TIDMFKE

RNS Number : 1145E

Fiske PLC

26 February 2020

26 February 2020

Fiske Plc

('Fiske' or 'the Company')

Interim Results

The Company announces its interim results for the six months

ended 30 November 2019.

In accordance with rule 26 of the AIM Rules for Companies this

information is also available, under the Investors section, at the

Company's website, http://www.fiskeplc.com .

For further information please contact:

-- Samantha Harrison/Harrison Clarke/Niall McDonald, Grant

Thornton UK LLP (Nominated Adviser)

(tel: 020 7383 5100)

-- Gerard Luchini, Fiske Plc - Compliance Officer

(tel: 020 7448 4700)

Chairman's Statement

Trading

Chairman's Statement

Trading

Our results for the half year to 30 November 2019 were

significantly better than for the prior half year with a pre-tax

operating loss of GBP158,000 compared to a loss of GBP344,000 for

the comparable period in 2018.

Our fee and commission revenues were some GBP334,000 higher than

the prior year comparative which represents an improvement of

approximately 15%. Within this our investment management fee

revenues grew by 19% whilst our commission revenues increased by

12% when compared to the equivalent period to 30 November 2018.

This has delivered total revenues of GBP2.509 million (2018:

GBP2.163 million) which is a result of generally improved market

conditions and the continued migration of clients to fee paying

services.

Our operating expenses increased by 9% to GBP2.746 million

(2018: GBP2.509 million) primarily as a result of additional costs

relating to the increasing burden of regulation manifesting itself

in the ongoing development of our internal controls around the

Client Money and Assets rules (CASS).

Asset Management

We are pleased to report further progress for our unit trust,

Ocean UK Equity. In the period to 31 January 2020 the fund has

delivered first quartile performance in each of the last three and

twelve month periods (Source: T. Bailey Fund Services

Limited/Financial Express Analytics). As at the end of January 2020

the fund was valued at approximately GBP8.2 million. We have also

delivered a good performance for The Investment Company plc, a

listed investment trust, with the net asset value rising by 7.6%

over the six months to 31 December 2019 and the share price rising

by 16.1% over the same period.

Investment Managers

Despite the ongoing cost pressure from the regulatory

environment we continue to invest in the growth of our front office

capabilities. The two investment managers who joined us shortly

before the beginning of the financial year are making an

increasingly positive contribution.

Euroclear

Due to the re-domiciliation of Euroclear from Switzerland to

Belgium in late 2018 we have not received dividend income from

Euroclear in either the financial year to 31 May 2019 or the six

month period to 30 November 2019. Subsequent to the period end we

have now received part of the dividend for Euroclear's financial

year to 31 December 2018. The dividend amounted to EUR55 per share

and we received EUR139,000 in December 2019 with the tax credit of

EUR59,000 to follow in due course.

Euroclear have recently announced that following another

successful year to 31 December 2019, where their profits rose by

34%, they have increased their full year dividend by 50%. This will

mean we can expect to receive a dividend of approximately

EUR298,000 from Euroclear during this calendar year. We expect this

to further strengthen the market value of our holding.

Restatement of accounts

Following our own internal audit process, the directors of the

Company have determined that certain adjustments need to be made to

the accounts. These result primarily from a change in an accounting

process which has affected the way in which our systems data has

been interpreted for accounting purposes. In addition, we have

resolved to change the way in which the accounting for the

acquisition of Fieldings Investment Management has been

executed.

There has been no impact on the client money or asset positions

of our clients, and no impact on the Company's cash position. The

overall impact has been an overstatement of current liabilities.

The necessary adjustments, accumulated over several years, amount

to a net addition of some GBP532,000 to the Group's net assets as

at 31 May 2019. Comparative data in this report has been restated

and the adjustments elaborated in notes to the accounts.

IFRS 16

The adoption of IFRS 16 from 1 June 2019 has resulted in a new

treatment of our property rental obligations leading to the

inclusion of GBP188,000 of right-of-use assets in the Statement of

Financial Position as at 30 November 2019 together with a lease

liability of GBP225,000. In the six months to 30 June 2019,

operating profit was increased by GBP26,000, which was matched by

an increase in lease liability interest of GBP14,000, giving a

de-minimis impact to the Income Statement. Further information can

be found in Note 1.

Markets

Since the decisive victory of the Conservatives in the UK

General Election held in December 2019 investment sentiment has

markedly improved. Having a government with a sizeable majority

should allow for positive measures to be delivered to drive

economic growth and maintain a more favourable market background.

