TIDMETX

RNS Number : 4573Y

e-Therapeutics plc

13 May 2021

e-therapeutics plc

("e-therapeutics" or "the Company" or "the Group")

Final Results for the Year Ended 31 January 2021

Oxford, UK, 13 May 2021 - e-therapeutics plc (AIM: ETX), the

drug discovery company, announces its final audited results for the

year ended 31 January 2021.

Operational Highlights

Management and Board restructure

-- On 11 February 2020, Ali Mortazavi was appointed Executive

Chairman in a management restructure that saw Ray Barlow stepping

down as Chief Executive Officer and Steve Medlicott stepping down

as Chief Financial Officer

-- From 12 October 2020, Ali Mortazavi was appointed as Chief Executive Officer

-- Post year end, Trevor Jones, who has been an independent

Non-Executive Director since 2015, was appointed Non-Executive

Chairman and post period, Karl Keegan was appointed Chief Financial

Officer in March 2021

Expansion into RNA interference (RNAi)

-- In May 2020, the Company announced expansion into RNAi as a

therapeutic modality having designed a novel GalNAc small

interfering RNA (siRNA) that will leverage expertise in network

biology and, post period, filed a patent application and commenced

experiments to characterise the platform. The Company expects to

offer this proprietary platform to potential partners in

2021-22

Collaboration with Galapagos NV ("Galapagos")

-- In June 2020, the Company announced a collaboration with

Galapagos to identify new therapeutic approaches to modulate a

specific mechanism involved in idiopathic pulmonary fibrosis

("IPF"). Significant progression has been made on this

collaboration during the year and post period, this collaboration

has achieved two success-based milestones. The Company remains in

business development discussions for both network-driven and

functional

genomics technologies with multiple potential partners

Scientific Advisory Board ("SAB") launched

-- During the year, a SAB was created. Headed by Dr Paul Burke,

with members Dr Bill Harte and Professor John Mattick, who all have

considerable industry experience and will provide strategic advice

and insight on transforming the drug discovery process

COVID-19 project

-- In response to the COVID-19 pandemic, the Company initiated a

project to identify approved and known drugs, both alone and as

synergistic combinations, that could rapidly be repositioned for

the treatment of COVID-19

-- Compounds identified through the Company's network-driven

discovery platform have been tested by Wuxi App Tec in cell-based

assays and show potent anti-inflammatory and antiviral activity.

This activity is expected to be generically applicable, raising the

prospect of utility against both existing and new emergent strains

of coronavirus

Financial highlights

During the year the Company strengthened its financial position

raising t otal gross funds of GBP13.2m .

-- Completed equity fundraises of GBP1.6m and GBP11.6m in

February and July 2020 respectively to scale the Group's business

model with focus on further developing the Group's informatics

platform capabilities, building and populating an internal pipeline

of high conviction early assets and expanding the team to support

the scale-up

-- Revenues of GBP0.3m (FY20: GBP0.5m)

-- Cash at 31 January 2021 of GBP13.0m (FY20: GBP3.8m)

-- Cash increase in the year of GBP9.2m (FY20: GBP(2.1)m)

-- R&D spend GBP2.7m (FY20: GBP2.1m)

-- Operating loss of GBP4.5m (FY20: loss of GBP2.9m)

-- R&D tax credit of GBP0.8m (FY20: GBP0.6m)

Ali Mortazavi, Chief Executive Officer of e-therapeutics,

commented: " Our ambition is to transform the drug discovery

process. The successful fundraises during the year enable the next

stage of growth and value creation for the Company. We have begun

to build momentum as we move forward with our strategy delivering

scientific progress as well as current and prospective

partnerships. "

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

-Ends-

Enquiries:

e-therapeutics plc Tel: +44 (0)1993 883

125

Ali Mortazavi, CEO www.etherapeutics.co.uk

Karl Keegan, CFO

SP Angel Corporate Finance LLP Tel: +44(0)20 3470

0470

Nominated Adviser and Broker

Matthew Johnson/Caroline Rowe (Corporate

Finance)

Vadim Alexandre/Rob Rees (Corporate

Broking)

About e-therapeutics plc

e-therapeutics plc is an Oxford, UK-based company with a

powerful computer-based approach to drug discovery, founded on its

industry-leading expertise in network biology to fully capture

disease complexity. The Company combines network science, machine

learning, artificial intelligence, statistics and big data with

expertise in drug discovery and development to transform the search

for new medicines and intervention strategies.

e-therapeutics has developed an in silico laboratory that

enables the rapid screening of millions of compounds and the

identification of small subsets that are enriched for highly active

hits. Its proprietary platform also has novel applications in

functional genomics, being able to analyse complex genetic

datasets, provide a deep understanding of pathological mechanisms

and distil actionable insights for the discovery of novel drugs,

biomarkers and diagnostics.

e-therapeutics has deployed and validated its disease-agnostic

drug discovery platform both in house and with partners, including

Novo Nordisk, Galapagos NV and a US-based, top 5 pharmaceutical

company.

Chairman's statement

During the financial year ended 31 January 2021, we have seen

good momentum in growing shareholder value, leveraging the funds

raised to deliver scientific progress and building upon current and

prospective partnerships and collaborations. The Company has ended

the period in a secure financial position which will enable it to

make significant progress in the year ahead and beyond.

In my first statement as Chairman, I am pleased to report that

the Company is now well positioned for future success. Over the

last 12 months e-therapeutics has made significant progress across

the business and raised significant funding to support its strategy

for value creation. The proceeds have facilitated a number of

initiatives, with a particular focus on expanding the Company's

computational platform capabilities, internal asset pipeline

prospects and success in securing partnerships and collaborations.

In light of the recent uncertainty arising from the COVID-19

pandemic, we have been quick to adapt to the changing circumstances

and there has been minimal impact on our business. Indeed, for our

Company, the situation has opened up new opportunities. The speed

at which the Company has reacted to changing circumstances and the

support it has offered its employees is a credit to the leadership

of CEO, Ali Mortazavi and the Executive Team.

e-therapeutics' ambition is to transform the drug discovery

process. We are leveraging our computational platform and network

biology expertise to accelerate the identification and development

of effective therapies, in particular through the synergy between

our computational approaches and our recently added proprietary

RNAi technology platform.

