TIDMVCAP

RNS Number : 7596K

Vector Capital PLC

06 September 2021

Vector Capital plc

("Vector Capital", "Company" or "Group")

Half Year Results for the period ended 30 June 2021

A Strong Trading Performance

Highlights

-- Loan book growth 24.2% to GBP40.6m (as at 30 June 2020: GBP32.7m)

-- Revenue up 16% to GBP2.5m (H1 2020: GBP2.1m)

-- PAT up 3% to GBP1.05m (H1 2020: GBP1.02m)

-- EPS of 2.50p (H1 2020: 3.00p)

-- Interim dividend of 0.95p per share, reflecting a strong performance

Operational Highlights

-- Successful placing to raise GBP1.5m gross, to build further

the capital base and meet demand for new loans

-- Increased our wholesale banking facilities from GBP25m to GBP30m

-- Significant progress made in establishing new broker

relationships which have led to an increased number of new

enquiries and proposals

-- Continued to invest in our technology platform to ensure

operational resilience and efficiency

-- Invested in staff training to enhance expertise which has led

to ability to handle higher volumes and more complex

transactions

-- Best practice ESG policies in place to support responsible

lending and encourage sustainability across our business

Agam Jain, CEO of Vector Capital, commented : "Vector Capital's

first half performance has been strong. We have continued to make

excellent progress against our strategy and we are well placed to

capitalise on the healthy property market and demand for our loans.

In response to this demand and ensure we have a strong capital

base, we raised a further GBP1.5m in the period and increased our

wholesale banking facilities to GBP30m. Reflecting our performance

and the confidence we have in the business, we are declaring an

interim dividend of 0.95p per share.

"Pleasingly, we have a best practice ESG policy now in place to

support our commitment towards being a responsible lender and

encouraging sustainability across our business. This is an

important part of our business and underpins our values and how we

conduct ourselves.

"Our aim is to be seen by our customers as a trusted,

responsible partner that delivers outstanding services. We are

determined to build on the progress we have made and enhance our

capability to provide new loans which will help secure sustainable

benefits for all of our stakeholders."

Enquiries

Vector Capital plc c/o TB Cardew

Agam Jain

Allenby Capital Limited

James Reeve/George Payne (Corporate

Finance)

Tony Quirke (Sales and Corporate Broking) + 44 (0) 20 3328 5656

TB Cardew

Shan Shan Willenbrock + 44 (0)7775 848537

Lucas Bramwell/Charlotte Anderson + 44 (0)20 7930 0777

vector@tbcardew.com

About Vector Capital:

Vector Capital provides secured, business-to-business loans to

SMEs based in England and Wales. Loans are typically secured by a

first legal charge against real estate. The Company's customers

typically borrow for general working capital purposes, bridging

ahead of refinancing, land development and property acquisition.

The loans provided by the Company are typically for renewable

12-month terms with fixed interest rates.

Chairman's Statement

I'm delighted to present our 2021 Interim Results for the

six-month period to 30 June 2021, which report consolidated pre-tax

profits of GBP1,298,000 (H1 2020: GBP1,258,000, FY 2020:

GBP2,347,000), and to declare an interim dividend of 0.95 pence per

share to be paid on 24th September 2021 to shareholders on the

register on 17(th) September 2021. The results for the first half

of the year reflect the continued positive development of the

business linked to building the Group's loan book to GBP40.6m (30

June 2020: GBP32.7m, 31 December 2020: GBP36.4m) and creating a

leading presence in our chosen market in the provision of secured

loans to the SME sector.

It's also very pleasing to report that, following the successful

admission to the AIM market on 29(th) December 2020, the Company

returned to the market with a Placing of 3,191,490 new ordinary

shares at 47 pence each on 23 June 2021 to raise GBP1.5m gross, to

build further the capital base. During the period, we were also

able to increase our wholesale banking facilities from GBP25m to

GBP30m. In addition, we are in the early stages of trialling a

co-funding model, allowing third party lenders to participate

directly alongside the Group in the provision of certain loans.