Offsetting this optimism to some extent is the growing impact of

the Coronavirus (COVID-19) not only in China but increasingly

around the world. Until we see a genuine peak in new cases in China

and a significant diminution in the rate of infection elsewhere

markets will struggle to shake off the increasingly negative

outlook for global growth in 2020.

Outlook

Assuming no significant deterioration in trading conditions, the

board remains confident that the Group will continue to make

further progress in 2020.

Clive Fiske Harrison

Chairman

26 February 2020

Condensed Consolidated Statement of Total Comprehensive

Income

for the six months ended 30 November 2019

Six months Six months

ended ended Year ended

30 November 30 November 31 May

2019 2018 2019

Unaudited Unaudited Unaudited

GBP'000 GBP'000

GBP'000 (restated) (restated)

------------------------------------- --- ------------ ------------ -----------

Fee and commission income 2,493 2,159 4,591

Other income 16 - (1)

Fair value through other

comprehensive income

(FVTOCI) - 4 (1)

Total Revenue 2,509 2,163 4,589

Operating expenses (2,746) (2,509) (5,020)

------------------------------------------ ------------ ------------ -----------

Operating Profit/(loss) (237) (346) (431)

------------------------------------------ ------------ ------------ -----------

Investment revenue 27 - -

Finance income 87 33 108

Finance costs (35) (31) (58)

(Loss) / Profit on ordinary

activities before taxation (158) (344) (381)

Taxation - - -

------------------------------------- --- ------------ ------------ -----------

(Loss)/Profit on ordinary

activities after taxation (158) (344) (381)

------------------------------------------ ------------ ------------ -----------

Other comprehensive income/(expense)

Movement in unrealised

appreciation of investments (212) 20 3,289

Deferred tax on movement

in unrealised appreciation

of investments 39 (4) (583)

------------------------------------------ ------------ ------------ -----------

Net other comprehensive

(expense)/ income (173) 16 2,706

------------------------------------------ ------------ ------------ -----------

Total comprehensive (loss)

/ income for the period/year

attributable to equity

shareholders (331) (328) 2,325

------------------------------------------ ------------ ------------ -----------

(Loss) / Earnings per

ordinary share (pence),

excluding other comprehensive

income

Basic (1.4p) (3.0p) (3.3p)

Diluted (1.4p) (3.0p) (3.3p)

All results are from continuing operations and are attributable

to equity shareholders of the parent company

Condensed Consolidated Statement of Financial Position

30 November 2019

As at As at As at As at

30 November 30 November 31 May 1 June

2019 2018 2019 2018

Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000

GBP'000 (restated) (restated) (restated)

-------------------------- --- ------------ ------------ ----------- -----------

Non-current assets

Intangible assets

arising on consolidation 1,379 1,510 1,445 1,576

Other intangible

assets 81 113 97 130

Right-of-use assets 188 - - -

Property, plant

and equipment 28 37 30 35

Financial assets

at fair value

through profit

or loss 5,546 2,491 5,759 2,470

------------------------------- ------------ ------------ ----------- -----------

Total non-current

assets 7,222 4,151 7,331 4,211

------------------------------- ------------ ------------ ----------- -----------

Current assets

Trade and other

receivables 2,667 2,273 2,387 4,183

Cash and cash

equivalents 1,377 2,014 2,073 2,453

------------------------------- ------------ ------------ ----------- -----------

Total current

assets 4,044 4,287 4,460 6,636

------------------------------- ------------ ------------ ----------- -----------

Current liabilities

Trade and other

payables 2,479 2,703 2,814 4,790

Short-term lease

liabilities 207 - - -

Current tax liabilities - 36 - 36

------------------------------- ------------ ------------ ----------- -----------

Total current

liabilities 2,686 2,739 2,814 4,826

------------------------------- ------------ ------------ ----------- -----------

Net current assets 1,358 1,548 1,646 1,810

------------------------------- ------------ ------------ ----------- -----------

Non-current liabilities

Long-term lease

liabilities 18 - - -

Deferred tax liabilities 759 217 797 214

------------------------------- ------------ ------------ ----------- -----------

Total non-current

liabilities 777 217 797 214

------------------------------- ------------ ------------ ----------- -----------

Net assets 7,803 5,482 8,180 5,807

------------------------------- ------------ ------------ ----------- -----------