Our goal is to establish e-therapeutics as the leading platform

in computational biology:

1. To win commercial deals and achieve industrial validation of our informatics Platform

2. Establish a validated RNAi platform

3. Develop high-conviction internal assets

4. Develop the Company to a sufficient scale through platform development and recruitment

5. Provide guidance, development and feedback to people to enable them to fulfil their role

The period has seen significant delivery against this strategy

with the following notable achievements:

-- The Company announced a collaboration with Galapagos to

identify new therapeutic approaches to modulate a specific

mechanism involved in Idiopathic Pulmonary Fibrosis (IPF) and

potentially other fibrotic indications. In addition, the Company

has existing partnerships with Novo Nordisk and this partnership on

Type- 2 diabetes has been extended with the potential to progress

to a larger discovery project. The Company expansion into RNA

interference (RNAi) and the establishment of a proprietary siRNA

platform with siRNA as the drug modality of choice for our internal

pipeline was a key achievement during 2020.

-- Significant progress has been made on our GaINAc siRNA

platform and we have recently filed a patent application relating

to specific hepatocyte targeting for liver gene silencing which

will provide a competitive advantage in developing our RNAi

therapeutic pipeline.

-- In addition to its partnerships/collaborations, the Company

intends to extract and retain further value from its platform by

building an in-house pipeline of assets to provide out-licensing

opportunities, through a data-driven and flexible partnering

strategy at the right value inflection points. The Company has

developed a proprietary disease-agnostic platform to produce

valuable disease biology insights and potential drug targets and

candidates.

-- In December 2020, the Company announced it had deployed its

network biology platform to identify clinical stage compounds that

either singly or in combination could be repurposed rapidly to

treat COVID-19 and it has generated very encouraging results.

-- Innovations continue to be made to our core platform

technologies including increased automation and in the area of

target identification. Significant headway has been made in

recruiting further skilled people to the team.

-- In order to support and develop our people, the appointment

of our Chief People Officer has resulted in new initiatives,

regular interactive learning and cross-team collaboration sessions

as well as the implementation of a new HR framework.

Strengthened financial position

During the period under review, the Board and management have

continued to implement robust financial control. A particular

achievement during the period was the Board's commitment to

strengthen the financial position of the Company by securing new

investors and raising funds to enable the Company's next stage of

growth and value creation.

I am delighted that in the most recent fund raise we welcomed

new institutional shareholders and retail shareholders, through a

specific Retail Offer via PrimaryBid. As a result, the overall size

and shape of our shareholder base has significantly changed. I

should like to thank all our new and existing shareholders for

their continued support.

The funds raised in the period gives the Company sufficient

working capital for at least 12 months and with an element of

discretionary spend.

Board and Executive Team

In February 2020, we announced a restructuring of the Board and

Executive Team resulting in the appointment of Ali Mortazavi as

Executive Chairman. In addition, Michael Bretherton was appointed

Non-Executive Director. Subsequently in October 2020, Ali Mortazavi

was also appointed Chief Executive of the Company in addition to

his role as Chairman. Post period in March 2021, a further

reorganisation of the Board resulted in my appointment to the role

of Independent Non-Executive Chairman with Ali Mortazavi continuing

in his role as Chief Executive Officer.

The Company continued to build its Executive competencies with

the appointments of Laura Roca-Alonso as Chief Business officer,

Stephanie Maley as Chief People Officer and, post period, the

appointment of Karl Keegan as Chief Financial Officer.

I should like to thank our dedicated staff for their very

significant contribution to the Company and for their continued

diligence, agility and commitment throughout this difficult time.

In my opinion, the Board restructuring has denoted a turning point

in the leadership and direction of e-therapeutics and we are now in

a strong position under the leadership of Ali Mortazavi to execute

on our strategy. I warmly welcome all the new appointments to our

company. I am delighted to have been appointed as Chairman and I

now look forward to completing the search for an additional Non-

Executive Director to strengthen the Board further and to support

the Company's future success.

Professor Trevor Jones CBE

Independent Non-Executive Chairman

12 May 2021

Chief Executive Officer's statement

Prior to investing and becoming the CEO, I conducted detailed

due diligence into the full range of computational approaches in

drug discovery. I was struck by the Company's "biology first"

approach and the interest its network biology capabilities were

receiving from large biopharmaceutical companies.

I am pleased to report my first set of full year results for

e-therapeutics as CEO. We have begun to build momentum as we move

forward with our strategy, accelerated by our substantial new

investment completed last year. Despite some of the most

challenging conditions that we have all seen in our lifetimes, this

year has been a pivotal and successful year for e-therapeutics. The

COVID-19 pandemic has affected every individual in very different

and sometimes tragic ways but, out of necessity, it has also opened

up opportunities for businesses such as ours.

e-therapeutics' expertise in network biology and drug

development, coupled with our nascent RNAi platform, gives us a

synergistic competitive advantage through effective drug discovery

target identification and a rapid and validated development path.

This expertise underpins many of the operational highlights for the

Company this year. Our collaboration agreement with Galapagos in

IPF, with potential in other fibrotic conditions and our type-2

diabetes agreement with Novo Nordisk are validation of our

platform, highlighting the ability of our network approach and

expertise to go beyond pure in silico predictions and identify

potentially clinically viable interventions with supporting

laboratory data.

The significant progress made on our GaINAc siRNA platform will

enable us to benchmark it against those of competitor RNAi

companies. In parallel, we have also established a dedicated group

to leverage our computational network biology discovery platform

specifically at target genes in hepatocytes, which are amenable to

GaINAc delivery. We believe that the combination of these elements

will enable us to offer an attractive business development

proposition to potential collaborators.

e-therapeutics' computational platform is capable of discovering

novel drug targets and active small molecules and of uncovering new

biological mechanisms and genetic insights. In our COVID-19 project

launched this year, we have deployed that capability to investigate

known compounds in a novel context and have uncovered new

mechanisms that mitigate infection-induced hyperinflammation as

well as discovering a potent anti-viral strategy.

