TIDMMTC

RNS Number : 8415G

Mothercare PLC

29 July 2021

Mothercare plc ("Mothercare", "the Company" or "the Group")

Full Year Results 2021

A trusted global brand - designed for the future

Mothercare plc, the leading specialist global brand for parents

and young children, today announces full year results for the 52

week period to 27 March 2021. Comparatives are based on the 52 week

period to 28 March 2020.

Strategic highlights

-- Successful transformation to create a strong platform for growth:

o Transitioned the business to provide a sustainable,

operationally efficient, capital-light platform for growth focused

on brand management and the design, development and sourcing of

product to support international franchise partners in over 700

stores across 37 countries.

-- A pure franchised global brand business:

o We established Boots UK Limited ("Boots") as our UK franchise

partner, with the Mothercare brand becoming available in Boots

stores and online from Autumn 2020.

o Our gross profit is principally derived from royalties payable

on global franchise partners' retail sales, across some two million

square feet of retail space worldwide.

o Whilst the design, quality control and choice of manufacturing

partner remains under Mothercare's control, today the Group is free

of the burden of a UK store estate, warehousing and the associated

operational costs.

-- Multiple opportunities for growth:

o Strong opportunities for growth in new territories -

Mothercare is still not represented in 7 of the top 10 baby markets

in the world.

o Organic growth through new and enhanced ways of working with

existing franchise partners and refocused product strategy aligned

to international customer demand.

o Extension of brand reach possible as we explore the

opportunities available to us in wholesale, licensing and online

marketplaces.

o Opportunity for stepchange growth through leveraging the

intrinsic value of our strong core global brand recognition

andextensive international footprint

o AIM listed entity with expectations of an improving trend in

operating profitability and being debt free within five years.

Current trading

-- We currently estimate that over 80% of our partners' global retail locations are now open.

-- Trade continues to be challenging in the key markets of

Russia, India, Indonesia and Malaysia due to the continuing impact

of COVID-19 on footfall and consumer confidence.

-- Throughout the pandemic we witnessed substantial online sales

growth, however, this in itself was not enough to offset the

temporary closure of retail stores.

Based upon reducing impacts on us and our franchise partners'

operations as the current year progresses and the implementation of

the new operating model, greatly reduced cost structures and the

elimination of significant legacy issues, we expect a significant

improvement in operating profits for the current year.

In the first thirteen weeks of FY22, the Group's Franchise

Partners, many of whom continue to be affected by Covid-19

lockdowns, recorded total retail sales of GBP94 million, generating

an adjusted EBITDA of approximately GBP2.5 million.

Financial highlights (on a continuing operations basis, unless

otherwise stated)

*Continuing operations in the current period are the same as

total operations; t he prior year has been restated for the impact

of prior year adjustments (note 12). Continuing operations in the

comparative period represent the Global operation of the business,

with the UK operational segment categorised as a discontinued

operation. Continuing operations reflect accounting guidelines and

therefore included some expenditure which ceased following the

administration process, and as such did not necessarily reflect the

result achieved by the standalone international business.

-- Loss from continuing operations for the 52 weeks to 27 March

2021 of GBP21.5 million (2020: GBP8.5 million loss).

-- Total loss for the 52 weeks to 27 March 2021 of GBP21.5

million (2020: GBP13.1 million profit).

-- Net debt(3) at GBP13.5 million (2020: GBP22.1 million).

Our Group - on a continuing operations basis

2021 2020

52 weeks to 52 weeks to % change

27 Mar 2021 28 Mar 2020 vs.

Restated (8)

GBPmillion GBPmillion last year

---------------------------------------- ------------ ------------- ----------

Turnover 85.8 164.7 (47.9)%

Adjusted EBITDA 2.2 6.2 (64.5)%

Adjusted operating profit/(loss) 0.2 (0.6) 66.7%

Group adjusted loss before taxation(2) (8.6) (6.4) (34.4)%

Statutory loss (21.5) (8.5) (352.9)%

Our Franchise partners - on a continuing operations basis

2021 2020

52 weeks to 52 weeks to % change

27 Mar 2021 28 Mar 2020 vs.

Restated (8)

GBPmillion GBPmillion last year

-------------------------------- ------------ ------------- ----------

Worldwide retail sales(1) GBPm 358.6 542.1 (33.8)%

Online retail sales GBPm 44.4 31.3 41.9%

Total number of stores 734 841 (12.7)%

Space (k) sq. ft. 1,970 2,345 (16.0)%

-------------------------------- ------------ ------------- ----------

Clive Whiley, Chairman of Mothercare, commented:

"The past financial year has clearly been a challenging one,

however, despite the backdrop of the pandemic, we have made a

tremendous amount of progress in fundamentally transforming the

Group.

We expect 2022 to be a year of further progress as we focus upon

developing our strategy and future plans to optimise the Mothercare

brand globally over the next five years. These are exciting times

as, notwithstanding the continued impact of the pandemic in many of

our franchise partners territories, without the distractions of the

last three years we are seeking to accelerate the growth of the

business and the Mothercare Brand. We look to the future with great

optimism having established a strong and efficient platform with

multiple opportunities for growth."

Investor and analyst enquiries to:

Mothercare plc

Email: investorrelations@mothercare.com

Clive Whiley, Chairman

Andrew Cook, Chief Financial Officer

Numis Securities Limited (Nominator Advisor & Joint

Corporate Broker) Tel: 020 7260 1000

Luke Bordewich

Henry Slater

finnCap (Joint Corporate Broker) Tel: 020 7260 1000

Christopher Raggett

Media enquiries to:

MHP Communications Email: mothercare@mhpc.com

Simon Hockridge Tel: 07709 496 125

Tim Rowntree

Alistair de Kare-Silver

Notes

The Directors believe that alternative performance measures

("APMs") assist in providing additional useful information on the

performance and position of the Group and across the period because

it is consistent with how business performance is reported to the

Board and Operating Board.

APMs are also used to enhance the comparability of information

between reporting periods and geographical units (such as

like-for-like sales), by adjusting for non-recurring or

uncontrollable factors which affect IFRS measures, to aid the user

in understanding the Group's performance. Consequently, APMs are

used by the Directors and management for performance analysis,

planning, reporting and incentive setting purposes. The key APMs

that the Group has focused on in the period are as set out in the

Glossary.

1 - Worldwide retail sales are total International retail

franchise partner sales to end customers (which are estimated and

unaudited) in relation to continuing operations only. International

stores refers to overseas franchise and joint venture stores.

2 - Adjusted loss before taxation is stated before the impact of

the adjusting items set out in note 4.

3 - Net Debt is defined as total borrowings including

shareholder loans, cash at bank and IFRS 16 lease liabilities. In

2020 it also included the financial asset; in 2021 this asset is no

longer linked to the borrowings and has therefore not been

included.

4 - This announcement contains certain forward-looking

statements concerning the Group. Although the Board believes its

expectations are based on reasonable assumptions, the matters to

which such statements refer may be influenced by factors that could

cause actual outcomes and results to be materially different. The

forward-looking statements speak only as at the date of this

document and the Group does not undertake any obligation to

announce any revisions to such statements, except as required by

law or by any appropriate regulatory authority.

5 - The information contained within this announcement is deemed

by the Company to constitute inside information for the purposes of

the Market Abuse Regulation (EU) No 596/2014. Upon the publication

of this announcement via a Regulatory Information Service, this

inside information is now considered to be in the public

domain.

6 - The person responsible for the release of this announcement

is Lynne Medini, Group Company Secretary at Mothercare plc,

Westside 1, London Road, Hemel Hempstead, HP3 9TD.

