TIDMTHAL

RNS Number : 1406N

Thalassa Holdings Limited

28 September 2021

28 September 2021

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation 596/2014 and is disclosed

in accordance with the Company's obligations under Article 17 of

those Regulations.

Thalassa Holdings Ltd

(Reuters: THAL.L, Bloomberg: THAL:LN)

("Thalassa", "THAL" or the "Company")

Interim Results for the period ended 30 June 2021

GROUP RESULTS 1H 2021 versus 1H 2020

Net financial income / (expense) ($0.01)m vs. $2.39m

Group Net Profit/(Loss) for the period ($1.12m) vs. $0.61m

Group Earnings/(Loss) Per Share (both basic ($0.14)/(GBP0.10) vs.

and diluted)*(1) $0.04/GBP0.03

Reported Book value per share*(2) $1.84/GBP1.33 vs. $1.85/GBP1.50

Net Cash $1.9m vs. $6.8m

Portfolio Holdings and available for sale

investments $10.9m vs. $13.5m

*(1) based on weighted average number of shares

in issue of 7,945,838 (1H20: 15,138,558)

*(2) based on actual number of shares in issue as at 30 June 2021

of 7,945,838

ARL

-- Focus on further continued development of Flying Node towards commercialisation

-- Efforts to monetise investment through commercial

collaboration, third party funding or business combination in

progress

id4

-- Software development completed and commercialisation and

monetisation of investment now primary objectives

London Medical Laboratory ("LML")

-- As announced on 17 September 2021, Thalassa exited from its

LML commitment due to unforeseen circumstances.

-- LML had not availed itself of the Thalassa facility and

Thalassa was, therefore, not due any interest.

-- Tim Donell, the Company's CFO remains on the Board of LML.

Investor Enquiries:

Thalassa Holdings Ltd

Duncan Soukup, Chairman +33 (0)6 78 63 26 89

www.thalassaholdingsltd.com

Note to Editors: Thalassa Holdings Ltd, incorporated and

registered in the BVI, is a holding company with various interests

across a number of industries.

CHAIRMAN'S STATEMENT

I am happy to present the unaudited interim accounts for the six

months to 30 June 2021.

The stock market merry-go-round continues...except in China.

US and European stock markets continue to climb and hit new

highs. These markets through the end of August 2021 are up between

10% (Spain) and 26% (Sweden). At the other end of the spectrum,

China has declined by 7.64% since the beginning of the year and by

+/-17% from its February high.

Rotation out of technology into more cyclical companies has been

the main theme recently. in an environment of continued Covid-19

uncertainty, this strikes us as possibly wishful thinking. Covid is

not going away in a hurry and with the summer holidays about to

end, it will be interesting to see whether a fourth wave disrupts

the burgeoning economic recovery. Whilst stock market investors are

clearly split, the Fed remains clearly cautious...on the fence!

OPERATIONS

Given the divestiture of ALNA and AMOI, the Board's primary

focus is to bring costs in line with the Company's reduced capital

base whilst at the same time creating value for shareholders.

ANEMOI (AMOI LN)

Investors will be aware that AMOI shares have been suspended

pending further announcements on a potential Reverse Take Over

(RTO).

APEIRON

Apeiron is a Swiss registered Company set up to acquire partial

or full control of FinTech/RegTech companies. The Company's first

transaction was the recently announced acquisition of id4.

AUTONOMOUS ROBOTICS (ARL)

Progress has continued with the development of the Flying Node

concept.

The company is continuing to investigate opportunities to

increase shareholder value including but not only the possibility

of a merger or sale of the business.

ALINA (ALNA LN)

Having completed its plan to transfer the Company to the

Standard List and change the Company's investment objectives from a

Real Estate Investment Trust (REIT) to an operating company, the

Board is now focused on the acquisition of assets to enhance

shareholder value. To this end the Company recently announced the

acquisition of 2.7% of Dolphin Capital Investors (DCI LN). On 21

July 2021, DCI issued a fact sheet stating that as of Q4 2020, NAV

was 16p. NAV has been calculated as a going concern, which somewhat

contradicts the reality of the situation, namely that DCI is in

liquidation. In the Board's experience there is usually a

substantial mismatch between a going concern valuation and a

company in liquidation. Whether the ultimate value of DCI shares,

in liquidation, lies North of the current market price of 4.2p but

South of the stated 16p NAV remains to be seen. We would be happy

were DCI to achieve 8p, for a gain in excess of 100% or ecstatic if

the new DCI Board achieved 12p which would give ALNA a better than

200% return on investment. Given DCI's current market price, it

would appear that Mr Market, does not believe that 16p is

achievable!?

