dYdX Founder Skeptical Of Current Bull Run, Cites Low Participation

05 Enero 2024 - 3:00PM

NEWSBTC

Taking to X on January 5, Antonio Juliano, the founder of dYdX, a

decentralized exchange (DEX), expressed skepticism regarding the

current crypto bull run. Juliano attributed the recent price surge

to “light trading volumes.” This formation might, despite the

overall confidence, not sustain the uptrend. Founder: This Bull Run

Is Different, Participation Is Low Juliano asserted that a true

bull cycle is not defined solely by price action but by

participation and community enthusiasm. The founder continued that

this “does not seem to be happening yet.” Related Reading: Ethereum

Mega Whales Continue To Buy: Do They Know Something You Don’t? The

founder attributed the lack of widespread adoption to the absence

of “groundbreaking” products that have captured the attention of a

“broader” audience. However, releasing these “products” to the

market could revive activity, driving crypto trading volume.

Juliano’s comments come ahead of the potential approval of the

first spot Bitcoin exchange-traded fund (ETF) by the U.S.

Securities and Exchange Commission (SEC). Among several applicants

are Fidelity, Grayscale, and BlackRock. Insiders claim the agency

could approve the first product in the coming days. A spot

Bitcoin ETF may open the floodgates to institutional investors,

allowing them to gain exposure to the Bitcoin and crypto market in

a regulated manner. As it is currently structured, willing

institutions regulated by the SEC can only get exposure through

Grayscale’s products, including the GBTC. Along the same line, some

commentators have speculated that the SEC’s approval of a spot

Bitcoin ETF could lead to the approval of a spot Ethereum ETF in

2024. An Ethereum Futures ETF was approved in 2023 and is currently

available for trading. Even so, the product, like Bitcoin Futures

ETFs that are widespread, tracks an Ethereum index price, not the

Ethereum spot rate. Even so, whether the SEC will greenlight a spot

Ethereum ETF remains to be seen. Will A Bitcoin ETF Approval

Revive DYDX Demand? Trading volume is a critical metric for

measuring participation and, thus, interest in a particular asset.

The higher it is, the more liquid the asset is. Depending on

the prevailing sentiment, this might support prices or lead to a

sell-off. As the crypto community eagerly waits for the SEC to

decide on the flagship product, altcoins, including DYDX, have been

firm. Related Reading: Maker Market Heats Up: Over 600 Addresses

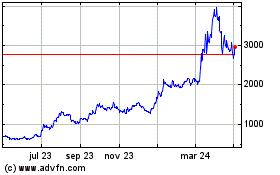

Complete MKR Trades In Single Day Looking at the DYDX price chart

in the daily chart, prices are moving horizontally but relatively

high from the October 2023 lows. The coin is up roughly 50%

but remains under pressure in the short term. DYDX is down 40% from

November 2023 peaks, trading below December 2023 lows in a bearish

breakout formation. Feature image from Canva, chart from

TradingView

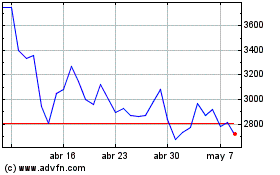

Maker (COIN:MKRUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Maker (COIN:MKRUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024