Equity

Share capital 2,904 2,890 2,904 2,890

Share premium 2,029 1,997 2,029 1,997

Revaluation reserve 4,030 1,514 4,203 1,497

Retained earnings (1,160) (919) (956) (577)

------------------------------- ------------ ------------ ----------- -----------

Shareholders'

equity 7,803 5,482 8,180 5,807

------------------------------- ------------ ------------ ----------- -----------

Condensed Consolidated Statement of Changes in Equity

Share Share Revaluation Retained Total

Capital Premium Reserve Earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- -------- -------- ----------- --------- -------

Balance at 1 December

2018 as reported 2,890 1,997 1,514 (1,337) 5,064

Adjustments - - - 418 418

----------------------------- -------- -------- ----------- --------- -------

As restated at 1

December 2018 2,890 1,997 1,514 (919) 5,482

Loss on ordinary

activities after

taxation - - - (37) (37)

Other comprehensive

income - - - (2) (2)

Movement in unrealised

appreciation of investments - - 3,268 - 3,268

Deferred tax on m

ovement in unrealised

appreciation of investments - - (579) - (579)

Share based payment

transactions - - - 2 2

Issue of ordinary

share capital 14 32 - - 46

----------------------------- -------- -------- ----------- --------- -------

Balance at 31 May

2019 (as restated) 2,904 2,029 4,203 (956) 8,180

----------------------------- -------- -------- ----------- --------- -------

Adoption of IFRS

16 (note 1) - - - (48) (48)

----------------------------- -------- -------- ----------- --------- -------

Balance at 1 June

2019 2,904 2,029 4,203 (1,004) 8,132

----------------------------- -------- -------- ----------- --------- -------

(Loss) on ordinary

activities after

taxation - - - (158) (158)

Other comprehensive

income - - - - -

Movement in unrealised

appreciation of investments - - (212) - (212)

Deferred tax on movement

in unrealised appreciation

of investments - - 39 - 39

----------------------------- -------- -------- ----------- --------- -------

Total comprehensive

(loss) for the period - - (173) (158) (331)

----------------------------- -------- -------- ----------- --------- -------

Dividends paid - - - - -

----------------------------- -------- -------- ----------- --------- -------

Share based payment

transactions - - - 2 2

----------------------------- -------- -------- ----------- --------- -------

Balance at 30 November

2019 2,904 2,029 4,030 (1,160) 7,803

----------------------------- -------- -------- ----------- --------- -------

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 November 2019

Six months Six months

ended ended Year ended

30 November 30 November 31 May

2019 2018 2019

Unaudited Unaudited Unaudited

GBP'000 GBP'000

GBP'000 (restated) (restated)

--------------------------------- ------------ ------------ -----------

Operating (loss) (237) (346) (431)

Amortisation of intangible

asset - customer relationships 66 66 131

Amortisation of other intangible

assets 16 17 33

Depreciation of Right-of-use

assets 86 - -

Depreciation of property,

plant and equipment 10 9 22

Expenses settled by the

issue of shares 2 - 2

Decrease/(increase) in

investments held for trading - - -

Decrease/(increase) in

receivables (280) 1,910 1,796

Increase/(decrease) in

payables (354) (2,117) (2,034)

--------------------------------- ------------ ------------ -----------

Cash generated from / (used

in) operations (692) (461) (481)

Tax recovered - - (36)

--------------------------------- ------------ ------------ -----------

Net cash (used in)/generated

from operating activities (692) (461) (517)

--------------------------------- ------------ ------------ -----------

Investing activities

Investment income received 27 - -

Interest received 87 33 108

Interest paid (15) - -

Purchases of property,

plant and equipment (8) (11) (17)

Purchases of other intangible

assets - - -

Net cash (used in)/ generated

from investing activities 91 22 91

--------------------------------- ------------ ------------ -----------

Financing activities

Proceeds from issue of

ordinary share capital - - 46

Repayment of lease liabilities (96) - -

Dividends paid - - -

--------------------------------- ------------ ------------ -----------

Net cash used in financing

activities (96) - 46

--------------------------------- ------------ ------------ -----------

Net (decrease) / increase

in cash and cash equivalents (696) (439) (380)

Cash and cash equivalents

at beginning of period 2,073 2,453 2,453

--------------------------------- ------------ ------------ -----------

Cash and cash equivalents

at end of period/year 1,377 2,014 2,073

--------------------------------- ------------ ------------ -----------

Notes to the Interim Financial Statements

1. Basis of preparation

The Condensed Consolidated Interim Financial Statements of Fiske

plc and its subsidiaries (the Group) for the six months ended 30

November 2019 have been prepared in accordance with IAS 34 (Interim

Financial Reporting), as adopted in the United Kingdom. The

accounting policies applied are consistent with those set out in

the May 2019 Fiske plc Annual Report and accounts except for IFRS

16 (Leases) which has been adopted in the current year.