OUTLOOK

I would repeat my statement from last year, "at some point Govt.

support will be withdrawn and we will, as Mr Buffett puts it...find

out who has been swimming naked when the tide goes out."

The big question your board is asking itself, is not will the US

Federal Reserve reduce bond buying but how quickly will they

increase interest rates. Our current view is that the Fed is more

concerned with Employment than inflation and not in a hurry to

raise interest rates. Having said that, input price inflation is

running substantially ahead of FED targets and if wage inflation

follows suit the FED will be faced with a real problem...allow

inflation to overshoot or combat inflation and risk harming the

economic recovery and job growth. In the meantime the only game in

town is the stock market!

Your Board is in the same camp as the FED and believes that

deflationary risks are as great as inflationary risks. In other

words, we remain cautious and would like to see the porridge cooked

before serving and eating.

Responsibility Statement

We confirm that to the best of our knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' and gives a

true and fair view of the assets, liabilities, financial position

and profit or loss of the Company and the undertakings included in

the consolidation as a whole as required by DTR 4.2.4 R;

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

Cautionary statement

This Interim Management Report (IMR) has been prepared solely to

provide additional information to shareholders to assess the

Company's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose.

Duncan Soukup

Chairman

Thalassa Holdings Ltd

20 September 2021

Interim Condensed Consolidated Statement of Income

For the six months ended 30 June 2021

Six months Six months Year

ended ended ended

30 Jun 30 Jun 31 Dec

21 20 20

Unaudited Unaudited Audited

Note $ $ $

Continuing Operations

Revenue 169,768 269,327 55,855

Cost of sales 246,149 (29,528) 900

Gross profit 415,917 239,799 56,755

------------------------------------- ----- ------------ ------------ ------------

Administrative expenses excluding

exceptional costs (1,735,604) (2,009,187) (3,131,073)

Exceptional administration costs - - (77,603)

------------------------------------- ----- ------------ ------------ ------------

Total administrative expenses (1,735,604) (2,009,187) (3,208,676)

------------------------------------- ----- ------------ ------------ ------------

Operating loss before depreciation (1,319,687) (1,769,388) (3,151,921)

------------------------------------- ----- ------------ ------------ ------------

Depreciation 5 (87,818) (9,268) (47,771)

------------------------------------- ----- ------------ ------------ ------------

Impairment - - -

------------------------------------- ----- ------------ ------------ ------------

Operating loss (1,407,505) (1,778,656) (3,199,692)

------------------------------------- ----- ------------ ------------ ------------

Net financial income/(expense) (12,814) 2,390,564 3,591,382

------------------------------------- ----- ------------ ------------ ------------

Other gains 302,391 - 1,160,300

------------------------------------- ----- ------------ ------------ ------------

Profit/(loss) before taxation (1,117,928) 611,908 1,551,990

------------------------------------- ----- ------------ ------------ ------------

Taxation (1,159) (994) 109,303

------------------------------------- ----- ------------ ------------ ------------

Profit/(loss) for the year from

continuing operations (1,119,087) 610,914 1,661,293

------------------------------------- ----- ------------ ------------ ------------

Discontinued Operations

Profit/(loss) for the year from

discontinued operations - - (868,303)

------------------------------------- ----- ------------ ------------ ------------

Gain on disposal of subsidiary - - 121,891

------------------------------------- ----- ------------ ------------ ------------

Profit/(loss) for the year (1,119,087) 610,914 914,881

------------------------------------- ----- ------------ ------------ ------------

Attributable to:

Equity shareholders of the parent (1,060,345) 688,859 765,725

Non-controlling interest (58,742) (77,945) 149,156

(1,119,087) 610,914 914,881

------------------------------------- ----- ------------ ------------ ------------

Earnings per share - US$ (using

weighted average number of shares)

Basic and Diluted 3 (0.14) 0.04 0.06

------------------------------------- ----- ------------ ------------ ------------

Interim Condensed Consolidated Statement of Comprehensive

Income

For the six months ended 30 June 2021

Six months Six months Year

ended ended ended

30 Jun 21 30 Jun 20 31 Dec 20

Unaudited Unaudited Audited

$ $ $

Loss for the financial year (1,119,087) 610,914 914,881

Other comprehensive income:

Exchange differences on re-translating

foreign operations (154,358) (618,630) (332,954)

