Confirmed guidance of FY 2021 net free

cash-flow comfortably above €1bn

Regulatory News:

Carrefour (Paris:CA):

- Solid performance in Q3: Continued sales growth (+4.0% on a

reported basis and +0.8% LFL), after record growth in Q3 2020

(+8.4% LFL)

- Over two years1, LFL sales growth reached +9.2%, in line

with the Q2 2021 trend

- In France (-0.3% LFL and +3.5% over 2 years), Carrefour

confirmed its market share gain momentum in the quarter2

- Good underlying dynamics in hypermarkets, temporarily impacted

in the second part of the quarter by the introduction of the

sanitary pass in large shopping malls

- In Brazil: Continued strong momentum over 2 years (+24.2%

LFL), on a high comparable base

- Atacadão (+2.7% LFL and

+28.4% over 2 years): Relevance of the model and good

execution

- Carrefour Retail (-13.3% LFL

and +13.2% over 2 years): Solid growth over 2 years.

Q3 2021 impacted by lower

non-food sales on an exceptional comparable base

- In Europe (ex-France): Carrefour Spain (-2.3% LFL and +3.9%

over 2 years) continued to gain market shares. Italy returned to

growth (+0.8% LFL and -7.2% over 2 years) notably thanks to an

improvement in customer satisfaction

- Continued food e-commerce sales growth: +19% in Q3, +100%

over 2 years. Carrefour will present its digital strategy and

opportunities during its Digital Day on November 9, 2021

Alexandre Bompard, Chairman and CEO, declared:

“We posted another quarter of

growth at Group level, despite a very high comparable base, and

continued to gain market share in most of our countries. Our

trajectory is very solid and demonstrates our ability to generate

structural growth thanks to our strong customer-centric approach,

good control over our operations, notably in digital, and impactful

strategic initiatives. Our net free cash-flow objective for FY

2021, which was raised in July, is confirmed. With these favorable

dynamics, its robust balance sheet, and thanks to the commitment of

its teams, Carrefour is attractive and on the offensive, for the

benefit of its customers and its shareholders.”

Note: (1) sum of Q3 2020 LFL and Q3 2021 LFL; (2) based on

NielsenIQ RMS data

THIRD-QUARTER 2021 FIGURES

Third-quarter 2021

Sales inc. VAT (€m)

LFL1

Total variation

At current exchange rates

At constant exchange rates

France

9,882

-0.3%

+2.1%

+2.1%

Europe

5,864

-1.2%

+0.9%

+1.4%

Latin America (pre-IAS 29)

4,005

+7.3%

+10.8%

+14.7%

Asia

718

-5.2%

+22.3%

+16.8%

Group (pre-IAS 29)

20,468

+0.8%

+4.0%

+4.6%

IAS 292

112

Group (post-IAS 29)

20,581

THIRD-QUARTER 2021 SALES INC. VAT

In a context still marked by the Covid-19 pandemic and evolving

sanitary conditions across its different markets, the Group’s

third-quarter activity confirmed its good commercial momentum.

Carrefour continued to gain market share in the vast majority of

its countries, thanks to the improvement in customer satisfaction,

which is at the heart of the Carrefour 2022 strategic plan. The

Group’s expansion also continues at a steady pace, thanks to

numerous organic openings as well as the successful integration of

recent acquisitions. E-commerce sales continued to grow on

extremely high comparables. The Group will provide a comprehensive

presentation of its digital strategy during its Digital Day, which

will be held in Paris on November 9.

On a like-for-like (LFL) basis, third-quarter sales inc. VAT

were up +0.8%. The Group’s sales inc. VAT reached €20,468m

pre-IAS 29, an increase of +4.6% at constant exchange rates. This

increase includes a favorable petrol effect of +2.0% (reflecting an

increase in oil prices and higher volumes). After taking into

account an unfavorable exchange rate of -0.7%, due to the weakness

of the Argentine peso, the total sales variation at current

exchange rates amounted to +4.0%. The impact of the application of

IAS 29 was +€112m.