While COVID-19 restrictions continued to impact the business

during the period our proven systems were able to manage all

operations successfully and the UK property lending market has

remained resilient.

The Group's half year results, recorded revenue growth of 15.8%

and an increase in profits before tax of 3.2%, year-on-year,

combined with an 11.6% rise in the value of the loan book from 31

December 2020 to 30 June 2021 referred to above, reflect the hard

work of the executive team, the quality of the underlying

operational systems and the strength of the business model.

We remain committed to building on the Group's strong business

foundations and its positive performance now as a public company

and to strategically grow the loan book using a combination of our

own resources, the facilities provided by our wholesale lenders

and, on a selective basis, via co-funding arrangements.

As a Board we are very mindful of our wider environmental,

social and governance responsibilities to shareholders and other

stakeholders and we have developed, from what we believe to be

market best practice, underlying principles and developing

procedures to address these important issues. Details of our ESG

policies and procedures, aimed principally at responsible lending

and encouraging sustainability and avoidance of waste in all we do,

are set out on the Company's website, www.vectorcapital.co.uk.

The results for the period, were only possible by the efforts of

Vector's employees and my fellow Board members and considerable

thanks are due to them and our business partners.

I am confident that as a team we have the skills, experience and

opportunities to make further progress throughout the rest of 2021

and beyond and to capitalise on the opportunities which will

arise.

Robin Stevens

Chairman

Chief Executive's Statement

A positive performance and continued growth

I am pleased to report a very healthy set of interim results

which evidences the Group's continued growth and development.

The loan book at the end of the period was GBP40.6m (30 June

2020: GBP32.7m, 31 December 2020: GBP36.4m). The average monthly

loan book value for the 6 months period was GBP38.4m (H1 2020

average monthly loan book: GBP34.7m, 2020 average monthly loan

book: GBP34.8m).

The average interest rate for the period increased to 11.70%

p.a. (H1 2020: 11.69%, 12 months to Dec 20 was 11.53%).

Pre-tax profit for the 6 months was GBP1.30m (H1 2020:

GBP1.26m).

Diverse portfolio

Our loan book security portfolio comprises:

-- residential investment properties

-- residential refurbishments

-- mixed use (commercial ground floor with flats above)

-- commercial (warehouse, retail, hospitality)

-- development projects (construction of houses and flats)

-- land with planning permission

The conventional residential bridging segment of the market has

become crowded with many new entrants however because of our

expertise in the different segments mentioned above we can still

target overall loan book growth. We are also issuing a limited

number of loans against 2(nd) charge where the equity is

substantial.

Funding

We raised further capital on AIM with a Placing of 3,191,490 new

shares at 47 pence each on 23 June 2021 to raise GBP1.5m gross.

Our capital and liquidity remain healthy and we are in a strong

position to fund new loan opportunities. We have two banking lines

that are available primarily for residential transactions. Both of

the wholesale banks from whom we have facilities have indicated

that they would be willing to offer increased facilities. We

continue to explore debt funding sources for the other market

segments that we operate in. At the end of the period, the Group

had GBP10.1m of available finance from the wholesale banks (30 June

2020: GBP5.68m, 31 December 2020: GBP10.2m).

Currently we have conservative gearing - we believe that there

is tremendous scope to use suitable debt facilities and start

gearing in the future. The Group has designed a co-funding

instrument and in the early stages of test marketing.

Information Technology

We continue to invest and initiate further improvements in our

software platform by reviewing and re-mapping our processes. These

software upgrades are expected to be ready for Q4 this year and

will further improve our operational resilience and efficiency.

Headcount

During the period we have invested significant effort in staff

training which has increased the expertise and productivity of each

team member. As a result, we have the capacity to handle increased

activity and handle more complex transactions with the same team.

We do not need to increase headcount.

Marketing

We have made considerable headway in establishing new Broker

relationships which have led to an increased number of new

enquiries and proposals. We will continue with this effort for the

rest of the year.

Dividend

On the basis of the financial performance in the first half of

the year, a dividend of 0.95p per share is being declared. This

will be paid on 24th September 2021 to shareholders on the register

on 17(th) September 2021.

