a well gold endowed Birimian greenstone belt in southern

Burkina Faso. During the year, the Company successfully secured the

reissue of the licence following administrative challenges with the

Malian government. Following the grant of this licence during the

year, the remaining areas considered suitable for gold in soil

sampling in the south-central part of the licence were surveyed.

Several high gold in soil sample assays were returned including

26.5g/t Au, 16.7g/t Au. A new zone of extensive artisanal working

activity targeting in situ mineralisation was identified during the

survey. In addition, numerous outcropping quartz veins were also

identified and a programme of mapping and rock chip sampling was

undertaken. As there are many discrete targets within the licence

area, further activities will be required to prioritise the targets

for follow-up drilling. In this regard, it is proposed that the

principal areas of interest are surveyed with IP during the 2021-22

financial year followed by drilling.

-- During the year, the Company spun out its Labola (Burkina

Faso) and Kalaka (Mali) Projects into Moydow Holdings Limited

(Moydow), a private exploration vehicle. The transaction provided

finance to kick start exploration on the Labola and Kalaka Projects

while maintaining for the Company a significant ongoing

shareholding in Moydow. Moydow has moved quickly to progress the

Labola and Kalaka projects:

- During the year, Moydow has successfully secured all of the

historical exploration data over the licence from the previous

explorers. A total of 65,556m drilling in 541 holes (mainly diamond

and reverse circulation) has been undertaken by previous explorers.

Broad, moderate grade mineralisation such as 59m @ 1.83g/t Au from

41m, as well as narrow, very high-grade mineralisation such as 1m @

258.7g/t Au from 66m have been returned. Work is currently focused

on confirming the previous data, in particular, by twin drilling a

selection of previous explorers' drill holes to confirm that the

location of mineralisation zones and gold grades within these

mineralisation zones are repeatable. This programme should enable

the estimation of a resource compliant with NI43-101 guidelines in

the fourth quarter of this calendar year.

- The Kalaka gold project in southern Mali, West Africa, is

located 55km south of the 7Moz Morila gold mine (Barrick/Anglogold)

and 85km northwest of the 6Moz Syama gold mine (Resolute). The

Kalaka project has confirmed the potential for large tonnages

(several hundred million tonnes) of low-grade gold mineralisation.

Potential for higher-grade zones within the large low-grade system

has been identified associated with IP anomalies and artisanal

workings in areas of interpreted structural complexity. Work during

and after the end of the financial year comprised two ground IP

surveys that resulted in the identification of more than 20 drill

targets. A maiden drill programme is planned for the fourth quarter

of this calendar year.

Bhukia Project (Rajasthan, India)

-- A JORC-Inferred Mineral Resource Estimate of 1.74Moz was

reported by the Company from its early exploration over granted

tenure during the period 2005-08; whilst it has defined a planned

exploration programme that targets increasing this to over 6.0Moz

upon grant of the PL.

-- Since 2008, the Company has actively sought the approval of

the Prospecting Licence over Bhukia (PL). The PL Application (PLA)

was again rejected by the Government of Rajasthan (GoR) in August

2018 on various spurious grounds. The Company subsequently obtained

an interim Stay Order from the Rajasthan High Court which continues

to remain in place restraining the GoR from granting third party

rights within the entire area of the PLA.

-- In March 2021, the Government of India (GoI) amended the

Mines and Minerals (Development and Regulation) Act (MMDR2021)

which resulted in the immediate lapse of all prospecting licence

applications. Under the MMDR2021, provision is made to reimburse

any expenses incurred towards reconnaissance or prospecting

operations in such manner as may be prescribed by the GoI. The

Company continues to seek the reinstatement of its PLA through the

Rajasthan High Court in order that it is eligible for any

applicable reimbursement.

-- In February 2021, the Company announced that it had appointed

Fasken to advise the Company on a potential dispute with the GoI

concerning Bhukia. More specifically, Fasken is advising the

Company on its potential dispute under the Australia India

Bilateral Investment Treaty (ABIT) in relation to Bhukia.

Chairman's Statement

Dear Shareholder,

I am pleased to present the 2020-21 Annual Report for Panthera

Resources PLC. Panthera aims to create a mid-tier mining company by

building a strong portfolio of high-quality, low-cost gold assets

in West Africa and India. The past year has seen significant value

accretion for our shareholders following the refocus of our

business to our West African gold projects, while the Company

continues to seek a resolution to the impasse over the Bhukia

Project in Rajasthan, India (Bhukia).

In July 2020, the Company announced the spin-out of its Labola

(Burkina Faso) and Kalaka (Mali) Projects into Moydow Holdings

Limited (Moydow), a private exploration vehicle led by Mr Brian

Kiernan. The Moydow transaction provided the necessary finance to

kick start exploration on the Labola and Kalaka Projects. The

Company maintained a significant ongoing shareholding in Moydow.