Total comprehensive income (1,273,445) (7,716) 581,927

---------------------------------------- ------------ ----------- ----------

Attributable to:

Equity shareholders of the parent (1,214,703) 117,333 432,771

Non-Controlling interest (58,742) (125,049) 149,156

Total Comprehensive income (1,273,445) (7,716) 581,927

---------------------------------------- ------------ ----------- ----------

Interim Condensed Consolidated Statement of Financial

Position

As at 30 June 2021

As at As at As at

30 Jun 21 30 Jun 20 31 Dec 20

Note Unaudited Unaudited Audited

Assets $ $ $

Non-current assets

Goodwill 4 204,724 204,724 204,724

Intangible assets 4 1,384,344 577,497 948,739

Investment properties - 3,868,782 -

Property, plant and equipment 5 1,021,373 63,448 418,656

Available for sale financial

assets 6 2,471,603 5,341,353 1,934,068

Loans 7 8,424,958 8,216,085 7,606,077

Total non-current assets 13,507,002 18,271,889 11,112,264

------------------------------- ----- ------------- ------------- -------------

Assets Held for Sale - 407,031 -

Current assets

Trade and other receivables 800,380 2,421,232 680,443

Cash and cash equivalents 8,438,006 12,891,696 9,712,779

Total current assets 9,238,386 15,312,928 10,393,222

------------------------------- ----- ------------- ------------- -------------

Liabilities

Current liabilities

Trade and other payables 959,263 1,469,036 1,044,721

Short term debt 8 74,060 - -

Borrowings 8 6,504,958 6,183,066 4,706,981

Total current liabilities 7,538,281 7,652,102 5,751,702

------------------------------- ----- ------------- ------------- -------------

Net current assets 1,700,105 7,660,826 4,641,520

------------------------------- ----- ------------- ------------- -------------

Non-current liabilities

Long term debt 8 611,741 472,041 39,331

Total non-current liabilities 611,741 472,041 39,331

------------------------------- ----- ------------- ------------- -------------

Net assets 14,595,366 25,867,705 15,714,453

------------------------------- ----- ------------- ------------- -------------

Shareholders' Equity

Share capital 10 208,522 255,675 208,522

Share premium 36,714,225 45,416,298 36,714,225

Treasury shares (11,414,289) (10,216,218) (11,414,289)

Other reserves 260,603 (179,431) 106,245

Non-Controlling Interest (225,667) 503,624 (166,925)

Retained earnings (10,948,028) (9,912,243) (9,733,325)

Total shareholders' equity 14,595,366 25,867,705 15,714,453

Total equity 14,595,366 25,867,705 15,714,453

------------------------------- ----- ------------- ------------- -------------

Interim Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2021

As at As at As at

30 Jun 30 Jun 31 Dec

21 20 20

Unaudited Unaudited Audited

Notes $ $ $

Cash flows from operating activities

Profit/Loss for the period before taxation (1,117,928) 611,908 (3,199,699)

Impairment losses on goodwill - - -

(Increase)/decrease in trade and other

receivables (105,342) (1,528,300) 123,388

(Decrease)/increase in trade and other

payables (98,618) 174,903 78,171

Loss/(gain) on disposal of PPE - - -

Gain/(loss) on disposal of AFS investments 88,130 (2,162,700) 1,907,391

Net exchange differences (153,833) (618,630) 1,379,322

Accrued interest income (237,392) (37,231) -

Depreciation 5 87,818 9,268 47,771

Share of losses of associate/gain on

disposal - - (701,165)

Fair value movement on AFS financial

assets (581,487) 226,778 1,290,219

Cash generated by operations (2,118,652) (3,324,004) 925,398

Taxation (2,775) - 109,303

Net cash flow used in operating activities (2,121,427) (3,324,004) 1,034,701

-------------------------------------------- ------

Net cash flow from discontinued operations - - (563,302)

-------------------------------------------- ------ ------------ ------------- -------------

Sale/(purchase) of property, plant

and equipment (25,927) (1,551) (390,971)

Sale/(purchase) of intangible assets (435,592) (420,072) (775,273)

Sale/(purchase) of investment property - 157,175 3,725,261

Net (purchase)/sale of AFS financial

assets (625,663) 1,396,019 (2,608,009)

Investments in subsidiaries - (6,385,349) (8,150,392)

Net cash flow used in investing activities

- continuing operations (1,087,182) (5,253,778) (8,199,384)

-------------------------------------------- ------ ------------ ------------- -------------