Outlook

The success to date of the vaccination programme and UK

Government's economic interventions provides cause for optimism and

allows us to move ahead with our growth agenda, supported by the

good level of interim profits.

There is heavy competition in the residential bridging segment,

but this is compensated by increased opportunities in the other

market segments such as land and development. We are confident of

continuing our positive performance in the remainder of 2021 and

generating healthy returns for the benefit of all stakeholders.

Agam Jain

Chief Executive Officer

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2021

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2021 2020 2020

Notes GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Revenue 3 2,467 2,130 4,325

Cost of sales (228) (132) (321)

------------- ------------- -------------

Gross profit 2,239 1,998 4,004

Other income 29

Administrative expenses 4 (378) (214) (668)

Operating profit 1,861 1,784 3,365

Finance costs (563) (526) (1,018)

------------- ------------- -------------

Profit on ordinary activities

before taxation 1,298 1,258 2,347

Income tax expense 5 (247) (239) (445)

------------- ------------- -------------

Profit after taxation 1,051 1,019 1,902

Other comprehensive income - - -

------------- ------------- -------------

Total comprehensive income attributable

to the shareholders of the Company 1,051 1,019 1,902

============= ============= =============

Pro - forma basic and diluted

earnings per share

attributable to the owners

of the Company (pence) 10 2.50 3.00 5.58

============= ============= =============

Condensed Consolidated Statements of Financial Position

For the six months ended 30 June 2021

Notes 30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Non-Current assets

Property, plant and equipment 6 3 - 4

3 - 4

------------- ------------- ------------

Current assets

Trade and other receivables 7 41,067 33,327 36,963

Cash and bank balances 971 1,612 2,569

42,038 34,939 39,532

------------- ------------- ------------

Total Assets 42,041 34,939 39,536

============= ============= ============

Current liabilities

Trade and other payables 8 18,653 16,220 18,030

Income tax payable 247 613 205

18,900 16,833 18,235

------------- ------------- ------------

Total Liabilities 18,900 16,833 18,235

------------- ------------- ------------

Equity

Share capital 9 226 170 210

Share premium 20,876 16,830 19,502

Group reorganisation reserve 188 188 188

Retained earnings 1,851 918 1,401

23,141 18,106 21,301

------------- ------------- ------------

Total Equity and Liabilities 42,041 34,939 39,536

============= ============= ============

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2021

Share Share premium Group reorganisation Retained Total equity

capital reserve profits

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January

2020 170 16,830 188 (101) 17,087

Profit for the six months

ended 30 June 2020 - - - 1,019 1,019

Dividends paid - - - - -

Balance at 30 June 2020 170 16,830 188 918 18,106

Issue of share capital 40 2,672 - - 2,712

Profit for the six months

ended 31 December 2020 - - - 883 883

Dividends paid - - - (400) (400)

Balance at 31 December

2020 210 19,502 188 1,401 21,301

Issue of share capital 16 1,374 - - 1,390

Profit for the six months

ended 30 June 2021 - - - 1,051 1,051

Dividends paid - - - (601) (601)

Balance at 30 June 2021 226 20,876 188 1,851 23,141

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2021

Six Months Six Months Year ended

ended 30 ended 30 31 December

June June

2021 2020 2020

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Cash flow from operating activities

Profit for the period before

taxation 1,298 1,258 2,347

Adjustment for:

Interest expense 563 526 1,018

Depreciation 1 - 1

Tax paid (205) - (614)

------------ ------------ -------------

Operating cash flows before

movements in working capital 1,657 1,784 2,752

(Increase)/decrease in trade

and other receivables (4,104) 924 (2,713)

Increase/(decrease) in trade

and other payables 623 (2,169) (1,566)

------------ ------------ -------------

Cash generated from/(absorbed

in) operating activities (1,824) 539 (1,527)

Interest paid (563 ) (526) (1,018)

Net cash generated from/(absorbed

in) operating activities (2,387) 13 (2,545)

------------ ------------ -------------

Cash flows (for)/from investing

activities

Acquisition of property, plant

and equipment - - (5)

