Australia Stocks Fall for Third Straight Session

27 Abril 2016 - 2:56AM

Noticias Dow Jones

By Robb M. Stewart

MELBOURNE--Australian shares were led lower in late trading

Wednesday by banks amid heightened uncertainty over interest

rates.

The market opened modestly higher in the wake of an overnight

recovery in oil prices, then built on gains to peak about midday

following the release of data showing the first quarter of domestic

deflation since the global financial crisis. That turned to selling

as analysts reflected on the increased likelihood the Reserve Bank

of Australia would next week lower interest rates, faced with the

risk that inflation will undershoot its 2%-3% target for a

sustained period.

Falling for a third straight session, the S&P/ASX 200 lost

32.9 points, or 0.6%, to end at 5187.7. After helping push the

market higher early in the day, the financial sector finished down

1.2%.

Analysts said there is a high degree of uncertainty dogging

equity markets amid U.S. earnings season and ahead of the U.S.

Federal Reserve's monetary policy update. The Fed isn't expected to

raise interest rates on Wednesday but may offer clues as to whether

it will act in June. Australia's largest banks, which account for a

big chunk of the ASX 200's value, are also due to turn in their

earnings reports from Monday.

Australian consumer prices fell 0.2% in the first three months

of this year and were up 1.3% from a year earlier, the Australian

Bureau of Statistics said Wednesday. Economists had expected

consumer prices to rise 0.2% in the quarter and 1.7% from a year

earlier.

"While we don't think there is a screaming need for interest

rates to be cut on economic activity grounds, the low inflation

result opens the door for the Reserve Bank to cut rates if they

deem it is necessary," Commonwealth Securities economist Savanth

Sebastian said.

Commonwealth Bank of Australia led the big banks lower, falling

2.5%. National Australia Bank Ltd. was 2.2% lower, Westpac Banking

Corp. lost 2% and Australia & New Zealand Banking Group Ltd.

shed 1.5%. Regional banks Bendigo & Adelaide Ltd. and Bank of

Queensland Ltd. slipped 1.4% and 2.5%, respectively.

"Next week's bank profit reports are now close enough to keep

investors cautious," CMC Markets chief market analyst Ric Spooner

said. "Markets are waiting for clarity on bank bad debt provisions

and whether interest margins have been sustained in the face of

increased competition."

Among mining stocks, BHP Billiton Ltd. lost 0.6% while fellow

iron-ore producers Rio Tinto Ltd. and Fortescue Metals Group Ltd.

fell 2.1% and 2.9%.

Woodside Petroleum Ltd. dropped 2.8% but Santos Ltd. gained 2%

and Origin Energy Ltd. added 2.1%.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 27, 2016 03:41 ET (07:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

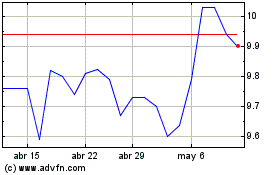

Origin Energy (ASX:ORG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Origin Energy (ASX:ORG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024