Pharming Group reports third quarter 2024 financial results and

provides business update

- Third quarter 2024 total

revenues increased by 12% to

US$74.8 million, compared to the third quarter 2023,

driven by continued strong RUCONEST® and Joenja® revenue

growth

- RUCONEST® third quarter

revenue increased by 6% to

US$63.6 million, compared to the third quarter 2023

- Joenja® (leniolisib) third

quarter revenue increased by 72%

to US$11.2 million, compared to the third quarter

2023

- First nine months total

revenues increased by 25% to

US$204.5 million, compared to the first nine months

2023

- On track for

2024 total revenue guidance of US$280 million -

US$295 million (14 - 20% growth)

- Third quarter operating

profit increased to US$4.1 million from US$1.9 million in the third

quarter 2023

- Overall cash and marketable

securities increased to US$173.3 million at the end of the third

quarter 2024 from US$161.8 million at the end of the second quarter

2024

- Sijmen de Vries, our

Executive Director/Chief Executive Officer, has informed the Board

of Directors that he will not be available for reappointment at the

next Annual General Meeting of Shareholders in May

2025

- Pharming to host a

conference call today at 13:30 CEST (7:30 am EDT)

Leiden, the Netherlands, October 24,

2024: Pharming Group N.V. (“Pharming” or “the Company”)

(Euronext Amsterdam: PHARM/NASDAQ: PHAR) presents its preliminary,

unaudited financial report for the three months ended

September 30, 2024.

Chief Executive Officer, Sijmen de

Vries, commented:

“Pharming has delivered an excellent third quarter, increasing

quarterly revenues by 12% to a record-high US$74.8 million and also

achieving record revenues of US$204.5 million for the first nine

months of the year. The combination of strong revenue performance,

combined with reduced operating expenses compared to the previous

quarter, enabled us to realize a positive operating profit in the

third quarter. We are firmly on track to meet our 2024 total

revenue guidance of US$280 million - US$295 million (14 - 20%

growth).

The third quarter demonstrated Pharming’s

ability to deliver continued growth for RUCONEST® in the

competitive U.S. HAE market, with strength in underlying demand

including new patient enrollments. Third quarter revenue for this

product increased by 6% compared to the same quarter in

2023.

For Joenja®, we continue to both increase

the number of patients on therapy quarter-on-quarter and to

maintain high adherence rates for these patients. We received U.K.

approval for Joenja® (leniolisib) in September, demonstrating our

active efforts with regulatory authorities to make this medicine

available to as many patients as possible, and now look forward to

the results of the reimbursement evaluation over the coming

quarters and to a subsequent commercial launch.

In October 2024, we announced the start of a

Phase II, proof of concept, clinical trial evaluating leniolisib in

primary immunodeficiencies (PIDs) with immune dysregulation linked

to PI3Kẟ signaling. This is an important step for Pharming as this

trial will include patients with various PIDs with significant

unmet medical need and much higher overall prevalence than APDS,

including ALPS-FAS, CTLA4 haploinsufficiency, NFKB1

haploinsufficiency and PTEN deficiency. With prevalence of

approximately seven patients per million, these PIDs represent a

potential five-fold increase in the commercial opportunity for

leniolisib, thereby ensuring Pharming is delivering on its mission

to serve the unserved rare disease patient.

I have informed the Board of Directors that

I will not be available, after a 16 year tenure at the helm of

Pharming, for reappointment as Executive Director/Chief Executive

Officer. Our company is in great shape today. So this is the right

moment for me to make way for a successor to lead Pharming into the

next chapter of its strategy for growth, building on the

achievements of the past years. I am proud of all these

achievements and grateful for the trust put in me by our patients,

employees and investors over the years. I will continue to dedicate

myself fully to Pharming until my successor has been appointed and

will do everything in my power to ensure a smooth

hand-over.”

Chairman of the Board of Directors, Dr.

Richard Peters, commented:

“On behalf of the entire Board of Directors, I would like to

thank Sijmen de Vries for his high commitment to Pharming over the

past 16 years and for the way he has created the company that it is

today, serving patients and paving the way for the delivery on the

company’s strategy for growth.

The Board of Directors has engaged a leading

global executive search firm for the search of a successor. Further

announcements will be made when appropriate.

We will of course take time to celebrate

Sijmen’s tenure as our CEO in the coming months.”

