Supplement dated June 14, 2013

to the Class J Shares Prospectus

for Principal Funds, Inc.

dated March 1, 2013

(as supplemented on March 28, 2013, April 17, 2013 and May 9, 2013)

This supplement updates information currently in the Prospectus. Retain this supplement with the Prospectus.

FUND SUMMARIES

Inflation Protection Fund

Under the

Principal Investment Strategies

heading, delete the paragraph and substitute:

The Fund invests primarily in inflation-indexed bonds of varying maturities issued by the U.S. and non-U.S. governments, their agencies or instrumentalities, and U.S. and non-U.S. corporations. Inflation-indexed bonds are fixed income securities that are structured to provide protection against inflation. The value of the bond's principal or the interest income paid on the bond is adjusted to track changes in an official inflation measure. The U.S. Treasury uses the Consumer Price Index for Urban Consumers as the inflation measure. Inflation-indexed bonds issued by a foreign government are generally adjusted to reflect a comparable inflation index, calculated by that government. Under normal circumstances, the Fund maintains an average portfolio duration that is within ±20% of the duration of the Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index. The Fund also invests in foreign securities, U.S. Treasuries and agency securities. The Fund utilizes derivative strategies, including financial futures contracts, swaps, currency forwards, and options for purposes of managing or adjusting the risk profile (for example, duration) of the Fund. The Fund actively trades portfolio securities.

MidCap Fund

Under the

Management

and

Sub-Advisor(s) and Portfolio Manager(s)

headings, delete the information regarding Tom Rozycki and substitute:

|

|

|

|

•

|

Tom Rozycki (since 2013), Research Analyst & Associate Portfolio Manager

|

Principal LifeTime Strategic Income Fund

Under the

Principal Investment Strategies

heading, delete the fourth paragraph and substitute:

The underlying funds invest in equity securities, growth and value stocks, fixed-income securities (including high yield or “junk” bonds), domestic and foreign securities, investment companies (including index funds), real estate securities, derivatives, mortgage-backed and asset-backed securities, and U.S. government and U.S. government-sponsored securities.

Principal LifeTime 2010 Fund

Under the

Principal Investment Strategies

heading, delete the fourth paragraph and substitute:

The underlying funds invest in equity securities, growth and value stocks, fixed-income securities (including high yield or “junk” bonds), domestic and foreign securities, securities denominated in foreign currencies, investment companies (including index funds), real estate securities, derivatives, mortgage-backed and asset-backed securities, and U.S. government and U.S. government-sponsored securities.

Under the

Principal Risks

heading, delete the Emerging Market Risk.

Strategic Asset Management ("SAM") Flexible Income Portfolio

Under the

Principal Investment Strategies

heading, delete the first bullet point and substitute:

|

|

|

|

•

|

Generally invests between 55% and 95% of its assets in fixed-income funds, and less than 40% in any one fixed-income fund (fixed-income funds that generally invest in fixed income instruments such as real estate securities, mortgage-backed securities, government and government-sponsored securities, corporate bonds and preferred securities)

|

Under the

Principal Risks

heading, before the Risk of Being an Underlying Fund risk, add the following:

Real Estate Securities Risk.

Real estate securities are subject to the risks associated with direct ownership of real estate, including declines in value, adverse economic conditions, increases in expenses, regulatory changes and environmental problems. Investing in securities of companies in the real estate industry, subjects a fund to the special risks associated with the real estate market including factors such as loss to casualty or condemnation, changes in real estate values, property taxes, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents, and the management skill and creditworthiness of the issuer.

Strategic Asset Management ("SAM") Conservative Balanced Portfolio

Under the

Principal Investment Strategies

heading, delete the first bullet point and substitute:

|

|

|

|

•

|

Generally invests between 40% and 80% of its assets in fixed-income funds, and less than 40% in any one fixed-income fund (fixed-income funds that generally invest in fixed income instruments such as real estate securities, mortgage-backed securities, government and government-sponsored securities, and corporate bonds)

|

Under the

Principal Risks

heading, before the Risk of Being an Underlying Fund risk, add the following:

Real Estate Securities Risk.

Real estate securities are subject to the risks associated with direct ownership of real estate, including declines in value, adverse economic conditions, increases in expenses, regulatory changes and environmental problems. Investing in securities of companies in the real estate industry, subjects a fund to the special risks associated with the real estate market including factors such as loss to casualty or condemnation, changes in real estate values, property taxes, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents, and the management skill and creditworthiness of the issuer.

Strategic Asset Management ("SAM") Balanced Portfolio

Under the

Principal Investment Strategies

heading, delete the first bullet point and substitute:

|

|

|

|

•

|

Generally invests between 20% and 60% of its assets in fixed-income funds, and less than 40% in any one fixed-income fund (fixed-income funds that generally invest in fixed income instruments such as real estate securities, mortgage-backed securities, government and government-sponsored securities, and corporate bonds)

|

Under the

Principal Risks

heading, before the Risk of Being an Underlying Fund risk, add the following:

Real Estate Securities Risk.