In France, Q3 2021 revenue was down -0.3% on a LFL basis

(+0.8% LFL in food and -7.1% LFL in non-food) in a declining

market, given a high comparable base. Hypermarkets were temporarily

impacted by the introduction of the sanitary pass, restricting

access to large shopping malls from mid-August to the end of

September. Excluding the impact of the sanitary pass, LFL growth in

France is estimated at +0.5% in Q3. Market share continued to

improve over the quarter, with gains in most formats3. On a two

year stack4, reported LFL growth reached +3.5%.

- Hypermarkets: Good resilience

(-2.8% LFL in Q3/-0.3% over 2 years), given a high comparable base

(+2.5% LFL in Q3 2020) and the temporary impact of the introduction

of the sanitary pass

- Supermarkets (+2.2% LFL in

Q3/+7.1% over 2 years) maintained their good momentum and continued

to gain market share3

- Convenience (+1.2% LFL in Q3/+6.5%

over 2 years) remained well oriented. Carrefour continued the

expansion of this growth format with +63 openings in the third

quarter

- Promocash’s activities posted

sustained LFL growth of +8.5%, thanks to the recovery of sales to

bars and restaurants

- Non-food sales remained up by

+2.7% on a LFL basis over 2 years (+9.9% LFL in Q3 2020)

- Food e-commerce in France grew

again strongly this quarter (+19%), a growth of +72% vs 2019.

Carrefour continues to deploy many initiatives in this field,

notably the recent acquisition of a minority stake in Cajoo, a

French pioneer in quick commerce

In Europe, LFL sales were down -1.2% compared to Q3 2020,

but up +0.6% over two years. This reflects situations that were not

uniform across countries:

- In Spain (-2.3% LFL/+3.9% over 2 years), the market was

marked by strong out-of-home consumption benefiting convenience

formats at the expense of hypermarkets, to which Carrefour is

particularly exposed. In this context, the Group continued to gain

market share. Supersol’s integration continued successfully

- In Italy (+0.8% LFL/-7.2% over 2 years), sales growth

returned to positive territory. The Group is starting to benefit

from the restructuring and recovery plan initiated by the new

management, with a sharp NPS increase, driven by a strong

improvement in price perception

- In Belgium (-5.4% LFL/stable over 2 years), the

performance reflects the declining market, marked by deflationary

pressures on food and a high comparable base, as the summer period

in 2020 benefited from high domestic tourism in the sanitary

context

- In Poland(+0.9% LFL/-0.5% over 2 years), the Group

maintained positive momentum

- In Romania (+5.9% LFL/+5.9% over 2 years), the trend

remained very solid, in the wake of an excellent second quarter.

Carrefour successfully launched a new loyalty program in the

country

In Latin America, LFL sales increased by +7.3%, and by

+35.7% over two years.

- In Brazil (-1.8% LFL/+24.2% over 2 years), LFL sales

decreased slightly in Q3, given an exceptionally high comparable

base. Over 2 years (+24.2% LFL), the trend marked an acceleration

compared to H1 (+18.6% LFL). Q3 sales were up +7.7% at constant

exchange rates thanks to a contribution from openings and

acquisitions of +8.4% and a positive petrol effect of +1.1%. The

currency effect was a favorable +2.1%.

- Atacadão’s sales were up +14.3% at

constant exchange rates in Q3 2021 with a continued increase in LFL

sales (+2.7% LFL/+28.4% over 2 years) on a very high comparable

base (+25.8% LFL in Q3 2020). This confirms the strength of

Atacadão’s model, which proved able to accelerate strongly its

expansion (+48 stores over the last 12 months, including Makro)