This ensures that it will benefit from any success derived from the

work programmes, while not diluting shareholders' exposure to the

Company's other assets. Moydow has moved quickly, recently

completing its initial drilling programme at Labola and anticipates

the release of its maiden mineral resource estimate in the fourth

quarter of this calendar year.

At Kalaka, Moydow has completed two successful Induced

Polarisation (IP) surveys with more than 20 drill targets

identified. The Kalaka project has confirmed the potential for

large tonnages (several hundred million tonnes) of low-grade gold

mineralisation. Potential for higher-grade zones within the large

low-grade system have been identified to be associated with IP

anomalies and artisanal workings in areas of interpreted structural

complexity. Following the completion of the IP surveys, a maiden

drill programme is planned for the fourth quarter of this calendar

year.

Following the implementation of the Moydow transaction, the

Company has capitalised on the exploration momentum conducting

several successful exploration programmes at its core Bido (Burkina

Faso) and Bassala (Mali) projects directly operated by Panthera. In

July 2021, the Company completed a 9,000 metre air-core drilling

programme at Bassala with the initial assays confirming the

presence of significant gold mineralisation. A follow-up drilling

programme is planned for the fourth quarter of this calendar

year.

During the year, the Company has continued its efforts through

its JV for the grant of its mineral rights over the highly

prospective Bhukia Project in India (Bhukia). Despite the acute

challenges, the Bhukia PLA remains a very valuable asset for our

Company and we are resolutely pursuing our rights over the

project.

During the early part of the year, the Company has worked

closely with its local partner, Galaxy, to advance its negotiations

with GoR for the grant of the PL over Bhukia. In March 2021,

progress to securing the PL took a significant setback when the GoI

amended the Mines and Minerals (Development and Regulation) Act

which resulted in the immediate lapse of all prospecting licence

applications. Given the frustration in the grant of the PL by the

GoR and subsequently legislation changes by the GoI, the Company

appointed Fasken to advise on a potential dispute with the GoI

under the Australia India Bilateral Investment Treaty. The Company

is presently in discussions with potential litigation funders in

support of possible arbitration proceedings under the treaty. In

light of the legislative changes in India, in May 2021 the Company

announced that it has elected not to extend its partnership with

Galaxy.

I would also like to express our appreciation and gratitude to

all of our employees for their efforts, sacrifices and hard work

during the past year.

Michael Higgins

Non-Executive Chairman

29 September 2021

The audited Annual Report and Financial Statements for the year

ended 31 March 2020 will shortly be sent to shareholders and

published at: pantheraresources.com

Group statement of comprehensive income for the year ended 31

March 2021

2021 2020

$ USD $ USD

----------------------------------------------------- ----------- -----------

Continuing operations

Revenue - -

----------------------------------------------------- ----------- -----------

Gross profit - -

Other Income 99,509 58,038

Exploration costs expensed (631,131) (365,139)

Administrative expenses (915,190) (821,156)

Impairment expense (801,724) -

Loss from operations (2,248,536) (1,128,257)

Investment revenues 3,953 632

Loss on sale of investments (1,108) -

----------------------------------------------------- ----------- -----------

Loss before taxation (2,245,691) (1,127,625)

Taxation - -

Other comprehensive income

Items that may be reclassified to profit or

loss:

Changes in the fair value of financial assets - -

measured at FVOCI

Gain on sale to non-controlling interest 1,625,372 -

Exchange differences (17,721) (4,889)

----------------------------------------------------- ----------- -----------

Loss and total comprehensive income for the

year (638,040) (1,132,514)

----------------------------------------------------- ----------- -----------

Total loss for the year attributable to:

- Owners of the parent Company (2,188,292) (1,084,736)

- Non-controlling interest (57,399) (42,889)

----------------------------------------------------- ----------- -----------

(2,245,691) (1,127,625)

----------------------------------------------------- ----------- -----------

Total comprehensive income for the year attributable

to:

* Owners of the parent Company (580,641) (1,089,625)

* Non-controlling interest (57,399) (42,889)

----------------------------------------------------- ----------- -----------

(638,080) (1,132,514)

----------------------------------------------------- ----------- -----------

Loss per share attributable to the owners

of the parent

Continuing operations (undiluted/diluted) (0.03) (0.01)

----------------------------------------------------- ----------- -----------

Group statement of financial position for the year ended 31

March 2021

2021 2020

$ USD $ USD

--------------------------------------------- ------------ --------------

Non-current assets

Property, plant and equipment 2,988 2,811

Investments 2,209,671 6,102

Financial assets at fair value through other

comprehensive income - 947,257

--------------------------------------------- ------------ --------------

2,212,659 956,170

Current assets

Trade and other receivables 155,589 64,788

Cash and cash equivalents 1,591,175 97,762

--------------------------------------------- ------------ --------------

1,746,764 162,550

--------------------------------------------- ------------ --------------

Total assets 3,959,423 1,118,720

Non-current liabilities

Provisions 45,327 36,300

--------------------------------------------- ------------ ------------

45,327 36,300

Current liabilities

Provisions 10,978 8,658

Trade and other payables 205,081 313,332

--------------------------------------------- ------------ --------------

Total liabilities 261,386 358,290

--------------------------------------------- ------------ --------------

Net assets 3,698,037 760,430

--------------------------------------------- ------------ --------------

Equity

Share capital 1,216,198 1,010,308

Share premium 18,836,758 18,032,309

Capital reorganisation reserve 537,757 537,757

Other reserves 1,454,157 (1,111,153)