Real estate securities are subject to the risks associated with direct ownership of real estate, including declines in value, adverse economic conditions, increases in expenses, regulatory changes and environmental problems. Investing in securities of companies in the real estate industry, subjects a fund to the special risks associated with the real estate market including factors such as loss to casualty or condemnation, changes in real estate values, property taxes, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents, and the management skill and creditworthiness of the issuer.

Strategic Asset Management ("SAM") Conservative Growth Portfolio

Under the

Principal Investment Strategies

heading, delete the first bullet point and substitute:

|

|

|

|

•

|

Generally invests between 0% and 40% of its assets in fixed-income funds, and less than 30% in any one fixed-income fund (fixed-income funds that generally invest in fixed-income instruments such as real estate securities, governm

ent and government-sponsored securities and corporate bonds)

|

Under the

Principal Risks

heading, before the Risk of Being an Underlying Fund risk, add the following:

Real Estate Securities Risk.

Real estate securities are subject to the risks associated with direct ownership of real estate, including declines in value, adverse economic conditions, increases in expenses, regulatory changes and environmental problems. Investing in securities of companies in the real estate industry, subjects a fund to the special risks associated with the real estate market including factors such as loss to casualty or condemnation, changes in real estate values, property taxes, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents, and the management skill and creditworthiness of the issuer.

Strategic Asset Management ("SAM") Strategic Growth Portfolio

Under the

Principal Investment Strategies

heading, delete the first bullet point and substitute:

|

|

|

|

•

|

Could invest between 0% and 25% of its assets in fixed-income funds (most likely between 0% and 10%), and generally less than 25% in any one fixed-income fund (fixed-income funds that generally invest in fixed income instruments such as government and government-sponsored securities)

|

ADDITIONAL INFORMATION ABOUT INVESTMENT STRATEGIES AND RISKS

In the table, under the column heading “SAM Flexible Income” and row labeled “Real Estate Securities”, delete “Non-Principal” and substitute “Principal.”

In the table, under the column heading “SAM Conservative Balanced” and row labeled “Real Estate Securities”, delete “Non-Principal” and substitute “Principal.”

In the table, under the column heading “SAM Balanced” and row labeled “Real Estate Securities”, delete “Non-Principal” and substitute “Principal.”

In the table, under the column heading “SAM Conservative Growth” and row labeled “Real Estate Securities”, delete “Non-Principal” and substitute “Principal.”

MANAGEMENT OF THE FUNDS

The Manager

On or about June 17, 2013, delete the additional sentences that were added via supplement dated March 28, 2013 to the paragraph that begins, "Principal provides a substantial part of the investment advisory services" so that the following appears:

Principal provides a substantial part of the investment advisory services to each of the Principal LifeTime Funds directly, while engaging PGI as a sub-advisor to assist in providing those investment advisory services. The portfolio managers Principal has appointed for each Principal LifeTime Fund are James Fennessey, Jeffrey Tyler, and Randy Welch. The portfolio managers PGI has appointed for each Principal LifeTime Fund are Matthew Annenberg and Dirk Laschanzky. Messrs. Fennessey, Tyler, Welch, Annenberg, and Laschanzky work as a team, sharing day-to-day management of the Principal LifeTime Funds; however, Mr. Tyler has ultimate decision making authority.

Under

The Sub-Advisors

sub-section, delete the paragraph the begins with "Several of the Funds have multiple Sub-Advisors" and substitute:

Several of the Funds have multiple Sub-Advisors. For those Funds, a team at Principal, consisting of James Fennessey and Randy Welch, determines the portion of the Fund's assets each Sub-Advisor will manage and may, from time-to-time, reallocate Fund assets between the Sub-Advisors. The decision to do so may be based on a variety of factors, including but not limited to: the investment capacity of each Sub-Advisor, portfolio diversification, volume of net cash flows, fund liquidity, investment performance, investment strategies, changes in each Sub- Advisor's firm or investment professionals or changes in the number of Sub-Advisors. Ordinarily, reallocations of Fund assets among Sub-Advisors occur as a Sub-Advisor liquidates assets in the normal course of portfolio management or with net new cash flows; however, at times existing Fund assets may be reallocated among Sub-Advisors.

Delete the paragraph that begins "Jessica S. Bush."

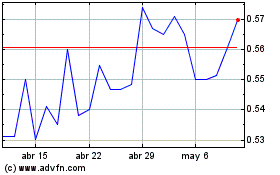

Emerson Radio (AMEX:MSN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

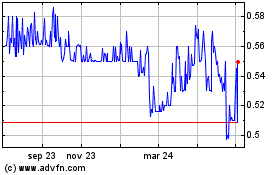

Emerson Radio (AMEX:MSN)

Gráfica de Acción Histórica

De May 2023 a May 2024