TIDMBGUK

RNS Number : 7358P

Baillie Gifford UK Growth Fund PLC

12 June 2020

RNS Announcement

Baillie Gifford UK Growth Fund plc

Legal Entity Identifier: 549300XX386SYWX8XW22

Unaudited Preliminary Results for the year to 30 April 2020

-----------------------------------------------------------

Over the year to 30 April 2020, the Company's net asset value

per share (NAV) total return was negative 12.5% compared to a

negative total return of 16.7% for the FTSE All Share index. The

share price total return for the same period was negative

14.6%.

3/4 The notable contributors to the relative outperformance

were: Genus (world leading animal genetics company); Boohoo.com

(online fashion retailer); Just Eat Takeaway.com (operator of

online and mobile market place for takeaway food); and, Ultra

Electronics (aerospace and defence systems provider).

3/4 Four new positions were initiated over the year (Farfetch,

Creo Medical, Games Workshop and 4imprint) and four exited (Jupiter

Fund Management, Ted Baker, M&G and Carnival). Annual turnover

was 5.4% and no gearing was deployed during the period.

3/4 The net revenue return for the year was 3.75p per share

(2019: 5.12p). A final dividend of 3.10p per share is being

recommended to give a total for the year of 3.10p (2019: 2.95p

Final and 1.50p Interim). The dividend is now paid by way of a

single final payment and is approximately the minimum permissible

to maintain investment trust status.

3/4 As a consequence of Covid-19, companies are in an extremely

challenging operating environment. The portfolio in aggregate is

comprised of holdings that are well capitalised and have lower than

average debt compared to the rest of the market.

3/4 Despite the opaque macro backdrop, the Board and Managers

remain convinced that exceptional UK growth companies can exploit

their competitive positions over the long-term and take advantage

of the opportunities that follow severe economic dislocation.

Total return information is sourced from Baillie

Gifford/Refinitiv. See disclaimer at the end of this announcement.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Baillie Gifford UK Growth Fund plc invests to achieve capital

growth predominantly from investment in UK equities with the aim of

providing a total return in excess of the FTSE All-Share Index.

The Company is managed by Baillie Gifford & Co, an Edinburgh

based fund management group with around GBP246 billion under

management and advice as at 11 June 2020.

Past performance is not a guide to future performance. Baillie

Gifford UK Growth Fund plc is a listed UK company. The value of its

shares and any income from them can fall as well as rise and

investors may not get back the amount invested. The Company is

listed on the London Stock Exchange and is not authorised or

regulated by the Financial Conduct Authority. You can find up to

date performance information about Baillie Gifford UK Growth Fund

plc at www.bgukgrowthfund.com ++ See disclaimer at the end of this

announcement.

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

For further information please contact:

Anzelm Cydzik, Baillie Gifford & Co

Tel: 0131 275 2000

Mark Knight, Four Communications

Tel: 0203 697 4200 or 07803 758810

The following is the unaudited preliminary statement of annual

results for the year to 30 April 2020 which was approved by the

Board on 11 June 2020.

Chairman's Statement

Covid-19

In these uncertain times, my fellow Directors and I would like

to take this opportunity to extend our thoughts to all affected by

recent events, and our gratitude to those working tirelessly for

the benefit of all.

Your Board has been monitoring how the Managers and other

service providers have been responding to developments and has

sought assurances that, operationally, they are acting responsibly

towards their employees whilst maintaining appropriate standards of

service to the Company. The portfolio managers in turn have

continued to seek similar assurances from the companies held in the

portfolio.

Annual General Meeting ('AGM')

It is intended that the Company's AGM will be held on Wednesday

5 August 2020 at 12.00 noon at the offices of Baillie Gifford, 1

Greenside Row, Edinburgh, EH1 3AN. Whilst normally inviting

shareholders to attend, this doesn't seem possible at the current

time, so shareholders are encouraged to submit their votes by proxy

rather than attempt to do so in person. The meeting itself will

involve the minimum number of people necessary for it to be quorate

so anyone not authorised to attend will be declined entry for

health reasons. Should the situation change, further information

will be made available through the Company's website at

www.bgukgrowthfund.com and the London Stock Exchange regulatory

news service.

Performance

For the year to 30 April 2020, the Company's net asset value

('NAV') total return (capital and income) was negative 12.5%

compared to a negative 16.7% for the FTSE All-Share Index total

return.

The Company's share price total return over the same period was

negative 14.6%. Whilst disappointing to see a fall in value, it is

good to see our quality portfolio outperforming the broader market

in these difficult times.

The longer-term prospects for our companies look exciting. The

Managers' review below highlights some of the interesting

developments in the portfolio as well as some of the issues

faced.

Stewardship

As long-term 'actual' investors, the portfolio managers' focus

is on promoting the best long-term performance outcomes for the

businesses in which they invest, actively engaging with companies

on those issues which could impact their long-term potential and

supporting actions which they believe will maximise returns in

future years. As part of the investment research process,

consideration is given to relevant environmental, social and

governance issues and the impact these may have on future

returns.

The portfolio managers invest in companies at different stages

in their evolution and across different industries and are wary of

prescriptive policies and rules, believing that these can run

counter to thoughtful and beneficial corporate stewardship. The

approach adopted therefore favours a small number of simple

stewardship principles which help shape interactions with

companies. These principles, along with their core investment

principles, are set out below.

Share Buy-backs and Issuance from Treasury

No shares were bought back during the year to 30 April 2020. At

the forthcoming AGM, the Board will ask shareholders to renew the

mandate to repurchase up to 14.99% of the outstanding shares. The

share buy-back policy seeks to operate in the best interests of

shareholders by taking into account the relative level of the

Company's share price discount to NAV when compared with peer group

trusts, the absolute level of discount, volatility in the level of

discount and the impact from share buy-back activity on the

long-term liquidity of the Company's issued shares.