The most significant challenge for the Company was having

sufficient capital to allow us to realise opportunities and I am

very pleased that we were able to secure the financing to execute

on our strategy and business model.

Strategy

e-therapeutics' ambition is to transform the drug discovery

process, leveraging its computational network biology platform

(drug discovery) to find novel targets to address mechanisms

underpinning complex disease. The business model incorporates out-

licensing of targets and compounds in addition to the development

of an in-house pipeline of RNAi therapeutics.

Drug discovery - computational network driven biology

platform

The Company was, and is, one of the few purely "biology first"

computational companies that I have come across, in contrast to

competitors who are primarily focused on computational approaches

to small molecule chemistry. This approach starts with a biological

question such as "which processes in COVID-19 disease might it make

most sense to address?" One answer could be "hyperinflammation".

From a knowledge of just some of the proteins involved we are able

to use our proprietary platform and data resources to construct

bespoke network models that capture the full complexity of this

process and predict missing information. These models are analysed

using our cutting- edge network analytics which leverage network

science, network statistics and ML/AI approaches to derive new drug

targets, biological mechanisms and active small molecules, as well

as providing genetic support for target choices.

Establishing world leading hepatocyte expertise, generating

novel hepatocyte expressed targets and a focus on expanding our

collaborations

The platform is disease agnostic and the Company has completed

multiple in-house and partnered projects in diverse disease areas

such as fibrosis, type-2 diabetes, CNS and oncology indications, to

name but a few. I believe that e-therapeutics is addressing the

most critical unmet need in drug discovery/development - the

modelling and interpretation of complex human biology. Biological

functions are controlled by networks of genes and proteins and we

construct in silico models of these

functions to interpret human biology/disease states. We believe

that the Company has the most complete datasets, predictive AI/ ML

algorithms and the most experienced computational biologists,

informaticians and data scientists in the field of network biology

and these assets provide an important barrier to entry for

competitors.

Informatics and drug development

Historically, the Company has operated a hybrid

partnership/collaboration model and the use of small molecules as a

drug modality for its internal pipeline. However, the time, costs

and time to value inflection in small molecule drug development

makes this difficult for a small company to prosecute.

By way of example, even after our in-house computational methods

have generated a biological hypothesis, target, active chemical

matter and an indication to pursue, it typically takes 3-4 years

and c.US$3-5m to create a lead compound to take into IND enabling

studies. In addition, a further 2 years would most likely be needed

to generate human phase 1 data where potential partnership

discussions

could begin. Clearly, these timelines and costs in addition to

the additional centralised overheads are hugely capital intensive

and at most, we would only be able to prosecute one high conviction

candidate.

As such, small molecule drug development now forms part of the

Company's partnership/ collaboration strategy and we will endeavour

to structure transactions where we have some upside economics/

opt-ins with biopharmaceutical collaborators who use

e-therapeutics' network driven computational biology platform but

who wish to develop small molecules in the clinic independently and

at their own cost.

RNAi platform the new drug modality of choice for our internal

pipeline

One of the key achievements of the year has been to establish

RNAi as the drug modality of choice for our internal pipeline.

Importantly, this is not a choice that many companies can easily

make and we have deep in-house expertise in this field which we

believe gives us a competitive advantage. It is fair to say that

without this expertise, it would have taken a significantly longer

time to file IP and develop the multiple RNA chemistries which we

have developed this year.

Liver presents large commercial opportunities for RNA

therapies

Focused delivery of siRNAs to the liver has striking advantages

over small molecules in terms of timelines, costs and value

inflection points: in contrast to the 3-4 years and c. US$3-5m to

create a lead small molecule compound an siRNA attached to a GaINAc

delivery system can be synthesised in 4-5 months and for a cost of

c. US$200-300K. In addition, as one of the most sought-after drug

modalities, there have been multiple collaboration transactions

pre-IND filing as opposed to at a later stage (Phase 1-2) with

small molecules.

We have recently filed a patent application related to the

chemistry of novel GaINAc conjugated siRNAs. In addition, a number

of siRNA constructs have been designed with potentially beneficial

safety and potency profiles and additional patent applications are

expected to be filed shortly. We believe that the new patent

applications, combined with our extensive know-how, will provide a

significant competitive advantage in further developing our RNAi

therapeutic pipeline. The new constructs will include features to

minimise potential microRNA off-target effects, thermally

destabilising regions of the siRNA for reduced toxicity and

important position-specific stabilisation chemistries to improve

potency. Multiple in vitro and in vivo experiments are underway to

test these constructs with contract research organisations in

Germany and China. We expect to offer our proprietary platform to

potential business development partners in 2021-2022 and anticipate

that these constructs will demonstrate at least equivalence to

competitors' platforms.

Liver focused informatics team

The advantages of RNAi as a drug modality extend beyond the

delivery platform. In Q3 2020, we established a liver-focused

scientific group which is actively engaged in curating, generating

and mining hepatocyte specific data and knowledge resources

specifically designed to complement our computational platform.

This focus on one cell type is an important driver for novel

targets and mechanisms and we believe will improve the performance

of our network models and algorithms.

Efforts in this area include proprietary data resources in

hepatocyte biology such as our hepatocyte- specific interactome,

which is an important and recently completed map of hepatocyte

network biology, a complete genome-wide siRNA signature database

for human hepatocytes and a comprehensive hepatocyte-centric

knowledge resource leveraging natural language processing (NLP),

our in-house proprietary data, knowledge graphs and AI-driven

inference approaches.

By deploying our cutting-edge informatics platform alongside our

novel RNAi technology platform, we believe that we can harness the

many therapeutic opportunities in the liver which have yet to be

identified.

The hepatocyte team comprises highly skilled scientists and

physicians whose objective is to identify novel

hepatocyte-expressed targets for complex indications such as

cardiovascular and metabolic diseases. This team will conduct

validation of those targets in appropriate phenotypic assay systems

and animal models and assess genetic support for the therapeutic

targets using our functional genomics capability. We are in a

unique position of using our "Hepatocyte Atlas" and computational

modelling of biology to feed a drug platform which can have

multiple shots on goal due to the costs and timelines outlined.

