TIDMVCAP

RNS Number : 7654C

Vector Capital PLC

23 June 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF IRELAND,

THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH

SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 ("EUWA")) ("UK MAR"). IN ADDITION, MARKET SOUNDINGS (AS

DEFINED IN UK MAR) WERE TAKEN IN RESPECT OF CERTAIN OF THE MATTERS

CONTAINED WITHIN THIS ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN

PERSONS BECAME AWARE OF INSIDE INFORMATION (AS DEFINED UNDER UK

MAR). UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, THOSE PERSONS THAT RECEIVED INSIDE INFORMATION

IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF SUCH INSIDE

INFORMATION, WHICH IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

23 June 2021

Vector Capital plc

("Vector Capital", the "Company" and with its subsidiaries the

"Group")

Placing to raise GBP1.5 million

Vector Capital plc (AIM: VCAP), a commercial lending group that

offers secured loans primarily to businesses located in the United

Kingdom, is pleased to announce that it has successfully completed

a placing of new ordinary shares in the Company, raising gross

proceeds of GBP1.5 million. These funds will be used to increase

the Group's lending power to meet demand for the Group's loans.

Highlights

-- Vector Capital has raised gross proceeds of GBP1.5 million

through a placing by the Company's sole broker, Allenby Capital

Limited ("Allenby Capital"), of 3,191,490 new ordinary shares of

0.5p each in the Company (the "Placing Shares") at an issue price

of 47 pence per Placing Share (the "Placing").

-- The Placing Shares will represent approximately 7.1 per cent.

of the enlarged issued share capital of the Company and have been

subscribed for by a combination of new investors and existing

shareholders.

-- The Placing Shares are being issued at a price of 47 pence

per Placing Share, representing a discount of approximately 7.84

per cent. to the closing mid-market share price of an existing

ordinary share on 22 June 2021, the business day prior to this

announcement.

-- The net proceeds of the Placing are expected to be used by

the Company to increase the Group's lending power to meet demand

for the Group's loans.

Agam Jain, Chief Executive of Vector Capital, said :

"With strong new and existing shareholder support for our proven

strategy, I am very pleased to announce a successful Placing to

increase our lending power. We are seeing continuing demand for our

loans, driven by a buoyant property market and our competitive

strengths through our broker relationships and the speed at which

we can approve loans. Vector Capital is a profitable business with

capacity to grow and this Placing positions us for further success

as we build towards a GBP100m loan book which we are confident of

reaching over the medium term. The year is progressing positively

in line with expectations and, with this in mind, I look forward to

providing updates on our progress as we execute our growth

strategy."

Background to and reasons for the Placing

The Company's shares were admitted to trading on AIM on 29

December 2020 and the Company raised gross proceeds of GBP3.1

million (net GBP2.6 million) at that time. The net proceeds have

been deployed into new lending and will provide the base for

drawing down further on the Group's debt facilities.

Current trading in 2021 has been in line with expectations and

the Company is now concentrating on loan book growth. In the first

three months of the year, the Company issued GBP4.2 million of new

loans.

The Company is seeing healthy demand for new loans and has

decided to undertake the Placing in order to meet that demand.

The net proceeds of the Placing are expected to total

approximately GBP1.39 million and the Directors intend to use these

funds to increase lending power and meet demand for the Company's

loans. The Group also has the option to drawdown amounts from the

facilities provided by the Company's two wholesale lenders,

Shawbrook Bank and Aldermore Bank to increase the loan book

further.

The Group has in place systems and employees to facilitate its

medium term growth targets and, as a result, it is not anticipated

that a significant portion of the Placing proceeds will be required

for overheads.

Details of the Placing

A total of 3,191,490 Placing Shares are to be issued at a price

of 47 pence per Share. The Placing has been conducted utilising the

Company's existing share authorities. Allenby Capital acted as the

Company's sole broker in connection with the Placing. The Placing

is conditional, inter alia, on admission of the Placing Shares to

trading on AIM ("Admission") becoming effective.

The Placing Shares will be credited as fully paid and will rank

equally in all respects with the Company's existing ordinary

shares. The Placing Shares will be eligible for all future

dividends and the Company expects to declare an interim dividend at

the time of announcement of the half-yearly results to June

2021.

The Placing Shares have been placed with certain existing and

new shareholders. The Directors value the Company's retail

shareholders, but due to the size of the Placing, the small

discount to the prevailing bid price of an Ordinary Share and the

cost of undertaking a retail offer, the Board determined that it

was not in the Company's interest to make the Placing available to

all investors. However, this will be kept under review should the

Company seek to raise further funds in the future.

