Solana Could Face A 41% Crash, Warns Mechanism Capital Co-Founder

20 Junio 2024 - 8:00AM

NEWSBTC

Andrew Kang, co-founder of Mechanism Capital, voiced concerns over

the potential volatility and impending price correction of Solana

(SOL) in a market analysis posted on X. His comments come amid a

broader dialogue concerning the delayed second wave of US spot

Bitcoin ETFs, which he now anticipates could be pushed back by one

to two quarters. He states, “I believe the timeline for this is

delayed by 1-2 quarters. Some market views. Experts now suggest

that solicitation approval/ETFs added to wealth management

platforms is slated for Q4 instead of late May as originally

suggested.” He believes that this delay in ETF approvals could

result in a lack of immediate capital influx into the market,

thereby potentially reversing the current upward momentum.

Impacting the broader crypto market, Kang’s prediction for Solana,

Kang’s prognosis is less optimistic. He highlights Solana’s price

volatility, which has been significantly influenced by meme-driven

trading activities. “Solana has been a great horse this cycle but

it’s seen the reflexivity from the meme trading demand works in

both directions. If meme trading takes a pause for the next few

months, then you’ll likely be able to buy SOL near $80 again,” he

remarked, indicating a potential 41% decline in SOL’s price from

its current price level. Reasons For A Potential Solana Price Crash

Crypto analyst TexasHedge further elaborated on Kang’s insights,

providing a nuanced view of the market dynamics that influenced

Solana’s price movements. He discussed the historical

attractiveness of Solana as a high-risk, high-reward investment,

often referred to metaphorically as “the world’s best casino.”

Related Reading: Bitcoin And Solana Brace For Quiet Q3: What Crypto

Traders Should Know This environment attracted significant capital

inflows, which were crucial in driving up Solana’s valuation during

its peak periods. “Kang’s SOL commentary makes a lot of sense.

Solana remains arguably the best casino in the world, but casino

outflows are as painful for the SOL token as inflows were

beneficial,” the crypto analyst noted. TexasHedge shared his

previous investment approach, which saw Solana as a compelling

trade based on several factors: Initially, it involved the

re-rating of Solana, which had been considered a laggard in the

crypto space due to the FTX collapse but then gained momentum.

Another factor was the strong influx of capital into SOL because of

the memecoin frenzy. Lastly, Solana’s movement often mirrored

broader crypto market trends, benefiting from the overall market

beta. Related Reading: Solana Down 40% But Analyst Says Now’s The

Time To Buy SOL Reflecting on these factors, TexasHedge remarked,

“I liked SOL in October 2023 as a three-part trade: (i) re-rating

of a presumed dead chain, (ii) inflows into the world’s best

casino, and (iii) crypto beta. Now, you’re largely just left with

(iii), at much higher levels, and amid a backdrop in which it is

hard to make a great case that SOL is the best expression of crypto

beta.” Moreover, the analyst pointed out several structural

challenges that Solana faces, which might contribute to a downward

price correction. These include an inherent annual inflation of

5.21%, translating to about 82,570 SOL entering the market each

year—worth approximately $11.1 million at current prices—and the

regular monthly release of locked SOL purchased from FTX, which

increases supply and potentially depresses prices if demand doesn’t

match up. “Even absent a cooling of memecoin mania, the outlook

over the next few months is challenging,” TexasHedge concluded,

indicating a tough road ahead for Solana amidst reduced speculative

memecoin trading and ongoing market pressures. At press time, SOL

traded at $137. Featured image from CoolWallet, chart from

TradingView.com

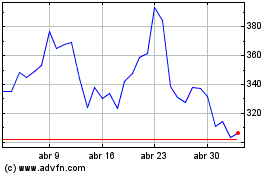

Gnosis (COIN:GNOUSD)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

Gnosis (COIN:GNOUSD)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025