TIDMPRIM

RNS Number : 6436Y

Primorus Investments PLC

10 May 2019

Primorus Investments plc

("Primorus" or the "Company")

Quarterly Investor Update

Primorus Investments plc (AIM: PRIM, NEX: PRIM) is pleased to

provide the quarter ending 31 March 2019 ("Q1" or the "Quarter")

periodic portfolio update regarding its current holdings and

activities acquired and managed as per its investment mandate.

Executive Director's Quarterly Comment - Alastair Clayton

The first Quarter of 2019 has been another good one for Primorus

despite rather negative sentiment in UK markets. The Quarter has

been punctuated by really good news in some of our larger oil and

technology investments and several of our longer-term investments

beginning to hit their straps. We also welcomed several TR1

shareholder notifications and launched our Twitter page

(@priminvestments) and I would encourage interested shareholders to

follow us to keep up to date with our investee companies first

hand

I don't need to tell shareholders the current macro-political

situation in the UK is difficult and whilst probably not directly

affecting many/most of our investments, it does act as a drag on

City confidence. To that end the IPO market in London is, by

historical standards, pretty weak at the moment.

The good news for shareholders is, as demonstrated by our highly

profitable exit from Horse Hill Developments Limited ("HHDL") in Q4

2018 and the recent offer for our Fresho stake (which we declined),

that we are not solely reliant on the IPO market to exit our

investments.

There are a whole range of potential acquirers for our

investments including; industry players, other pre-IPO investors,

venture capitalists, incoming later-stage investors, high net worth

individuals and family offices to name a few.

We are regularly talking to many of these types of investors to

discuss future exits from our investments so, whilst frustration at

face-value with a lack of IPO activity in the timeframes we

estimate/provide guidance for may be warranted, it does not

necessarily detract from our ability to generate returns from our

investments. This is important to consider when evaluating the

overall performance of our investee companies.

Highlights for the period:

Our largest investment, GBP1.4 million in Engage Technology

Partners reports that its monthly recurring revenues and billable

transactions have increased significantly on the back of the much

awaited first Self-Serve truly scalable SaaS products. More to come

in Q2.

Greatland Gold (GGP.L) signs a Farm-in Agreement with Newcrest

Mining (NCZ.AX) ("Newcrest") over the Havieron Project. Newcrest

has the right to acquire up to a 70% interest in 12 blocks within

E45/4701 that cover the Havieron target by spending up to US$65

million (circa GBP50 million or AUD$90 million) and completing a

series of exploration and development milestones in a four-stage

farm-in over six years.

SOA Energy ("SOA") execute a farm-in with Delek Drilling

("Delek"), one of Israel's largest Oil and Gas companies with a

market capitalisation of circa US$3.5 billion. According to the

agreement, Delek will invest up to US$8.3 million, in return Delek

will assume a 25%, non-operated stake in each of the Ofek and Yahel

licences, leaving SOA with a 45% stake in each permit. The IPO and

drilling programme is still on track for 2019.

Fresho press ahead on its accelerated growth programme and

completes a heavily backed A$2.55 million capital raise at 47%

premium to our initial investment price. Primorus received a bid

for its stake but declined the offer.

Zuuse completes its UK institutional roadshow as it contemplates

a UK IPO in 2020. Primorus holds A$500,000 in Series B loan notes

attracting a (rolled up) coupon of 12% due December 2019 as well as

1,000,000 options in Zuuse exercisable at A$0.50. We expect Zuuse

to next raise capital at a price greater than A$1.00.

WeShop strengthens its Board ahead of an anticipated institution

funding pitch in Q2.

The Company finishes the Quarter debt-free and the Board still

foresees no short-term need or intention to raise capital.

Update on Investments

Engage Technology Partners ("Engage") is our largest investment

with a total of GBP1.4 million invested across two funding rounds.

We invested in Engage because we believe it has potential to sweep

the SME market for temporary and permanent recruitment, agency back

office and pay and bill, would be hugely valuable if they could

develop and release a pure SaaS, mass-market, scalable

platform.

I am very happy to report that the first Self-Sign-Up

"Registration & Compliance" went live on 25 March and this will

be joined before the end of Q2 2019 by "Vacancies", "Placements"

and "Timesheets" for agencies; "Vendor Management Service" for

hirers; and "in-app" invitations between agencies and hirers to

drive unassisted "network" sales.

As a result, Engage has already seen monthly recurring revenue

and billable transactions increase significantly and we eagerly

await further exponential growth and complimentary

revenue-generating product releases to join the suite

imminently.

What this means for Primorus as investors is that the product

derived from the core proposition we invested in some time ago can

now be sold and we can observe its progress in the market and map

the key metrics.

We expect Engage to undertake further modest fund-raising

activities in the near-term as part of its considered capital

deployment plan to maintain the momentum of product releases as

they drive towards breakeven on a cashflow basis later in 2019. In

terms of timing, exiting our investment in Engage is really

dependent on the product growth and performance over the next six

months. Continued success and confirmation of the power of Engage

will clearly give us and Engage the largest number of options to

consider. IPO, trade sale or secondary sell-down are all possible

outcomes we may need to consider.

We are very pleased to report that Fresho is pressing ahead with

its plans for growth of sales and product development. As

shareholders will recall in March, we participated in a fully

subscribed A$1.5 million capital raise at 47% premium to our

initial investment price. In doing this we maintained our circa

3.4% shareholding.

Since the end of the Quarter, Fresho have accepted a further

A$1.05 million in subscriptions from several high-profile

technology investors. This has diluted our shareholding to circa

3.1%. We are expecting some press soon discussing their

participation and believe once known, their investment in Fresho

should prove a huge endorsement and open many doors for the company

both in Australia and internationally.