These Condensed Consolidated Interim Financial Statements do not

include all the information required for full annual statements and

should be read in conjunction with the May 2019 Annual Report and

Accounts.

The comparative figures for the year ended 31 May 2019 do not

constitute the Group's statutory Financial Statements for that

financial year as defined in Section 434 of the Companies Act 2006,

and amounts which have been extracted from those Financial

Statements for reporting in these have been subject to restatements

as elaborated in Note 4 below.

The Financial Statements of the Group for the year ended 31

May2019 were prepared in accordance with International Financial

Reporting Standards adopted by in the United Kingdom. The statutory

Consolidated Financial Statements for Fiske plc in respect of the

year ended 31 May 2019 have been reported on by the Company's

auditor and delivered to the registrar of companies. The report of

the auditor was (i) unqualified, (ii) did not include a reference

to any matters to which the auditor drew attention by way of

emphasis without qualifying their report, and (iii) did not contain

a statement under Section 498 (2) or (3) of the Companies Act

2006.

Under IAS 27 these financial statements are prepared on a

consolidated basis where the Group consists of Fiske plc, the

parent, and those subsidiaries in which it owns 100% of the voting

rights, being Ionian Group Limited, Fiske Nominees Limited,

Fieldings Investment Management Limited and VOR Financial Strategy

Limited.

The directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. Thus they continue to adopt the going concern

basis of accounting in preparing this half-yearly financial

report.

New standards adopted in the current year

IFRS 16 (Leases)

The Group adopted IFRS 16 (Leases) using the modified

retrospective approach on 1 June 2019. IFRS 16 introduces new

requirements for lessee and lessor accounting, with the distinction

between operating lease and finance lease no longer applying for

lessees. Under IFRS 16, a lessee is required to recognise assets

and liabilities for all leases with a term of more than 12 months,

unless the underlying asset is of a low value when new. The new

standard also requires depreciation of the asset to be recognised

separately from the interest expense on the lease liability.

As a result of adopting IFRS 16, the difference between the

asset and liability recognised on 1 June 2019 has been shown as an

adjustment to opening retained earnings within the Consolidated

Statement of Changes in Equity. The exemptions taken by the Group

on transition are detailed below. For any new leases entered into

after 1 June 2019, the lease liability is initially measured at the

present value of the lease payments that are not paid at the

commencement date, discounted by using the incremental borrowing

rate for the related geographical location. The lease liability is

subsequently measured by increasing the carrying amount to reflect

interest on the lease liability and by reducing the carrying amount

to reflect the lease payments made.

The right-of-use assets comprise the initial measurement of the

corresponding lease liability, lease payments made at or before the

commencement date and any initial direct costs. They are

subsequently measured at cost less accumulated depreciation and

impairment losses.

2. Taxation

No tax credit on the loss for the period has been recognised for

the six months to 30 November 2019, due to uncertainty over the

timing and quantum of future taxable profits being available.

3. Dividends paid

Dividends paid in the first half of the year to 31 May 2020

GBPnil (2019 - GBPnil).

4. Impact of restatements

(a) Consolidated Statement of Total Comprehensive income in the

prior half year to 30 November 2018

As previously

reported Adjustments As restated

(Unaudited) (Unaudited) (Unaudited)

Notes GBP'000 GBP'000 GBP'000

------------------------------------- ------ ------------- ------------ ------------

Fee and commission income i 2,015 144 2,159

Other income - - -

Fair value through other

comprehensive income

(FVTOCI) 4 - 4

Total Revenue 2,019 144 2,163

Operating expenses i (2,544) 35 (2,509)

------------------------------------- ------ ------------- ------------ ------------

Operating Profit/(loss) (525) 179 (346)

--------------------------------------------- ------------- ------------ ------------

Finance income 33 - 33

Finance costs ii - (31) (31)

(Loss) / Profit on ordinary

activities before taxation (492) 148 (344)