Net cash (used in)/generated

from investing activities - - (5)

------------ ------------ -------------

Cash flows (for)/from financing

activities

Increase in inter-company

debts - 1,665 2,473

Amount withdrawn by directors - (3) (3)

Issue of new shares 1,390 - 2,712

Equity dividends paid (601) (400) (400)

Net cash generated from financing

activities 789 1,262 4,782

------------ ------------ -------------

Net increase(decrease) in

cash & cash equivalents (1,598) 1,275 2,232

Cash and equivalent at beginning

of period 2,569 337 337

Cash and equivalent at end

of period 971 1,612 2,569

============ ============ =============

Notes to the Interim Financial Statements

For the six months ended 30 June 2021

1 . Basis of Preparation

The interim financial statements of Vector Capital Plc are

unaudited condensed financial statements for the six months ended

30 June 2021. These include unaudited comparatives for the six

months ended 30 June 2021 together with audited comparatives for

the year ended 31 December 2020.The financial information for the

six months ended 30 June 2021 does not constitute statutory

financial statements within the meaning of section 434 of the

Companies Act 2006. A copy of the audited financial statements for

the year ended 31 December 2020 is available on the Company's

website. The auditor's opinion on those financial statements was

unqualified and did not draw attention to any matters by way of an

emphasis of matter paragraph. These interim condensed financial

statements have been prepared on the basis of the accounting

policies expected to apply for the financial year to 31 December

2021 which are based on the recognition and measurement principles

of United Kingdom adopted International Financial Reporting

Standards (IFRS), in accordance with the provisions of the

Companies Act 2006, applicable to companies reporting under

IFRS.

The financial statements have been prepared under the historical

cost convention. The Group's presentation and functional currency

is Sterling. The interim financial statements do not include all of

the information required for full annual financial statements and

do not comply with all the disclosures in IAS 34 'Interim Financial

Reporting', and should be read in conjunction with the Group's

annual financial statements to 31 December 2020. Accordingly,

whilst the interim statements have been prepared in accordance with

IFRS, they cannot be construed as being in full compliance with

IFRS. The preparation of financial statements in conformity with

United Kingdom adopted International Financial Reporting Standards

(IFRS) requires the use of certain critical accounting estimates.

It also requires management to exercise its judgement in the

process of applying the Group's accounting policies. The accounting

policies adopted are consistent with those followed in the

preparation of the Group's annual financial statements for the year

ended 31 December 2020.

2. General information

The condensed consolidated financial information comprises the

financial information of Vector Capital Plc, Vector Asset Finance

Ltd and Vector Business Finance Ltd (the Group ).

The principal activities of the entities in the Group are as

follows: -

Name of company Country of incorporation Principal activities

------------------------------ ------------------------------ --------------------------

Vector Capital Plc England and Wales Holding company

Vector Business Finance England and Wales Commercial lending

Ltd

Vector Asset Finance Ltd England and Wales Commercial lending

There have been no significant changes in these activities

during the relevant financial periods.

3. Segmental reporting

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Operating Group that

are regularly reviewed by the chief operating decision maker (which

takes the form of the Board of Directors) as defined in IFRS 8, in

order to allocate resources to the segment and to assess its

performance.

Based on management information there is one operating segment.

Revenues are reviewed based on the services provided.

No customer has accounted for more than 10 % of total revenue

during the periods presented .

4 . Administrative costs

30 Jun 21 30 Jun 20 31 Dec 20

(Unaudited) (Unaudited) (Audited)

Current GBP'000 GBP'000 GBP'000

Recurring 378 214 539

Non-recurring costs 129

Total 378 214 668

------------- ------------- -----------

During the year ended 31 Dec 20 exceptional non-recurring costs

in relation to the admission of the Company's ordinary shares to

trading on AIM were incurred totalling GBP129k.

5. Income Tax expense

The tax charge on profits assessable has been calculated at the

rates of tax prevailing, based on existing legislation,

interpretation and practices in respect thereof.