Shareholders will recall that in March we were offered a price

for our shareholding in Fresho which we decided not to accept and

whilst we are well ahead on our investment already, we consider the

real growth in value of our investment is only just beginning.

Greatland Gold PLC ("Greatland") has announced they are soon to

kick off exploration at their Black Hills prospect in the Paterson

Province in Western Australia. This follows on from the exploration

commencement at the Firetower Project in Tasmania and very soon the

much anticipated Havieron exploration programme recommences.

Of course the huge news during the Quarter was the Farm-in

Agreement with Newcrest Mining (NCZ.AX) ('Newcrest") over the

Havieron Project. Newcrest has the right to acquire up to a 70%

interest in 12 blocks within E45/4701 that cover the Havieron

target by spending up to US$65 million (circa GBP50 million or

AUD$90 million) and completing a series of exploration and

development milestones in a four-stage farm-in over six years.

Clearly, the farm-in by Newcrest supports our belief that the

results to date make Havieron one of the most outstanding

Gold/Copper projects globally. It was pleasing to be able to get

our shareholders exposure to Havieron before Newcrest.

We believe recent share price softness in Greatland is simply a

function of market impatience and short-sightedness. I was asked

recently by a shareholder why Primorus bought its shares in

Geatland. The simple answer is because we believe the share price

will appreciate substantially and that the market is asleep to the

opportunity before it. With exploration kicking off now across

multiple projects we hope to soon be proven correct.

As flagged in our Q4 report, SOA Energy were close to concluding

a significant farm-in deal over its prospects in Israel. We were

therefore very pleased to report in late March that a farm-in with

Delek Drilling ("Delek"), one of Israel's largest Oil and Gas

companies with a market capitalisation of circa US$3.5 billion had

been executed. According to the agreement, Delek will invest up to

US$8.3 million, in return Delek will assume a 25% non-operated

stake in each of the Ofek and Yahel licences, leaving SOA with a

45% stake in each permit.

This now allows for Ofek's re-entry/appraisal well drilling

programme to get underway, most likely in Q2/Q3. Upon successful

conclusion this will allow long-held plans to list the company in

London to commence. We look forward to the commencement of drilling

activities and are pleased that this significant hurdle to "value

unlock" for our investment has now finally been cleared.

We are eagerly awaiting news from NOMAD Energy on their

sensitive negotiations with VITOL and the Ivorian Government. We

will report back as soon as we have any information cleared for

release.

Zuuse is an international construction payments and lifecycle

software vendor with significant operations in the UK, United

States and Australia. With forecast revenues in CY2020 of circa

US$30 million and already EBITDA positive, the company is now

evaluating the potential for a UK listing in 2020 to support

further global growth ambitions. With some US$1.2 billion per month

through the platform globally and growing at a compound 5-6% per

month we see Zuuse as a strong candidate for a successful IPO in

the coming 12-18 months.

Shareholders will recall we also hold A$500,000 in loan notes

due December 2019 at an attractive rolled up coupon of 12% as well

as some options. Given we expect the next capital raise by Zuuse to

be greater than A$1.00 per share and with a total of 1,000,000

options at A$0.50 in Zuuse it is fair to say we are pleased with

the performance of this investment already.

We believe this investment is a good example of taking

opportunities that arise in niche funding rounds that in a

relatively short space of time can be very lucrative.

We are not yet in a position to be able to provide a detailed

update from StreamTV, who we understand are in the process of

arranging a significant capital injection to expedite their push to

commercial sales in 2019. We will report back once we have a full

update. As we stated last quarter, once the company locks down a

large funding package we can discuss what we feel our valuation

relative to initial investment on this investment might be and what

the next steps to realising it might look like.

Similarly, we understand TruSpine are in the process of mapping

out a route to IPO presently having garnered interest from several

investors recently. As such, and once plans have been finalised, we

will report back to shareholders with a more detailed update.

On the Sport:80 front we now believe an IPO in the short-term is

unlikely. A delay due to a protracted disagreement with a

shareholder means that realistically the window for an IPO (given

significant softness in the IPO market in the London) has now

closed. While disappointing, we also believe it is the right

outcome. We would prefer Sport:80 to focus on growing its business

rather than spending significant cash on an IPO process that would,

in all likelihood, be met with an anaemic market response. We will

get a more detailed update from Sport:80 in the coming quarter.

WeShop have yet to give us any further update other than the

investment update we released in mid-March.

Summary

The message from this Quarterly is that regardless of a weak IPO

market, we have a number of other ways of exiting our investments

including trade sales and secondary sell downs. This has already

been demonstrated not only by our HHDL exit but also the bid for

our Fresho stake which in this case we declined.

Several of our longer-standing and larger investments really

began to hit their straps with Engage and SOA passing significant

commercial milestones that we have been eagerly awaiting and Fresho

pushing forward with a rapid expansion of their business, something

we have advocated for some time. Our Zuuse debt and options

investment package looks very well timed and lucrative and with

three concurrent drilling programmes across Australia we believe

Greatland Gold/Newcrest will be generating a significant amount of

news flow in the coming Quarters.

With no debt and no foreseeable need to raise capital, we are in

a position to maximise any potential uplifts and exits in our

portfolio as it stands today.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3621 4120

Turner Pope Investments

Andy Thacker

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDGLGDUDUBBGCG

(END) Dow Jones Newswires

May 10, 2019 03:00 ET (07:00 GMT)

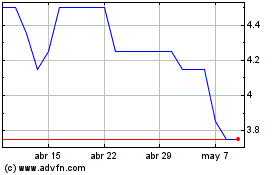

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024