Proceeds from disposal of Alina Holdings

PLC - - 121,891

Net cash flow from investing activities

- discontinued operations - - 121,891

-------------------------------------------- ------ ------------ ------------- -------------

Cash flows from financing activities

Purchase of treasury shares - (1,525,753) (2,723,824)

Leasing Liabilities (30,969) - 39,331

Interest Expense (24,404) - -

Proceeds from borrowings 1,834,851 (1,021,720) 212,343

Repayment of borrowings - - (3,007,076)

Net cash flow from financing activities

- continuing operations 1,779,478 (2,547,473) (5,479,226)

-------------------------------------------- ------ ------------ ------------- -------------

Net cash flow from financing activities

- discontinued operations - - (468,856)

-------------------------------------------- ------ ------------ ------------- -------------

-

Net decrease in cash and cash equivalents (1,429,131) (11,125,255) (13,554,176)

Cash and cash equivalents at the start

of the year 9,712,779 24,198,744 24,198,744

Effects of exchange rate changes on

cash and cash equivalents 154,358 (181,793) (931,789)

Cash and cash equivalents at the end

of the year 8,438,006 12,891,696 9,712,779

-------------------------------------------- ------ ------------ ------------- -------------

Interim Condensed Consolidated Statement of Changes in

Equity

For the six months ended 30 June 2021

Attributable to owners of the Company

----------------------------------------------------------------- ------------

Non- Total

Share Share Treasury Other Retained controlling Shareholders

Capital Premium Shares Reserves Earnings Total Interest Equity

$ $ $ $ $ $ $ $

Balance as at

31 December

2019 255,675 45,416,298 (8,690,465) 439,199 (10,648,206) 26,772,501 628,673 27,401,174

--------------- --------- ------------ ------------- ---------- ------------- ------------ ------------ -------------

Purchase of

treasury

shares - - (1,525,753) - - (1,525,753) - (1,525,753)

Total

comprehensive

income for

the

period - - - (618,630) 735,963 117,333 (125,049) (7,716)

Balance as at

30 June 2020 255,675 45,416,298 (10,216,218) (179,431) (9,912,243) 25,364,081 503,624 25,867,705

--------------- --------- ------------ ------------- ---------- ------------- ------------ ------------ -------------

Redemption of

Capital (47,153) (8,702,073) - - - (8,749,226) - (8,749,226)

Purchase of

treasury

shares - - (1,198,071) - - (1,198,071) - (1,198,071)

Disposal of

subsidiary

with NCI - - - - 89,072 89,072 (396,344) (307,272)

Total

comprehensive

income for

the

period - - - 285,676 89,846 375,522 (274,205) 101,317

Balance as at

31 December

2020 208,522 36,714,225 (11,414,289) 106,245 (9,733,325) 15,881,378 (166,925) 15,714,453

--------------- --------- ------------ ------------- ---------- ------------- ------------ ------------ -------------

- - - - - - - -

Forex - - - - - - - -

adjustment

on bought

forwards

Total

comprehensive

income for

the

period - - - 154,358 (1,214,703) (1,060,345) (58,742) (1,119,087)

Balance as at

30 June 2021 208,522 36,714,225 (11,414,289) 260,603 (10,948,028) 14,821,033 (225,667) 14,595,366

--------------- --------- ------------ ------------- ---------- ------------- ------------ ------------ -------------

Notes to the Interim Condensed Consolidated Financial

Information

1. General information

Thalassa Holdings Ltd (the "Company") is a British Virgin Island

("BVI") International business company ("IBC"), incorporated and

registered in the BVI on 26 September 2007. The Company is a

holding company with various interests across a number of

industries.

Autonomous Robotics Limited ("ARL" - formerly GO Science 2013

Ltd) is a wholly owned subsidiary of Thalassa and is an Autonomous

Underwater Vehicle ("AUV") research and development company.

Apeiron Holdings (BVI) Ltd is a BVI registered company and is

wholly owned by Thalassa. It owns 100% of Apeiron Holdings AG which

is a company registered in Switzerland. In 2019 Apeiron Holdings AG

completed the acquisition of 84% of id4, a FinTech company also

registered in Switzerland.

WGP Geosolutions Limited is a wholly owned subsidiary of

Thalassa which has an additional subsidiary, WGP Group AT GmbH,

both currently non-operational.

2. Significant Accounting policies

The Group prepares its accounts in accordance with applicable

International Financial Reporting Standards ("IFRS") as adopted by

the United Kingdom.

