Ace Liberty & Stone PLC Statement re acquisition of properties (0493Y)

07 Mayo 2019 - 1:01AM

UK Regulatory

TIDMALSP

RNS Number : 0493Y

Ace Liberty & Stone PLC

07 May 2019

ACE LIBERTY AND STONE PLC

("Ace" or "the Company")

ACQUISTION OF PROPERTIES IN WARRINGTON AND MIDDLESBROUGH

FOR A COMBINED CONSIDERATION IN EXCESS OF GBP10 MILLION

Ace Liberty and Stone Plc (NEX: ALSP), the active property

investment company, capitalising on commercial property investment

opportunities across the UK, is pleased to announce that it has

completed the purchase of two new properties; Nolan House in

Warrington for GBP2,900,000 and James Cook House in Middlesbrough

for GBP7,125,00.

Both properties are let to the Secretary of State for

Communities and Local Government, who are long-term tenants, until

31 March 2027. The property in Warrington is the only Jobcentre

Plus serving the Warrington South constituency, and likewise the

Middlesbrough property is the only Jobcentre Plus servicing its

local constituency (Middlesbrough).

Looking further ahead, the properties' strong potential is

evident. Although in different regional hubs, they have very

similar characteristics. Both have blue chip government tenants

with long leases and strong yields. Furthermore, they are in

attractive locations with strong repurposing opportunities.

Both are also close to local transport; Nolan House lies in the

middle of the northwest motorway network and over 25 different bus

routes are within a two-minute walk. Warrington has an excellent

regional location, being equidistant between Manchester and

Liverpool. Direct trains run from Warrington New Quay to London

Euston taking just under 2 hours. James Cook House lies in the

centre of the Teesside conurbation and from 15 miles from the

A1(M). By rail, the fastest journey time from Middlesbrough to

London Kings Cross is 3 hours 4 minutes. Bus routes serve the

location of James Cook House well with various stops providing

direct access into the Middlesbrough town centre and other

destinations such as Park End, Ormesby, Netherfield and

Easington.

The properties are both let on an attractive full repairing and

insuring (FRI) basis and are subject to an upwards only market rent

review in 2023.

Ismail Ghandour, Chief Executive Officer, commented:

"We always look for properties with potential, particularly when

that potential can be harnessed without any of the additional risk

associated with further development. We have a proven track record

of finding properties with hidden multiple uses that also provide

an immediate risk free income, and these two acquisitions fit that

criteria perfectly. Smart and solid investments such as those we

have made in Middlesbrough and Warrington form the backbone of the

Company's well proven strategy that continues to deliver a healthy

return on investment for our shareholders, as well as increasing

our Company's prospects when compared to other more traditional

property company models."

- ends -

The Directors accept responsibility for this announcement.

For further information, please contact:

Ace Liberty & Stone Plc http://acelibertyandstone.com

Ivan Minter, Financial Director Tel: +44 (0) 20 7201 8340

Alfred Henry Corporate Finance Ltd www.alfredhenry.com

NEX Exchange Corporate Adviser

Jon Isaacs / Nick Michaels Tel: +44 (0) 20 3772 0021

SP Angel Corporate Finance LLP www.alfredhenry.com

Vadim Alexandre / Abigail Wayne Tel: +44 (0) 20 3470 0470

/ Rob Rees

Belvedere Communications www.belvederepr.com

John West Tel: +44 (0) 20 3687 2754

Llew Angus

ACF Equity Research www.acfequityresearch.com

Christopher Nicholson / Amalia Barnoschi Tel: +44 (0) 20 7558 8974

Notes to Editors

Ace Liberty & Stone Plc is a property investment company

with a diverse portfolio of properties located across the UK,

currently including Leeds, Sunderland, Plymouth, Dudley, Gateshead,

Barnstaple, and London. The Company locates commercial and

residential properties which have the potential for an increase in

value through creative asset management activity, such as change of

tenancy, change of use or new lease negotiation.

Ace has maintained a track record of generating strong profits

at disposal of properties and achieving better-than average returns

on capital. With strong support from shareholders and mortgage

lenders, the Company is currently seeking further investment

opportunities in the UK to create value for existing and new

investors.

Ace is run by a board with extensive property experience, an

excellent network of contacts and relevant professional

qualifications. This sector expertise has allowed the Board to

identify opportunities and act promptly to secure investments.

For more information on the Company please visit

www.acelibertyandstone.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NEXZMGGKGFLGLZM

(END) Dow Jones Newswires

May 07, 2019 02:01 ET (06:01 GMT)

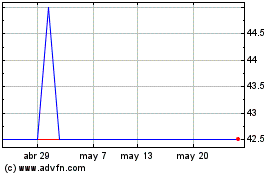

Ace Liberty & Stone (AQSE:ALSP)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

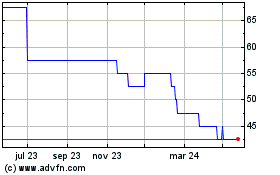

Ace Liberty & Stone (AQSE:ALSP)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024