Partnerships and collaborations

In Q2 2020, we announced a collaboration agreement with

Galapagos to identify new therapeutic approaches to modulate a

specific mechanism involved in IPF and potentially in other

fibrotic indications with high unmet need. The project has

successful achieved two pre-defined milestones to date. In this

period we also extended our collaboration with Novo Nordisk in type

2 diabetes until March 2021, after which there is a 6-month option

period to progress the collaboration to a larger discovery

project.

COVID-19 project

Our project to find compounds for the treatment of COVID-19

using our platform generated very encouraging results. In Q2 2020,

small molecule compounds predicted by our platform were tested in

validated SARS-CoV-2 in vitro assays at WuXi AppTech. These

compounds showed potent anti-inflammatory and anti-viral activity

and confirmed our in silico predictions. We identified a clear

mechanism, target and clinical stage compounds. This activity also

extended to other alpha and beta coronaviruses and we expect this

to be generically applicable, raising the prospect of utility

against both existing coronaviruses that cause serious disease such

as SARS and MERS and against new emergent strains of coronavirus.

This data set is a strong validation of our platform and the

network biology approach to drug discovery.

The success of the two fundraises in the year have enabled us to

make significant hires in all aspects of our business and headcount

since I joined in February 2020 has risen from 16 to 25. I would

like to thank the dedicated team, the Board and our shareholders

for their hard work and support during the year.

I believe that we have a unique blend of individual skillsets in

the Company and look forward with great confidence to the coming

year and beyond.

Outlook

The last twelve months have been very encouraging as we have

continued to develop our strategy and consistently demonstrated our

scientific capabilities and further validation of our platforms.

Importantly, with further investment to continue to develop our

capabilities we now enter the next year ready to deliver on our

exciting plans and with multiple opportunities.

The Company will look to maximise the value of its computational

network driven biology platform through creating deal structures

and positioning e-therapeutics as a global leader in network

biology. Our ambition is to secure multiple research collaborations

each year.

The Company will also look to commence RNAi platform

partnerships/deals - an area currently commanding significant and

attractive deals - and we anticipate business development

opportunities in the second half of 2021.

Our priorities for the coming year are to:

-- Expand computational platform collaborations

-- Establish world-leading hepatocyte expertise

-- Identify novel hepatocyte-expressed targets

-- Commence RNAi in vivo studies and platform partnerships

The Company aims to maximise the value of its internal platform

capabilities through two core channels - entering into platform

collaborations with strategic partners and through the generation

of in-house datasets to support development candidates. In addition

to its partnerships, the Company intends to extract and retain

further value from its platform by building an in-house pipeline of

assets to provide out-licensing opportunities, through a

data-driven and flexible partnering strategy at the right value

inflection points.

Ali Mortazavi

Chief Executive Officer

12 May 2021

Financial review

Our people and processes have responded well to a financial year

that has brought a lot of change to e-therapeutics - with a new

management team and gross fundraises totalling GBP13.2m in the year

enabling us to focus on streamlining and scaling our business model

and pushing forward with our strategic aims.

Revenue

In June 2020, we signed a collaboration agreement with Galapagos

to identify new therapeutic approaches to modulate a specific

mechanism involved in IPF and potentially in other fibrotic

indications. Revenue during the year, of GBP0.3m, relates to the

partial recognition of upfront payments and achieved milestones

during the year, in accordance with IFRS 15. Additional revenue is

expected to be recognised in the coming financial year as this

collaboration further advances. The business development functions

of the Group have been strengthened during the year, including the

hire of a Chief Business Officer in April 2020, and it is expected

that further collaborations will be signed in the coming financial

year. Revenue in the prior year, of GBP0.5m, related to deals with

Novo Nordisk in the area of type-2 diabetes, which successfully

completed in the prior year.

Fundraises

The fundraises during the year (gross GBP1.6m in February 2020

and gross GBP11.6m in July 2020) have enabled the Group to refocus

its strategy on enhancing and validating our platform technologies

and developing our internal asset pipeline. It was also announced

during the year that e-therapeutics would be expanding into RNA as

a therapeutic modality, with computational drug discovery outcomes

to be harnessed both internally and in partnership with

collaborators.

R&D expenditure

An increase in R&D expenditure began to materialise after

the half-year fundraise and the full year expenditure totalled

GBP2.7m (2020: GBP2.1m). R&D spend is expected to increase

significantly in the coming year, with the advancements of internal

discovery programmes, both small molecule and RNAi, along with the

release of a competitive and functional RNAi platform.

Administrative expenditure

Administrative expenditure for the year totalled GBP2.1m (2020:

GBP1.2m), with the management restructure in February 2020

resulting in one-off redundancy costs of GBP0.4m. In the coming

year we will continue to invest in our people, both in terms of

recruitment and ongoing motivation and development. We will also

continue to improve our underlying system infrastructure and

processes to ensure that they grow with the business, enabling our

employees to work efficiently and ensuring the safety of our

information assets. Although we are not expecting the same level of

one-off expenditure, we are expecting the underlying cost base to

increase as the business continues to grow.

Operating loss

The operating loss for the year, of GBP4.5m (2020: GBP2.9m), is

GBP1.6m greater than the operating loss in the prior year, due to

the one-off administrative expenses during the current year

referred to above and as plans for expanding the business are put

into motion.

R&D tax credits

We are anticipating an R&D tax credit of GBP0.8m (2020:

GBP0.6m) to be received in relation to the current year, bringing

the loss for the year to GBP3.7m (2020: GBP2.3m). The R&D tax

credit claim has not yet been submitted to HM Revenue and Customs,

yet historically the amounts received have been materially in line

with the receivable booked at the year end.