7 - Mothercare plc's Legal Entity Identifier ("LEI") number is

213800ZL6RPV9Z9GFO74

8 - The prior year has been restated for the impact of prior

year adjustments (note 12).

Chairman's Statement

A Platform for Growth

I am pleased to report that we have completed our transition to

refocus the Mothercare brand on its core competencies of

international franchise and brand management coupled with design,

development and distribution of product which is sold through our

international partners' stores and online. Today the Group is free

of the burden of a UK store estate, warehousing and the associated

operational costs. Our gross profit is principally derived from

royalties payable on global franchise partners' retail sales,

operating through over 700 stores, representing some 2 million

square feet of retail space.

The Mothercare brand is represented in 37 countries around the

world including the UK through our franchise with Boots. Yet whilst

this reach is impressive, the brand is still not represented in 7

of the top 10 baby markets in the world, when viewed by wealth and

birth rate. Hitherto, the Brand's singular route to market today is

via franchisees and post the restructuring we are now able to

explore the opportunities available to us in wholesale, licensing

or online marketplaces.

Accordingly, our current measure of success, as we strive to be

the leading global brand for parents and young children, remains

our ability to distribute the Mothercare brand and its products to

many more territories around the world through franchising,

wholesale & licensing as well as growing our existing

territories: hence optimising the level of sustainable long-term

revenues and profitability going into 2022 and beyond.

Understandably, during this past year our focus has been on our

existing franchise partners and their markets, managing both the

impact of the pandemic upon them and its effect on our supply

chain. However we now have the management time and resource to

optimise our operating platform generating revenues through an

asset-light model, both in the UK and other international

territories and backed by new debt facilities provided by Gordon

Brothers Brands LLC ("GBB").

We look to the future with great optimism and with multiple

opportunities to grow the global presence of the Mothercare brand.

We are actively pursuing a three-pronged growth strategy

encompassing:

Opportunities for Organic growth

During 2020 we commissioned an in-depth customer survey across

many of our major territories to gain greater insight of our

customers' views on both the local Mothercare business and the

relevant competitors. The analysis of the results has shown strong

correlation across the sampled markets and has allowed us to

refocus our product strategy both in terms of the specific

categories we develop and the level and quality and design. This

revised product strategy, will be more geared to meet the

expectations of our customers in our international markets, rather

than majoring on products that were historically designed and

developed for the UK market. Our spring/summer 2022 season, which

was the first to use these learnings, was presented to our

franchise partners recently receiving positive initial

feedback.

Opportunities for growth beyond the existing territories

Secondly, as we noted last year, we estimate that the birth rate

around the world is c130 million births per annum, within which we

believe that at least 30 million babies are born each year into

households where there is a sufficient income level to make this an

addressable market for the Mothercare brand. Indeed, of the top ten

territories by wealth and birth rate, the Mothercare brand is only

available in three of them today. For example, we currently have no

presence in the USA, Japan, Australia or Brazil. Closer to home, we

have no stores or online presence in any of the bigger European

economies, such as Germany, France, the Netherlands or Scandinavia.

We believe this translates into great potential for the Mothercare

brand beyond its existing global footprint. An assessment is now

underway to identify the right franchise partners and channels to

market for these territories.

Opportunities for step change growth

Thirdly, we are seeking to leverage the intrinsic value

liberated by our extensive efforts over the last three years, where

in addition to the above:

-- we are an AIM listed entity with expectations of an improving

trend in operating profitability and being debt free within five

years;

-- Mothercare is a strong unencumbered core brand, superior in

its quality, international footprint & global reach than many

peers who are being afforded premium market ratings; &

-- we have a transactionally astute PLC Board & senior

executive team that has overseen our emergence from both the

restructuring and the pandemic in better shape than we entered.

Accordingly, these are exciting times as, without the

distractions of the last three years, we are seeking to accelerate

the growth of the business to encompass large and attractive

markets where we currently have no presence.

The Pandemic

As a global brand and franchise operator the impact of Covid-19

has varied enormously by market as the countries in which our

franchise partners operate have addressed the Covid-19 pandemic in

many different ways including, but not limited to, restrictions on

travel, movement and operating hours of retailers. These issues

have been compounded by similar restrictions for our manufacturing

partners, which coupled with the disruption to the global movement

of freight, have caused additional challenges with availability of

product for franchise partners further impacting sales for the

year.

These circumstances introduced an unprecedented demand shock

throughout the first quarter of 2020 which led to the year under

review commencing with many of our Franchise Partners' global

retail locations being closed which, alongside significant

disruption within our manufacturing base, required extensive

efforts to reorganise production to ensure the best possible range

availability. Whilst stores have substantially re-opened for

customers since then this still equated to an aggregate reduction

in worldwide retail sales by our Franchise Partners of 34 per cent.

compared to last year, reflecting the impact of Covid-19 in the

various markets in which our franchisees operate around the world.

Throughout the pandemic we witnessed substantial online sales

growth, however, this in itself was not enough to offset the

temporary closure of retail stores.

The contingency plans activated by the Board are detailed

elsewhere in this report, however these primarily focused

management attention upon the well-being of our colleagues

alongside protecting corporate liquidity in order to preserve the

businesses of our manufacturing and Franchise Partners as a

prerequisite to returning to longer-term profitability. The Group

did not access any of the distress loan facilities proferred by Her

Majesty's Government nor did we furlough any direct employees in

the continuing business.

Rebuilding the Group

Last year we finalised the fundamental restructuring of the

Company's operations and the associated refinancing of the Group,

commenced in the summer of 2018, which ultimately resulted in the

placing into administration of the Group's UK retail business in

November 2019. This unavoidable step preserved value most notably

for our pension fund, our global franchise operations and lending

group - who would have otherwise faced significant losses -

importantly it cleared a path for the Mothercare brand to emerge as

the profitable and cash generative international franchise

operation it is today.

As previously stated, the key strategic aim post the

restructuring was to further transform the business by creating

both a financial structure which supports a sustainable, capital

light franchising model with the capacity to secure both future

global growth and brand reach, alongside redeveloping the Group's

UK retail presence within a Mothercare franchise.

The year under review witnessed substantial progress with all of

our goals, notwithstanding the continuing challenges presented by

Covid-19, as recorded in detail within the Chief Operating

Officer's Review and Financial Review, achieving the Board's

objective of preserving significant value for all stakeholders.

New ways of working with our Partners

We continue to work towards our goal of becoming an asset light

business, greatly facilitated by the implementation of our new way

of stock purchasing, meaning that our franchise partners contract

to pay for products directly with our manufacturing partners.

For the autumn/winter 2021 season currently in our supply chain

some 55% of the products by value are invoiced directly to

franchise partners by our manufacturing partners, thus removing the

Group's exposure to the debt and working capital requirement for

these products. Hence for these products the creditors and stock

will not be recognised by the Group and whilst the associated

revenue will also be excluded the continued receipt of royalty

payments will ensure no material impact on the sterling margin

earned. The responsibility for design, quality control and choice

of manufacturing partner for these products remains with the Group.

Also, for the autumn/winter 2021 season some 70% of the products by

value, will be shipped directly from the country of manufacture to

our franchise partners without passing through our warehouses, both

reducing our cost base and speeding up the supply of product.

As detailed in the Financial Review, we have targeted extending

these ways of working to the remainder of our franchise partners

and anticipate 80% of our products moving direct by the end of this

current financial year and we continue to work to minimise costs

for both ourselves and our franchise partners by moving activities

further up the supply chain.

