Solana Rally Stalls: Pullback To Key Support Signals Potential Correction

07 Enero 2025 - 3:00PM

NEWSBTC

Solana’s strong rally is losing momentum as prices face a pullback,

suggesting a potential correction toward the $209.9 support level.

After a period of bullish gains, market dynamics and profit-taking

impact its upward movement. This pullback signals a pause in the

bullish trend, with traders and investors watching for signs of

recovery or further decline. The $209.9 support zone is crucial for

Solana, as its ability to hold will likely determine the next price

movement. A successful defense could spark renewed buying interest

and lead to a rally, while a breach of this support may trigger

deeper corrections, impacting market sentiment. A Pullback To

$209.9 In Sight For Solana Bears have taken control after the

pullback at $223, overpowering the bulls and driving the price

toward the critical $209.9 support level. This shift in market

sentiment reflects growing selling pressure, with bears looking to

push the price even lower. Bulls’ failure to maintain prices above

$223 has raised concerns about the strength of the current uptrend.

Related Reading: Solana Price Will Complete 1,800% Surge To $4,000

With This Formation: Analyst With the $209.9 support level now in

focus, the market is at a critical juncture. If the price fails to

hold at this level, it may signal a lengthy correction. On the

other hand, if the bulls manage to defend the support and regain

control, the market might stabilize and set the stage for another

rally. The battle between the bulls and bears is now centered on

this support zone, and the next price action will likely reveal the

direction in which the asset is headed. Traders should remain

vigilant as the outcome of this test could have significant

implications for the short-term price movement. Additionally,

technical indicators suggest that the rally may be losing steam,

with a slight bearish divergence appearing on the RSI and a

slowdown in buying pressure. A retracement to $209.9 is likely to

provide the market with an opportunity to reset, offering bulls a

chance to consolidate and prepare for a possible rebound.

Evaluating Crucial Support And Resistance Zones For Price Direction

Evaluating the key support and resistance zones is essential for

predicting the future direction of the price movement. In this

case, the $209.9, $194, and $164 support levels are critical to

watch. Related Reading: Solana Back Above Weekly & Monthly

Support Levels – Analyst Expects New ATH Should the price decline,

these levels may act as strong cushions, potentially preventing

more drops. If the price fails to hold at $209.9, the next support

level to watch is $194, followed by $164, which might signal a

deeper correction. Meanwhile, the $240 and $260 levels stand as

critical resistance zones once the bulls manage to regain control

at $209.9. A breakout above the $240 resistance is set to trigger a

notable surge, possibly driving the price toward the $260

resistance. These levels serve as key barriers, and a successful

break above them could indicate an extended upsurge, signaling

continued strength. Featured image from Unsplash, chart from

Tradingview.com

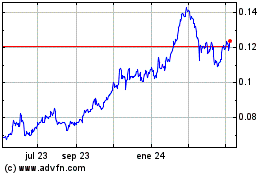

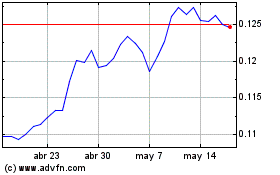

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025