Pound Higher On Easing Trade Fears

26 Junio 2019 - 3:23AM

RTTF2

The pound strengthened against its major opponents in the

European session on Wednesday, as sentiment lifted up after U.S.

Treasury Secretary Steven Mnuchin remarked that the U.S.-China

trade deal is 90 percent over and further progress in talks could

be made at the G20 summit this weekend.

Speaking to CNBC, Mnuchin said that U.S. negotiators were "about

90% of the way" to a trade deal with China and he was hopeful to

seal an agreement this year.

His comments eased worries over a stalemate with China as Trump

and Xi are set to meet on the sidelines of the G20 summit on

Saturday.

Speaking in Parliament, Bank of England Governor Mark Carney

told that the central bank would change its economic forecasts in

the event of a no-deal Brexit.

"In the event that there is progress toward a deal, the

committee forecast becomes very relevant," he told lawmakers.

"In the event that the government switches policy, the BOE would

switch."

The JobsOutlook survey by the Recruitment & Employment

Confederation showed that UK employers' confidence on the economy

and their hiring and investment intentions improved since the

extension of the Brexit deadline.

Employers' confidence in making hiring and investment decisions

improved with the index rising 4 percentage points to positive

1.

The currency was trading mixed against its major counterparts in

the Asian session. While it rose against the yen and the franc, it

fell against the euro and the greenback.

The pound appreciated to 136.84 against the yen, from a low of

135.87 touched at 5:15 pm ET. The currency is likely to challenge

resistance around the 139.00 mark.

Following near a 6-month low of 1.2348 seen at 3:00 am ET, the

pound reversed direction and gained to 1.2474 against the Swiss

franc. The next possible resistance for the pound is seen around

the 1.27 area.

The pound bounced off to 1.2707 against the greenback, from a

5-day low of 1.2663 marked at 3:00 am ET. If the currency rises

further, 1.29 is possibly seen as its next resistance level.

The U.K. currency edged higher to 0.8941 against the euro, after

falling to an 8-day low 0.8974 at 3:45 am ET. The pound is seen

finding resistance around the 0.88 level.

Survey data from market research group GfK showed that Germany's

consumer sentiment is set to weaken in July as income expectations

suffer significant setbacks amid fears of job losses among

shoppers.

The forward-looking consumer sentiment index dropped

more-than-expected to 9.8 in July from 10.1 in June. The score was

forecast to fall marginally to 10.0.

Looking ahead, U.S. durable goods orders, advance goods trade

data and wholesale inventories, all for May, are scheduled for

release in the New York session.

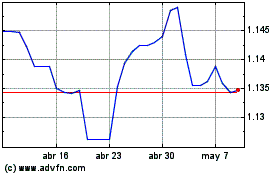

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024