The accounting policies applied by the Company in this unaudited

consolidated interim financial information are the same as those

applied by the Company in its consolidated financial statements as

at and for the period ended 31 December 2020 except as detailed

below.

The financial information has been prepared under the historical

cost convention, as modified by the accounting standard for

financial instruments at fair value.

2.1. Basis of preparation

The condensed consolidated interim financial information for the

six months ended 30 June 2021 has been prepared in accordance with

International Accounting Standard No. 34, 'Interim Financial

Reporting'. They do not include all of the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Company as at and

for the year ended 31 December 2020.

These condensed interim financial statements for the six months

ended 30 June 2021 and 30 June 2020 are unaudited and do not

constitute full accounts. The comparative figures for the period

ended 31 December 2020 are extracted from the 2020 audited

financial statements. The independent auditor's report on the 2020

financial statements was not qualified.

All intra-group transactions, balances, income and expenses are

eliminated in full on consolidation.

2.2. Going concern

The financial information has been prepared on the going concern

basis as management consider that the Group has sufficient cash to

fund its current commitments for the foreseeable future.

Notes to the Interim Condensed Consolidated Financial

Information Continued

3. Earnings per share

Six months Six months Year

ended ended ended

30 Jun 30 Jun 20 31 Dec 20

21

Unaudited Unaudited Audited

The calculation of earnings per share

is based on

the following loss and number of shares:

Profit/(loss) for the period (1,119,087) 610,914 914,881

Weighted average number of shares of

the Company 7,945,838 15,138,558 14,139,629

Earnings per share:

Basic and Diluted (US$) (0.14) 0.04 0.06

4. Intangible assets

Development

costs Patents Software Sub-total Goodwill Total

$ $ $ $ $ $

At 31 December 2020

Cost 838,147 110,592 - 948,739 361,909 1,310,648

Accumulated amortisation

and impairment - - - - (157,185) (157,185)

Net book amount 838,147 110,592 - 948,739 204,724 1,153,463

------------ -------- --------- ---------- ---------- ----------

Half-year ended 30 June

2021

Opening net book amount 838,147 110,592 - 948,739 204,724 1,153,463

FX movement (6,088) 1,504 - (4,584) - (4,584)

832,059 112,096 - 944,155 204,724 1,148,879

Additions 372,157 37,596 30,436 440,189 - 440,189

Amortisation charge - - - - - -

Closing net book amount 1,204,216 149,692 30,436 1,384,344 204,724 1,589,068

------------ -------- --------- ---------- ---------- ----------

At 30 June 2021

Cost 1,204,216 149,692 30,436 1,384,344 361,909 1,746,253

Accumulated amortisation

and impairment - - - - (157,185) (157,185)

Net book amount 1,204,216 149,692 30,436 1,384,344 204,724 1,589,068

------------ -------- --------- ---------- ---------- ----------

The intangible assets held by the Group increased as a result of

capitalising the development costs of Autonomous Robotics Ltd

("ARL") and id4 AG, alongside the introduction of a new ERP system

within the Group.

Notes to the Interim Condensed Consolidated Financial

Information Continued

5. Property, plant and equipment

Plant

Land and and Motor

Total buildings Equipment Vehicles

Cost $ $ $ $

Cost at 1 January 2021 784,149 75,829 187,937 520,383

FX movement 5,709 1,032 (378) 5,055

----------------------------------- ----------

789,858 76,861 187,559 525,438

Additions 685,454 664,237 980 20,237

Cost at 30 June 2020 1,475,312 741,098 188,539 545,675

Depreciation

Depreciation at 1 January 2021 365,494 25,277 160,405 179,812

FX movement 693 344 215 134

----------------------------------- ----------

366,187 25,621 160,620 179,946

Charge for the year on continuing

operations 87,818 37,184 3,237 47,397

Foreign exchange effect on year

end translation (66) (27) (3) (36)

Depreciation at 30 June 2021 453,939 62,778 163,855 227,307

----------------------------------- ---------- ---------- ---------- ---------

Closing net book value at 30 June

2021 1,021,373 678,320 24,685 318,368

----------------------------------- ---------- ---------- ---------- ---------

Additions relate to the office lease taken out in Aperion

Holdings AG, with a corresponding liability in note 10.

Depreciation differs to the Income Statement due to forex

translation.