Taxation - - -

------------------------------------- ------ ------------- ------------ ------------

(Loss)/Profit on ordinary

activities after taxation (492) 148 (344)

--------------------------------------------- ------------- ------------ ------------

Other comprehensive income/(expense)

Movement in unrealised

appreciation of investments 20 - 20

Deferred tax on movement

in unrealised appreciation

of investments (4) - (4)

--------------------------------------------- ------------- ------------ ------------

Net other comprehensive

(expense)/ income 16 - 16

--------------------------------------------- ------------- ------------ ------------

Total comprehensive (loss)

/ income for the period/year

attributable to equity

shareholders (476) 148 (328)

--------------------------------------------- ------------- ------------ ------------

(Loss) / Earnings per

ordinary share (pence),

excluding other comprehensive

income

Basic (4.5p) 1.3p (3.0p)

Diluted (4.5p) 1.3p (3.0p)

(b) Consolidated Statement of Total Comprehensive income in the prior year to 31 May 2019

As previously

reported Adjustments As restated

(Audited) (Unaudited) (Unaudited)

Notes GBP'000 GBP'000 GBP'000

------------------------------------- ------ ------------- ------------ ------------

Fee and commission income i 4,289 302 4,591

Other income (1) - (1)

Fair value through other

comprehensive income

(FVTOCI) (1) - (1)

Total Revenue 4,287 302 4,589

Operating expenses i (5,037) 17 (5,020)

------------------------------------- ------ ------------- ------------ ------------

Operating Profit/(loss) (750) 319 (431)

--------------------------------------------- ------------- ------------ ------------

Finance income 108 - 108

Finance costs ii - (58) (58)

(Loss) / Profit on ordinary

activities before taxation (642) 261 (381)

Taxation - - -

------------------------------------- ------ ------------- ------------ ------------

(Loss)/Profit on ordinary

activities after taxation (642) 261 (381)

--------------------------------------------- ------------- ------------ ------------

Other comprehensive income/(expense)

Movement in unrealised

appreciation of investments 3,289 - 3,289

Deferred tax on movement

in unrealised appreciation

of investments (583) - (583)

--------------------------------------------- ------------- ------------ ------------

Net other comprehensive

(expense)/ income 2,706 - 2,706

--------------------------------------------- ------------- ------------ ------------

Total comprehensive (loss)

/ income for the period/year

attributable to equity

shareholders 2,064 261 2,325

--------------------------------------------- ------------- ------------ ------------

(Loss) / Earnings per

ordinary share (pence),

excluding other comprehensive

income

Basic (5.5p) (2.2p) (3.3p)

Diluted (5.5p) (2.2p) (3.3p)

(c) Consolidated Statement of Financial Position as at 30 November 2018

As previously

reported Adjustments As restated

(Unaudited) (Unaudited) (Unaudited)

Notes GBP'000 GBP'000 GBP'000

------------------------- ------ ------------- ------------ ------------

Non-current assets

Goodwill and intangible

assets 1,510 - 1,510

Other intangible

assets 113 - 113

Property, plant

and equipment 37 - 37

Equity investments 2,491 - 2,491

Total non-current

assets 4,151 - 4,151

--------------------------------- ------------- ------------ ------------

Current assets

Trade and other

receivables i 2,364 (91) 2,273

Cash and cash

equivalents 2,014 - 2,014

--------------------------------- ------------- ------------ ------------

Total current

assets 4,378 (91) 4,287

--------------------------------- ------------- ------------ ------------

Current liabilities

Trade and other i,

payables ii 3,212 (509) 2,703

Current tax liabilities 36 - 36

Total current

liabilities 3,248 (509) 2,739

--------------------------------- ------------- ------------ ------------

Net current assets 1,130 418 1,548

--------------------------------- ------------- ------------ ------------

Non-current liabilities

Deferred tax liabilities 217 - 217

--------------------------------- ------------- ------------ ------------

Total non-current

liabilities 217 - 217

--------------------------------- ------------- ------------ ------------

Net assets 5,064 418 5,482

--------------------------------- ------------- ------------ ------------

Equity

Share capital 2,890 - 2,890

Share premium 1,997 - 1,997

Revaluation reserve 1,514 - 1,514

Retained earnings (1,337) 418 (919)