Retained earnings (18,021,218) (17,440,576)

--------------------------------------------- ------------ --------------

Total equity attributable to owners of the

parent 4,023,652 1,028,645

Non-controlling interest (325,614) (268,215)

--------------------------------------------- ------------ --------------

Total equity 3,698,038 760,430

--------------------------------------------- ------------ --------------

Group statement of changes of equity for the year ended 31 March

2021

Share Capital

Share premium re-organisation Other Retained Total Non-controlling

capital account reserve reserves earnings equity interest Total

$ USD $ USD $ USD $ USD $ USD $ USD $ USD $ USD

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Balance at 1

April 2019 913,588 17,373,601 537,757 (115,997) (16,352,292) 2,356,657 (225,326) 2,131,331

Year ended 31

March 2020:

Loss for the

year - - - - (1,082,878) (1,082,878) (42,889) (1,125,767)

Foreign

exchange

differences - - - - (5,407) (5,407) - (5,407)

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Total

comprehensive

income for

the

year - - - - (1,088,285) (1,088,285) (42,889) (1,131,174)

Issue of

shares

during period 96,720 658,708 755,428

Foreign

exchange

differences

on

translation

of

currency - - - (73,759) - (73,759) - (73,759)

Loss on

remeasurement

of financial

assets at

FVOCI - - - (921,397) - (921,397) - (921,397)

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Total

transactions

with owners,

recognised

directly

in equity 96,720 658,708 - (995,156) - (239,728) - (239,728)

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Balance at 31

March 2020 1,010,308 18,032,309 537,757 (1,111,153) (17,440,577) 1,028,644 (268,215) 760,429

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Capital re-organisation reserve is the balance of share capital

remaining after the Company purchased all shares in its subsidiary

Indo Gold Pty Ltd.

Other reserves is the combined balance of the Share Option

Reserve, Unrealised gain on investments reserve and Foreign

exchange translation reserve.

Share Capital

Share premium re-organisation Other Retained Total Non-controlling

capital account reserve reserves earnings equity interest Total

$ USD $ USD $ USD $ USD $ USD $ USD $ USD $ USD

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Balance at 1

April 2020 1,010,308 18,032,309 537,757 (1,111,153) (17,440,577) 1,028,644 (268,215) 760,429

Year ended 31

March 2021:

Loss for the

year - - - - (2,188,293) (2,188,293) (57,399) (2,245,692)

Gain on sale

to non

controlling

interest - - - - 1,625,372 1,625,372 - 1,625,372

Foreign

exchange

differences - - - - (17,721) (17,721) - (17,721)

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Total

comprehensive

income for

the

year - - - - (580,642) (580,642) (57,399) (638,041)

Share

Application

moneys

received - - - 45,658 - 45,658 - 45,658

Share Options

Issued - - - 102,914 - 102,914 - 102,914

Issue of

shares

during period 205,890 804,449 - - - 1,010,339 - 1,010,339

Foreign

exchange

differences

on

translation

of

currency - - - 190,577 190,577 - 190,577

Loss on

remeasurement

of financial

assets at

FVOCI - - - 2,226,161 - 2,226,161 - 2,726,161

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Total

transactions

with owners,

recognised

directly

in equity 205,890 804,449 - 2,565,310 - 3,575,649 - 3,575,649

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Balance at 31

March 2021 1,216,198 18,836,758 537,757 1,454,157 (18,021,219) 4,023,651 (325,614) 3,698,037

--------------- ---------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Group statement of cash flows for the year ended 31 March

2021

2021 2020

$ USD $ USD

---------------------------------------------------- ------------ ----------

Cash flows from operating activities

Cash used in operations (1,402,247) (947,313)

Income taxes paid -

---------------------------------------------------- ------------ ----------

Net cash outflow from operating activities (1,402,247) (947,313)

Investing activities

Purchase of intangible assets -

Sale of property, plant and equipment (2,408) (1,133)

Sale/(Purchase) of financial assets at FVOCI 1,832,188 49,603

Net cash generated /(used) in investing activities 1,829,780 48,470

Financing activities

Proceeds from issue of shares 790,616 635,881

Proceeds from share applications 45,658 -

Proceeds from issue of shares in subsidiaries - 250,000

Effect of exchange rate on cash 229,608 (77,650)

---------------------------------------------------- ------------ ----------

Net cash generated from financing activities 1,065,882 808,231

Net decrease in cash and cash equivalents 1,493,415 (90,613)

Cash and cash equivalents at beginning of

year 97,762 188,375

Cash and cash equivalents at end of year 1,591,177 97,762

---------------------------------------------------- ------------ ----------

Material non-cash transactions included issue of shares in lieu

of fees of $219,723.