Cash flow

The year-end cash position is GBP13.0m (2020:GBP3.8m), with the

most significant inflow during the year being the gross fundraises

of GBP13.2m, with associated costs of GBP0.6m. After adjusting for

the net fundraises, the R&D tax credit received during the

year, of GBP0.6m (2020:GBP1.1m), the non-cash charges of share

options under IFRS 2, of GBP0.4m, and depreciation, amortisation

and impairment of GBP0.1m, the underlying cash burn of GBP4.0m

(2020: GBP3.2m) is broadly in line with the operating loss.

Financial outlook

In the coming financial year, we will drive forward with the

strategic plans formulated during the large mid-year fundraise,

validating our platform technologies, developing our RNAi platform

and progressing our high-conviction in-house RNAi and small

molecule assets.

Our budget, which has been prepared taking risk factors such as

COVID-19 and Brexit into consideration, shows that we have

sufficient funds to continue in operational existence for at least

12 months from the signing of these financial statements. We

anticipate a significant increase in our rate of spend, but our

budget remains prudent and incorporates discretionary spend which

would only be incurred if data supported that it remained the best

strategic direction for the Group.

Ali Mortazavi

Chief Executive Officer

12 May 2021

Consolidated Income Statement

For the year ended 31 January 2021

2021 2020

(audited) (audited)

Notes GBP000 GBP000

-------------------------------------- ------ ----------- -----------

Revenue 317 456

Cost of sales - -

-------------------------------------- ------ ----------- -----------

Gross profit 317 456

Research and Development expenditure (2,705) (2,104)

Administrative expenses (2,097) (1,240)

Operating loss (4,485) (2,888)

Investment income 17 15

Loss before tax (4,468) (2,873)

Taxation 5 784 526

-------------------------------------- ------ ----------- -----------

Loss for the year attributable to

equity holders of the Company (3,684) (2,347)

-------------------------------------- ------ ----------- -----------

Loss per share - basic and diluted 6 (0.99)p (0.87)p

-------------------------------------- ------ ----------- -----------

Consolidated Statement of Comprehensive Income

For the year ended 31 January 2021

2021 2020

(audited) (audited)

GBP000 GBP000

-------------------------------------------- ----------- -----------

Loss for the financial year (3,684) (2,347)

Other comprehensive income - -

-------------------------------------------- ----------- -----------

Total comprehensive loss for the financial

year (3,684) (2,347)

-------------------------------------------- ----------- -----------

Consolidated Statement of Changes in Equity

For the year ended 31 January 2021

Share Share Retained

capital premium earnings Total

GBP000 GBP000 GBP000 GBP000

------------------------------------------------------- -------- -------- --------- --------

As at 31 January 2019 (audited) 269 65,165 (58,632) 6,802

Total comprehensive income for year

Loss for the nancial year - - (2,347) (2,347)

------------------------------------------------------- -------- -------- --------- --------

Total comprehensive loss for year - - (2,347) (2,347)

------------------------------------------------------- -------- -------- --------- --------

Transactions with owners, recorded directly in equity

Issue of ordinary shares - 11 - 11

Equity-settled share-based payment transactions - - 36 36

------------------------------------------------------- -------- -------- --------- --------

Total contributions by and distribution to owners - 11 36 47

------------------------------------------------------- -------- -------- --------- --------

As at 31 January 2020 (audited) 269 65,176 (60,943) 4,502

Total comprehensive income for year

Loss for the nancial year - - (3,684) (3,684)

------------------------------------------------------- -------- -------- --------- --------

Total comprehensive loss for year - - (3,684) (3,684)

------------------------------------------------------- -------- -------- --------- --------

Transactions with owners, recorded directly in equity

Issue of ordinary shares 152 12,492 - 12,644

Equity-settled share-based payment transactions - - 422 422

------------------------------------------------------- -------- -------- --------- --------

Total contributions by and distribution to owners 152 12,492 422 13,066

------------------------------------------------------- -------- -------- --------- --------

As at 31 January 2021 (unaudited) 421 77,668 (64,205) 13,884

------------------------------------------------------- -------- -------- --------- --------

Company Statement of Changes in Equity

For the year ended 31 January 2021

Share Share Retained

capital premium earnings Total

GBP000 GBP000 GBP000 GBP000

------------------------------------------------------- -------- -------- --------- --------

As at 31 January 2019 (audited) 269 65,165 (56,060) 9,374

Total comprehensive income for year

Loss for the nancial year - - (5,171) (5,171)

------------------------------------------------------- -------- -------- --------- --------

Total comprehensive loss for year - - (5,171) (5,171)

------------------------------------------------------- -------- -------- --------- --------

Transactions with owners, recorded directly in equity

Issue of ordinary shares - 11 - 11

Equity-settled share-based payment transactions - - 36 36

------------------------------------------------------- -------- -------- --------- --------

Total contributions by and distribution to owners - 11 36 47

------------------------------------------------------- -------- -------- --------- --------

As at 31 January 2020 (audited) 269 65,176 (61,195) 4,250

Total comprehensive income for year

Loss for the nancial year - - (3,682) (3,682)

------------------------------------------------------- -------- -------- --------- --------

Total comprehensive loss for year - - (3,682) (3,682)

------------------------------------------------------- -------- -------- --------- --------

Transactions with owners, recorded directly in equity

Issue of ordinary shares 152 12,492 - 12,644

Equity-settled share-based payment transactions - - 422 422

------------------------------------------------------- -------- -------- --------- --------

Total contributions by and distribution to owners 152 12,492 422 13,066

------------------------------------------------------- -------- -------- --------- --------

As at 31 January 2021 (unaudited) 421 77,668 (64,455) 13,634

------------------------------------------------------- -------- -------- --------- --------

Balance Sheets

As at 31 January 2021

Group Company

------------------------ ------------------------

2021 2020 2021 2020

(audited) (audited) (audited) (audited)

Notes GBP000 GBP000 GBP000 GBP000

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Non-current assets

Intangible assets 7 82 110 82 110

Property, plant and equipment 8 80 93 80 93

162 203 162 203

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Current assets

Tax receivable 5 769 557 769 557

Trade and other receivables 57 36 57 36

Prepayments 296 149 296 149

Cash and cash equivalents 13,027 3,841 12,776 3,840

-------------------------------- ------ ----------- ----------- --- ----------- -----------