--------------------------------- ------------- ------------ ------------

Shareholders'

equity 5,064 418 5,482

--------------------------------- ------------- ------------ ------------

(d) Consolidated Statement of Financial Position as at 31 May 2019

As previously

reported Adjustments As restated

(Audited) (Unaudited) (Unaudited)

Notes GBP'000 GBP'000 GBP'000

------------------------- ------ ------------- ------------ ------------

Non-current assets

Goodwill and intangible

assets 1,445 - 1,445

Other intangible

assets 97 - 97

Property, plant

and equipment 30 - 30

Equity investments 5,759 - 5,759

Total non-current

assets 7,331 - 7,331

--------------------------------- ------------- ------------ ------------

Current assets

Trade and other

receivables i 2,545 (158) 2,387

Cash and cash

equivalents 2,073 - 2,073

--------------------------------- ------------- ------------ ------------

Total current

assets 4,618 (158) 4,460

--------------------------------- ------------- ------------ ------------

Current liabilities

Trade and other i,

payables ii 3,504 (690) 2,814

Current tax liabilities - - -

Total current

liabilities 3,504 (690) 2,814

--------------------------------- ------------- ------------ ------------

Net current assets 1,114 532 1,646

--------------------------------- ------------- ------------ ------------

Non-current liabilities

Deferred tax liabilities 797 - 797

--------------------------------- ------------- ------------ ------------

Total non-current

liabilities 797 - 797

--------------------------------- ------------- ------------ ------------

Net assets 7,648 532 8,180

--------------------------------- ------------- ------------ ------------

Equity

Share capital 2,904 - 2,904

Share premium 2,029 - 2,029

Revaluation reserve 4,203 - 4,203

Retained earnings (1,488) 532 (956)

--------------------------------- ------------- ------------ ------------

Shareholders'

equity 7,648 532 8,180

--------------------------------- ------------- ------------ ------------

(e) Consolidated Statement of Financial Position as at 1 June 2018

As previously

reported Adjustments As restated

(Audited) (Unaudited) (Unaudited)

Notes GBP'000 GBP'000 GBP'000

------------------------- ------ ------------- ------------ ------------

Non-current assets

Goodwill and intangible

assets 1,576 - 1,576

Other intangible

assets 130 - 130

Property, plant

and equipment 35 - 35

Equity investments 2,470 - 2,470

Total non-current

assets 4,211 - 4,211

--------------------------------- ------------- ------------ ------------

Current assets

Trade and other

receivables i 4,087 96 4,183

Cash and cash

equivalents 2,453 - 2,453

--------------------------------- ------------- ------------ ------------

Total current

assets 6,540 96 6,636

--------------------------------- ------------- ------------ ------------

Current liabilities

Trade and other i,

payables ii 4,965 (175) 4,790

Current tax liabilities 36 - 36

Total current

liabilities 5,001 (175) 4,826

--------------------------------- ------------- ------------ ------------

Net current assets 1,539 271 1,810

--------------------------------- ------------- ------------ ------------

Non-current liabilities

Deferred tax liabilities 214 - 214

--------------------------------- ------------- ------------ ------------

Total non-current

liabilities 214 - 214

--------------------------------- ------------- ------------ ------------

Net assets 5,536 271 5,807

--------------------------------- ------------- ------------ ------------

Equity

Share capital 2,890 - 2,890

Share premium 1,997 - 1,997

Revaluation reserve 1,497 - 1,497

Retained earnings (848) 271 (577)

--------------------------------- ------------- ------------ ------------

Shareholders'

equity 5,536 271 5,807

--------------------------------- ------------- ------------ ------------

Notes:

i impact of change in an accounting process which has affected

the way in which our systems data has been interpreted for

accounting purposes, resulting in increased revenue and reallocated

costs

ii impact of change in the way in which the accounting for the

acquisition of Fieldings Investment Management Ltd has been

executed, resulting in an amortisation of the fair value adjustment

to deferred consideration payable

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FLFITFIIEFII

(END) Dow Jones Newswires

February 26, 2020 02:00 ET (07:00 GMT)

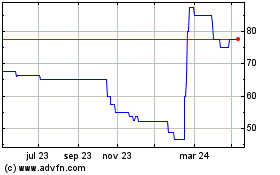

Fiske (LSE:FKE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

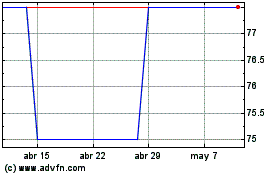

Fiske (LSE:FKE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024