Notes to the 2021 Financial Statements (Extract)

1. Accounting policies

Group information

Panthera Resources PLC is a public Company limited by shares

incorporated in the United Kingdom. The registered office is

Salisbury House, London Wall, London EC2M 5PS

The Group consists of Panthera Resources PLC and its subsidiaries,

as listed in note 23.

1.1 Basis of preparation

The Group's and Company's financial statements for the year ended

31 March 2021 have been prepared in accordance with International

Financial Reporting Standards (IFRS) in conformity with the requirements

of the Companies Act 2006.

The financial statements have been prepared on the historical

cost basis, except for the valuation of investments at fair value

through profit or loss. The principal accounting policies adopted

are set out below.

The functional currency of the Company is British Pounds (GBP).

This is due to the Company being registered in the U.K and being

listed on AIM, a London based market. Additionally, a large proportion

of its administrative and operative costs are denominated in

GBP.

The financial statements are prepared in United States Dollars

($), which is the reporting currency of the Group. Monetary amounts

in these financial statements are rounded to the nearest whole

dollar. This has been selected to align the Group with accounting

policies of other major gold-producing Companies, the majority

of whom report in $.

As permitted by section 408 of the Companies Act 2006, the Company

has not presented its own statement of comprehensive income and

related notes. The Company's profit for the year was $1,985,025

(2020: loss of $13,390,677).

1.2 Basis of consolidation

The consolidated financial statements comprise the financial

statements of Panthera Resources PLC and its subsidiaries as

at 31 March 2021.

Panthera Resources PLC was incorporated on 8 September 2017.

On 21 December 2017, Panthera Resources PLC acquired the entire

share capital of Indo Gold Limited by way of a share for share

exchange. The transaction has been treated as a Group reconstruction

and has been accounted for using the reverse merger accounting

method. This transaction does not satisfy the criteria of IFRS

3 Business Combinations and therefore falls outside the scope

of the standard. Accordingly, the financial information for the

current year and comparatives have been presented as if Indo

Gold Limited has been owned by Panthera Resources PLC throughout

the current and prior years.

A controlled entity is any entity Panthera Resources PLC has

the power to control the financial and operating policies of,

so as to obtain benefits from its activities. Details of the

subsidiaries are provided in note 23. The assets, liabilities

and results of all subsidiaries are fully consolidated into the

financial statements of the Group from the date on which control

is obtained by the Group. The consolidation of a subsidiary is

discontinued from the date that control ceases. Intercompany

transactions, balances and unrealised gains or losses on transactions

between Group entities are fully eliminated on consolidation.

Accounting policies of subsidiaries have been changed and adjustments

made where necessary to ensure uniformity of the accounting policies

adopted by the Group.

Equity interests in a subsidiary not attributable, directly or

indirectly, to the Group are presented as "non-controlling interests".

The Group initially recognises non-controlling interests that

are present ownership interests in subsidiaries either at fair

value or at the non-controlling interests' proportionate share

of the subsidiary's net assets when the holders are entitled

to a proportionate share of the subsidiary's net assets on liquidation.

All other components of non-controlling interests are initially

measured at their acquisition-date fair value. Subsequent to

initial recognition, non-controlling interests are attributed

their share of profit or loss and each component of other comprehensive

income. Non-controlling interests (when applicable) are shown

separately within the equity section of the statement of financial

position and statement of comprehensive income.

Associates are entities over which the Group has significant

influence but not control over the financial and operating policies.

Investments in associates are accounted for using the equity

method of accounting and are initially recognised at cost. The

Group's share of its associates' post-acquisition profits or

losses is recognised in profit or loss, and its share of post-acquisition

movements in reserves is recognised in other comprehensive income.

The cumulative post acquisition movements are adjusted against

the carrying amount of the investment. Accounting policies of

equity-accounted investees have been changed where necessary

to ensure consistency with the policies adopted by the Group.

"Joint ventures" as referred to in the financial statements refer

to agreements with exploration partners and not joint ventures

as defined within IFRS 11.

1.3 Going concern

The financial statements have been prepared on a going concern

basis. The group incurred a net loss of $638,080 and incurred

operating cash outflows of $1,402,247 and is not expected to

generate any revenue or positive outflows from operations in

the 12 months from the date at which these financial statements

were signed. Management indicate that on current expenditure

levels, all current cash held will be used prior to the 12 months

subsequent of the signing of the financial statements.

The Directors are currently in talks with potential investors

to secure the necessary funding to ensure that the Group can

continue to fund its operations for the 12 months subsequent

to the date of the signing of the financial statements. While

they are confident that they will be able to secure the necessary

funding, the current conditions do indicate the existence of

a material uncertainty that may cast doubt regarding the applicability

of the going concern assumption and the auditors have made reference

to this in their audit report.