Third quarter highlights

Commercialized products

RUCONEST® marketed for the treatment of acute HAE

attacks

RUCONEST® continued to perform well in the third

quarter of 2024, with revenues of US$63.6 million, a 6% increase

compared to the third quarter of 2023. Revenue for the first nine

months of 2024 was US$172.6 million, a 12% increase compared to the

same period in 2023.

The U.S. market contributed 97% of third quarter

revenues, while the EU and Rest of World contributed 3%.

In the U.S. market, we saw continued strength in

the third quarter in underlying in-market demand, including

approximately 100 new patient enrollments. We achieved strong

overall performance in the third quarter in other leading key

revenue indicators including the number of prescribers, the total

number of patients on therapy, and vials shipped to patients.

Increasing enrollments helped to drive a sharp increase in unique

patient shipments in the third quarter.

Joenja® (leniolisib) marketed for the treatment of

APDS

Joenja® revenues increased to US$11.2 million in

the third quarter of 2024, a 72% increase compared to the third

quarter of 2023. This increase was mostly driven by higher volume

from the 50% increase in patients on paid therapy in the U.S.

compared to the third quarter of 2023, and revenues from EU and

Rest of World which are from product provided on a named patient

basis. Revenue for the first nine months of 2024 was US$31.9

million, compared to US$10.3 million for the same period in

2023.

As of September 30, 2024, we have 93 patients on

paid therapy in the U.S. and an additional five patients enrolled

and pending authorization, representing an increase of both active

and pending patients during the third quarter and continued

progress enrolling and moving eligible patients to paid

therapy.

Joenja® (leniolisib) development updates

Leniolisib for APDS

Pharming made continued progress in the third

quarter of 2024 on leniolisib regulatory filings for APDS patients

12 years of age and older in key global markets. Pharming is on

track to complete the manufacturing activities requested by the

European Medicines Agency’s (EMA) Committee for Human Medicinal

Products (CHMP) and submit a response prior to the January 2026

deadline. In addition, Pharming progressed ongoing clinical trials

to support regulatory filings for approval in Japan and pediatric

label expansion beginning in 2025. Data readout from the clinical

trial for children ages 4 to 11 years old is expected in the fourth

quarter of 2024.

In total, there are currently 164 patients in a

leniolisib Expanded Access Program (compassionate use), an ongoing

clinical study, or a named patient program.

United Kingdom

On September 25, 2024, the U.K. Medicines and

Healthcare products Regulatory Agency (MHRA) granted marketing

authorization for Joenja® (leniolisib) for the treatment of APDS in

adult and pediatric patients 12 years of age and older. Joenja® was

the first new medicine approved by the MHRA via the International

Recognition Procedure (IRP) using the U.S. FDA as reference

regulator. Leniolisib is currently under evaluation by the National

Institute for Health and Care Excellence (NICE) regarding

reimbursement within the National Health Service (NHS) in

England.

Leniolisib for additional indications (PI3Kδ platform) -

Primary immunodeficiencies (PIDs) beyond APDS

On October 10, 2024, Pharming announced the

start of a Phase II, proof of concept, clinical trial evaluating

leniolisib in PIDs with immune dysregulation linked to PI3Kẟ

signaling in lymphocytes, with similar clinical phenotypes and

unmet medical needs to APDS. The first patient is expected to be

enrolled in the study in the coming weeks. The clinical trial will

include PID patients with ALPS-FAS, CTLA4 haploinsufficiency, NFKB1

haploinsufficiency and PTEN deficiency, among others. Epidemiology

suggests a prevalence of approximately seven patients per million

in this targeted PID population, compared to one to two patients

per million for APDS.

The Phase II clinical trial is a single arm,

open-label, dose range-finding study to be conducted in

approximately 12 patients. The objectives for the trial will be to

assess safety and tolerability, pharmacokinetics, pharmacodynamics,

and explore clinical efficacy of leniolisib in the targeted PID

population. The trial has been designed to inform a subsequent

Phase III program.

Pharming has also prioritized development of

leniolisib for an additional PID indication. Pharming will provide

further updates and details on our plans, including the proposed

clinical development plan, later this year.

Organizational update

Sijmen de Vries, our Executive Director/Chief

Executive Officer, has informed the Board of Directors that he will

not be available for reappointment at the Company’s next Annual

General Meeting of Shareholders (AGM) in May 2025. The mandate of

Sijmen de Vries is scheduled to expire at the closing of the AGM to

be held in May 2025. Further announcements on the search of a

successor will be made when appropriate.

