Solana MVRV Signals More Gains Ahead Amid Market Downturn: Analysts

21 Diciembre 2024 - 1:30PM

NEWSBTC

Amid a crypto market mayhem over the past week, Solana (SOL) has

suffered significant losses to the tune of 17.13%,. according to

data from CoinMarketCap. This decline adds to the token’s

steep price movement after it reached a new all-time high of

$263.83 following the US Presidential elections in November.

However, with the crypto bull cycle still in its early stages,

analysts at Glassnode remain positive on the token’s ability to

regain its bullish form despite not establishing any higher highs

in the past three weeks. Related Reading: Solana Holds Monthly

Support As Network Activity Grows – Time For A Breakout? More Room

For SOL Price Growth, Analysts Say In a recent blog post on

December 20, Glassnode in collaboration with crypto analysts

UkuriaOC and CryptoVizArt shared vital insights on the current

state of the Solana market. By analyzing the Net Realized

Profit/Loss metric, these market experts discovered that Solana has

experienced a positive net capital inflow since early September

2023, with a recorded peak inflow of $776 million of new capital

per day. During this period, the SOL market witnessed minor

inflows with the majority of the profit-taking volume coming from

coins aged 1 day-1 week, 1 week-1 month, and 6 months-12 months,

demonstrating the endearment of Solana to both long and short-term

holders. To ascertain the status of Solana amidst these recent

market activity, Glassnode employs the MVRV ratio to determine if

the market is overheated. For context, the Market Value To Realized

Value (MVRV) ratio is used to assess if an asset is potentially

overvalued (>1) or undervalued (<1). This MVRV

ratio can be used to establish pricing bands that classify

investors’ profitability into ranges. Using this setup, Glassnode

observes that Solana is currently observing a sideways movement

between the mean MVRV and +0.5 standard deviation range. This

development indicates the Solana market is quite heated but still

far from a bull cycle top. This is because MVRV breakouts of +1

standard deviation have historically signaled when the altcoin

forms a longer-term macro topping formation. Therefore,

Solana still has the potential to record much profit before

entering an overheated zone that will likely precede a market

downtrend. Related Reading: Solana Bull Flag Signals A Breakout To

$300 – Analyst Shares Key Levels Solana A Stellar Investment So Far

– Glassnode In addition to more insights on the Solana market,

Glassnode notes that altcoin has proven to be a highly profitable

asset in the crypto market. Following its price crash to

$9.64 in November 2022, Solana has experienced a remarkable price

gain of over 2,143% over the past two years. During this

period, the altcoin has outperformed both Bitcoin and Ethereum on

344 out of 727 market days since the FTX exchange collapsed

indicating significant market demand and interest. At the time of

writing, Solana trades at $194.58 reflecting a price loss of 0.50%

in the past day. However, the asset’s trading volume is up by

18.94% and is valued at $9.94 billion. Featured image from

MoneyCheck, chart from Tradingview

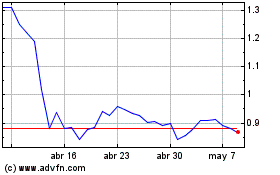

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024