The Directors have, in the light of all the above circumstances,

a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future.

Thus, they continue to adopt the going concern basis of accounting

preparing the Group Financial Statements.

The effect of COVID-19 is actively being assessed by the Directors,

the future impact of which remains unknown. The Directors are

of the opinion that there is no reason to believe there will

be any effect in respect of the Group's going concern status

for the foreseeable future.

1.4 Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, which is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of Directors that

makes strategic decisions.

1.5 Fair Value of Assets and Liabilities

The Group measures some of its assets and liabilities at fair

value on either a recurring or non-recurring basis, depending

on the requirements of the applicable Accounting Standard.

Fair value is the price the Group would receive to sell an asset

or would have to pay to transfer a liability in an orderly (i.e.

unforced) transaction between independent, knowledgeable and

willing market participants at the measurement date.

As fair value is a market-based measure, the closest equivalent

observable market pricing information is used to determine fair

value. Adjustments to market values may be made having regard

to the characteristics of the specific asset or liability. The

fair values of assets and liabilities that are not traded in

an active market are determined using one or more valuation techniques.

These valuation techniques maximise, to the extent possible,

the use of observable market data.

To the extent possible, market information is extracted from

either the principal market for the asset or liability (i.e.

the market with the greatest volume and level of activity for

the asset or liability) or, in the absence of such a market,

the most advantageous market available to the entity at the end

of the reporting period (i.e. the market that maximises the receipts

from the sale of the asset or minimises the payments made to

transfer the liability, after taking into account transaction

costs and transport costs).

For non-financial assets, the fair value measurement also takes

into account a market participant's ability to use the asset

in its highest and best use or to sell it to another market participant

that would use the asset in its highest and best use.

The fair value of liabilities and the entity's own equity instruments

(excluding those related to share-based payment arrangements)

may be valued, where there is no observable market price in relation

to the transfer of such financial instruments, by reference to

observable market information where such instruments are held

as assets. Where this information is not available, other valuation

techniques are adopted and, where significant, are detailed in

the respective note to the financial statements.

1.6 Business combinations

Business combinations occur where an acquirer obtains control

over one or more businesses.

A business combination is accounted for by applying the acquisition

method, unless it is a combination involving entities or businesses

under common control. The business combination will be accounted

for from the date that control is attained, whereby the fair

values of the identifiable assets acquired and liabilities (including

contingent liabilities) assumed are recognised (subject to certain

limited exceptions).

When measuring the consideration transferred in the business

combination, any asset or liability resulting from a contingent

consideration arrangement is also included. Subsequent to initial

recognition, contingent consideration classified as equity is

not remeasured and its subsequent settlement is accounted for

within equity. Contingent consideration classified as an asset

or a liability is remeasured in each reporting period to fair

value recognising any change to fair value in profit or loss,

unless the change in value can be identified as existing at acquisition

date.

All transaction costs incurred in relation to business combinations,

other than those associated with the issue of a financial instrument,

are recognised as expenses in profit or loss.

The acquisition of a business may result in the recognition of

goodwill or a gain from a bargain purchase.

Included in the measurement of consideration transferred is any

asset or liability resulting from a contingent consideration

arrangement. Any obligation incurred relating to contingent consideration

is classified as either a financial liability or equity instrument,

depending on the nature of the arrangement. Rights to refunds

of consideration previously paid are recognised as receivables.

Subsequent to initial recognition, contingent consideration classified

as equity is not re-measured and its subsequent settlement is

accounted for within equity.

Contingent consideration classified as an asset or a liability

is re-measured each reporting period to fair value through the

statement of comprehensive income, unless the change in value

can be identified as existing at acquisition date.

All transaction costs incurred in relation to the business combination

are expensed to the consolidated statement of comprehensive income.

The Group transferred the non-Indian assets from Indo Gold Pty

Ltd to the parent company following the execution of the funding

agreement with Galaxy to invest directly in the equity of Indo

Gold Pty Ltd. The transfer was completed on 28 March 2019.

During the year the Group formed a new wholly owned group to

hold Mali interests, Panthera Mali (UK) Limited and local company

Panthera Exploration Mali SARL.

1.7 Taxation

Income tax expense represents the sum of the tax currently payable

and deferred tax.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from profit as reported in the consolidated

statement of comprehensive income because of items of income

or expense that are taxable or deductible in other years and

items that are never taxable or deductible. The Group's liability

for current tax is calculated using tax rates that have been

enacted or substantively enacted by the end of the reporting

period.