while improving the performance of the existing store network

- Carrefour Retail’s sales were down

in Q3 (-13.3% LFL/+13.2% over 2 years), due to a drop in non-food

sales given an exceptionally high comparable base (+44% LFL in Q3

2020). Over two years, sales grew both in food and in non-food

- Food e-commerce accelerated in Q3,

with growth of +53%, notably driven by the rapid ramp-up at

Atacadão; cash & carry now represents more than half of food

e-commerce sales in Brazil

- Financial services continued the

recovery initiated at the beginning of the year; billings were up

+26% in Q3, notably thanks to the success of the Atacadão credit

card

- In Argentina (+57.0% LFL/+98.4% over 2 years), Carrefour

confirmed its excellent momentum, in a persistently high

inflationary environment. Carrefour largely outperformed the

market, thanks to record growth excluding inflation, driven by an

increase in volumes despite a declining market

In Taiwan (Asia), Q3 sales were up +16.8% at

constant exchange rates, thanks notably to the integration of

Wellcome stores. LFL sales were down -5.2% (-4.5% over 2 years),

impacted by the sanitary measures that penalized important festive

events in the country. Wellcome stores, whose conversion to

Carrefour banners will be finalized in November, significantly

outperform when converted.

FURTHER DISPOSALS OF NON-STRATEGIC REAL ESTATE ASSETS

As part of its plan to dispose €300m additional non-strategic

real estate assets by 2022, the Group sold the real estate of 7

hypermarkets in Spain in September, through a sale & lease-back

agreement with Realty Income, for €93m.

To date, the Group has disposed an additional €250m of

non-strategic real estate assets.

FURTHER TRANSFORMATION OF THE OPERATING MODEL

In October, Carrefour Italy announced, as part of a broad

recovery plan, an acceleration of its transformation, that notably

includes the transfer to a franchising model of over 50 stores in

2021 and 25 in the first quarter of 2022.

In France, the Group will have transferred 10 hypermarkets and

44 supermarkets to lease-management this year. A new program of 43

stores (16 hypermarkets and 27 supermarkets) was announced, with

the first transfers expected starting in March 2022.

LIMITED IMPACT OF INFLATIONARY PRESSURES EXPECTED IN

2021

The Group pays particular attention to the dynamics of

inflation, notably regarding energy and food prices. The impact of

the increase in commodity prices has had a limited impact on the

Group’s performance to date, as it benefits from contracts

negotiated for the whole year for most of its purchases in Europe,

including goods not for resale. For now, the Group does not

anticipate any material effect of inflation on its full-year 2021

performance.

NET FREE CASH FLOW OBJECTIVE CONFIRMED

In this context, and given its good operational performance in

the third quarter, the Group confirms its net free cash-flow

generation objective for 2021, which continues to be expected

comfortably above the initial objective of €1bn.

AGENDA

- Digital Day : November 9, 2021

APPENDIX

Share capital decrease by way of cancellation of treasury

shares

On October 20, 2021, the Board of Directors, pursuant to the

authorization granted by the Extraordinary Shareholders’ Meeting,

decided to decrease the share capital of Carrefour S.A. by way of

cancellation of 12,252,723 treasury shares representing

approximately 1.6 % of the share capital.

These shares were repurchased from August 2, 2021 to September

13, 2021 within the framework of the €200 million share buyback

program decided by the Board of Directors on July 28, 2021.

After the cancellation of these shares, the outstanding number

of Carrefour S.A. shares will be 775,895,892 and the number of

treasury shares will hence be 9,457,539, representing approximately

1.2 % of the share capital. The number of shares carrying voting

rights will thus stand at 766,438,353.

Third-quarter 2021 sales inc. VAT

The Group’s sales amounted to €20,468m pre-IAS 29. Foreign

exchange had an unfavorable impact in the third quarter of -0.7%,

due to the depreciation of the Argentine Peso. Petrol had a

favorable impact of +2.0%. The calendar effect was a favorable

+0.1%. The effect of openings was +0.9%. The effect of acquisitions

was +2.1%. The impact of the application of IAS 29 was +€112m.