Financial Summary

|

Consolidated Statement of Income |

3Q 2024 |

3Q 2023 |

9M 2024 |

9M 2023 |

|

Amounts in US$m except per share data |

|

|

|

|

|

Total Revenues |

74.8 |

66.7 |

204.5 |

164.1 |

|

Cost of sales |

(6.8) |

(8.3) |

(23.2) |

(18.1) |

|

Gross profit |

68.0 |

58.4 |

181.3 |

146.0 |

|

Other income |

0.8 |

0.3 |

2.1 |

22.8 |

|

Research and development |

(20.7) |

(20.8) |

(60.8) |

(57.3) |

|

General and administrative |

(15.3) |

(10.9) |

(46.0) |

(31.9) |

|

Marketing and sales |

(28.7) |

(25.1) |

(91.9) |

(86.1) |

|

Other Operating Costs |

(64.7) |

(56.8) |

(198.7) |

(175.3) |

|

Operating profit (loss) |

4.1 |

1.9 |

(15.3) |

(6.5) |

|

Finance income (expense) and share of net profits in

associates |

(2.6) |

1.4 |

0.1 |

(3.5) |

|

Profit (loss) before tax |

1.5 |

3.3 |

(15.2) |

(10.0) |

|

Income tax credit (expense) |

(2.5) |

0.2 |

0.5 |

2.6 |

|

Profit (loss) for the period |

(1.0) |

3.5 |

(14.7) |

(7.4) |

|

Share Information |

|

|

|

|

|

Basic earnings per share (US$) |

(0.002) |

0.005 |

(0.022) |

(0.011) |

|

Diluted earnings per share (US$) |

(0.002) |

0.005 |

(0.022) |

(0.011) |

|

Segment information - Revenues |

3Q 2024 |

3Q 2023 |

9M 2024 |

9M 2023 |

|

Amounts in US$m |

|

|

|

|

|

Revenue - RUCONEST® (US) |

62.0 |

58.4 |

168.4 |

149.3 |

|

Revenue - RUCONEST® (EU and RoW) |

1.6 |

1.8 |

4.2 |

4.5 |

|

Total Revenues - RUCONEST® |

63.6 |

60.2 |

172.6 |

153.8 |

|

Revenue - Joenja® (US) |

10.0 |

6.5 |

28.7 |

10.3 |

|

Revenue - Joenja® (EU and RoW) |

1.2 |

— |

3.2 |

— |

|

Total Revenues - Joenja® |

11.2 |

6.5 |

31.9 |

10.3 |

|

|

|

|

|

|

|

Total Revenues - US |

72.0 |

64.9 |

197.1 |

159.6 |

|

Total Revenues - EU and RoW |

2.8 |

1.8 |

7.4 |

4.5 |

|

|

|

|

|

|

|

Total Revenues |

74.8 |

66.7 |

204.5 |

164.1 |

|

Consolidated Balance Sheet |

September 30, 2024 |

December 31, 2023 |

|

Amounts in US$m |

|

|

|

Cash and cash equivalents, restricted cash and marketable

securities |

173.3 |

215.0 |

|

Current assets |

282.2 |

316.3 |

|

Total assets |

425.5 |

462.9 |

|

Current liabilities |

79.8 |

78.0 |

|

Equity |

225.8 |

218.8 |

Financial highlights

Third quarter 2024

For the third quarter of 2024, total revenues

increased by US$8.2 million, or 12%, to US$74.8 million, compared

to US$66.7 million in the third quarter of 2023. RUCONEST® revenues

amounted to US$63.6 million, a 6% increase compared to the third

quarter of 2023. The volume increase in the U.S., and a U.S. price

increase in line with CPI, were the primary factors behind this

increase in RUCONEST® revenues. Joenja® revenues amounted to

US$11.2 million in the third quarter of 2024, a 73% increase

compared to the third quarter of 2023. This increase was primarily

driven by an increase in volume.

Gross profit increased by US$9.7 million or 17%

to US$68.0 million (3Q 2023: US$58.4 million), mainly due to the

increase in revenues.

The operating profit amounted to US$4.1 million

compared to an operating profit of US$1.9 million in the third

quarter of 2023. This increase was primarily due to the increase in

gross profit mentioned above, offset by the increase in operating

expenses from US$56.8 million in the third quarter of 2023 to

US$64.7 million. The increase in operating expenses compared to the

same quarter in 2023 was caused by a combination of continuing

investments in Joenja® in the U.S., launch preparation for

leniolisib outside of the U.S., increasing R&D investments to

expand the leniolisib franchise and increased payroll expenses due

to business growth. Third quarter 2024 operating expenses decreased

8% from US$70.1 million in the second quarter of 2024.