Deferred tax

Deferred tax is recognised on temporary differences between the

carrying amounts of assets and liabilities in the consolidated

financial statements and the corresponding tax bases used in

the computation of taxable profit. Deferred tax liabilities are

generally recognised for all taxable temporary differences. Deferred

tax assets are generally recognised for all deductible temporary

differences to the extent that it is probable that taxable profits

will be available against which those deductible differences

can be utilised. Such deferred tax assets and liabilities are

not recognised if the temporary difference arises from goodwill

or from the initial recognition (other than in a business combination)

of other assets and liabilities in a transaction that affects

neither the taxable profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences associated with investments in subsidiaries and associates,

and interest in joint ventures, except where the Group is able

to control the reversal of the temporary difference and it is

probable that the temporary difference will not reverse in the

foreseeable future. Deferred tax assets arising from deductible

temporary differences associated with such investments and interests

are only recognised to the extent that it is probable that there

will be sufficient taxable profits against which to utilise the

benefits of the temporary differences and they are expected to

reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at the

end of each reporting period and reduced to the extent that it

is no longer probable that sufficient taxable profits will be

available to allow all or part of the asset to be recovered.

Deferred tax assets and liabilities are measured at the tax rates

that are expected to apply in the period in which the liability

is settled or asset is realised, based on tax rates (and tax

laws) that have been enacted or substantively enacted by the

end of the reporting period. The measurement of deferred tax

liabilities and assets reflects the tax consequences that would

follow from the manner in which the Group expects, at the end

of the reporting period, to recover or settle the carrying amount

of its assets and liabilities.

Deferred tax assets and liabilities are offset when there is

a legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes

levied by the same taxation authority and the Group intends to

settle its tax assets and liabilities on a net basis.

Current and deferred tax for the year

Current and deferred tax are recognised in profit or loss, except

when they relate to items that are recognised in other comprehensive

income or directly in equity, in which case the current and deferred

tax are also recognised in other comprehensive income or directly

in equity, respectively. Where current tax or deferred tax arises

from the initial accounting for a business combination, the tax

effect is included for the business combination.

The purchase method of accounting is used for all acquisitions

of assets regardless of whether equity instruments or other assets

are acquired. Cost is measured as the fair value of the assets

given up, shares issued, or liabilities undertaken at the date

of acquisition plus incidental costs directly attributable to

the acquisition

1.8 Acquisitions of assets

The purchase method of accounting is used for all acquisitions

of assets regardless of whether equity instruments or other assets

are acquired. Cost is measured as the fair value of the assets

given up, shares issued, or liabilities undertaken at the date

of acquisition plus incidental costs directly attributable to

the acquisition.

1.9 Revenue recognition

The Group currently is in the exploration and development phase

of its assets and has no directly attributable revenues. For

any one-off items transacted, revenues are recognised at fair

value of the consideration received, net of the amount of value

added tax ("VAT) or similar taxes payable to the taxation authority.

Exchanges of goods or services of the same nature and value without

any cash consideration are not recognised as revenues.

Interest income from a financial asset is recognised when it

is probable that the economic benefits will flow to the Group

and the amount of revenue can be measured reliably. Interest

income is accrued on a time basis, by reference to the principal

outstanding and the effective interest rate applicable.

1.10 Payables

A liability is recorded for goods and services received prior

to balance date, whether invoiced to the Group or not. Payables

are normally settled within 30 days.

1.11 Cash and cash equivalents

Cash and cash equivalents includes cash on hand, deposits held

at call with financial institutions, other short-term, highly

liquid investments with original maturities of three months or

less that are readily convertible to known amounts of cash and

which are subject to an insignificant risk of changes in value,

and bank overdrafts. The Group currently does not utilise any

bank overdrafts.

1.12 Exploration and Development Expenditure

Exploration and evaluation costs are expensed as incurred. Acquisition

costs will normally be expensed but will be assessed on a case

by case basis and if appropriate may be capitalised. These acquisition

costs are only carried forward to the extent that they are expected

to be recouped through the successful development or sale of

the area. Accumulated acquisition costs in relation to an abandoned

area are written off in full against profit in the year in which

the decision to abandon the area is made.

The carrying values of acquisition costs are reviewed for impairment

when events or changes in circumstances indicate the carrying

value may not be recoverable.

1.13 Financial Assets

The Group and Company has classified all of its financial assets

as loans and receivables. The classification depends on the purpose

for which the financial assets were acquired. Management determines

the classification of its financial assets at initial recognition.

Loans and receivables are non-derivative financial assets with

fixed or determinable payments that are not quoted in an active

market. They are included in current assets. The Group's loans

and receivables comprise trade and other receivables and cash

and cash equivalents in the Statement of Financial Position.

Loans and receivables are initially recognised at fair value

plus transaction costs and are subsequently carried at amortised

cost using the effective interest method, less provision for

impairment.

Impairment of financial assets

The Group assesses, on a forward-looking basis, the expected

credit losses associated with its debt instruments carried at

amortised cost. The impairment methodology applied depends on

whether there has been a significant increase in credit risk.

A financial asset, or a group of financial assets, is impaired,

and impairment losses are incurred, only if there is objective

evidence of impairment as a result of one or more events that

occurred after the initial recognition of the asset (a "loss

event"), and that loss event (or events) has an impact on the

estimated future cash flows of the financial asset, or group

of financial assets, that can be reliably estimated.

