RBG Holdings PLC Purchase of Shares by Directors of Convex (2954U)

02 Diciembre 2021 - 1:00AM

UK Regulatory

TIDMRBGP

RNS Number : 2954U

RBG Holdings PLC

02 December 2021

RBG Holdings Plc

(the "Company")

Purchase of Shares by Directors of Convex

The Company is pleased to announce that on 1 December 2021 the

directors of Convex Capital Limited ("Convex") acquired a total of

160,942 ordinary shares of GBP0.002 pence each in the capital of

the Company (the "Shares") at a price of 114 pence per Ordinary

Share.

As previously stated in the announcement on 3 February 2021, the

Shares were purchased as part of the arrangement between the

directors of Convex and the Company to exchange their fixed base

salary arrangements for a flexible commission structure directly

linked to income from completed deals([1]) .

The number of Shares acquired by each director of Convex is

summarised below:

Name No. of Shares No. of No. of Shares Aggregate

held prior Shares held post holding as

to Acquisition Acquired Acquisition a % of issued

share capital

Mike Driver (CEO) 2,443,431 77,276 2,520,707 2.64

Chris Froggatt (Partner) 921,016 46,853 967,869 1.02

Nathalie Hodgkinson

(Partner) 350,550 36,813 387,363 0.41

Enquiries:

RBG Holdings plc Via Newgate Communications

Nicola Foulston, CEO

Singer Capital Markets (Nomad and Tel: +44 (0)20 7496 3000

Broker)

Shaun Dobson / Alex Bond (Corporate

Finance)

Tom Salvesen (Corporate Broking)

Newgate Communications (for media Tel: +44 (0)20 3757 6880

enquiries) rbg@newgatecomms.com

Robin Tozer/Tom Carnegie

About RBG Holdings plc

RBG Holdings plc is a professional services group, which

comprises the following divisions:

RBG Legal Services Limited ("RBGLS")

RBGLS is the Company's legal services division which combines

the businesses previously operated by Rosenblatt Limited and Memery

Crystal Limited.

Rosenblatt

Rosenblatt is one of the UK's pioneering legal practises and a

leader in dispute resolution. Rosenblatt provides a range of legal

services to its diversified client base, which includes companies,

banks, entrepreneurs, and individuals. Complementing this is

Rosenblatt's increasingly international footprint, advising on

complex cross-jurisdictional disputes.

Memery Crystal

Memery Crystal offers legal services in a range of areas such as

corporate (including a market-leading corporate finance offering),

real estate, commercial, IP & technology (CIPT), banking &

finance, tax & wealth structuring and employment. Memery

Crystal is one of the leading legal practises in the UK to advise

the emerging cannabis sector on a wide range of business issues.

Memery Crystal offers a partner-led service to a broad range of

clients, from multinational companies, financial institutions and

owner-managed businesses to individual entrepreneurs.

LionFish Litigation Finance Limited ("LionFish")

The Company also provides litigation finance in selected cases

through a separate arm, LionFish Litigation Finance Limited.

LionFish finances litigation matters being run by other solicitors

in return for a significant return on the outcome of those cases.

As such, the Company has two types of litigation assets -

Rosenblatt's own client matters, and litigation matters run by

third-party solicitors. LionFish is positioned to be a unique,

alternative provider to the traditional litigation funders.

Convex Capital Limited ("Convex Capital")

Convex Capital is a specialist sell-side corporate finance

boutique based in Manchester. Convex Capital is entirely focused on

helping companies, particularly owner-managed and entrepreneurial

businesses, realise their value through sales to large corporates.

Convex Capital identifies and proactively targets firms that it

believes represent attractive acquisition opportunities.

([1]) The authority granted by management under the scheme is

irrevocable and non-discretionary, and during a Close Period the

Board has no power to invoke any changes to the authority. Any

purchases will be undertaken at the sole discretion of Singer

Capital Markets Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHKZMGZRMLGMZM

(END) Dow Jones Newswires

December 02, 2021 02:00 ET (07:00 GMT)

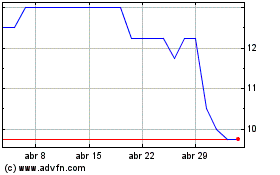

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024