Updated Financing Requirement

At the year-end Mothercare had net borrowing of GBP12.1 million,

being cash of GBP6.9 million against a substantial drawdown of

GBP19.5 million from the new facility announced last November,

reflecting both ongoing tight control of cash and the conversion of

the total outstanding GBP19 million of shareholder loans into new

ordinary shares on 17 March 2021.

This represents a significant reduction in the total financing

requirement, of around GBP50 million, anticipated in November 2019

and bears testimony to our accelerated progress to becoming a

focused, asset light global franchising business with no directly

operated stores and greatly reduced direct costs.

GBB, with whom terms for a new GBP19.5 million secured 4 year

loan facility, to refinance the Company's outstanding secured

senior debt facility and for additional working capital purposes,

were agreed in November 2020, is now the Group's sole lender.

These changes are detailed in the Financial Review, including

the terms agreed with the Pension Scheme Trustees of our defined

benefit schemes, for a revised schedule of contributions, which

allows the Group to pay contributions at an affordable level whilst

paying off the new loan.

Cost Reduction Programme

Last year the Group made substantial progress in addressing its

legacy infrastructure and associated cost base which greatly

assisted in reducing the total financing requirement the Group

refinanced with GBB:

-- we surrendered the lease of our former head office in Watford

and moved into our new head office in Apsley, Hemel Hempstead, in

August 2020 reducing cash occupancy costs for our head office by

GBP900,000 per annum;

-- The National Distribution warehouse facility in Daventry,

which predominantly serviced the Mothercare UK retail business,

which was previously sublet to a third-party on a short-term basis,

was fully assigned to a third party with a strong covenant on 1

March 2021. This removed a contingent risk of around GBP3 million

per annum to the Group on a lease that expires in June 2026;

-- We are also progressing the development of a new integrated

ERP system designed to provide easier, more accurate and

cost-effective access to information to benefit our own business

and those of our manufacturing & franchise partners. In the

year ending March 2023, the first full year to benefit from the new

system, our information technology costs would be expected to

reduce to close to half of those for the year to March 2021, a

direct bottom line improvement of over GBP2 million.

This continued improvement in overhead recovery and reduced

distribution costs, in tandem with the impact of the new ways of

working, will support cash generation as highlighted above and is

detailed further within the Chief Operating Officer's Review and

Financial Review.

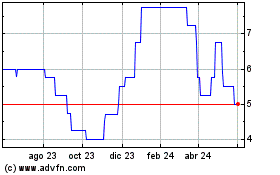

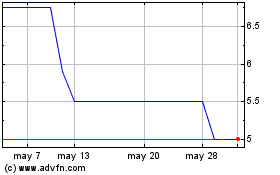

Delisting & AIM Admission

The Company first listed on the London Stock Exchange in 1972

with its listing on the main market continuing throughout via

various different corporate entities. However, with the completion

of the transformation plan the Board considered, for the reasons

highlighted below, that AIM is a more appropriate market for the

Company at this stage, commensurate with the Company now being a

Small-Cap company. AIM was launched in 1995 as the London Stock

Exchange's market specifically designed for smaller companies, with

a more flexible regulatory regime, and has an established

reputation with investors and is an internationally recognised

market:

-- AIM will offer greater flexibility with regard to corporate

transactions, enabling the Company to agree and execute certain

transactions more quickly and cost effectively than a company on

the Official List;

-- Companies whose shares trade on AIM are deemed to be unlisted

for the purposes of certain areas of UK taxation, including

possibly being eligible for relief from inheritance tax.

Furthermore stamp duty is not payable on the transfer of shares

that are traded on AIM and not listed on any other market;

-- In addition to existing institutional investors, given the

possible tax benefits, admission to trading on AIM could make the

Company's shares more attractive to both AIM specific funds and

certain retail investors where, since 2013, shares traded on AIM

can be held in ISAs.

Accordingly, following shareholder approval, the Company applied

to cancel the listing of its Ordinary Shares on the Official List

and to trading on the Main Market alongside applying to the London

Stock Exchange for admission to trading on AIM which was

successfully completed on 12 March 2021.

Management & Board changes

We have a PLC Board that is appropriate for a company of our

size, nature and circumstances with Non-Executive Directors with

deeply embedded and relevant skills who have directly contributed

to the change process and interface cohesively with the Operating

Board.

In addition, the Company's management requirements have evolved

as we have successfully transitioned the business to become a

focused international brand owner and operator. Hence during the

year we reinforced the executive team with the appointment of both

a Chief Product Officer and Head of Commercial, whose collective

expertise has already contributed to our evolving product roadmap

as we strive to build closer partner relationships and better serve

end customer needs in key markets.

Accordingly, having completed the short-term priorities

associated with the refinancing and the transformation plan,

alongside continuing to manage through the continuing restrictions

imposed upon us by Covid-19, we have recommenced the search for a

new Chief Executive Officer: where we are seeking proven global

brand & E-commerce experience.

A further announcement will be made when appropriate and, in the

interim, the day-to-day management of the Group is being run by the

Chief Operating Officer and Chief Financial Officer with oversight

from me as Non-Executive Chairman and my fellow Non-Executive

Directors.

Dividend Policy

The Company has not paid a dividend since 3 February 2012. The

Directors understand the importance of optimising value for

shareholders and it is the Directors' intention to return to paying

a dividend as soon as this is possible under the Company's

agreements with GBB and the pension trustees and as soon as the

Directors believe it is financially prudent for the Group to do

so.

Outlook

First and foremost I would like to thank all of our colleagues

across the organisation for their continued diligence in combating

the challenges created by the pandemic. Their combined efforts in

the face of adversity have been truly inspiring.

Whilst the global outlook remains uncertain and we are not

immune to the continued impact of Covid-19 being felt around the

world, over 80 per cent. of our Franchise Partners' global retail

locations are now open, which points towards recovery in their

sales and consequently our revenues.

Accordingly, based upon reducing impacts on us and our franchise

partners' operations as the current year progresses and the

implementation of the new operating model, greatly reduced cost

structures and the elimination of significant legacy issues, we

expect a significant improvement in operating profits for the

current year.

Furthermore, we still anticipate that the steady state operation

of our existing retail franchise operations, in more normal

circumstances, should exceed annual operating profits of GBP15

million in future years, underwritten by the planned further

reduction in overheads. For the first 13 weeks of the financial

year to March 2022 our total retail sales were GBP94 million,

generating an adjusted EBITDA of approximately GBP2.5 million.

Hence we expect 2022 to be a year of further progress as we

focus upon developing our strategy and future plans to optimise the

Mothercare brand globally over the next five years. That is an

exciting prospect for all of our staff and stakeholders as we

finally exit this most uncertain of times.

Clive Whiley

Chairman

Mothercare plc

Preliminary Results

FINANCIAL AND OPERATIONAL REVIEW

In addition to the significant progress we have made around our

product and brand strategy the last year has also seen a radical

change in the way the business is now financed and in our new

operating model. The result has been the emergence of a profitable

and cash generative international business, with reduced risk,

lower overheads and an asset-light model.

After a period of significant change and restructuring of the

Group in 2020, the year ended 27 March 2021 was a relative return

to stability for Mothercare - albeit with international

uncertainties over COVID-19 continuing to impact trading

levels.