Sales inc. VAT (€m)

Variation ex petrol ex

calendar

Total variation inc.

petrol

LFL

Organic

at current exchange

rates

at constant exchange

rates

France

9,882

-0.3%

-2.0%

+2.1%

+2.1%

Hypermarkets

4,867

-2.8%

-3.3%

-0.2%

-0.2%

Supermarkets

3,295

+2.2%

-2.4%

+2.7%

+2.7%

Convenience /other formats

1,720

+2.5%

+2.7%

+8.0%

+8.0%

Other European countries

5,864

-1.2%

-1.7%

+0.9%

+1.4%

Spain

2,681

-2.3%

-2.2%

+3.9%

+3.9%

Italy

1,073

+0.8%

-3.5%

-2.5%

-2.5%

Belgium

1,010

-5.4%

-5.4%

-5.1%

-5.1%

Poland

499

+0.9%

+1.7%

+0.1%

+2.9%

Romania

601

+5.9%

+7.3%

+5.5%

+7.3%

Latin America (pre-IAS 29)

4,005

+7.3%

+10.2%

+10.8%

+14.7%

Brazil

3,369

-1.8%

+2.1%

+9.7%

+7.7%

Argentina (pre-IAS 29)

636

+57.0%

+56.9%

+16.9%

+56.6%

Asia

718

-5.2%

-5.6%

+22.3%

+16.8%

Taiwan

718

-5.2%

-5.6%

+22.3%

+16.8%

Group total (pre-IAS 29)

20,468

+0.8%

+0.3%

+4.0%

+4.6%

IAS 29(1)

112

Group total (post-IAS 29)

20,581

Note: (1) hyperinflation and foreign exchange

Comparable base and 2-year stack – Third quarter 2021

LFL change excl. petrol and

calendar

Q3 2020

Q3 2021

2-year stack(1)

France

+3.8%

-0.3%

+3.5%

Hypermarkets

+2.5%

-2.8%

-0.3%

Supermarkets

+4.9%

+2.2%

+7.1%

Convenience /other formats

+5.4%

+2.5%

+7.9%

Other European countries

+1.9%

-1.2%

+0.6%

Spain

+6.3%

-2.3%

+3.9%

Italy

-8.0%

+0.8%

-7.2%

Belgium

+5.4%

-5.4%

-0.0%

Poland

-1.4%

+0.9%

-0.5%

Romania

+0.0%

+5.9%

+5.9%

Latin America

+28.4%

+7.3%

+35.7%

Brazil

+26.0%

-1.8%

+24.2%

Argentina

+41.4%

+57.0%

+98.4%

Asia

+0.6%

-5.2%

-4.5%

Taiwan

+0.6%

-5.2%

-4.5%

Group total

+8.4%

+0.8%

+9.2%

Note: (1) sum of Q3 2020 LFL and Q3 2021 LFL

Technical effects – Third quarter 2021

Calendar

Petrol

Foreign exchange

France

+0.1%

+3.8%

-

Hypermarkets

+0.0%

+3.2%

-

Supermarkets

+0.3%

+4.7%

-

Convenience /other formats

+0.1%

+4.1%

-

Other European countries

+0.2%

+1.0%

-0.5%

Spain

+0.0%

+1.7%

-

Italy

+0.3%

+0.7%

-

Belgium

+0.4%

-

-

Poland

+0.6%

+0.6%

-2.8%

Romania

+0.1%

+0.0%

-1.9%

Latin America

-0.1%

+0.7%

-3.9%

Brazil

+0.0%

+1.1%

+2.1%

Argentina

-0.3%

-

-39.7%

Asia

+1.4%

-

+5.5%

Taiwan

+1.4%

-

+5.5%

Group total

+0.1%

+2.0%

-0.7%

Nine-month 2021 sales inc. VAT

The Group’s sales amounted to €58,725m pre-IAS 29. Foreign

exchange had an unfavorable impact in the first nine months of the

year of -3.5%, due to the depreciation of the Argentine Peso and

the Brazilian Real. Petrol had a favorable impact of +1.5%. The

calendar effect was an unfavorable -0.4%. The effect of openings

was +0.8%. The effect of acquisitions was +1.8%. The impact of the

application of IAS 29 was +€175m.