The Board also believes that the Company benefits from the

flexibility of being able to re-issue any shares that might be held

in treasury and is therefore looking to renew the annual issuance

authority. At present there are 10,396,700 shares, 6.9% of the

Company's issued share capital as at 30 April 2020, held in

treasury. To avoid any dilution to existing investors, these would

only be re- issued at a premium to NAV and after associated

costs.

Gearing

During the year, the Company replaced its Scotiabank GBP35

million revolving one year credit facility with a GBP20 million

revolving credit facility with National Australia Bank. This new

facility contains the option to increase the amount borrowed to

GBP35 million. No borrowings were drawn in the period and this

continues to be the position.

The Board sets internal guidelines for the portfolio managers'

use of gearing which are altered from time to time but are subject

to net effective gearing not representing more than 20% of

shareholders' funds.

Earnings and Dividends

The net revenue return per share for the year was 3.75p, versus

5.12p in 2019. A final dividend of 3.10p per share, payable on 12

August 2020 to shareholders on the register as at 10 July 2020, is

being recommended. Shareholders should not rely on receiving a

regular or growing level of income from the Company as its priority

is capital growth. Any dividend paid will be by way of a single

final payment and the Board expects that such dividends would

represent approximately the minimum permissible to maintain

investment trust status.

Diversity Policy

The Board believes that maintaining a diversity of thought and

experience on the Board, and at an operational level within Baillie

Gifford, represents the best way of discharging its

responsibilities to shareholders. In furtherance of this belief,

the Board will look for the best ways to increase the diversity of

gender, ideas, professional experiences and cultural backgrounds to

which the Company is exposed.

The Board will continue to monitor diversity on an ongoing

basis, having regard to developments in Corporate Governance Code

and wider market practice, and seek to ensure that the Company

retains the benefits of a diversity of thought and experience going

forward. As circumstances allow, the Company will continue to look

for opportunities to broaden the diversity to which the Company is

exposed, in furtherance of this commitment.

Financial Conduct Authority ('FCA') Value Assessment

Shareholders might be aware that new FCA rules require

Alternative Investment Fund Managers to assess the overall value

that their authorised unit trusts and open-ended funds deliver to

investors. Although these rules do not apply to investment trusts,

it should be noted that, over the course of the Company's financial

year, the Company's Committees and Board assessed various costs

levied by third party service providers as well as the Managers and

Secretaries, and the quality of service received. I can therefore

report that at present it is the Board's view that charges levied

by third parties and the Managers and Secretaries are

reasonable.

Outlook

The long-term ramifications of Covid-19 on the UK and global

economies are unknown, but it is likely that in the short-term the

trading environment for many companies will be exceptionally

challenging. On top of this, whilst the UK has left the European

Union, the risks of a disorderly Brexit remain high.

The Board and Managers have attempted to consider the

implications of such matters sensibly and dispassionately and

remain convinced that exceptional UK growth companies are still

able to exploit their competitive strengths over the long-term and

take advantage of the opportunities that follow severe economic

dislocation. Patient investors should, therefore, be rewarded in

due course.

Carolan Dobson

Chairman

11 June 2020

For a definition of terms, see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

The Managers' Core Investment Principles

Investment Philosophy

The following are the three core principles underpinning our

investment philosophy. We have a consistent, differentiated

long-term investment approach to managing UK equities that should

stand investors in the Company in good stead:

Growth

We search for the few companies which have the potential to grow

substantially and profitably over many years. Whilst we have no

insight into the short-term direction of a company's share price,

we believe that, over the longer term, those companies which

deliver above average growth in cash flows will be rewarded with

above average share price performance and that the power of

compounding is often under-appreciated by investors. Successful

investments will benefit from a rising share price and also from

income accumulated over long periods of time.

Patience

Great growth companies are not built in a day. We firmly believe

that investors need to be patient to fully benefit from the scale

of the potential. Our investment time horizon, therefore, spans

decades rather than quarters and our portfolio turnover, at 5.4%,

is significantly below the UK industry average. This patient,

long-term approach affords a greater chance for the superior growth

and competitive traits of companies to emerge as the dominant

influence on their share prices and allows compounding to work in

the investors' favour.

Active Investment Management

It is our observation that many investors pay too much attention

to the composition of market indices and active managers should

make meaningful investments in their best ideas regardless of the

weightings of the index. For example, we would never invest in a

company just because it is large or to reduce risk. As a result,

shareholders should expect the composition of the portfolio to be

significantly different from the benchmark. This differentiation is

a necessary condition for delivering superior returns over time and

shareholders should be comfortable tolerating the inevitable ups

and downs in short-term relative performance that will follow from

that.

Portfolio construction flows from the investment beliefs stated

above.

The Managers' Stewardship Principles

We have a responsibility to behave as supportive and

constructively engaged long-term investors. Our approach favours a

small number of simple principles which help shape our interactions

with companies:

Prioritisation of long-term value creation

We encourage company management and their boards to be ambitious

and focus their investments on long-term value creation.

Sustainable business practices

We look for companies to act as responsible corporate citizens,

working within the spirit and not just the letter of the laws and

regulations that govern them.

Fair treatment of stakeholders

We believe it is in the long-term interests of companies to

maintain strong relationships with all stakeholders, treating

employees, customers, suppliers, governments and regulators in a

fair and transparent manner.

A constructive and purposeful board

We believe that boards play a key role in supporting corporate

success and representing the interests of minority

shareholders.