International retail sales by our franchise partners of GBP358.6

million (2020: GBP542.1 million) showed a 34% decrease year on

year. This trend reflects the impact of the COVID-19 pandemic,

which has affected each market across the world in many different

ways. During the current year, the percentage of retail stores open

globally varied between 23% and 95% of the total portfolio. The

most significant impact was felt in the first quarter; for the rest

of the year the percentage of retail stores open globally varied

between 81% and 95%. At 27 March 2021, the Group's franchise

partners had 92% of stores open (2020: 58%).

The loss from operations in the year was GBP2.4 million (2020:

loss of GBP8.8 million) reflecting the significant impact of

COVID-19 on our business. The Group uses a non-statutory reporting

measure of adjusted profit, to show results before any one-off

significant non-trading items , adding back the adjusted items

which relate to the restructuring and reorganisation costs and are

non-recurring of GBP2.6 million together with depreciation and

amortisation of GBP2.0 million gives an adjusted EBITDA profit for

the year of GBP2.2 million (2020: GBP6.2 million).

The Group recorded a loss from continuing operations for the 52

weeks to 27 March 2021 of GBP21.5 million (2020: GBP8.5 million

loss). The adjusted loss for the year from continuing operations

was GBP8.6 million (2020: GBP6.4 million loss). Continuing

operations represent the Global operation of the business; all

operations for the 2021 financial year were continuing, however,

the UK operational segment ceased during the comparative year and

was previously categorised as a discontinued operation. Continuing

operations reported reflected accounting guidelines and therefore

included some expenditure which ceased following the administration

process, and as such, the comparative period does not necessarily

reflect the result achieved by the standalone international

business.

Total loss for the year of GBP21.5 million (2020: GBP13.1

million profit) was the same as the loss from continuing

operations. However, the prior year also included a gain on the

loss of control of the Group's main trading subsidiary Mothercare

UK Limited (in administration), and a shared service entity,

Mothercare Business Services Limited (in administration) of GBP46.2

million.

Retail space at the end of the year was 2.0 million sq. ft. from

734 stores (2020: 2.3 million sq. ft. from 841 stores - continuing

operations).

There was also COVID-19 induced disruption in the supply chain,

impacting both the current and previous financial years. This

temporarily decelerated, or in some instances constrained, the

movement of product within the supply chain, which resulted in a

lack of availability for franchise partners.

The Group has two distribution centres, one in the UK and one in

Shenzhen, China; and whilst routes directly from suppliers to

partners were able to continue, there were barriers to stock being

shipped in and out of the facility in China. There were also

COVID-19 related logistical challenges in securing space and

haulage, with shipments being delayed once vessel capacities were

reached.

Each of the Group's key markets - including the Middle East,

Russia, China, India, Indonesia and Singapore saw a decline in

trading year on year - driven by the aforementioned stock

availability limitations and store closures.

The year ended 28 March 2020 saw two subsidiaries of the Group,

Mothercare UK Limited (MUK) and Mothercare Business Services

Limited (MBS), enter administration. Mothercare Global Brand

Limited (MGB), also a subsidiary of Mothercare PLC (PLC), purchased

the brand, customer relationships, and certain assets and

liabilities of the international business from the

administrators.

Responsibility for the UK operating segment ceased to belong to

PLC from the point of administration; included within this were the

UK retail store estate, through which the Group sold to end

consumers, as well as the Group's UK trading website. Subsequently,

the administrators wound down the UK operations, generating cash to

repay the creditors, with the bank debt to which MUK was a

guarantor, being the sole secured creditor, and the Group liable

for any shortfall.

The International and UK operating segments were previously both

trading segments of the same legal entity, MUK. The corporate costs

were therefore managed as one business. In categorising these

operations between continued and discontinued operations, the

accounting standards do not allow for such costs to be pro-rated.

Any expenditure which was incurred under a contract used by the

international continuing business as well as the UK discontinued

operation was disclosed under continuing operations - regardless of

whether the expenditure did not continue after the administration,

and regardless of whether the contract was primarily for the

benefit of the UK segment. For this reason, the continuing

administrative expenses disclosed in the comparative period do not

necessarily reflect the ongoing corporate cost base of the

business. There were no discontinued operations in the current

period.

COMPLETION OF REFINANCING

As initially announced last November, there were three main

achievements connected with the refinancing -

-- A new GBP19.5 million four year term loan to refinance the

Company's previous debt that was repayable on demand due to

covenant breaches.

-- The holders of the GBP19.0 million of Convertible Unsecured

Loan Notes that were potentially due for repayment on 30 June 2021,

have converted their entire holdings into equity, increasing the

number of ordinary shares in issue from 374.2 million to 563.8

million.

-- Revised contribution schedules have been agreed for the next

five years with the Mothercare pension schemes' trustees that will

enable us to generate sufficient cash over that period to repay the

term loan in full whilst still meeting the reduced deficit

reduction contributions. The value of the deficit under the full

actuarial valuation at 31 March 2020 was GBP123.4 million; the

Group's deficit payments are calculated using this as the basis.

The agreed annual contributions to the pension schemes, for the

years ending in March, are as follows: 2022 - GBP4.1 million; 2023

- GBP9.0million; 2024 - GBP10.5 million; 2025 - GBP12.0 million;

2026 to 2029 - GBP15 million; 2030 - GBP5.7 million.

Whilst COVID-19 is still having a negative short term impact on

the Group's profitability and cash generation our forecasts show

that we are able to comply with our commitments to our lender and

the pension schemes for the foreseeable future. As at the balance

sheet date the Group had net borrowings of GBP12.1m, being cash of

GBP6.9 million against a substantial drawdown of GBP19.5 million

from the new facility, reflecting an ongoing tight control of

cash.

In March 2021 the Group transitioned stock exchanges by

simultaneously being admitted to AIM and cancelling its listing on

the Main Market.

OPERATING MODEL

The Group continues to work towards its goal of becoming an

asset light business. At the beginning of the COVID-19 pandemic

with supply chains being stretched, it was clear that our existing

operating model would put excessive demands on our limited working

capital. At that time product was often shipped to our warehouse to

be picked and repacked and shipped back to franchise partners,

resulting in our manufacturing partners frequently being paid well

before our franchise paid us, due to the time the stock was inside

our supply chain. We launched the new tripartite agreement ('TPA')

at the beginning of COVID-19, whereby the franchise partners commit

to paying the manufacturing partners for the product when due. And

as a result the manufacturing partners were generally willing to

re-extend credit terms that had sometimes been lost because of the

UK retail administration, thereby limiting the impact on our

franchise partners' working capital. The TPA process has resulted

in a substantial reduction in our working capital requirement and

has been an instrumental element of our successful navigation

through the impact of COVID-19.

We have subsequently further improved the TPA model whereby the

franchise partner is invoiced directly by the manufacturing

partner. This allows the manufacturing partners the opportunity to

obtain credit insurance in relation to the franchise partners debt,

which due to MGB's limited trading history was sometimes difficult

to obtain for invoices raised to MGB. Additionally, this model

removes the Group's exposure to the debt and working capital

requirement for these products. Where this is the case, under IFRS

15 the Group is the agent in the transaction - previously the Group

was the principal. Hence for these products the creditors and stock

will not be recognised by the Group and whilst the associated

revenue and cost of sales will also be excluded there will be no

material impact on the absolute margin earned. The responsibility

for design, quality control and choice of manufacturing partner for

these products, as outlined in the Chief Operating Officer's

report, are unchanged and remains with the Group.

For the autumn/winter 2021 season, recently in our supply chain

some 55% of the products by value are invoiced directly to

franchise partners by our manufacturing partners. The direct

invoicing to franchise partners by manufacturing partners for

products is a condition in recent franchise agreements highlighted

below, which will mean that within the next year this figure should

increase to around 70%.