14,149 4,583 13,898 4,582

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Total assets 14,311 4,786 14,060 4,785

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Current liabilities

Trade and other payables 327 215 326 466

Lease liability 23 46 23 46

Contract liability 77 - 77 -

-------------------------------- ------ ----------- ----------- --- ----------- -----------

427 261 426 512

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Non-current liabilities

Lease liability - 23 - 23

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Total liabilities 427 284 426 535

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Net assets 13,884 4,502 13,634 4,250

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Equity

Share capital 9 421 269 421 269

Share premium 77,668 65,176 77,668 65,176

Retained earnings (64,205) (60,943) (64,455) (61,195)

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Total equity attributable to

equity holders of the Company 13,884 4,502 13,634 4,250

-------------------------------- ------ ----------- ----------- --- ----------- -----------

Consolidated Statement of Cash Flow

For the year ended 31 January 2021

Group

------------------------

2021 2020

(audited) (audited)

Notes GBP000 GBP000

-------------------------------------------- ------ ----------- -----------

Loss for the year (3,684) (2,347)

Adjustments for:

Depreciation, amortisation and impairment 7,8 112 97

Investment income (17) (15)

Equity-settled share-based payment

expense 422 36

Taxation 5 (802) (547)

-------------------------------------------- ------ ----------- -----------

Operating cash flows before movements

in working capital (3,969) (2,776)

Decrease in trade and other receivables (168) 161

Decrease in trade and other payables 189 (500)

Tax received 590 1,088

-------------------------------------------- ------ ----------- -----------

Net cash used in operating activities (3,358) (2,027)

-------------------------------------------- ------ ----------- -----------

Interest received 17 15

Acquisition of property, plant and

equipment 8 (53) (5)

Acquisition of other intangible assets 7 (18) (11)

Net cash (used in)/from investing

activities (54) (1)

-------------------------------------------- ------ ----------- -----------

Net proceeds from issue of share capital 12,644 11

Payments under lease liability (46) (46)

-------------------------------------------- ------ ----------- -----------

Net cash (used in)/from nancing activities 12,598 (35)

-------------------------------------------- ------ ----------- -----------

Net increase/(decrease) in cash and

cash equivalents 9,186 (2,063)

Cash and cash equivalents at 1 February 3,841 5,904

-------------------------------------------- ------ ----------- -----------

Cash and cash equivalents at 31 January 13,027 3,841

-------------------------------------------- ------ ----------- -----------

Notes

1. Status of Audit

The financial information set out herein does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The financial information for the year ended 31 January 2021

has been extracted from the Company's audited financial statements

which were approved by the Board of Directors on 12 May 2021 and

which, if adopted by the members at the Annual General Meeting,

will be delivered to the Registrar of Companies for England and

Wales.

The financial information for the year ended 31 January 2020 has

been extracted from the Group's audited financial statements which

were approved by the Board of Directors on 25 March 2020 and which

have been delivered to the Registrar of Companies for England and

Wales. The report of the auditor on these financial statements was

unqualified, did not contain a statement under Section 498(2) or

Section 498(3) of the Companies Act 2006.

The report of the auditor on the 31 January 2020 financial

statements was unqualified, did not contain a statement under

Section 498(2) or Section 498(3) of the Companies Act 2006, and did

not include a matter to which the auditors drew attention by way of

emphasis without qualifying their report.

The information in this preliminary statement has been extracted

from the audited financial statements for the year ended 31 January

2021 and as such, does not contain all the information required to

be disclosed in the financial statements prepared in accordance

with International Accounting Standards in Conformity with the

provisions of the Companies Act 2006.

The Company is a public limited company incorporated and

domiciled in England & Wales and whose shares are quoted on

AIM, a market operated by The London Stock Exchange.

2. Basis of preparation

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International accounting standards in

conformity with the requirements of the Companies Act 2006 this

announcement does not in itself contain sufficient information to

comply with IFRS. This preliminary announcement has been prepared

using the accounting policies that are expected to be published in

the Group's accounts for the year ended 31 January 2021, which are

consistent with the accounting policies published in the Group's

accounts for the year ended 31 January 2020 and that are available

on the Company's website at www.etherapeutics.co.uk, with the

exception of those new standards, interpretations and amendments

which became effective during the year and were adopted by the

Group, albeit with no impact on the Group's loss for the year or

equity on initial recognition.

This announcement contains forward-looking statements that are

based on current expectations or beliefs, as well as assumptions

about future events. These forward-looking statements can be

identified by the fact that they do not relate only to historical

or current facts. Forward-looking statements often use words such

as anticipate, target, expect, estimate, intend, plan, goal,

believe, will, may, should, would, could, is confident, or other

words of similar meaning. Undue reliance should not be placed on

any such statements because they speak only as at the date of this

document and, by their very nature, they are subject to known and

unknown risks and uncertainties and can be affected by other

factors that could cause actual results, plans and objectives, to

differ materially from those expressed or implied in the

forward-looking statements. There are a number of factors which

could cause actual results to differ materially from those

expressed or implied in forward-looking statements. The Company

undertakes no obligation to revise or update any forward-looking

statement contained within this announcement, regardless of whether

those statements are affected as a result of new information,

future events or otherwise, save as required by law and

regulations.

Going concern

Although the Group has recognised revenue from commercial deals

during the current and prior year, it is still largely reliant on

its cash balance to fund ongoing operations.

At 31 January 2021 we reported cash and liquid resources of

GBP13,027,000 and an underlying cash burn during the year,

excluding R&D tax credits received and the net proceeds from

fundraises, of GBP4,030,000.

We prepared detailed strategic plans as part of the fundraise

process in July 2020, which raised total gross proceeds, along with

the smaller fundraise in February 2020, of GBP13,203,000. We have

also prepared a detailed budget for 16 months, which supports the

view that the Group has sufficient cash to meet its operational

requirements for at least 12 months from the signing of these

financial statements. The budget includes a significant increase in

R&D expenditure, in line with progressing our strategic aims.

This expenditure is largely uncommitted and discretionary and would

be reduced or postponed if required to manage the Group's cash

resources.