Sales inc. VAT (€m)

Variation ex petrol ex

calendar

Total variation inc.

petrol

LFL

Organic

at current exchange

rates

at constant exchange

rates

France

28,697

+2.6%

+0.5%

+3.0%

+3.0%

Hypermarkets

14,175

+1.5%

+0.9%

+2.5%

+2.5%

Supermarkets

9,754

+5.4%

-0.1%

+3.7%

+3.7%

Convenience /other formats

4,768

+0.5%

+0.7%

+3.0%

+3.0%

Other European countries

17,127

-1.6%

-1.8%

-0.3%

+0.2%

Spain

7,475

-1.2%

-0.9%

+3.6%

+3.6%

Italy

3,237

-4.8%

-7.9%

-6.9%

-6.9%

Belgium

3,192

-3.2%

-3.1%

-3.6%

-3.6%

Poland

1,497

+1.8%

+2.6%

-0.4%

+2.5%

Romania

1,727

+4.1%

+5.5%

+3.4%

+5.2%

Latin America (pre-IAS 29)

10,924

+11.2%

+13.9%

-1.4%

+16.2%

Brazil

9,182

+3.9%

+7.3%

-1.2%

+10.6%

Argentina (pre-IAS 29)

1,742

+45.3%

+45.2%

-2.3%

+44.7%

Asia

1,976

-4.5%

-6.1%

+14.4%

+14.3%

Taiwan

1,976

-4.5%

-6.1%

+14.4%

+14.3%

Group total (pre-IAS 29)

58,725

+2.9%

+2.3%

+1.5%

+5.0%

IAS 29(1)

175

Group total (post-IAS 29)

58,900

Note: (1) hyperinflation and foreign exchange

Comparable base and 2-year stack – Nine months 2021

LFL change excl. petrol and

calendar

9M 2020

9M 2021

2-year stack(1)

France

+2.9%

+2.6%

+5.5%

Hypermarkets

-0.1%

+1.5%

+1.5%

Supermarkets

+5.7%

+5.4%

+11.1%

Convenience /other formats

+6.2%

+0.5%

+6.7%

Other European countries

+4.2%

-1.6%

+2.6%

Spain

+7.5%

-1.2%

+6.3%

Italy

-4.4%

-4.8%

-9.2%

Belgium

+9.2%

-3.2%

+6.0%

Poland

+0.9%

+1.8%

+2.7%

Romania

+2.3%

+4.1%

+6.4%

Latin America

+22.2%

+11.2%

+33.4%

Brazil

+16.4%

+3.9%

+20.3%

Argentina

+53.9%

+45.3%

+99.2%

Asia

+1.6%

-4.5%

-2.9%

Taiwan

+1.6%

-4.5%

-2.9%

Group total

+7.5%

+2.9%

+10.4%

Note: (1) sum of 9M 2020 LFL and 9M 2021 LFL

Technical effects – Nine months 2021

Calendar

Petrol

Foreign exchange

France

-0.4%

+2.9%

-

Hypermarkets

-0.5%

+2.1%

-

Supermarkets

-0.3%

+4.0%

-

Convenience / other formats

-0.3%

+2.8%

-

Other European countries

-0.4%

+0.9%

-0.4%

Spain

-0.6%

+1.5%

-

Italy

+0.1%

+0.8%

-

Belgium

-0.5%

-

-

Poland

-0.6%

+0.5%

-2.9%

Romania

-0.3%

+0.0%

-1.8%

Latin America

-0.6%

+0.2%

-17.6%

Brazil

-0.5%

+0.6%

-11.8%

Argentina

-0.5%

-

-47.0%

Asia

+0.4%

-

+0.1%

Taiwan

+0.4%

-

+0.1%

Group total

-0.4%

+1.5%

-3.5%

Application of IAS 29

The impact on Group sales is presented in the table below:

Sales incl. VAT (€m)

2020

pre-IAS 29(1)

LFL(2)

Calendar

Openings

Scope and others(3)

Petrol

2021 at constant rates

pre-IAS 29

Forex

2021 at current rates

pre-IAS 29

IAS 29(4)