The second major change to the operating model was within our

supply chain. As mentioned above we previously contracted warehouse

space and associated labour to accept and unpack products from

manufacturing partners then pick and repack to send to our

franchise partners. Clearly it is more cost effective to do things

once so from our spring/ summer 2022 season due to ship later this

year, where volumes allow, our manufacturing partners will

individually pack orders for each franchise partner and then they

will be shipped direct to our franchise partners, eliminating the

need for us to use our warehouses. For the spring/ summer 2022

season we anticipate 80% of our products will be moving direct and

we continue to work to minimise costs for both ourselves and our

franchise partners by moving activities further up the supply

chain.

These new ways of working are being accepted by both our

franchise and manufacturing partners as they are beneficial for

all. Our franchise partners have the potential of reduced

distribution recharges, shorter delivery times and improved surety

and availability of product. In turn, manufacturing partners have

greater security of payment through credit insurance or simply

dealing directly with some of our well capitalised franchise

partners.

Another change that is currently underway is the development of

a new integrated ERP system, expected to go live early in 2022. In

the year ending March 2023, the first full year to benefit from the

new system, our information technology costs would be expected to

be reduced to close to half of those for the year to March 2021,

which would result in a direct bottom line improvement of over GBP2

million. This system will allow us to automate much of our ordering

process with both our franchise partners and manufacturing partners

accessing the system through portals. It will also provide easier,

more accurate and cost-effective access to information, including

our ability to analyse our franchise partners' sales data to ensure

we are optimising our product designs.

PARTNERSHIP AGREEMENTS

In addition to the TPAs above we have also been rolling out a

new more balanced version of our franchise partner agreement. In

the past there was sometimes limited consistency between the

agreements which makes them more difficult to manage and increases

our legal costs. In August 2020 we completed new 10 year franchise

agreements with an option to extend for another 10 years, with both

Alshaya Group, our largest franchise partner, and Boots UK Limited

for the UK and Republic of Ireland. Subsequently we have now

finalised new agreements with our franchise partners in Indonesia,

Malaysia, Singapore and Hong Kong. These new agreements are all

based on the same standard version and contain the commitments to

the TPA, direct shipping and direct invoicing. We intend to extend

these new standard agreements to other franchise partners when

appropriate in relation to their existing agreements.

We have also launched a new manufacturing partner agreement,

which is common to all our manufacturing partners and again is more

balanced and replaces relationships in the past that were often

more informal and lacked the clarity that we now have. All our

manufacturing partners receiving future orders, commencing with the

spring/ summer 2022 season now being placed, will be required to

sign up to this agreement.

LEGACY ISSUES FROM THE ADMINISTRATION OF THE UK RETAIL

BUSINESS

The National Distribution Centre ('NDC') warehouse facility in

Daventry, which predominantly serviced the Mothercare UK retail

business and was previously sublet to a third-party on a short-term

basis, has now been fully assigned to a third party. This has

removed a potential risk of around GBP3 million per annum to the

Group on a lease that expires in June 2026.

In addition to the NDC lease above after issuing our results for

the year ended Mach 2020, we were approached by the landlord of a

previous UK retail store, where a cross guarantee existed that we

were not aware of. The resultant provision, which needed to be made

as a prior year adjustment, as detailed in note 12, was

GBP1.3m.

BALANCE SHEET

Total equity at 27 March 2021 was a deficit of GBP43.0 million,

a worsening on the deficit position of GBP4.0 million at 27 March

2020. This was driven by the temporary defined pension scheme

moving from a surplus of GBP29.8 million to a deficit of GBP25.6

million. There was also the conversion of the shareholder loans

from borrowings to equity during the year - these were carried at a

borrowings amount of GBP12.8 million and embedded derivatives of

GBP0.3 million at the comparative period end.

The Group has moved to a net current asset position of GBP1.6

million. In the comparative period, the net current liability

position is driven by the level of provision held against Group

receivables and includes the unwind of certain non-cash provisions.

The Group's working capital position is closely monitored and

forecasts demonstrate the Group is able to meet its debts as they

fall due.

27 March 2021 28 March 2020

Restated

GBP million GBP million

------------------------------------------------------------------------ -------------- --------------

Intangible assets 1.1 0.6

Property, plant and equipment 1.7 8.6

Retirement benefit obligations asset/(liability) (net of deferred tax) (25.6) 19.4

Net debt (13.5) (43.1)

Derivative financial instruments 0.8 20.6

Other net liabilities (7.5) (18.5)

Net liabilities (43.0) (4.0)

------------------------------------------------------------------------- -------------- --------------

Share capital and premium 198.1 179.1

Reserves (241.1) (183.1)

------------------------------------------------------------------------- -------------- --------------

Total equity (43.0) (4.0)

------------------------------------------------------------------------- -------------- --------------

Pensions

The Mothercare defined benefit pension schemes were closed with

effect from 30 March 2013.

The pension deficit at 27 March 2021 was GBP25.6 million,

whereas at 28 March 2020, the Group was in the unusual and

temporary position of recognising an accounting surplus under IAS

19 of GBP29.8 million for these schemes. This accounting surplus -

arising as a result of a decrease in long term inflation

expectations and the use of a lower pre-retirement discount rate -

was a function of the volatile markets around that time, driven by

the extreme situation of countries all over the world being about

to enter a period of 'lockdowns' and high levels of uncertainty.

During the current year, therefore, the scheme has returned to a

deficit of a level similar to the value it was held at in 2019.

The Group's deficit payments are calculated using the full

triennial actuarial valuation as the basis rather than the

accounting deficit / surplus. The value of the deficit under the

full actuarial valuation at 31 March 2020 was GBP123.4 million.

Details of the income statement net charge, total cash funding

and net assets and liabilities in respect of the defined benefit

pension schemes are as follows:

GBP million 52 weeks ending 52 weeks ending 52 weeks ending

26 March 2022* 27 March 2021 28 March 2020

------------------------------------------------ ---------------- ---------------- --------------------

Income statement

Running costs (2.5) (3.4) (2.9)

Net interest on liabilities / return on assets (0.5) 0.2 (0.6)

------------------------------------------------ ---------------- ---------------- --------------------

Net charge (3.0) (3.2) (3.5)

------------------------------------------------ ---------------- ---------------- --------------------

Cash funding

Regular contributions (1.0) (1.3) (1.9)

Additional contributions - - (1.9)

Deficit contributions (4.1) (3.2) (7.8)

------------------------------------------------ ---------------- ---------------- --------------------

Total cash funding (5.1) (4.5) (11.6)

------------------------------------------------ ---------------- ---------------- --------------------

Balance sheet**

Fair value of schemes' assets n/a 403.4 401.2

Present value of defined benefit obligations n/a (429.0) (371.4)

------------------------------------------------ ---------------- ---------------- --------------------

Net liability n/a (25.6) 29.8

------------------------------------------------ ---------------- ---------------- --------------------

*Forecast

**The forecast fair value of schemes' assets and present value

of defined benefit obligations is dependent upon the movement in

external market factors, which have not been forecast by the Group

for 2022 and therefore have not been disclosed.

In consultation with the independent actuaries to the schemes,

the key market rate assumptions used in the valuation and their

sensitivity to a 0.1% movement in the rate are shown below:

2021 2020 2020 2020

Sensitivity Sensitivity

GBP million

----------------- ----- ----- ------------- -------------

Discount rate 2.0% 2.3% +/- 0.1% -7.3 /+7.5

Inflation - RPI 3.1% 2.5% +/- 0.1% +4.5 /-5.7

----------------- ----- ----- ------------- -------------

Inflation - CPI 2.4% 1.7% +/- 0.1% +1.8 /-1.8

----------------- ----- ----- ------------- -------------

The Group has a deferred tax liability of GBPnil (2020: GBP10.4

million). In 2021, no deferred tax asset was recognised as there

was not considered to be enough certainty over the recoverability.