The criteria that the Group and Company uses to determine that

there is objective evidence of an impairment loss include:

* significant financial difficulty of the issuer or

obligor;

* a breach of contract, such as a default or

delinquency in interest or principal repayments.

The amount of the loss is measured as the difference between

the asset's carrying amount and the present value of estimated

future cash flows (excluding future credit losses that have not

been incurred), discounted at the financial asset's original

effective interest rate. The asset's carrying amount is reduced,

and the loss is recognised in the profit or loss.

For trade receivables, the Group applies the simplified approach

permitted by IFRS 9, which requires expected lifetime losses

to be recognised from initial recognition of the receivables.

If, in a subsequent year, the amount of the impairment loss decreases

and the decrease can be related objectively to an event occurring

after the impairment was recognised (such as an improvement in

the trade and other receivables credit rating), the reversal

of the previously recognised impairment loss is recognised in

the Statement of Comprehensive Income.

1.14 Impairment of Assets

At each reporting date, the Group reviews the carrying values

of its tangible and intangible assets to determine whether there

is any indication that those assets have been impaired. If such

an indication exists, the recoverable amount of the asset, being

the higher of the asset's fair value less costs to sell and value

in use, is compared to the asset's carrying value. Any excess

of the asset's carrying value over its recoverable amount is

expensed to the income statement.

Impairment testing is performed annually for goodwill and intangible

assets with indefinite lives.

Where it is not possible to estimate the recoverable amount of

an individual asset, the Group estimates the recoverable amount

of the cash-generating unit to which the asset belongs.

1.15 Foreign currency transactions and balances

Transactions and balances

Foreign currency transactions are translated into functional

currency using the exchange rates prevailing at the date of the

transaction. Foreign currency monetary items are translated at

the year-end exchange rate. Non-monetary items measured at historical

cost continue to be carried at the exchange rate at the date

of the transaction. Non-monetary items measured at fair value

are reported at the exchange rate at the date when fair values

were determined.

Exchange differences arising on the translation of monetary items

are recognised in the income statement, except where deferred

in equity as a qualifying cash flow or net investment hedge.

Exchange differences arising on the translation of non-monetary

items are recognised directly in equity to the extent that the

gain or loss is directly recognised in equity; otherwise the

exchange difference is recognised in the income statement.

Group companies

The financial results and position of foreign operations whose

functional currency is different from the Group's presentation

currency are translated as follows:

* assets and liabilities are translated at year-end

exchange rates prevailing at that reporting date;

* income and expenses are translated at average

exchange rates for the period; and

* equity and retained earnings balances are translated

at the exchange rates prevailing at the date of the

transaction.

1.16 Employee benefits

A liability is recognised for benefits accruing to employees

in respect of wages and salaries, annual leave, long service

leave, and sick leave when it is probable that settlement will

be required and they are capable of being measured reliably.

Liabilities recognised in respect of employee benefits expected

to be settled within 12 months are measured at their nominal

values using the remuneration rate expected to apply at the date

of settlement.

Liabilities recognised in respect of employee benefits which

are not expected to be settled within 12 months are measured

as the present value of the estimated future cash outflows to

be made by the Group in respect of services provided to employees

up to reporting date.

1.17 Value Added Tax (VAT) and similar taxes

Revenues, expenses and assets are recognised net of the amount

of VAT or similar tax, except where the amount of tax incurred

is not recoverable from the relevant taxing authority. In these

circumstances the tax is recognised as part of the cost of acquisition

of the asset or as part of an item of the expense. Receivables

and payables in the consolidated statement of financial position

are shown inclusive of tax.

1.18 Provisions

Provisions are recognised when the Group has a legal or constructive

obligation, as a result of past events, for which it is probable

that an outflow of economic benefits will result and that outflow

can be reliably measured.

1.19 Plant and equipment

Each class of plant and equipment is carried at cost less, where

applicable, any accumulated depreciation and impairment losses.

Plant and equipment are measured on the cost basis less depreciation

and impairment losses. The carrying amount of plant and equipment

is reviewed annually by Directors to ensure it is not in excess

of the recoverable amount from these assets.

All other repairs and maintenance are charged to the income statement

during the financial period in which they are incurred.

The depreciable amount of all fixed assets is depreciated on

a diminishing value basis over the asset's useful life to the

consolidated Group commencing from the time the asset is held

ready for use.

Class of Fixed Asset: Depreciation rate

Property Plant and Equipment 10% - 50%

The assets' residual values and useful lives are reviewed, and

adjusted if appropriate, at each Statement of financial position

date.

An asset's carrying amount is written down immediately to its

recoverable amount if the asset's carrying amount is greater

than its estimated recoverable amount.

Gains and losses on disposals are determined by comparing proceeds

with the carrying amount. These gains or losses are included

in the income statement.