Long-term focused remuneration with stretching targets

We look for remuneration policies that are simple, transparent

and reward superior strategic and operational endeavour.

Managers' Report

================

The impact of the Covid-19 pandemic will likely be felt for some

years to come. It has had tragic consequences for many families

to-date whilst also shining a light on a number of professions that

historically have always worked tirelessly for the good of society

without the deserved recognition. We extend our sympathies to those

that have suffered bereavement and our thanks to those vital

workers that have carried out their duties in exceptionally

difficult times. Considering the current tragic backdrop, it seems

rather trivial to remind people that investment for the long-term

remains our core professional focus, assimilating events and

considering the implications for the portfolio, but professionally

this is what we must do.

Although one can never say never, when writing future reports,

we think it will be hard to match the events of the 12 months to

30(th) April 2020 for escalating drama. In the interim report we

referred to the first half of the financial year as "tumultuous"

with Brexit negotiations and global trade war concerns dominating

headlines. So how on earth can one describe the events of the

second half? Firstly, a snap UK election resulting in a

surprisingly large Conservative majority that initially cheered

markets and directly led to 'Brexit' actually happening, with the

UK leaving the European Union at the end of January. But even those

historic events were in turn superseded by the coronavirus

(Covid-19) pandemic that led to most countries in the world forcing

their citizens into lockdown and a collapse in economic activity.

The UK stock market, in particular, suffered in this latter phase

and, as the Chairman noted in her report, we ended in negative

territory for the year.

Rather than speculate and blether on (a Scottish phrase) at

length about the consequences of current events where the most

intellectually honest, if slightly unsatisfactory, response to

fellow shareholders is "we simply don't know", we think a more

useful analysis is to answer 'what have you done, what are you

doing and where are you going?' Particularly in regard to the

latter point, whilst we have said in the past that we have no

crystal ball, it is reasonable to ask how our investment framework

helps us think about the current extraordinarily difficult and

uncertain environment for companies.

What have we done?

The main thing to say about the last twelve months is that we

have stayed true to our investment principles which, as always, are

separately shown above. In our minds, there is a strong temptation

to start reacting to near term events unless one has the discipline

of a consistent investment process. Despite the distractions of the

last twelve months we are, and remain, bottom up stock pickers with

a long-term investment horizon, meaning that portfolio turnover has

remained low. We have said previously that performance over

short-term periods will be random. Consequently, we should not draw

out significant conclusions of the portfolio outperforming over

this twelve-month period, particularly as we downplayed the

significance of the portfolio underperforming over the first half

in the interim report. Such ups and downs are to be expected with a

portfolio that looks very different from the index. What we can say

is that despite some significant share price falls we remain

unenthused about large parts of the UK markets, such as energy and

banking, as we continue to believe the long-term prospects in those

areas are unexciting for growth investors.

Nevertheless, we remained alert to new opportunities and prior

to the crisis bought new holdings in Farfetch (discussed in the

interim report), Games Workshop and a small holding in Creo

Medical. Games Workshop is a well-established retailer of its own

fantasy games (such as Warhammer) and model figures that

enthusiastic gamers buy and paint themselves. Over thirty years the

business has built a fantastic amount of intellectual property and

nurtured a loyal and passionate customer base. While this is always

going to be a niche hobby, the growing interest in the fantasy area

has, we think, stimulated additional demand for its products. Over

the last few years, the current management team has made some well

thought out tweaks to the business model that have been very

successful, such as letting the company's independent wholesalers

also sell the product online, simplifying the rules book to make

the game more accessible to new customers, increased new product

introductions and also engaged digitally with the gaming community.

This latter change has generated significant goodwill and

strengthened the relationship Games Workshop has with its community

of gamers. We are excited about the remaining growth potential for

the hobby, particularly internationally, as well as the scope to

build a large and profitable IP licensing business. The latter will

take time and patience, but we think the returns to long-term

shareholders are potentially significant.

Creo Medical is one of the most exciting smaller companies we

have come across in the recent past. It designs and manufactures

new and highly innovative endoscopes which enable physicians to

take this technology outside of the purely investigative/diagnostic

realm into the operating theatre and use it effectively in

therapeutic applications. Although Creo is still at an early stage

of its development, and therefore with associated risks, there is

growing evidence that its products are transformative to patient

care in a range of cancers (starting with gastrointestinal

indications), allowing for significantly quicker recovery, reduced

hospital stays and lower recurrence rates. A recent liquidity event

- the company raised some funding to accelerate the

distribution/commercialisation of its product suite - allowed us to

buy a small holding.

What are we doing?

Since the coronavirus outbreak, the focus of our discussions

(now over Zoom calls rather than in person) has continued to be on

finding and owning the most promising UK growth businesses over a

five-year plus horizon. This means that we are simultaneously

looking for new opportunities while also carefully appraising the

resilience of our existing investments in the face of current

events and asking ourselves if the long-term case has in any way

been impaired. One painful decision we took in the early stages of

the crisis was to sell the holding in the cruise ship operator

Carnival, despite the shares having already fallen significantly.

In this particular case, we had concerns that growing the cruise

market may prove challenging when a semblance of normality returns

while, in the short-term, the balance sheet of the business was

uncomfortably laden with debt, not a promising position when

revenues are rapidly drying up. Interestingly, subsequent to our

sale, Carnival has attempted to shore up its balance sheet with a

mixture of expensive debt and equity which will undoubtedly dilute

the upside for shareholders in the business should a cheerful

scenario of recovery for cruising come to pass. On the flipside, we

bought a new holding in 4imprint, a company which we have liked for

some time but where valuation has been a stumbling block. 4imprint

distributes promotional products used by businesses (primarily in

the United States) as a form of advertising or as gifts to

customers and employees. It operates in a large and extremely

fragmented market and, through investments in marketing and its

sales force, it has been gaining market share over many years from

its smaller and less efficient competitors. The current lockdown

measures have resulted in an extremely challenging operating

environment. However, the business has a very robust financial

position and should withstand the storm. If the 2009 downturn is an

example, the company will emerge stronger and continue to

significantly outgrow its underlying market.