In the comparative period, the deferred tax liability arose as a

temporary difference due to the surplus on the pension scheme.

Net debt

Net debt of GBP13.5 million, which includes net borrowings,

related financial assets and IFRS 16 lease liabilities represents

an improvement on the 2020 position of GBP22.1 million.

The Group's IFRS 16 lease liabilities significantly reduced to

GBP1.4 million (2020: GBP8.4 million) as a result of the assignment

of the warehouse facility lease, which had been vacated since the

administration of the UK business.

In March 2021, the Group's shareholder loans were converted to

equity. At the 2021 year end, the net debt amount in relation to

these was therefore GBPnil. At the 2020 year end, GBP12.8 million

in relation to these was included within net debt; GBP6.2 million

of interest accrued up to the point of conversion.

During the year, the Group agreed a GBP19.5 million secured four

year term loan, which was drawn down in November 2020; the carrying

value of this at 27 March 2021 is GBP19.0 million (GBP19.5 million

gross of unamortised facility fee).

At the point of the administration of Mothercare UK Ltd and

Mothercare Business Services Ltd, the Group's secured Revolving

Credit Facility (RCF) crystalised at GBP28.0 million, and this

GBP28.0 million was shown as a current liability at 28 March 2020.

Linked to this debt was a financial asset. Under the sales purchase

agreement with the administrators, the proceeds of the wind up of

the UK business were first be used to repay the secured creditor

i.e. the RCF. Monies of GBP21.0 million were expected to be

generated towards this, and therefore in addition to the debt of

GBP28.0 million, a financial asset of GBP21.0 million was

recognised gross of the debt to reflect this. During the current

year, the outstanding balance on the RCF was settled through

distributions received from the administrators, with the remaining

balance settled at the point of drawdown of the Group's new term

loan. The Group still holds a financial asset of GBP2.6 million,

reflecting expected future distributions from the administrators,

however as at the current year end this financial asset is no

longer linked to the Group's borrowings.

Also included within net debt is GBP6.9 million (2020: GBP6.1

million) of cash funds, the increase being driven by cash received

under the term loan facility during the year.

Leases

Right-of-Use assets of GBP1.2 million (2020: GBP7.9 million) and

lease liabilities of GBP1.4 million (2020: GBP8.4 million)

represented the Group's head office leases. The comparative period

included an investment property asset relating to the NDC warehouse

facility in Daventry which the Group ceased to use for supply of

goods from the point at which Mothercare UK Ltd went into

administration; this lease was assigned in March 2021 and therefore

the carrying value was disposed of in the period.

Working capital

The Group only purchases stock directly needed to fulfil

franchise partner orders. Of the GBP5.9 million (2020: GBP9.7

million) year-end inventories balance, GBP2.6 million (2020: GBP4.5

million) of this related to stock in transit, i.e. was on a boat on

its way to one of the Group's two distribution centres, at the year

end date.

Trade receivables have remained consistent year on year, being

GBP11.6 million at 27 March 2021 (2020: GBP11.2 million).

Similarly, trade payables have also remained fairly constant, being

GBP11.8 million at 27 March 2021 (2020: GBP12.0 million).

INCOME STATEMENT - on a continuing operations basis

52 weeks to 52 weeks to

27 March 2021 28 March 2020

Restated

GBPmillion GBPmillion

---------------------------------------------- -------------- --------------

Revenue 85.8 164.7

Adjusted EBITDA (EBITDA before exceptionals) 2.2 6.2

Depreciation and amortisation (2.0) (6.8)

---------------------------------------------- -------------- --------------

Adjusted result before interest and

taxation 0.2 (0.6)

Adjusted net finance costs (8.7) (4.9)

---------------------------------------------- -------------- --------------

Adjusted result before taxation (8.5) (5.5)

---------------------------------------------- -------------- --------------

Adjusted costs (12.9) (2.2)

Loss before taxation (1) (21.4) (7.7)

---------------------------------------------- -------------- --------------

Taxation (0.1) (0.8)

Profit/(loss) from discontinued operations

(note 7) - 21.6

---------------------------------------------- -------------- --------------

Total profit/( loss) (21.5) 13.1

---------------------------------------------- -------------- --------------

EPS - basic (continuing operations) (5.7)p (2.4)p

Adjusted EPS - basic (continuing

operations) (2.3)p (1.8)p

------------------------------------- ------- -------

1. Adjusted results are consistent with how the business

performance is measured internally. Refer to adjusted items table

in note 4 for further details. See accounting policies for

definitions.

Foreign exchange

The main exchange rates used to translate the consolidated

income statement and balance sheet are set out below:

52 weeks ended 53 weeks ended

27 March 2021 28 March 2020

Average:

------------------- --------------- ---------------

Euro 1.1 1.1

Russian rouble 96.9 82.4

Chinese Renminbi 8.8 8.9

Kuwaiti dinar 0.4 0.4

Saudi riyal 4.9 4.8

Emirati dirham 4.8 4.7

Indonesian rupiah 18,954 17,968

Indian rupee 96.9 90.1

Closing:

Euro 1.1 1.1

Russian rouble 102.9 93.9

Chinese Renminbi 9.0 8.3

Kuwaiti dinar 0.4 0.4

Saudi riyal 5.2 4.4

Emirati dirham 5.1 4.3

Indonesian rupiah 19,965 19,576

Indian rupee 100.5 88.5

------------------- --------------- ---------------

The principal currencies that impact the translation of

International sales are shown below. The net effect of currency

translation caused worldwide retail sales and adjusted loss to

decrease by GBP26.1 million (2020: increase by GBP14.4 million) and

GBP1.4 million (2020: increase by GBP0.9 million) respectively as

shown below:

Adjusted

Worldwide retail sales Profit/(loss)

GBP million GBP million

------------------- ------------------------- -----------------

Euro (0.6) -

Russian rouble 4.8 0.3

Chinese Renminbi (0.1) -

Kuwaiti dinar 1.0 0.1

Saudi riyal 2.5 0.1

Emirati dirham 1.6 0.1

Indonesian rupiah 1.3 0.1

0.4 -

Indian rupee

Other currencies 3.6 0.2

------------------- ------------------------- -----------------

14.4 0.9

------------------- ------------------------- -----------------

See glossary for definitions

Net finance cost

Financing costs include interest receivable on bank deposits,

less interest payable on borrowing facilities, the amortisation of

costs relating to bank facility fees and the net interest charge on

the liabilities/assets of the pension scheme.

Year-on-year finance costs have increased due to the compounding

interest on the convertible shareholder loans. Whilst interest of

GBP2.6 million accrued in the prior period, the current year saw an

interest accrual of GBP6.2 million - the increase partly as a

result of the effect of compounding, but also due to an

acceleration of interest on early conversion to include interest up

to what would have been the conversion date (three months

later).

There was also a swing in interest income/costs on the pension

scheme, with a GBP0.2 million income in the current year compared

to a GBP0.6 million cost in 2020.