The financial performance and position of the Group are

discussed in more detail in the Financial Review above.

The preliminary announcement has been prepared on the going

concern basis since, given the points discussed above, the

Directors have a reasonable expectation that the parent Company and

the Group have adequate resources to continue in operational

existence for the foreseeable future.

3. Accounting judgements and sources of estimation uncertainty

The preparation of financial statements requires management to

make judgements, estimates and assumptions that may affect the

application of accounting policies and the reported amounts of

assets, liabilities, income and expenses. The estimates and

underlying assumptions are reviewed on an ongoing basis.

The following are the key judgements that management have made

in the process of applying the Group's accounting policies and that

have the most significant effect on the amounts recognised in these

financial statements:

-- Management considers the continued adoption of the going

concern basis appropriate, as discussed further in Note 2 of this

preliminary announcement.

-- There are various revenue streams from collaborative

partnerships and management review these revenue streams against

the IFRS 15 criteria to establish whether revenue should be

recognised over time or at a point in time. Revenue recognised over

time results in a difference between up-front cash receipts and

revenue recognised, the balance of which is recorded on the Balance

Sheet. At the year end, contract liabilities were GBP77,000 (2020:

GBPnil). Revenue of GBP317,000 (2020: GBP456,000) is made up of

GBP163,000 (2020: GBPnil) recognised at a point in time and

GBP154,000 (2020: GBP456,000) over time. Variable consideration

consists of future potential pre-clinical and clinical development

and commercial milestone payments and it is deemed by the directors

to be fully constrained at this time given the uncertainty around

drug development.

-- The Directors have not recognised a deferred tax asset based

on an assessment of the probability that future taxable income will

be available against which the deductible temporary differences and

tax loss carry-forwards can be utilised. The potential deferred tax

asset is disclosed in note 5.

The following are the key assumptions concerning estimation

uncertainty that may have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within

the next financial year:

-- Revenue recognised from collaborative partnerships, and

corresponding contract liabilities, reflect management's best

estimate of each contract's stage of completion. Management

estimates project progress at each reporting date, with

consideration to project plans outlined in customer contracts, and

remeasures revenue accordingly. There were commercial contracts in

progress at the year end and management has recognised revenue in

accordance with IFRS 15 using the 5-step process. As a result, at

the year end contract liabilities of GBP77,000 (2020: GBPnil) were

recognised on the Balance Sheet.

-- The current tax receivable, of GBP769,000 (2020: GBP557,000),

represents an R&D tax credit based on an advance claim with

HMRC. The final receivable is subject to judgement and the correct

application of complex R&D tax rules. The minimum receipt

approved by HMRC could be GBPnil. Historically, final claims have

been successful and materially in line with the receivable

recognised in the financial statements. The Group expects the

current year to be successful too.

4. Staff numbers

The average number of persons employed by the Group and the

Company (including Executive Directors and excluding Non-Executive

Directors) during the year, analysed by category, was as

follows:

Number of employees

Group and Company

2021 2020

(audited) (audited)

---------------------------------- ----------- -----------

R&D Staff 12 12

Finance and administration staff 5 2

Executive Directors 1 2

---------------------------------- ----------- -----------

18 16

---------------------------------- ----------- -----------

5. Taxation

Recognised in the Income Statement: 2021 2020

(audited) (audited)

GBP000 GBP000

---------------------------------------------- ---- ----------- -----------

Current tax income

R&D tax credit receivable for the current

year (751) (536)

Adjustments for prior year in respect of R&D

tax credit (33) 10

---------------------------------------------------- ----------- -----------

Current tax credit (784) (526)

---------------------------------------------------- ----------- -----------

Deferred tax - -

---------------------------------------------- ---- ----------- -----------

Total on loss on ordinary activities (784) (526)

---------------------------------------------------- ----------- -----------

The standard rate of corporation tax applied to reported profit

is 19% (2020: 19%). The credit for the year can be reconciled to

the consolidated Income Statement as follows:

2021 2020

(audited) (audited)

GBP000 GBP000

---------------------------------------------- ---- ----------- -----------

Loss before tax (4,468) (2,873)

Tax at UK corporation tax rate of 19% (2020:

19%) (849) (546)

Expenses not deductible for tax purposes - 4

Enhanced relief for R&D (323) (231)

Unrelieved tax losses 396 230

Other 25 7

Adjustments in respect of prior period (33) 10

---------------------------------------------------- ----------- -----------

Total tax credit for the year (784) (526)

---------------------------------------------------- ----------- -----------

The total tax credit recognised with the Consolidated Income

Statement is GBP802,000 (2020: GBP547,000), which is made up the

small or medium sized enterprise ("SME") R&D tax relief of

GBP784,000 (2020: GBP526,000) and Research and Development

Expenditure Credit ("RDEC") of GBP18,000 (2020: GBP21,000). The SME

tax credit is shown within taxation, as reconciled above. The RDEC

is included within administrative expenses in the Consolidated

Income Statement on the basis that the RDEC is treated as taxable

income, being an 'above the line' relief.

The tax receivable on the Balance Sheet, of GBP769,000 (2020:

GBP557,000), is made up of SME tax relief of GBP751,000 (2020:

GBP536,000) and RDEC of GBP18,000 (2020: GBP21,000). Historically,

R&D credits relating to both the SME scheme and the RDEC scheme

have been received from HMRC as a single payment.

The Group has accumulated losses available to carry forward

against future trading profits of GBP28,835,000 (2020:

GBP26,855,000). No deferred tax has been recognised in respect of

tax losses since it is uncertain at the Balance Sheet date as to

whether future profits will be available against which the unused

tax losses can be utilised. At the Budget 2020, the UK Government

announced that the corporation tax main rate for the years starting

1 April 2020 and 2021 would remain at 19%. At the Budget 2021, the

UK Government announced that the corporation tax main rate for the

year starting 1 April 2022 will remain at 19% and that legislation

will be introduced to set the main rate at 25% for the year

starting 1 April 2023. The estimated value of the deferred tax

asset not recognised, measured at the main rate of 19% (2020: 17%),

is GBP5,499,000 (2020: GBP4,589,000).