The net finance result amounted to a loss of

US$2.2 million compared to a gain of US$1.9 million in the third

quarter of 2023. This was primarily driven by unfavorable EUR/USD

exchange rate developments, resulting in a foreign currency loss of

US$1.5 million compared to a gain of US$1.7 million in the third

quarter of 2023. Additionally, interest expense increased by US$1.0

million in the third quarter of 2024 compared to the previous year,

following the convertible bond issuance in the second quarter of

2024.

The Company had a net loss of US$1.0 million,

compared to a net profit of US$3.5 million in the third quarter of

2023. This change was mainly due to higher finance expense

resulting from unfavorable EUR/USD exchange rate developments and

higher income tax expenses, despite higher operating profit. While

the exchange rate fluctuations resulted in a foreign currency loss

in the income statement, currency translation differences in other

comprehensive income led to a positive result of US$2.9 million,

compared to a negative result of US$5.2 million in the third

quarter of 2023. This outcome was driven by the Company’s

predominantly euro-denominated assets, including the vast majority

of the cash and marketable securities position.

Cash and cash equivalents, including restricted

cash and marketable securities, increased from US$161.8 million at

the end of second quarter of 2024 to US$173.3 million at the end of

the third quarter of 2024. This increase was primarily driven by

positive cash flows from operations of US$9.7 million (3Q 2023:

US$3.5 million), which includes a deduction of US$9.1 million in

paid taxes (3Q 2023: US$0.0 million).

Nine months 2024

Total revenues increased 25% during the first

nine months of 2024 to US$204.5 million, versus US$164.1 million

during the first nine months of 2023. Total RUCONEST® revenues were

12% higher at US$172.6 million, compared to revenues of US$153.8

million for the first nine months of 2023. Joenja® revenues

amounted to US$31.9 million in the first nine months of 2024, a

210% increase compared to the first nine months of 2023 (first

sales commenced at the start of the second quarter of 2023). This

increase was primarily driven by an increase in volume.

Gross profit increased by US$35.3 million or 24%

to US$181.3 million (9M 2023: US$146.0 million), mainly due to the

increase in revenues.

Other income decreased to US$2.0 million

compared to US$22.8 million in the first nine months of 2023. Other

income in the first nine months of 2023 was supported by the sale

of the Rare Pediatric Disease Priority Review Voucher (PRV) to

Novartis for a pre-agreed, one-time payment of US$21.1 million.

The operating loss amounted to US$15.3 million

compared to an operating loss of US$6.5 million in the first nine

months of 2023. This change was mainly due to the decrease in other

income and the expected increase in operating expenses from

US$175.3 million in the first nine months of 2023 to US$198.7

million, offset by the above mentioned increase in gross profit in

the first nine months of 2024. The first nine months of 2023

operating expenses included milestone payments for Joenja® of

US$10.5 million in the second quarter. The increase in operating

expenses in the first nine months of 2024 was caused by a

combination of continuing investments in Joenja® in the U.S.,

launch preparation for leniolisib outside of the U.S., increasing

R&D investments to expand the leniolisib franchise and

increased payroll expenses due to business growth. Excluding the

one time proceeds from the PRV sale and the milestone payment

expenses for Joenja® in the first nine months of 2023, the

operating loss decreased from US$17.1 million to US$15.3 million in

the first nine months of the current year.

The net finance result amounted to a gain of

US$1.4 million compared to a loss of US$2.6 million in the first

nine months of 2023. This was primarily driven by a fair value gain

of US$5.2 million upon the reclassification of the convertible

bond-related derivative to equity. This fair value gain was a

result of the decrease in value of the option component classified

as a derivative from issuance until the physical settlement date of

the newly issued convertible bond. In addition, interest income

from investments in marketable securities, which commenced in the

second quarter of 2023, increased by US$1.7 million. These positive

results were partially offset by US$1.1 million higher interest

expense on the 2024 issued convertible bond and unfavorable EUR/USD

exchange rate developments, which led to a foreign currency loss of

US$1.3 million compared to a loss of US$0.1 million in the first

nine months of 2023.

