Euro Strengthens Amid Risk Appetite On Trade Optimism

03 Abril 2019 - 1:05AM

RTTF2

The euro strengthened against its major counterparts in the

European session on Wednesday, as Eurozone bond yields rose and

investors cheered possibility of a soft Brexit and indications of

progress in U.S.-China trade talks.

The Financial Times reported that the U.S. and China have

resolved most of the outstanding issues and are drawing closer to a

final trade agreement. White House economic adviser Larry Kudlow

also said on Tuesday that the world's two largest economies "expect

to make more headway" in trade talks this week.

Investors also watched Brexit headlines, with reports suggesting

that British Prime Minister Theresa May will ask the EU for an

extension to the Brexit deadline to "break the logjam" in

Parliament.

Preliminary data from Eurostat showed that Eurozone retail sales

grew for a second consecutive month and at a faster-than-expected

pace in February.

Retail sales rose 0.4 percent month-on-month in February,

surpassing economists' expectations for 0.10 percent growth.

Survey data from IHS Markit showed that Eurozone private sector

activity continued its modest growth in March.

The final composite output index came in at 51.6 compared to

51.9 in February. The flash score was 51.3.

The final services PMI advanced to 53.3 from 52.8 in February.

The reading was initially estimated at 52.7.

The currency has been trading in a positive territory against

its major counterparts in the Asian session, barring the pound.

The euro advanced to 125.45 against the yen, its strongest since

March 22. If the euro rises further, 127.00 is possibly seen as its

next resistance level.

The latest survey from Nikkei showed that Japan's services

sector continued to expand in March, albeit at a slightly lower

pace, with a services PMI score of 52.0.

That's down from 52.3 in February, although it remains above the

boom-or-bust line of 50 that separates expansion from

contraction.

The common currency rebounded to 0.8545 against the pound, from

an early weekly low of 0.8502. The euro is seen finding resistance

around the 0.87 area.

The euro strengthened to a 6-day high of 1.1255 against the

greenback, from yesterday's closing value of 1.1204. The euro is

likely to challenge resistance around the 1.14 level.

The euro that closed Tuesday's trading at 1.1180 against the

franc climbed to a 6-day high of 1.1211. The next possible

resistance for the euro is seen around the 1.14 level.

The euro reversed from an early low of 1.4924 against the

loonie, rising to 1.4969. Continuation of the euro's uptrend may

see it challenging resistance around the 1.51 level.

Looking ahead, ADP private payrolls data for March is slated for

release at 8:15 am ET.

The U.S. ISM non-manufacturing composite index and Markit's

services PMI for March will be out in the New York session.

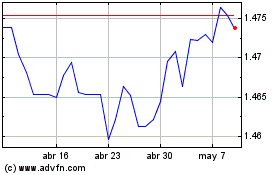

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Abr 2024 a May 2024

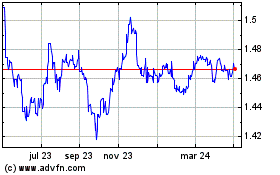

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De May 2023 a May 2024