Current Report Filing (8-k)

21 Junio 2021 - 7:01AM

Edgar (US Regulatory)

0000040545false00000405452021-06-182021-06-180000040545us-gaap:CommonStockMember2021-06-182021-06-180000040545ge:A0.375NotesDue2022Member2021-06-182021-06-180000040545ge:A1.250NotesDue2023Member2021-06-182021-06-180000040545ge:A0.875NotesDue2025Member2021-06-182021-06-180000040545ge:A1.875NotesDue2027Member2021-06-182021-06-180000040545ge:A1.500NotesDue2029Member2021-06-182021-06-180000040545ge:A7.5GuaranteedSubordinatedNotesDue2035Member2021-06-182021-06-180000040545ge:A2.125NotesDue2037Member2021-06-182021-06-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 18, 2021

General Electric Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York

|

|

001-00035

|

|

14-0689340

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

5 Necco Street

|

Boston,

|

MA

|

|

|

|

02210

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

|

|

|

|

|

|

|

(Registrant’s telephone number, including area code) (617) 443-3000

_______________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

|

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.06 per share

|

GE

|

New York Stock Exchange

|

|

0.375% Notes due 2022

|

GE 22A

|

New York Stock Exchange

|

|

1.250% Notes due 2023

|

GE 23E

|

New York Stock Exchange

|

|

0.875% Notes due 2025

|

GE 25

|

New York Stock Exchange

|

|

1.875% Notes due 2027

|

GE 27E

|

New York Stock Exchange

|

|

1.500% Notes due 2029

|

GE 29

|

New York Stock Exchange

|

|

7 1/2% Guaranteed Subordinated Notes due 2035

|

GE /35

|

New York Stock Exchange

|

|

2.125% Notes due 2037

|

GE 37

|

New York Stock Exchange

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

|

|

|

|

Emerging growth company

|

☐

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act.

|

☐

|

Item 8.01. Other Events.

On June 18, 2021, General Electric Company (“GE”) announced that it will proceed with the 1-for-8 reverse stock split, proportionate reduction in the authorized common stock and reduction in par value per share from $0.06 to $0.01 (collectively, the “reverse stock split”) previously approved by its shareholders at the annual meeting of shareholders on May 4, 2021. GE plans to file an amendment to its certificate of incorporation to effectuate the reverse stock split, which is expected to be effective after the close of trading on July 30, 2021, and GE common stock is expected to begin trading on a split-adjusted basis on August 2, 2021.

Attached as Exhibit 99.1 and incorporated by reference herein is a press release dated June 18, 2021 issued by GE announcing the reverse stock split.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

104 The cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

This document contains “forward-looking statements”—that is, statements related to future, not past, events. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated or anticipated by such forward-looking statements. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, the risk factors as detailed from time to time in GE’s reports filed with the SEC, including GE’s annual reports on Forms 10-K, periodic quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Electric Company

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date: June 21, 2021

|

|

/s/ Michael J. Holston

|

|

|

|

|

Michael J. Holston

Senior Vice President, General Counsel & Secretary

|

|

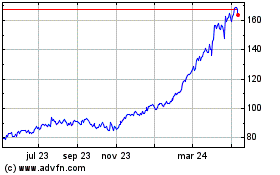

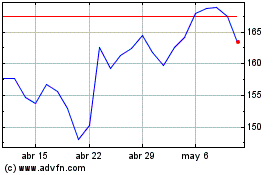

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024