Where are we going?

Perhaps the most important question of the three we asked

ourselves is this final one. Neither of your portfolio managers are

fans of trying to draw lessons from the last crisis, as some

commentators have done. This smacks to us of generals trying to

fight the last war. In reality, all crises are unique and

complicated in their origins and we have been considering whether

some of the broad themes that many of our holdings play into still

ring true. What we would venture is that much of our thinking here

is tentative and may change as more information comes to light. The

most important theme by far is the growing digitisation of the

economy and our belief that many growth businesses are trying to

capitalise on this. Our view is that the current crisis is akin to

a shock that will likely accelerate this trend. From our own

business to others that we own or observe, necessity is forcing

organisations to adopt digital ways of working. This can be painful

but in the long-term can unlock significant productivity gains and

opportunities for smart management teams. Our holdings in FDM Group

and First Derivatives are, we believe, well-placed to benefit from

enterprises in many different industries increasing investments in

their technology infrastructure. The current crisis will also

likely further entrench the "digital" habits of consumers and boost

demand for our consumer technology platforms and retailers such as

Just Eat Takeaway.com, Farfetch and Boohoo.com. We also remain

enthusiastic about the strong network effects underpinning the

dominant positions of Rightmove and Autotrader. In this severe and

sudden downturn in activity in their end markets, however, both

businesses have rightly realised that their competitive positions

are best served by being financially supportive of their own

customers, estate agent and second-hand car dealers respectively.

Our mindset in both these cases is to back this policy of

short-term financial pain in order to safeguard long-term

opportunities.

We cannot wish away the fact that it is likely that the most

dramatic recession in UK history is pending and will cause damage

whose effects are not clear. That explains why, despite the Board

being supportive of us utilising the additional firepower of our

borrowing facilities, we have so far been cautious in gearing the

portfolio. One final point is worth noting. As growth investors,

dividends do not hold centre stage in our approach and in our view

should only flow from the profits and cash flow generated after

appropriate investment back into the business. The current dividend

crisis in the UK, with an unprecedented decline in pay-outs to

shareholders, is therefore of less interest to us. Indeed, in

several cases, we have been supportive of decisions by companies to

suspend dividends given the economic difficulties and the necessity

to protect the business and position themselves for the

opportunities that may arise.

While we remain optimistic about the overall quality and

superior growth potential of the companies in portfolio, we must

acknowledge the greater than usual element of uncertainty. What

gives us some confidence, if one is prepared to look beyond the

immediate crisis, is that we have a high degree of confidence in

the management teams of our business. In communication with many of

them over recent weeks, our message has been simple: please try to

do the right thing for the long-term interests of your business and

try to do right by your other stakeholders such as staff, suppliers

and customers. This is not easy, but rather like our investment

style, we think by attempting to focus on the fundamentals of

long-term success, the odds of a positive outcome are tilted in

your favour. And to our fellow shareholders, we would like to thank

you for your continued patience and support and look forward to

updating you on our future progress.

Baillie Gifford & Co Limited

Managers & Secretaries

11 June 2020

Past performance is not a guide to future performance.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Total return information is sourced from Refinitiv/Baillie

Gifford and relevant underlying index providers. See disclaimer at

the end of this announcement.

List of Investments as at 30 April 2020 (unaudited)

====================================================

Name Business Fair Value % of

GBP'000 total

assets

========================= ============================================ ============== ==========

Basic Materials

Rio Tinto Metals and mining company 6,764 2.6

Speciality high-performance chemicals

Victrex manufacturer 4,633 1.7

============== ==========

11,397 4.3

============== ==========

Consumer Goods

Diageo International drinks company 7,823 3.0

Games Workshop

Group Toy manufacturer and retailer 6,484 2.4

Burberry Luxury goods retailer 5,554 2.1

============== ==========

19,861 7.5

============== ==========

Consumer Services

Just Eat Operator of online and mobile market

Takeaway.com place for takeaway food 11,178 4.2

Advertising portal for second hand

Auto Trader Group cars in the UK 9,895 3.7

Boohoo.com Online fashion retailer 9,705 3.7

HomeServe Domestic insurance 9,004 3.4

Professional publications and information

RELX provider 8,574 3.2

Rightmove UK's leading online property portal 8,088 3.1

Manufacturer and distributor of kitchens

Howden Joinery to trade customers 7,554 2.9

Inchcape Car wholesaler and retailer 4,903 1.9

Euromoney Institutional

Investor Specialist publisher 2,611 1.0

Mitchells & Butlers Pub and restaurant operator 2,106 0.8

Technology platform for the global

Farfetch fashion industry 2,041 0.8

4imprint Direct marketer of promotional merchandise 1,984 0.8

============== ==========

77,643 29.5

============== ==========

Financials

St. James's Place UK wealth manager 9,129 3.5

Hargreaves Lansdown UK retail investment platform 8,967 3.4

Prudential International life insurer 8,596 3.3

Insurance and investment management

Legal & General company 6,639 2.5

Helical Property developer 6,533 2.5

Provides platform services to financial

IntegraFin clients 6,309 2.4

Provider of retirement income products

Just Group and services 4,370 1.6

Technology focused venture capital

Draper Esprit firm 3,451 1.3

IG Group Spread betting website 3,245 1.2

Hiscox Property and casualty insurance 2,834 1.1

AJ Bell Investment platform 2,792 1.0

62,865 23.8

======= =====

Healthcare

World leading

animal

genetics

Genus company 10,899 4.1

Online

platform

selling

antibodies

to life

science

Abcam researchers 10,829 4.1

Designer and

manufacturer

of medical

Creo Medical equipment 593 0.3

-------------------------------- ---------------------------------------------------