GBP10.3 million of finance costs (2020: GBP6.0 million of

finance income) are included in adjusted items. GBP9.1 million of

costs arose on the fair value movements of the shareholder loan

embedded derivatives (2020: income of GBP6.0 million).This GBP9.1

million was driven by fluctuations in the Group's share price - in

March 2020 there was a high level of uncertainty in the UK market -

driven by COVID-19, which caused the fair value of these

instruments to plummet; during 2021 the value returned to pre-March

2020 levels. The shareholder loans converted in March 2021 and were

fair valued immediately prior to their transfer to share capital

and share premium. Also included in adjusted finance costs is the

recognition of 15.0 million of warrants issued in March 2021, as

well as the fair value movements on these to the year end date,

totalling GBP1.2 million (2020: GBPnil).

Discontinued operations

There were no discontinued operations presented for the current

financial 52 week period ended 27 March 2021.

On 5 November 2019, administrators were appointed for MUK and

MBS, two subsidiaries of Mothercare PLC. The trade, and certain

assets and liabilities pertaining to the international business

were transferred to a new Group subsidiary, MGB. Consequently, in

the comparative period, the UK operating segment was presented as a

discontinued operation, and a profit on the loss of control of

GBP46.2 million subsequently recognised. This profit reflected the

greater value of liabilities disposed of compared to assets, the

largest of these being the IFRS 16 lease liabilities for the UK

store estate - this was significantly greater than the

corresponding right-of-use assets because the onerous lease

provision and lease incentives liability had been transferred

against the asset at inception.

The profit from discontinued operations for the period is GBPnil

(2020: GBP21.6 million).

The total statutory loss after tax for the Group is GBP21.5

million (2020: GBP13.1 million profit).

Taxation

The tax charge comprises corporation taxes incurred and a

deferred tax charge. The total tax charge from continuing

operations was GBP0.1 million (2020: GBP0.8 million) - (see note

6).

The total tax credit from discontinued operations was GBPnil

million (2020: GBP0.1 million).

Earnings per share

Basic adjusted losses per share from continuing operations were

2.3 pence (2020: 1.8 pence). Continuing statutory losses per share

were 5.7 pence (2020: 2.4 pence).

Total basic adjusted losses per share were 2.3 pence (2020: 4.2

pence). Total statutory losses per share were 5.7 pence (2020: 3.7

pence earnings).

Some of the comparative disclosures for earnings per share have

been restated - see note 9.

CASHFLOW

Statutory net cash outflow from continuing operating activities

was an outflow of GBP2.6 million, compared with an outflow of

GBP2.9 million in the prior year; this was driven by trading in the

year and refinancing/ restructuring costs.

Cash outflow from investing activities of GBP0.4 million (2020:

GBP1.5 million - from continuing operations), reflects a reduction

in capital expenditure.

Cash inflows from financing activities netted to GBP3.8 million

(2020: GBP2.9 million outflow - from continuing operations). The

income was driven by the cash receipt of GBP7.3 million on the

Group's new four year term loan. The outflow in the comparative

period was as a result of repayments of the Group's RCF.

Going concern

As stated in the strategic report, the Group's business

activities and the factors likely to affect its future development

are set out in the principal risks and uncertainties section of the

Group financial statements. The financial position of the Group,

its cash flows, liquidity position and borrowing facilities are set

out in the financial review.

The consolidated financial information has been prepared on a

going concern basis. Despite the current global retail sector

challenges, we have attempted to capture the impact on both our

supply chain and key franchise partners based on what is currently

known and localised trading activity since the start of the crisis.

When considering the going concern assumption, the Directors of the

Group have reviewed a number of factors, including the Group's

trading results and its continued access to sufficient borrowing

facilities against the Group's latest forecasts and projections,

comprising:

1) A Base Case forecast, which is built up at franchise partner

level and incorporates key assumptions specific to each partner and

the impact of Covid-19 in each jurisdiction. This base case

forecasts that the sales for the financial year to March 2022

increase to levels similar to those achieve immediately before the

impact of COVID-19 and the sales for the year to March 2023 show a

more modest increase.

2) A Sensitised forecast, which applies sensitivities against

the Base Case for reasonably possible adverse variations in

performance, reflecting the ongoing volatility in our key markets.

This assumes the following additional key assumptions:

A delayed recovery that assumes that retail sales remain subdued

throughout the majority of the forecast period as a result of

continued restrictions on both our franchise and manufacturing

partners as a result of COVID-19.

The potential for subsequent reintroduction or imposition of new

measures to control COVID-19 in areas that will restrict both our

franchise and manufacturing partners and consequentially impact our

retail sales.

The sensitised forecast shows a decrease in sales of 7% as

compared to the Base Case in the financial years to March 2022 and

2023, with the net working capital and the overhead costs assumed

to remain constant. Despite showing a decreases against the Base

Case, the assumptions still assume an increase in revenue from the

financial years 2021 to 2022. The four debt covenants are also not

forecast to be breached under this scenario; and

3) A Reverse Stress Test which assumes an overall increase in

net sales in the financial year to March 2022 of around half that

used in the Base Case.

Based on the sales to date in the current financial year to

March 2022, the Group is significantly behind the Base Case

forecast due to the adverse impact of Covid-19 in certain

jurisdictions. This post year end performance could extend

throughout the going concern assessment period as a result of the

ongoing Covid-19 restrictions and had therefore already

demonstrated that the base case scenario is challenging.

The Board's confidence that the Group will operate within the

terms of the borrowing facilities, and the Group's proven cash

management capability supports our preparation of the financial

statements on a going concern basis. We have modelled a substantial

reduction in global retail sales in our sensitised case and reverse

stress test as a result of possible future store closures and

subdued consumer confidence or as a result of reduced availability

due to restrictions in our manufacturing partners to maintain

production and supply chain constraints throughout the remainder of

FY22 with recovery in FY23.

The impact of the pandemic on the future prospects of the Group

is not fully quantifiable at the reporting date, as the complexity

and scale of restrictions in place at a global level is outside of

what any business could accurately reflect in a financial forecast.

However, if trading conditions were to deteriorate beyond the level

of risks applied in the sensitised forecast, or the Group was

unable to mitigate the material uncertainties assumed in the Base

Case Forecast and the Group were not able to execute further cost

or cash management programmes, the Group would at certain points of

the working capital cycle have insufficient cash. If this scenario

were to crystallise the Group would need to renegotiate with its

lender in order to secure waivers to potential covenant breaches

and consequential cash remedies or secure additional funding.

Therefore, we have concluded that, in this situation, there is a

material uncertainty that casts significant doubt that the Group

will be able to operate as a going concern.

Treasury policy and financial risk management

The Board approves treasury policies, and senior management

directly controls day-to-day operations within these policies. The

major financial risk to which the Group is exposed relates to

movements in foreign exchange rates and interest rates. Where

appropriate, cost effective and practicable, the Group uses

financial instruments and derivatives to manage the risks, however

the main strategy is to effect natural hedges wherever

possible.

No speculative use of derivatives, currency or other instruments

is permitted.

Foreign currency risk

All International sales to franchisees are invoiced in Pounds

sterling or US dollars. The Group therefore has some currency

exposure on these sales, but they are used to offset or hedge in

part the Group's US dollar denominated product purchases. Under the

tripartite agreements, there has been an increased level of

currency matching between purchases and sales, improving the

Group's ability to hedge naturally.

Interest rate risk

The principal interest rate risk of the Group arises in respect

of the drawdown of the GBP19.5 million term loan. These borrowings

are at a fixed rate of 12% plus LIBOR, and exposes the Group to

cash flow interest rate risk. The interest exposure is monitored by

management but due to low interest rate levels during the period

the risk is believed to be minimal and no interest rate hedging has

been undertaken.