6. Investments - Available For Sale Financial Assets

The Group classifies the following financial assets at fair

value through profit or loss (FVPL):-

Equity investments that are held for trading

As at As at As at

30 Jun 21 30 Jun 20 31 Dec 20

Unaudited Unaudited Audited

$ $ $

Available for sale investments

At the beginning of the period 1,934,068 4,801,450 4,801,450

Additions 4,462,197 19,589,204 28,983,183

Unrealised gain/(losses) 41,095 (370,754) 214,956

Disposals (3,965,757) (18,678,547) (32,065,521)

At period close 2,471,603 5,341,353 1,934,068

-------------------------------- ------------ ------------- -------------

AFS investments have been valued incorporating Level 1 inputs in

accordance with IFRS7.

Notes to the Interim Condensed Consolidated Financial

Information Continued

7. Investment Loans

As at As at As at

30 Jun 21 30 Jun 20 31 Dec 20

Unaudited Unaudited Audited

$ $ $

Loans at period open 1,746,866 1,695,302 1,695,302

Accrued interest - to be waived 26,368 25,589 51,564

---------- ---------- ------------

Loans at period close 1,773,234 1,720,891 1,746,866

--------------------------------- ---------- ---------- ------------

Portfolio Holdings at period 5,859,211 - -

open

Issued 448,362 6,495,194 10,661,053

Accrued interest - to be waived 217,278 - 90,245

Repaid - - (6,538,704)

Forex 70,565 - 578,810

Fair Value Adjustment 56,308 - 1,067,808

Portfolio holdings at period

close 6,651,724 6,495,194 5,859,211

--------------------------------- ---------- ---------- ------------

Total of loans and holdings 8,424,958 8,216,085 7,606,077

--------------------------------- ---------- ---------- ------------

The Loan is to the THAL Discretionary Trust, the terms of the

loan are set with a 0% interest rate however interest has been

accrued at 3% as per IFRS requirements, it is the intention of the

Company to waive this interest upon repayment of the capital.

The portfolio holdings increased through further drawdown of

convertible loan notes to Anemoi International Ltd and the issuance

of a convertible loan note from the Group company Apeiron AG to

Janzz Technologies of CHF200,000.

8. Borrowings

As at As at As at

30 Jun 21 30 Jun 20 31 Dec 20

Unaudited Unaudited Audited

Non-current liabilities $ $ $

Credit facility - -

Lease liabilities 611,741 472,041 39,330

---------- ---------- ----------

611,741 472,041 39,330

------------------------- ---------- ---------- ----------

Current liabilities

Credit facility 6,504,958 6,148,339 4,694,511

Lease liabilities 74,060 34,727 12,470

---------- ---------- ----------

6,579,018 6,183,066 4,706,981

------------------------- ---------- ---------- ----------

The credit facilities outstanding as at 30 Jun 2021 consist of

fixed term advances opened on 28 Jun 2021 for GBP4.4m and opened on

7 Jun 2021 for EUR300k, both advances were settled by 31 Jul 2021

and new credit facilities opened.

The lease liabilities comprise of amounts owed in relation to

office leases held by ARL and Aperion AG. The lease held by Aperion

Holdings AG was entered in to in Feb 2021.

Notes to the Interim Condensed Consolidated Financial

Information Continued

9. Related party balances and transactions

Under the consultancy and administrative services agreement

entered into on 30 August 2014 with a company in which the Chairman

has a beneficial interest, the Group accrued $335,000

(1H20:$264,000) for consultancy and administrative services

provided to the Group. At 30 June 2021 the amount owed to this

company was $200,000 (1H20: $63,287).

10. Share capital

As at As at

30 Jun 2021 31 Dec 2020

$ $

Authorised share capital:

100,000,000 ordinary shares of $0.01

each 1,000,000 1,000,000

Allotted, issued and fully paid:

20,852,359 ordinary shares of $0.01

each 208,522 208,522

11. Subsequent events

In July 2021 the Board entered into non-legally binding heads of

terms with Anemoi International Ltd and one of its investee

companies, id4 AG which set out the key terms for the proposed

acquisition of the entire issued share capital of id4 by

Anemoi.

In July 2021, the loan to Janzz Technologies of CHF 200,000, as

held by the subsidiary Apeiron AG, converted in to equity equal to

133,333 ordinary shares.

12. Copies of the Interim Report

The interim report is available on the Company's website:

www.thalassaholdingsltd.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKOBDDBKBACB

(END) Dow Jones Newswires

September 28, 2021 02:00 ET (06:00 GMT)

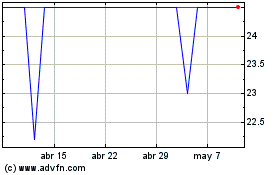

Thalassa (LSE:THAL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thalassa (LSE:THAL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024