22,321 8.5

================================ ===================================================

Industrials

World leading

metrology

Renishaw company 9,121 3.4

Aerospace and

Ultra defence

Electronics company 7,569 2.9

Specialist

Halma engineer 6,704 2.5

Distributor

of

consumable

Bunzl products 6,266 2.4

Construction

equipment

rental

Ashtead company 5,884 2.2

Supplier of

ventilation

Volution Group products 5,210 2.0

Recruitment

PageGroup consultancy 4,098 1.6

Heat

treatment

and

materials

Bodycote testing 4,019 1.5

James Fisher Specialist

& Sons service

provider to

the

global marine

and energy

industries 2,270 0.9

Power systems

Rolls-Royce manufacturer 2,157 0.8

53,298 20.2

================================ ===================================================

Technology

IT consultant

First and software

Derivatives developer 6,560 2.5

Provider of

professional

services

focusing on

information

FDM Group technology 5,848 2.2

================================ ===================================================

12,408 4.7

================================ ===================================================

Total Equities 259,793 98.5

Net Liquid Assets 3,866 1.5

Total Assets 263,659 100.0

=============================== ================================ ===================================================

Stocks highlighted in bold are the 20 largest holdings.

Income Statement (unaudited)

For the year ended 30 April 2020 For the year ended 30 April 2019

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

========================================== =========== =========== ========== =========== =========== ==========

Net losses on investments - (42,210) (42,210) - (6,850) (6,850)

Currency losses - (9) (9) - - -

Income 6,562 - 6,562 8,658 - 8,658

Investment management fee (438) (1,021) (1,459) (239) (556) (795)

Other administrative expenses (463) - (463) (689) - (689)

========================================== =========== =========== ========== =========== =========== ==========

Net return before finance costs and

taxation 5,661 (43,240) (37,579) 7,730 (7,406) 324

Finance costs of borrowings (17) (40) (57) (20) (47) (67)

========================================== =========== =========== ========== =========== =========== ==========

Net return on ordinary activities before

taxation 5,644 (43,280) (37,636) 7,710 (7,453) 257

Tax on ordinary activities - - - - - -

========================================== =========== =========== ========== =========== =========== ==========

Net return on ordinary activities after

taxation 5,644 (43,280) (37,636) 7,710 (7,453) 257

========================================== =========== =========== ========== =========== =========== ==========

Net return per ordinary share (note 4) 3.75p (28.75p) (25.00p) 5.12p (4.95p) 0.17p

========================================== =========== =========== ========== =========== =========== ==========

The Board of Baillie Gifford UK Growth Fund plc is recommending

to the Annual General Meeting of the Company to be held on 5 August

2020 the payment of a final dividend of 3.10p (2019 - 2.95p) per

ordinary share making a total of 3.10p (2019 - 4.45p) paid and

proposed for the year ended 30 April 2020.

The total column of this statement is the profit and loss

account of the Company. The supplementary revenue and capital

return columns are prepared under guidance published by the

Association of Investment Companies.

All revenue and capital items in this statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as all gains

and losses of the Company have been reflected in the above

statement.

The accompanying notes at the end of this announcement are an

integral part of the Financial Statements.

Balance Sheet (unaudited)

At 30 April 2020 At 30 April 2019

GBP'000 GBP'000

====================================================== ================ ================

Fixed assets

Investments held at fair value through profit or loss 259,793 300,207

====================================================== ================ ================

Current assets

Debtors 746 1,487

Cash and cash equivalents 3,512 4,488

====================================================== ================ ================

4,258 5,975

====================================================== ================ ================

Creditors

Amounts falling due within one year (392) (447)

====================================================== ================ ================

Net current assets 3,866 5,528

====================================================== ================ ================

Net assets 263,659 305,735

====================================================== ================ ================

Capital and reserves

Share capital 40,229 40,229

Share premium account 9,875 9,875

Capital redemption reserve 19,759 19,759

Warrant exercise reserve 417 417

Share purchase reserve 60,433 60,433

Capital reserve 120,725 164,005

Revenue reserve 12,221 11,017

====================================================== ================ ================

Shareholders' funds 263,659 305,735

====================================================== ================ ================

Net asset value per ordinary share* 175.2p 203.1p

====================================================== ================ ================

Ordinary shares in issue (note 8) 150,520,484 150,520,484

====================================================== ================ ================

* See Glossary of Terms and Alternative Performance Measures at the end of this announcement.

The accompanying notes at the end of this announcement are an

integral part of the Financial Statements.