In the comparative period, the Group was exposed to interest

rate risk from the Revolving Credit Facility ('RCF') and

shareholder loans.

The convertible shareholder loans attracted a monthly compound

interest rate of 0.83%. These loan agreements contained an option

to convert to equity which is treated as an embedded derivative and

fair valued. This fair value was calculated using the Black Scholes

model and is therefore sensitive to the relevant inputs,

particularly share price. These loans were converted to equity in

March 2021.

The RCF facility was at a fixed rate of 5.5% plus LIBOR. The

interest exposure was monitored by management but, similarly to in

the current year, low interest rate levels during the period meant

the risk was considered to be minimal. At 28 March 2020, the debt

due under the RCF was GBP28.0 million.

Credit risk

The Group has exposure to credit risk inherent in its trade

receivables.

The Group has no significant concentrations of credit risk.

The Group operates effective credit control procedures in order

to minimise exposure to overdue debts. Before accepting any new

trade customer, the Group obtains a credit check from an external

agency to assess the credit quality of the potential customer and

then sets credit limits on a customer by customer basis. IFRS 9

'Financial Instruments' has been applied such that receivables

balances are held net of a provision calculated using a risk

matrix, taking micro and macro-economic factors into

consideration.

Shareholders' funds

Shareholders' funds amount to a deficit of GBP43.0 million, a

worsening from the deficit of GBP4.0 million achieved in the

comparative period. This was driven by actuarial losses of GBP56.7

million on the Group's defined benefit pension scheme, with GBP10.2

million of deferred tax liability being released as result of the

scheme returning to a deficit position - overall giving GBP46.5

million of movement driven solely by the pension scheme. Another

significant movement in the year related to the conversion of the

Group's shareholder loans to equity, resulting in a GBP28.5 million

increase in share capital, share premium and distributable

reserves.

DIRECTORS' RESPONSIBILITY STATEMENT

The 2021 Annual Report and Accounts which will be issued in July

2021, contains a responsibility statement which sets out that as at

the date of approval of the Annual Report on 28 July 2021, the

directors confirm to the best of their knowledge:

-- the Group and unconsolidated Company financial statements,

prepared in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006, give a

true and fair view of the assets, liabilities, financial position

and profit or loss of the company and the undertakings included in

the consolidation taken as a whole; and

-- the Strategic Report and Directors' Report include a fair

review of the development and performance of the business and the

position of the company and the undertakings included in the

consolidation taken as a whole, together with a description of the

principal risks and uncertainties that they face.

Consolidated income statement

For the 52 weeks ended 27 March 2021

Note 52 weeks ended 27 March 2021 52 weeks ended 28 March 2020

Restated*

------------------------------------------- ----------------------------------------------

Before Adjusted Total Before Adjusted Total

adjusted items(1) adjusted items(1)

items items

GBP million GBP million GBP million GBP million GBP million GBP million

---------------- ----- ------------ --------------- ------------ ------------ ---------------- ------------

Revenue 3 85.8 - 85.8 164.7 - 164.7

Cost of sales (63.3) - (63.3) (128.5) - (128.5)

---------------- ----- ------------ --------------- ------------ ------------ ---------------- ------------

Gross profit 22.5 - 22.5 36.2 - 36.2

Administrative

expenses (23.3) (2.6) (25.9) (34.6) (8.2) (42.8)

Other income 2.0 - 2.0 - - -

Impairment

losses on

receivables (1.0) - (1.0) (2.2) - (2.2)

Profit/(loss)

from

operations 3 0.2 (2.6) (2.4) (0.6) (8.2) (8.8)

Finance costs 5 (8.9) (10.3) (19.2) (5.2) - (5.2)

Finance income 5 0.2 - 0.2 0.3 6.0 6.3

---------------- ----- ------------ --------------- ------------ ------------ ---------------- ------------

Loss before

taxation (8.5) (12.9) (21.4) (5.5) (2.2) (7.7)

Taxation (0.1) - (0.1) (0.9) 0.1 (0.8)

---------------- ----- ------------ --------------- ------------ ------------ ---------------- ------------

Loss for the

period from

continuing

operations (8.6) (12.9) (21.5) (6.4) (2.1) (8.5)

Discontinued

operations

(Loss)/profit

for the period

from

discontinued

operations 7 - - - (8.4) 30.0 21.6

(Loss)/profit

for the period

attributable

to equity

holders of the

parent (8.6) (12.9) (21.5) (14.8) 27.9 13.1

---------------- ----- ------------ --------------- ------------ ------------ ---------------- ------------

(Loss)/profit

per share

From continuing

operations

Basic 9 (5.7)p (2.4)p

Diluted 9 (5.7)p (2.4)p

From continuing

and

discontinued

operations

Basic 9 (5.7)p 3.7p

Diluted 9 (5.7)p 3.7p

1. Includes adjusted costs (property costs, restructuring costs

and impairment charges) , the fair value movement on embedded

derivatives and the profit/loss on disposal of the UK operating

segment as set out in note 6 to the consolidated financial

statements. Adjusted items are considered to be one-off or

significant in nature and /or value. Excluding these items from

profit metrics provides readers with helpful additional information

on the performance of the business across the periods because it is

consistent with how the business performance is reviewed by the

Board.

* Results for the prior year have been restated for the impact

of prior year adjustments (note 12) . Earnings/(loss) per share

have also been restated as a result of the prior year adjustment

and the correction of the dilution calculation (note 9).

Consolidated statement of comprehensive income

For the 52 weeks ended 27 March 2021

52 weeks ended 53 weeks ended

27 March 2021 28 March 2020

Restated

GBP million GBP million

------------------------------------------------------------------------------- --- --------------- ---------------

(Loss)/profit for the period (21.5) 13.1

Items that will not be reclassified subsequently to the income statement:

Actuarial (loss)/gain on defined benefit pension schemes (56.7) 46.6

Income tax relating to items not reclassified 10.2 (10.4)

------------------------------------------------------------------------------- --- --------------- ---------------

(46.5) 36.2

------------------------------------------------------------------------------- --- --------------- ---------------

Items that may be reclassified subsequently to the income statement:

Exchange differences on translation of foreign operations - (1.9)

Deferred tax relating to items reclassified - -

- (1.9)

------------------------------------------------------------------------------- --- --------------- ---------------

Other comprehensive (expense)/income for the period (46.5) 34.3

------------------------------------------------------------------------------- --- --------------- ---------------

Total comprehensive (expense)/income for the period wholly attributable to equity

holders

of the parent (68.0) 47.4

------------------------------------------------------------------------------------ --------------- ---------------

Consolidated balance sheet

As at 27 March 2021

27 March 2021 28 March 2020

restated

GBP million GBP million

----------------------------------------------------- -------------- --------------

Non-current assets

Intangible assets 1.1 0.6

Property, plant and equipment 0.5 0.7

Right-of-use leasehold assets 1.2 7.9

Retirement benefit obligations - 29.8

2.8 39.0

----------------------------------------------------- -------------- --------------

Current assets

Inventories 5.9 9.7

Trade and other receivables 17.4 15.6

Derivative financial instruments 2.6 21.0

Cash and cash equivalents 6.9 6.1

32.8 52.4

Total assets 35.6 91.4

------------------------------------------------------- -------------- --------------

Current liabilities

Trade and other payables (24.9) (29.5)

Borrowings - (28.0)

Current tax liabilities - (0.3)

Derivative financial instruments (1.8) (0.1)

Lease liabilities (0.3) (1.0)

Provisions (4.2) (2.8)

(31.2) (61.7)