1.20 Financial assets at fair value through other comprehensive income

Financial assets at fair value through other comprehensive income

are non-derivative financial assets that are either not capable

of being classified into other categories of financial assets

due to their nature or they are designated as such by management.

They comprise investments in the equity of other entities where

there is neither a fixed maturity nor fixed or determinable payments

and the intention is to hold them for the medium to long term.

They are subsequently measured at fair value with any re-measurements

other than impairment losses and foreign exchange gains and losses

recognised in Reserves. When the financial asset is derecognised,

the cumulative gain or loss pertaining to that asset previously

recognised in Reserves is reclassified into profit or loss.

The financial assets are presented as non-current assets unless

they matured, or the intention is to dispose of them within 12

months of the end of the reporting period.

1.21 Share-based payments

The Group operates equity-settled share-based payment option

schemes. The fair value of the options to which employees become

entitled is measured at grant date and recognised as an expense

over the vesting period, with a corresponding increase to an

equity account. The fair value of options is ascertained using

a Black-Scholes pricing model which incorporates all market vesting

conditions. The number of options expected to vest is reviewed

and adjusted at the end of each reporting date such that the

amount recognised for services received as consideration for

the equity instruments granted shall be based on the number of

equity instruments that eventually vest.

1.22 Critical accounting estimates and judgements

The Directors evaluate estimates and judgments incorporated into

the financial statements based on historical knowledge and best

available current information. Estimates assume a reasonable

expectation of future events and are based on current trends

and economic data, obtained both externally and within the Group.

Key estimates - Impairment of the carrying value of investments

& financial assets

The Group assesses impairment at the end of each reporting period

by evaluating the conditions and events specific to the Group

that may be indicative of impairment triggers. Recoverable amounts

of relevant assets are reassessed using value-in-use calculations

that incorporate various key assumptions.

Management make judgements in respect of the carrying value of

their investments in associates both at a group and company level.

In undertaking this exercise management make estimations in respect

of the projected success of the associates projects at the period

end based on the information available at that time including,

but not limited to, the financing available to the associate

to pursue its projects. At the year end they consider the best

estimate of the carrying value of the associate to be same at

both a Group and Company level.

Key estimates - Estimated fair value of certain financial assets

measured at fair value through other comprehensive income

The fair value of financial instruments that are not traded in

an active market is determined using judgement to make assumptions

that are mainly based on market conditions existing at the end

of each reporting period. Refer to note 13 for additional information.

2. Adoption of new and revised standards and changes in accounting

policies

At the date of authorisation of these financial statements, there

are no new, but not yet effective, standards, amendments to existing

standards, or interpretations that have been published by the

IASB that will have a material impact on these financial statements.

Contacts

Panthera Resources PLC

Mark Bolton (Managing Director) +61 411 220 942

contact@pantheraresources.com

Allenby Capital Limited (Nominated Adviser & Broker) +44 (0)

20 3328 5656

John Depasquale / Vivek B hardwaj (Corporate Finance)

Financial Public Relations

Vigo Communications Ltd +44 (0)20 7390 0230

Oliver Clark / Chris McMahon

Subscribe for Regular Updates

Follow the Company on Twitter at: @PantheraPLC

For more information and to subscribe to updates visit:

pantheraresources.com

Qualified Person

The technical information contained in this disclosure has been

read and approved by Antony Truelove (BSc (Hon), MAusIMM, MAIG),

who is a qualified geologist and acts as the Competent Person under

the AIM Rules - Note for Mining and Oil & Gas Companies. Antony

Truelove is the COO of Panthera Resources PLC.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information for the purposes of

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310. Upon the publication of this announcement via a

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

Forward-looking Statements

This news release contains forward-looking statements that are

based on the Company's current expectations and estimates.

Forward-looking statements are frequently characterised by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", "suggest", "indicate" and other similar

words or statements that certain events or conditions "may" or

"will" occur. Such forward-looking statements involve known and

unknown risks, uncertainties, and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such factors include, among others: the

actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans

continue to be refined; possible variations in ore grade or

recovery rates; accidents, labour disputes, and other risks of the

mining industry; delays in obtaining governmental approvals or

financing; and fluctuations in metal prices. There may be other

factors that cause actions, events, or results not to be as

anticipated, estimated, or intended. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Company disclaims

any intent or obligation to update any forward-looking statement,

whether as a result of new information, future events, or results

or otherwise. Forward-looking statements are not guarantees of

future performance and accordingly, undue reliance should not be

put on such statements due to the inherent uncertainty therein.

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR URRORAWUKORR

(END) Dow Jones Newswires

September 30, 2021 01:59 ET (05:59 GMT)

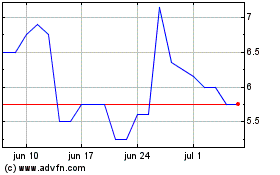

Panthera Resources (LSE:PAT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Panthera Resources (LSE:PAT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024