2021 at current rates post-IAS

29

Q1

19,445

+4.2%

-1.0%

+0.8%

-0.6%

-1.1%

+2.2%

-6.7%

18,564

+13

18,577

Q2

18,710

+3.6%

-0.4%

+0.8%

+0.6%

+3.8%

+8.3%

-3.0%

19,692

+49

19,742

H1

38,155

+3.9%

-0.7%

+0.8%

+0.0%

+1.3%

+5.2%

-4.9%

38,256

+63

38,319

Q3

19,690

+0.8%

+0.1%

+0.9%

+0.9%

+2.0%

+4.6%

-0.7%

20,468

+112

20,581

9M

57,845

+2.9%

-0.4%

+0.8%

+0.3%

+1.5%

+5.0%

-3.5%

58,725

+175

58,900

Notes: (1) restated for IFRS 5; (2) excluding petrol and

calendar effects and at constant exchange rates; (3) including

transfers; (4) hyperinflation and foreign exchange

Expansion under banners – Q3 2021

Thousands of sq. m

Dec. 31 2020

June 30 2021

Openings/ Store

enlargements

Acquisitions

Closures/ Store reductions/

Disposals

Q3 2021 change

Sept. 30 2021

France

5,507

5,543

+23

+4

-8

+19

5,563

Europe (ex Fr)

6,165

5,914

+38

-

-79

-41

5,873

Latin America

2,717

2,870

+39

-

-

+39

2,909

Asia

1,035

1,140

+5

-

-3

+2

1,142

Others(1)

1,486

1,480

+25

-

-4

+21

1,501

Group

16,910

16,947

+130

+4

-94

+41

16,988

Store network under banners – Q3 2021

N° of stores

Dec. 31 2020

June 30 2021

Openings

Acquisitions

Closures/ Disposals

Transfers

Total Q3 2021 change

Sept. 30 2021

Hypermarkets

1,212

1,224

+6

-

-4

-

+2

1,226

France

248

253

-

-

-

-

-

253

Europe (ex Fr)

456

455

+2

-

-4

-

-2

453

Latin America

185

184

-

-

-

-

-

184

Asia

172

172

+3

-

-

-

+3

175

Others(1)

151

160

+1

-

-

-

+1

161

Supermarkets

3,546

3,521

+56

-

-50

-1

+5

3,526

France

1,173

1,048

+3

-

-1

-3

-1

1,047

Europe (ex Fr)

1,864

1,904

+30

-

-47

+2

-15

1,889

Latin America

151

150

-

-

-

-

-

150

Asia

10

12

-

-

-

-

-

12

Others(1)

348

407

+23

-

-2

-

+21

428

Convenience stores

7,827

8,435

+133

+14

-92

-

+55

8,490

France

4,018

4,218

+49

+14

-22

-

+41

4,259

Europe (ex Fr)

3,156

3,344

+74

-

-63

-

+11

3,355

Latin America

530

535

+10

-

-1

-

+9

544

Asia

66

287

-

-

-6

-

-6

281

Others(1)

57

51

-

-

-

-

-

51

Cash & carry

392

419

+8

-

-1

-

+7

426

France

147

146

+1

-

-1

-

-

146

Europe (ex Fr)

13

13

-

-

-

-

-

13

Latin America

214

242

+7

-

-

-

+7

249

Asia

-

-

-

-

-

-

-

-

Others(1)

18

18

-

-

-

-

-

18

Soft discount (Supeco)

71

96

+4

-

-2

+3

+5

101

France

6

14

+3

-

-

+3

+6

20

Europe (ex Fr)

64

81

+1

-

-2

-

-1

80

Latin America

1

1

-

-

-

-

-

1

Asia

-

-

-

-

-

-

-

-

Others(1)

-

-

-

-

-

-

-

-

Group

13,048

13,695

+207

+14

-149

+2

+74

13,769

France

5,592

5,679

+56

+14

-24

-

+46

5,725

Europe (ex Fr)

5,553

5,797

+107

-

-116

+2

-7

5,790

Latin America

1,081

1,112

+17

-

-1

-

+16

1,128

Asia

248

471

+3

-

-6

-

-3

468

Others(1)

574

636

+24

-

-2

-

+22

658

Note: (1) Africa, Middle East and Dominican Republic

DEFINITIONS

Free cash-flow

Free cash flow corresponds to cash flow from operating

activities before net finance costs and net interests related to

lease commitment, after the change in working capital, less net

cash from/(used in) investing activities.

