HSBC Misses Third-Quarter Profit Expectations -- 2nd Update

28 Octubre 2019 - 6:44AM

Noticias Dow Jones

By Margot Patrick

HSBC Holdings PLC dropped one of its main financial targets for

2020 and said it would embark on a new round of restructuring as

tougher market conditions hit its third-quarter earnings.

Net profit fell 24% in the quarter, to $2.97 billion, the bank

said Monday. A FactSet poll of analysts had tipped a net profit of

$3.96 billion for the quarter.

Noel Quinn, who has been interim chief executive since August,

said Monday that the bank needs to simplify its structure further

and revamp its operations in the U.K., Europe and the U.S. That

would mean pulling back in commercial banking and investment

banking in the U.K. and Europe and investing more in higher-growth

areas such as Asia, the Middle East, Mexico and Canada, he told The

Wall Street Journal on Monday.

The Journal previously reported that the bank is already acting

on plans to sell its large French retail business.

HSBC shares fell 4% in European trading as analysts said the

plans added new risks around timing and execution.

Mr. Quinn said he has dropped the bank's 2020 target to make an

at least 11% return on tangible equity, and said new financial

targets will be set at full-year results in February, if not

sooner.

As a result, HSBC said it expects to take significant charges in

the fourth quarter and beyond, including the possible impairment of

goodwill and severance costs for departing staff.

Mr. Quinn didn't say how many of the bank's 238,000 jobs might

go, but noted that HSBC continues to hire staff in Hong Kong and

mainland China.

Mr. Quinn replaced former CEO John Flint after the bank's board

decided it needed a leadership change to address worsening economic

conditions. The bank's board is undertaking a global headhunt for a

new CEO and Mr. Quinn said Monday that he hopes to take the job

permanently.

The latest rejig comes after HSBC recently completed a yearslong

restructuring that saw it exit around 20 countries and dozens of

businesses. Mr. Quinn said the earlier reorganization was more of a

"risk management" program, while the current plans would help free

up capital to invest in technology and adapt quickly to changes in

the bank's markets.

--Yifan Wang contributed to this article.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

October 28, 2019 08:29 ET (12:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

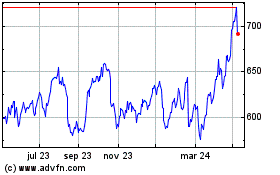

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

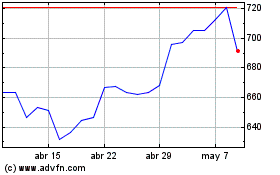

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024