Duck Creek Technologies Boosts Expected IPO Price Range to $23-$25 A Share

12 Agosto 2020 - 8:37AM

Noticias Dow Jones

By Colin Kellaher

Duck Creek Technologies Inc. on Wednesday raised the expected

pricing range of its initial public offering of 15 million shares

to $23 to $25 apiece from a prior range of $19 to $21 each.

At the $24 midpoint of the new range, the Boston provider of

software and services to the insurance industry said it expects net

proceeds of about $333.7 million, or roughly $384.7 million if the

underwriters exercise an option to buy an additional 2.25 million

shares.

In a filing with the Securities and Exchange Commission, Duck

Creek said it would have about 130.6 million shares outstanding

after the IPO, assuming exercise of the overallotment option, for a

valuation of about $3.13 billion at the $24-a-share midpoint.

Duck Creek said funds advised by private-equity firm Apax

Partners L.P. will own a roughly 33.2% stake, assuming exercise of

the greenshoe, while Accenture PLC will own about 22.1%.

Duck Creek said it has applied to list its shares on the Nasdaq

Global Market under the symbol DCT.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

August 12, 2020 09:22 ET (13:22 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

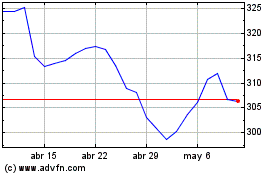

Accenture (NYSE:ACN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Accenture (NYSE:ACN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024