Statement of Changes in Equity (unaudited)

For the year ended 30 April 2020

Share

premium Capital Warrant Share

Share account redemption exercise purchase Capital Revenue Shareholders'

capital GBP'000 reserve reserve reserve reserve reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ======== ============ =========== =========== =========== =========== =========== =============

Shareholders'

funds at 1

May 2019 40,229 9,875 19,759 417 60,433 164,005 11,017 305,735

Dividends paid

during the

year (note 5) - - - - - - (4,440) (4,440)

Net return on

ordinary

activities

after

taxation

(note 4) - - - - - (43,280) 5,644 (37,636)

Shareholders'

funds at 30

April 2020 40,229 9,875 19,759 417 60,433 120,725 12,221 263,659

============== ======== ============ =========== =========== =========== =========== =========== =============

For the year ended 30 April 2019

Share Capital Warrant Share

Share premium redemption exercise purchase Capital Revenue Shareholders'

capital account reserve reserve reserve reserve reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ======== =========== =========== =========== =========== =========== ============ =============

Shareholders'

funds at 1

May 2018 40,229 9,875 19,759 417 60,433 171,458 10,081 312,252

Dividends paid

during the

year (note 5) - - - - - - (6,774) (6,774)

Net return on

ordinary

activities

after

taxation

(note 4) - - - - - (7,453) 7,710 257

Shareholders'

funds at 30

April 2019 40,229 9,875 19,759 417 60,433 164,005 11,017 305,735

============== ======== =========== =========== =========== =========== =========== ============ =============

The accompanying notes at the end of this announcement are an

integral part of the Financial Statements.

Cash Flow Statement (unaudited)

===============================

For the year ended 30 April

2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

==================================================== ======== ======= ========= ========

Cash flows from operating activities

Net return on ordinary activities before taxation (37,636) 257

Net losses on investments 42,210 6,850

Currency losses 9 -

Finance cost of borrowings 57 67

Changes in debtors and creditors 686 258

Cash from operations 5,326 7,432

Interest paid (57) (72)

==================================================== ======== ======= ========= ========

Net cash inflow from operating activities 5,269 7,360

==================================================== ======== ======= ========= ========

Cash flows from investing activities

Acquisitions of investments (16,917) (313,132)

Disposals of investments 15,121 325,392

Net cash (outflow)/inflow from investing activities (1,796) 12,260

==================================================== ======== ======= ========= ========

Cash flows from financing activities

Bank loan repaid - (12,000)

Equity dividends paid (4,440) (6,774)

==================================================== ======== ======= ========= ========

Net cash outflow from financing activities (4,440) (18,774)

==================================================== ======== ======= ========= ========

(Decrease)/increase in cash and cash equivalents (967) 846

Exchange movements (9) -

Cash and cash equivalents at start of year 4,488 3,642

==================================================== ======== ======= ========= ========

Cash and cash equivalents at end of year* 3,512 4,488

==================================================== ======== ======= ========= ========

* Cash and cash equivalents represent cash at bank and

short-term money market deposits repayable on demand.

The accompanying notes at the end of this announcement are an

integral part of the Financial Statements.

Notes to the Condensed Financial Statements (unaudited)

=======================================================

1. The Financial Statements for the year to 30 April 2020 have been prepared in accordance with

FRS 102 'The Financial Reporting Standard applicable in the UK and Republic of Ireland'. The

accounting policies adopted are consistent with those of the previous financial year.

=================================================================================================

2. Income 2020 2019

GBP'000 GBP'000

================================================== ====================== =====================

Income from investments

UK dividends 6,544 8,648

Other income

Deposit interest 18 10

====================================================== ====================== =====================

Total income 6,562 8,658

====================================================== ====================== =====================

Investment Management Fee

================================================== ====================== =====================

3. 2020 2020 2020 2019 2019 2019

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================ =============== =============== ======== ============ ======== ===========

Investment

management fee 438 1,021 1,459 239 556 795

-------------------- --------------- --------------- -------- ------------ -------- -----------

Baillie Gifford & Co Limited, a wholly owned subsidiary of Baillie Gifford & Co, has been

appointed as the Company's Alternative Investment Fund Manager ('AIFM') and Company Secretary.

Baillie Gifford & Co Limited has delegated portfolio management services to Baillie Gifford

& Co. Dealing activity and transaction reporting has been further sub-delegated to Baillie

Gifford Overseas Limited and Baillie Gifford Asia (Hong Kong) Limited.

The Investment Management Agreement between the AIFM and the Company sets out the matters

over which the Managers have authority in accordance with the policies and directions of,

and subject to restrictions imposed by, the Board. The Investment Management Agreement is

terminable on not less than six months' notice or on shorter notice in certain circumstances.

Compensation would only be payable if termination occurred prior to the expiry of the notice

period. The annual management fee is 0.5% of net assets, calculated and payable quarterly.

For the financial year ended 30 April 2019, in order to offset the costs of repositioning

the portfolio following its appointment as AIFM, Baillie Gifford agreed to waive its management

fee for the year to the extent of GBP732,000 (approximately equal to six months' management

fee payable to Baillie Gifford based on the Company's net asset value on 29 June 2018).

=================================================================================================

4. Net Return per 2020 2020 2019 2019 2019

Ordinary Share 2020 Revenue Capital Total Revenue Capital Total

================ =============== =============== ======== ============ ======== ===========

Net return on

ordinary activities 3.75p (28.75p) (25.00p) 5.12p (4.95p) 0.17p

==================== =============== =============== ======== ============ ======== ===========

Revenue return per ordinary share is based on the net revenue return on ordinary activities

after taxation of GBP5,644,000 (2019 - GBP7,710,000), and on 150,520,484 (2019 - 150,520,484)

ordinary shares, being the weighted average number of ordinary shares in issue during each

year.

Capital return per ordinary share is based on the net capital loss for the financial year

of GBP43,280,000 (2019 - net capital loss of GBP7,453,000), and on 150,520,484 (2019 -

150,520,484)

ordinary shares, being the weighted average number of ordinary shares in issue during each

year.

There are no dilutive or potentially dilutive shares in issue.

=================================================================================================

5. Ordinary Dividends 2020 2019 2020 2019

GBP'000 GBP'000

================================================== ======== ============ ======== ===========

Amounts recognised as distributions in the year:

Previous year's final dividend (paid 6 August 2019) 2.95p 3.00p 4,440 4,516

Interim dividend - 1.50p - 2,258

====================================================== ======== ============ ======== ===========

2.95p 4.50p 4,440 6,774

====================================================== ======== ============ ======== ===========

Also set out below are the total dividends paid and proposed in respect of the financial year,

which is the basis on which the requirements of section 1158 of the Corporation Tax Act 2010

are considered. The revenue available for distribution by way of dividend for the year is

GBP5,644,000 (2019 - GBP7,710,000).

2020 2019 2020 2019

GBP'000 GBP'000

Dividends paid and payable in respect of the year:

Interim dividend - 1.50p - 2,258

Proposed final dividend (payable 12 August 2020) 3.10p 2.95p 4,666 4,440

================================================================= ======== ======= ========== ==========

3.10p 4.45p 4,666 6,698

================================================================= ======== ======= ========== ==========

If approved, the final dividend of 3.10p will be paid on 12 August 2020 to all shareholders

on the register at the close of business on 10 July 2020. The ex-dividend date is 9 July 2020.

6. At 30 April 2020, The Company has a one year GBP20 million unsecured floating rate facility

with National Australia Bank which expires on 8 July 2020. There were no drawings under this

facility at 30 April 2020. Negotiations are underway to replace this facility on expiry.

7. Transaction costs incurred on the purchase and sale of investments are added to the purchase

costs or deducted from the sales proceeds, as appropriate. During the year, transaction costs

on purchases amounted to GBP51,000 (2019 - GBP1,476,000) and transaction costs on sales amounted

to GBP8,000 (2019 - GBP90,000).

8. The Company's authority permits it to hold shares bought back 'in treasury'. Such treasury

shares may be subsequently either sold for cash (at a premium to, net asset value per ordinary

share) or cancelled. At 30 April 2020 the Company had authority to buy back 22,563,020 ordinary

shares. During the years to 30 April 2020 and to 30 April 2019, no ordinary shares were bought

back. Under the provisions of the Company's Articles of Association share buy-backs are funded

from the capital reserve.

9. The financial information set out above does not constitute the Company's statutory accounts

for the year ended 30 April 2020 or 2019. The financial information for 2019 is derived from

the statutory accounts for 2019 which have been delivered to the Registrar of Companies. The

Auditors have reported on the 2019 accounts, their report was (i) unqualified; (ii) did not

include a reference to any matters to which the Auditors drew attention by way of emphasis

without qualifying their report; and (iii) did not contain a statement under sections 498(2)

or (3) to 497 of the Companies Act 2006. The statutory accounts for 2020 will be finalised

on the basis of the financial information presented in this preliminary announcement and will

be delivered to the Registrar of Companies in due course.

10. The Annual Report and Financial Statements will be available on the Company's website www.bgukgrowthfund.com

on or around 3 July 2020.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

Glossary of Terms and Alternative Performance Measures (APM)

Total Assets

Total assets less current liabilities, before deduction of all borrowings.

Net Asset Value

Net Asset Value (NAV) is the value of total assets less liabilities (including borrowings).

The NAV per share is calculated by dividing this amount by the number of ordinary shares in

issue (excluding treasury shares).

Net Liquid Assets

Net liquid assets comprise current assets less current liabilities, excluding borrowings.

Discount/Premium (APM)

As stockmarkets and share prices vary, an investment trust's share price is rarely the same

as its NAV. When the share price is lower than the NAV per share it is said to be trading

at a discount. The size of the discount is calculated by subtracting the share price from

the NAV per share and is usually expressed as a percentage of the NAV per share. If the share

price is higher than the NAV per share, it is said to be trading at a premium.

2020 2019

========================================== ========================= ================================

Closing NAV per share 175.2p 203.1p

Closing share price 161.5p 192.0p

------------------------------------------ ------------------------- --------------------------------

Discount (7.8%) (5.5%)

========================================== ========================= ================================

Total Return (APM)

The total return is the return to shareholders after reinvesting the net dividend on the date

that the share price goes ex-dividend.

=======================================================================================================

2020 2020 2019 2019

NAV Share NAV Share

Price Price

========================================= ================= ======= ============== ====== ========

Closing NAV per share/share price (a) 175.2p 161.5p 203.1p 192.0p

Dividend adjustment factor* (b) 1.0143 1.0155 1.0236 1.0255

Adjusted closing NAV per share/share

price (c = a x b) 177.7p 164.0p 207.9p 196.9p

Opening NAV per share/share price (d) 203.1p 192.0p 207.5p 187.5p

========================================= ================= ======= ============== ====== ========

Total return (c ÷ d) - 1 (12.5%) (14.6% ) 0.2% 5.0%

========================================= ================= ======= ============== ====== ========

* The dividend adjustment factor is calculated on the assumption that the dividends of 2.95p

(2019 - 4.50p) paid by the Company during the year were reinvested into shares of the Company

at the cum income NAV per share/share price, as appropriate, at the ex-dividend date.

=======================================================================================================

Ongoing Charges (APM)

The total expenses (excluding borrowing costs) incurred by the Company as a percentage of

the average net asset value. The ongoing charges have been calculated on the basis prescribed

by the Association of Investment Companies.

A reconciliation from the expenses detailed in the Income Statement above is provided below.

=======================================================================================================

2020 2019

============================================================ ======= ============== ================

Investment management fee GBP1,459,000 GBP795,000

Other administrative expenses GBP463,000 GBP689,000

------------------------------------------------------------ ------- -------------- ----------------

Total expenses (a) GBP1,922,000 GBP1,484,000

Average net asset value (b) GBP292,419,000 GBP293,237,000

============================================================ ======= ============== ================

Ongoing Charges ((a) ÷ (b) expressed as a percentage) 0.66% 0.51%

============================================================ ======= ============== ================

Glossary of Terms and Alternative Performance Measures (APM)

(unaudited) (Ctd)

Baillie Gifford and Co Limited was appointed on 29 June 2018 and agreed to waive its management

fee for the year ended 30 April 2019 to the extent of GBP732,000 (approximately equal to six

months' management fee payable to Baillie Gifford based on the Company's net asset value on

29 June 2018). The calculation for 2019 is therefore not representative of future management

fees. The reconciliation below shows the ongoing charges figure if the waived management fee

is included in the ongoing charges calculation.

2019

=============================================================================== ======= ======================

Investment management fee GBP795,000

Investment management fee waived during the year GBP732,000

Other administrative expenses GBP689,000

=============================================================================== ======= ======================

Total expenses (a) GBP2,216,000

Average net asset value (b) GBP293,237,000

=============================================================================== ======= ======================

Ongoing Charges ((a) ÷ (b) expressed as a percentage) 0.76%

========================================================================================= ======================

Gearing (APM)

At its simplest, gearing is borrowing. Just like any other public company, an investment trust

can borrow money to invest in additional investments for its portfolio. The effect of the

borrowing on the shareholders' assets is called 'gearing'. If the Company's assets grow, the

shareholders' assets grow proportionately more because the debt remains the same. But if the

value of the Company's assets falls, the situation is reversed. Gearing can therefore enhance

performance in rising markets but can adversely impact performance in falling markets.

Equity gearing is the Company's borrowings adjusted for cash and cash equivalents as a percentage

of shareholders' funds.

Potential gearing is the Company's borrowings expressed as a percentage of shareholders' funds.

The Company currently has no borrowings drawn down.

Leverage (APM)

For the purposes of the Alternative Investment Fund Managers (AIFM) Directive, leverage is

any method which increases the Company's exposure, including the borrowing of cash and the

use of derivatives. It is expressed as a ratio between the Company's exposure and its net

asset value and can be calculated on a gross and a commitment method. Under the gross method,

exposure represents the sum of the Company's positions after the deduction of sterling cash

balances, without taking into account any hedging and netting arrangements. Under the commitment

method, exposure is calculated without the deduction of sterling cash balances and after certain

hedging and netting positions are offset against each other.

Active Share (APM)

Active share, a measure of how actively a portfolio is managed, is the percentage of the portfolio

that differs from its comparative index. It is calculated by deducting from 100 the percentage

of the portfolio that overlaps with the comparative index. An active share of 100 indicates

no overlap with the index and an active share of zero indicates a portfolio that tracks the

index.

Automatic Exchange of Information

In order to fulfil its obligations under UK Tax Legislation relating to the automatic exchange

of information, the Company is required to collect and report certain information about certain

shareholders.

The legislation will require investment trust companies to provide personal information to

HMRC on certain investors who purchase shares in investment trusts. As an affected company,

Baillie Gifford UK Growth Fund plc will have to provide information annually to the local

tax authority on the tax residencies of a number of non-UK based certificated shareholders

and corporate entities.

Shareholders, excluding those whose shares are held in CREST, who come on to the share register

will be sent a certification form for the purposes of collecting this information.

For further information, please see HMRC's Quick Guide: Automatic Exchange of Information

- information for account holders

https://www.gov.uk/government/publications/exchange-of-information-account-holders

.

Third Party Data Provider Disclaimer

No third party data provider ('Provider') makes any warranty, express or implied, as to the

accuracy, completeness or timeliness of the data contained herewith nor as to the results

to be obtained by recipients of the data.

No Provider shall in any way be liable to any recipient of the data for any inaccuracies,

errors or omissions in the index data included in this document, regardless of cause, or for

any damages (whether direct or indirect) resulting therefrom. No Provider has any obligation

to update, modify or amend the data or to otherwise notify a recipient thereof in the event

that any matter stated herein changes or subsequently becomes inaccurate.

Without limiting the foregoing, no Provider shall have any liability whatsoever to you, whether

in contract (including under an indemnity), in tort (including negligence), under a warranty,

under statute or otherwise, in respect of any loss or damage suffered by you as a result of

or in connection with any opinions, recommendations, forecasts, judgements, or any other conclusions,

or any course of action determined, by you or any third party, whether or not based on the

content, information or materials contained herein.

FTSE Index Data

FTSE International Limited ('FTSE') (c) FTSE 2020. 'FTSE(R)' is a trade mark of the London

Stock Exchange Group companies and is used by FTSE International Limited under licence. All

rights in the FTSE indices and/or FTSE ratings vest in FTSE and/or its licensors. Neither

FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices

and/or FTSE ratings or underlying data and no party may rely on any FTSE indices, ratings

and/or underlying data contained in this communication. No further distribution of FTSE Data

is permitted without FTSE's express written consent. FTSE does not promote, sponsor or endorse

the content of this communication.

Regulated Information Classification : Additional regulated information required to be disclosed

under applicable laws.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR UAVNRRUUNAAR

(END) Dow Jones Newswires

June 12, 2020 02:00 ET (06:00 GMT)

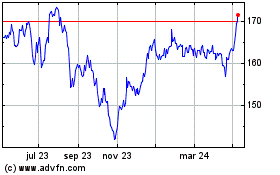

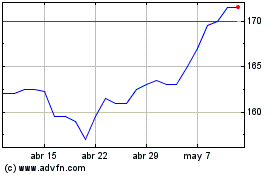

Baillie Gifford Uk Growth (LSE:BGUK)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Baillie Gifford Uk Growth (LSE:BGUK)

Gráfica de Acción Histórica

De May 2023 a May 2024