Net free cash-flow

Net free cash flow corresponds to free cash flow after net

finance costs and net lease payments.

Like for like sales growth (LFL)

Sales generated by stores opened for at least twelve months,

excluding temporary store closures, at constant exchange rates,

excluding petrol and calendar effects and excluding IAS 29

impact.

Organic sales growth

Like for like sales growth plus net openings over the past

twelve months, including temporary store closures, at constant

exchange rates.

Gross margin

Gross margin corresponds to the sum of net sales and other

income, reduced by loyalty program costs and cost of goods sold.

Cost of sales comprise purchase costs, changes in inventory, the

cost of products sold by the financial services companies,

discounting revenue and exchange rate gains and losses on goods

purchased.

Recurring Operating Income (ROI)

Recurring Operating Income corresponds to the gross margin

lowered by sales, general and administrative expenses, depreciation

and amortization.

Recurring Operating Income Before Depreciation and

Amortization (EBITDA)

Recurring Operating Income Before Depreciation and Amortization

(EBITDA) also excludes depreciation and amortization from supply

chain activities which is booked in cost of goods sold.

Operating Income (EBIT)

Operating Income (EBIT) corresponds to the recurring operating

income after income from associates and joint ventures and

non-recurring income and expenses. This latter classification is

applied to certain material items of income and expense that are

unusual in terms of their nature and frequency, such as impairment

of non-current assets, gains and losses on sales of non-current

assets, restructuring costs and provisions recorded to reflect

revised estimates of risks provided for in prior periods, based on

information that came to the Group’s attention during the reporting

year.

® Net Promoter, Net Promoter System, Net Promoter Score, NPS and

the NPS-related emoticons are registered trademarks of Bain &

Company, Inc., Fred Reichheld and Satmetrix Systems, Inc

DISCLAIMER

This press release contains both historical and forward-looking

statements. These forward-looking statements are based on Carrefour

management's current views and assumptions. Such statements are not

guarantees of future performance of the Group. Actual results or

performances may differ materially from those in such forward

looking statements as a result of a number of risks and

uncertainties, including but not limited to the risks described in

the documents filed with the Autorité des Marchés Financiers as

part of the regulated information disclosure requirements and

available on Carrefour's website (www.carrefour.com), and in

particular the Annual Report (Document de Référence). These

documents are also available in English on the company's website.

Investors may obtain a copy of these documents from Carrefour free

of charge. Carrefour does not assume any obligation to update or

revise any of these forward-looking statements in the future.

_________________________ 1 Excluding petrol and calendar

effects and at constant exchange rates 2 Hyperinflation and foreign

exchange in Argentina 3 Market share based on NielsenIQ RMS data

for total food and non-food sales for the 13-week period ending

26/09/2021 for Carrefour Group, Carrefour Supermarkets, Carrefour

Convenience and Carrefour Drive vs the French total retail market

(Copyright © 2021, NielsenIQ) 4 Sum of Q3 2020 LFL and Q3 2021

LFL

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211020005811/en/

Investor Relations Sébastien Valentin, Anthony Guglielmo

and Antoine Parison Tel: +33 (0)1 64 50 82 57

Shareholder Relations Tel: 0 805 902 902 (toll-free in

France)

Group Communication Tel: +33 (0)1 58 47 88 80

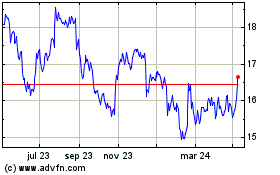

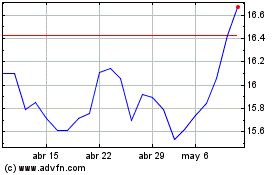

Carrefour (EU:CA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Carrefour (EU:CA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024