The Company had a net loss of US$14.7 million,

compared to a net loss of US$7.4 million in the first nine months

of 2023. In addition to the support in other income from the PRV

and the milestone payments for Joenja® in the first nine months of

2023, the change was mainly due to an increase in gross profit,

higher interest income and the fair value gain upon the

reclassification of the convertible bond-related derivative to

equity, offset by an increase in operating expenses, unfavorable

EUR/USD exchange rate developments and higher interest expenses on

the 2024 issued convertible bond.

Cash and cash equivalents, including restricted

cash and marketable securities, decreased from US$215.0 million at

the end of 2023 to US$173.3 million at the end of September 2024.

This decrease was primarily driven by the repurchase of the

outstanding convertible bonds amounting to US$134.9 million and

paid taxes of US$13.9 million, offset by net proceeds of US$104.5

million for newly issued convertible bonds.

On 5 October 2023, Orchard Therapeutics Plc.

(Orchard) announced it had entered into a definitive agreement with

Japanese company Kyowa Kirin Co. LTD for the acquisition of

Orchard. During the first nine months of 2024, Pharming received

US$2.0 million in cash for its shares held in Orchard. Pharming has

terminated the research collaboration & licensing agreement

with Orchard Therapeutics and discontinued the OTL-105 program.

Outlook/Summary

For the remainder of 2024 and the full year, the

Company anticipates:

- Total revenues between US$280

million and US$295 million (14% to 20% growth).

- Continued progress finding

additional APDS patients in the U.S., supported by family testing

and VUS validation efforts, and subsequently converting patients to

paid Joenja® (leniolisib) therapy.

- Increasing leniolisib ex-U.S.

revenues - through our Named Patient Program and other funded early

access programs in key global markets.

- Completion of leniolisib clinical

trials to support regulatory filings for approval in Japan and

pediatric label expansion in key global markets.

- Progress towards regulatory

approvals for leniolisib in the EEA, Canada and Australia.

- Advancing the Phase II clinical

trial for leniolisib in PIDs with immune dysregulation linked to

PI3Kδ signaling to significantly expand the long-term commercial

potential of leniolisib.

- Continued focus on potential

acquisitions and in-licensing of clinical stage opportunities in

rare diseases. Financing, if required, would come via a combination

of our strong balance sheet and access to capital markets.

No further specific financial guidance for 2024

is provided.

Additional information

Presentation

The conference call presentation is available on

the Pharming.com website from 07:30 CEST today.

Conference Call

The conference call will begin at 13:30

CEST/07:30 EDT on Thursday, October 24. A transcript will be made

available on the Pharming.com website in the days following the

call.

Please note, the Company will only take

questions from dial-in attendees.

Webcast Link:

https://edge.media-server.com/mmc/p/yotjk8ib

Conference call dial-in details:

https://register.vevent.com/register/BId118ac68d9124f67b1a83e3769559100

Additional information on how to register for the conference

call/webcast can be found on the Pharming.com website.

For further public information, contact:

Pharming Group N.V., Leiden, the

Netherlands

Michael Levitan, VP Investor Relations & Corporate

Communications

T: +1 (908) 705 1696

E: investor@pharming.com

FTI Consulting, London, UK

Victoria Foster Mitchell/Alex Shaw

T: +44 203 727 1000

LifeSpring Life Sciences Communication,

Amsterdam, the Netherlands

Leon Melens

T: +31 6 53 81 64 27

E: pharming@lifespring.nl

About Pharming Group N.V.

Pharming Group N.V. (EURONEXT Amsterdam:

PHARM/Nasdaq: PHAR) is a global biopharmaceutical company dedicated

to transforming the lives of patients with rare, debilitating, and

life-threatening diseases. Pharming is commercializing and

developing an innovative portfolio of protein replacement therapies

and precision medicines, including small molecules and biologics.

Pharming is headquartered in Leiden, the Netherlands, and has

employees around the globe who serve patients in over 30 markets in

North America, Europe, the Middle East, Africa, and

Asia-Pacific.

For more information, visit www.pharming.com and

find us on LinkedIn.

Auditor’s involvement

The Condensed Consolidated Interim Financial

Statements have not been audited by the Company’s statutory

auditor.

Forward-looking Statements

This press release may contain

forward-looking statements. Forward-looking statements are

statements of future expectations that are based on management’s

current expectations and assumptions and involve known and unknown

risks and uncertainties that could cause actual results,

performance, or events to differ materially from those expressed or

implied in these statements. These forward-looking statements are

identified by their use of terms and phrases such as “aim”,

“ambition”, ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘estimate’’,

‘‘expect’’, ