Facebook Expected to Post Higher Revenue, Analysts Watch Instagram Growth

29 Enero 2020 - 5:29AM

Noticias Dow Jones

By Jeff Horwitz

Facebook Inc. is scheduled to report its fourth-quarter and

full-year 2019 results after the market closes Wednesday. Here are

the key points to watch:

REVENUE FORECAST: Facebook is expected to post revenue of $20.9

billion for the quarter and $70.5 billion for the year, according

to FactSet, up from $16.9 billion in the fourth quarter of 2018 and

$55.8 billion for that year.

EARNINGS FORECAST: Analysts polled by FactSet expect Facebook's

quarterly profit will be $2.53 a share, rising to $7.3 billion from

$6.9 billion a year earlier. But earnings for the year are

anticipated to be $8.75 a share, down slightly as year-over-year

profit is expected fall to $18.3 billion from $22.1 billion,

largely because of a $5 billion privacy settlement with the Federal

Trade Commission.

WHAT TO WATCH:

-- DRAMATIC COMPANY, STEADY RESULTS: If analysts' expectations

are met, Facebook will report diminishing cost growth and healthy

results across its advertising business, which is the only one that

matters. Concerns about the health of the main Facebook app have

receded, with engagement and revenue growth from the core newsfeed

product surprising analysts last quarter, even as the company has

remained in the headlines over regulatory and privacy issues.

Facebook and Alphabet Inc.'s Google have steadily increased their

dominance of the digital advertising market in recent years, and

this quarter isn't expected to be any different.

-- INSTAGRAM DECELERATION: While consistently impressive, the

pace of Instagram's revenue growth appears to be slowing, according

to data from digital-marketing firm Kenshoo, which estimates

platform-specific spending that Facebook itself doesn't reveal.

While Kenshoo's estimate of 22% year-over-year revenue growth for

the image-based social platform is below the industry average, it

is still quite good. Meanwhile, eMarketer estimates that

Instagram's user growth in the U.S. will have slowed from 10.1% in

2018 to 6.7% in 2019, with older demographics not picking up the

app as quickly as previously forecast. Any guidance from the

company about the state of Instagram's business will be watched

closely.

-- NEW BUSINESS FRONTIERS: With advertising holding steady at

98.4% of Facebook's revenue, finding new "surfaces" to advertise on

is a challenge. Expect analyst interest in services such as

Facebook Marketplace, Instagram Checkout and features offered by

Messenger and WhatsApp -- especially because Facebook has backed

off the plans to monetize WhatsApp through ads. And while the

Facebook-backed Libra cryptocurrency project isn't looking likely

to meet Facebook's initial 2020 launch target, the company's

interest in money transfers is alive and well.

Write to Jeff Horwitz at Jeff.Horwitz@wsj.com

(END) Dow Jones Newswires

January 29, 2020 06:14 ET (11:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

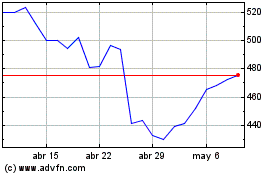

Meta Platforms (NASDAQ:META)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Meta Platforms (NASDAQ:META)

Gráfica de Acción Histórica

De May 2023 a May 2024