6. Property, plant and equipment

Fixture, fittings and equipment

---------------------------------------------

30 Jun 21 30 Jun 20 31 Dec 20

(Unaudited (Unaudited)GBP'000 (Audited`)

GBP'000 GBP'000

Cost

Brought forward 5 - -

Additions - - 5

Disposals - - -

Carried forward 5 - 5

----------- ------------------- -----------

Accumulated depreciation

Brought forward 1 - -

Depreciation 1 - 1

----------- ------------------- -----------

Carried forward 2 - 1

----------- ------------------- -----------

NBV c/fwd 3 - 4

----------- ------------------- -----------

NBV b/fwd 4 - -

----------- ------------------- -----------

7. Trade and other receivables

30 Jun 21 30 Jun 20 31 Dec 20

(Unaudited) (Unaudited) (Audited)

Current GBP'000 GBP'000 GBP'000

Trade receivables 40,604 32,740 36,374

Prepayments and accrued income 463 587 589

Total 41,067 33,327 36,963

------------- ------------- -----------

61% of trade receivables were held by third party secure funding

(30 Jun 20: 78%, 31 Dec 20: 73%).

8 . Trade and other payables

30 Jun 21 30 Jun 20 31 Dec 20

(Unaudited) (Unaudited) (Audited)

Current GBP'000 GBP'000 GBP'000

Trade payable 26 9 18

Amounts owed to group undertakings 3,000 1,791 3,000

Other payables 15,481 14,366 14,823

Accruals and deferred income 146 54 189

Total 18,653 16,220 18,030

------------- ------------- -----------

Other payables includes loan finance of GBP15,417k (30 Jun 20:

GBP14,320k, 31 Dec 20: GBP14,812k) which is secured against

associated loans assigned by way of block discounting.

9 . Called up share capital

30 Jun 21 30 Jun 20 31 Dec 20

Authorised Nominal value (Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

45,244,385 Ordinary GBP0.005 226 170 210

(30 Jun 20: 17,000,000 Ordinary (30 Jun 20 GBP0.01,

31 Dec 20: 42,052,895 Ordinary) 31 Dec 20 GBP0.005)

On 28 June 2021 the Company issued 3 , 191 , 490 new Ordinary

shares of 0.5 pence each at a 47 pence per share

10. Basic and diluted earnings per share

The calculation of earnings per share is based on the following

earnings and number of shares .

30 Jun 31 Dec 20

21 30 Jun 20

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Total comprehensive ( income for

the period, used in the calculation

of total basic and diluted profit

per share 1,051 1,019 1,902

Weighted average number of ordinary

shares for the purpose of basic

and diluted profit per share 42,079,055 34,000,000 34,066,007

Earnings per share

Basic and diluted earnings per

share (0.5 pence (30 Jun 20; 1

pence, 31 Dec 20; 0.5 pence)) 2.50 3.00 5.58

The weighted average number of shares for 30 Jun 20 include a

retrospective adjustment for the share split undertaken in Dec

20.

11 . Significant related party transactions

The Group owed GBP3 million to its parent company, Vector

Holdings Ltd (30 Jun 20 GBP1.8 million, 31 Dec 20: GBP3 million).

During the period the Company paid interest totalling GBP75k to

Vector Holdings Ltd in relation to the balance owed as per the loan

agreement (30 Jun 20: GBPNil, 31 Dec 20: GBPNil).

During the period the Company paid GBP486k in dividends to

Vector Holdings Ltd (30 Jun 20: GBPNil, 31 Dec 20: GBP400k).

12 . Subsequent events

There were no significant subsequent events which warranted

disclosure.

13 . Half Year Report

A copy of this half year interim report, as well as the annual

statutory accounts to 31 December 2020 are available on the

Company's website at

www.vectorcapital.co.uk/investors/corporate-documents

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFLLAVIEIIL

(END) Dow Jones Newswires

September 06, 2021 02:00 ET (06:00 GMT)

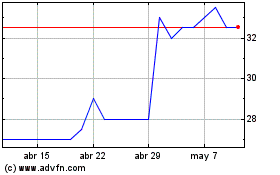

Vector Capital (LSE:VCAP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Vector Capital (LSE:VCAP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024