Admission to trading and total voting rights

Application has been made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. It is expected

that Admission will become effective and that dealings in the

Placing Shares on AIM will commence on or around 28 June 2021.

On Admission, the Company's issued ordinary share capital will

consist of 45,244,385 ordinary shares of 0.5p each, with one vote

per share. The Company does not hold any ordinary shares in

treasury. Therefore, on Admission, the total number of ordinary

shares and voting rights in the Company will be 45,244,385. With

effect from Admission, this figure may be used by shareholders in

the Company as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the share capital of the Company

under the FCA's Disclosure Guidance and Transparency Rules.

Significant shareholders

Vector Holdings Limited, a company controlled by Agam Jain and

his family, currently holds 34,000,000 Ordinary Shares. As a result

of the issue of the Placing Shares and with effect from Admission,

this holding will represent 75.15% of the Company's enlarged share

capital. Vector Holdings Limited is not acquiring any shares

pursuant to the Placing.

Notice to Distributors

Solely for the purposes of the temporary product intervention

rules made under sections S137D and 138M of the Financial Services

and Markets Act 2000 and the FCA Product Intervention and Product

Governance Sourcebook (together, the "Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the Product Governance Requirements) may

otherwise have with respect thereto, the Placing Shares have been

subject to a product approval process, which has determined that

the Placing Shares are: (i) compatible with an end target market of

retail investors and investors who meet the criteria of

professional clients and eligible counterparties, as defined under

the FCA Conduct of Business Sourcebook COBS 3 Client

categorisation, and are eligible for distribution through all

distribution channels as are permitted by the FCA Product

Intervention and Product Governance Sourcebook (the "Target Market

Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

offer no guaranteed income and no capital protection; and an

investment in the Placing is compatible only with investors who do

not need a guaranteed income or capital protection, who (either

alone or in conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such an

investment and who have sufficient resources to be able to bear any

losses that may result therefrom. The Target Market Assessment is

without prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, Allenby Capital Limited will only procure investors who

meet the criteria of professional clients and eligible

counterparties. For the avoidance of doubt, the Target Market

Assessment does not constitute: (a) an assessment of suitability or

appropriateness for the purposes of the FCA Conduct of Business

Sourcebook COBS 9A and 10A respectively; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to the Placing

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Enquiries

Vector Capital plc c/o TB Cardew

Agam Jain

Allenby Capital Limited + 44 (0) 20 3328 5656

James Reeve / George Payne (Corporate www.allenbycapital.com

Finance)

Tony Quirke (Sales and Corporate

Broking)

TB Cardew + 44 (0)7775 848537

Shan Shan Willenbrock + 44 (0)20 7930 0777

Charlotte Anderson vector@tbcardew.com

About Vector Capital:

Vector Capital provides secured, business-to-business loans to

SMEs primarily based in England and Wales. Loans are typically

secured by a first legal charge against real estate. The Company's

customers typically borrow for general working capital purposes,

bridging ahead of refinancing, land development and property

acquisition. The loans provided by the Company are typically for

renewable 12-month terms with fixed interest rates.

Important Notices

This Announcement includes "forward-looking statements" which

includes all statements other than statements of historical fact,

including, without limitation, those regarding the Company's

financial position, business strategy, plans and objectives of

management for future operations, or any statements preceded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates",

"would", "could" or similar expressions or negatives thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Company's

control that could cause the actual results, performance or

achievements of the Group to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are

based on numerous assumptions regarding the Company's present and

future business strategies and the environment in which the Company

will operate in the future. These forward-looking statements speak

only as at the date of this Announcement. The Company expressly

disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statements contained herein to

reflect any change in the Company's expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statements are based unless required to do so by

applicable law or the AIM Rules for Companies.

No statement in this Announcement is intended to be a profit

forecast and no statement in this Announcement should be

interpreted to mean that earnings per share of the Company for the

current or future financial years would necessarily match or exceed

the historical published earnings per share of the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIMZGZVNZLGMZM

(END) Dow Jones Newswires

June 23, 2021 02:00 ET (06:00 GMT)

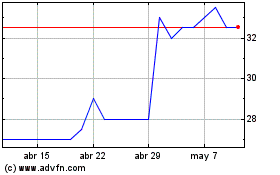

Vector Capital (LSE:VCAP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Vector Capital (LSE:VCAP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024