The increase in the current year tax credit is due to an

increased R&D credit, as a result of higher qualifying

expenditure during the year, enabled by the fundraise during the

year. The current year R&D credit has not yet been approved by

HMRC and, therefore, there is a risk that this claim may not be

successful.

6. Loss per share

The analysis of loss per share is as follows:

2021 2020

(audited) (audited)

---------------------------------------------- ----------- -----------

Earnings for the purposes of basic earnings

per share and diluted earnings per share,

being loss attributable to owners of the

Company (GBP000) (3,684) (2,347)

---------------------------------------------- ----------- -----------

Weighted average number of ordinary shares

for the purposes of basic earnings per share

and diluted earnings per share (number) 373,215,456 268,855,366

---------------------------------------------- ----------- -----------

Loss per share - basic and diluted (p) (0.99) (0.87)

---------------------------------------------- ----------- -----------

Diluted EPS is calculated in the same way as basic EPS but also

with reference to reflect the dilutive effect of share options in

existence at the year end over 22,622,836 (2020: 19,220,500)

ordinary shares. The diluted loss per share is identical to the

basic loss per share, as potential dilutive shares are not treated

as dilutive since they would reduce the loss per share.

7. Goodwill and intangible assets

Group Company

------------------------------- -------------------------------

Patents Patents

and and

Goodwill trademarks Total Goodwill trademarks Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------- --------- ----------- ------- --------- ----------- -------

Cost

As at 31 January 2019

(audited) 2,101 1,320 3,421 2,824 1,320 4,144

Additions - 11 11 - 11 11

----------------------------- --------- ----------- ------- --------- ----------- -------

As at 31 January 2020

(audited) 2,101 1,331 3,432 2,824 1,331 4,155

Additions - 18 18 - 18 18

----------------------------- --------- ----------- ------- --------- ----------- -------

As at 31 January 2021

(unaudited) 2,101 1,349 3,450 2,824 1,349 4,173

----------------------------- --------- ----------- ------- --------- ----------- -------

Amortisation and impairment

As at 31 January 2019

(audited) 2,101 1,201 3,302 - 1,201 1,201

Impairment losses - 3 3 2,824 3 2,827

Amortisation charge

for the year - 17 17 - 17 17

As at 31 January 2020

(audited) 2,101 1,221 3,322 2,824 1,221 4,045

Impairment losses - 30 30 - 30 30

Amortisation charge

for the year - 16 16 - 16 16

As at 31 January 2021

(unaudited) 2,101 1,267 3,368 2,824 1,268 4,092

----------------------------- --------- ----------- ------- --------- ----------- -------

Net book value

As at 31 January 2019

(audited) - 119 119 2,824 119 2,943

----------------------------- --------- ----------- ------- --------- ----------- -------

As at 31 January 2020

(audited) - 110 110 - 110 110

----------------------------- --------- ----------- ------- --------- ----------- -------

As at 31 January 2021

(unaudited) - 82 82 - 82 82

----------------------------- --------- ----------- ------- --------- ----------- -------

Amortisation

Amortisation has been charged on patents for which the

registration process is complete, over the term granted.

The goodwill in the Company Balance sheet arose following the

hive up of the trade and assets of InRotis Technologies Limited in

2007 and was fully impaired during the prior year, reflecting the

significant advancements in technology, such as the launch of GAINs

in the prior year, to the extent that management deem that the

business model is now founded upon a different technological

capability than it was at the date of the hive up in 2007 and to

which the goodwill is allocated.

8. Property, plant and equipment - Group and Company

Right-to-use Plant Fixtures

and

Property equipment and fittings Total

Group and Company GBP000 GBP000 GBP000 GBP000

----------------------------------- ------------- ---------- ------------- -------

Cost

As at 31 January 2019 (audited) - 198 107 305

On transition to IFRS 16 123 - - 1 23

Additions - 5 - 5

Disposals - (41) (4) (45)

As at 31 January 2020 (audited) 123 162 103 388

Additions - 53 - 53

Disposals - (1) - (1)

----------------------------------- ------------- ---------- ------------- -------

As at 31 January 2021 (unaudited) 123 214 103 440

Depreciation

As at 31 January 2019 (audited) - 161 102 263

Depreciation charge for the year 46 29 2 77

Eliminated on disposals - (41) (4) (45)

As at 31 January 2020 (audited) 46 149 100 295

Depreciation charge for the year 46 18 1 66

Eliminated on disposals - (1) - (1)

----------------------------------- ------------- ---------- ------------- -------

As at 31 January 2021 (unaudited) 92 167 101 360

Net book value

As at 1 February 2019 (audited) - 37 5 42

----------------------------------- ------------- ---------- ------------- -------

As at 31 January 2020 (audited) 77 13 3 93

----------------------------------- ------------- ---------- ------------- -------

As at 31 January 2021 (unaudited) 31 47 2 80

----------------------------------- ------------- ---------- ------------- -------

9. Capital and reserves

No. of ordinary

shares

2021 2020

(audited) (audited)

Share capital '000 '000

------------------------------------- ---- ---- ---- ----------- -----------

In issue at 1 February 269,125 268,690

Issued for cash 151,649 435

In issue at 31 January - fully paid 420,774 269,125

------------------------------------------------------- ----------- -----------

2021 2020

GBP000 GBP000

------------------------------------------ ------- -------

Allotted, called up and fully paid

420,773,546 (2020: 269,125,498) ordinary

shares of GBP0.001 each 421 269

--------------------------------------------- ------- -------

421 269

------------------------------------------ ------- -------

The Company has one class of ordinary shares, which carry no

right to fixed income.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DGGDUGGBDGBD

(END) Dow Jones Newswires

May 13, 2021 02:00 ET (06:00 GMT)

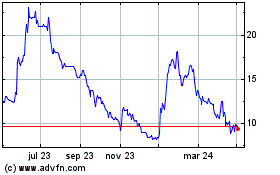

E-therapeutics (LSE:ETX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

E-therapeutics (LSE:ETX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024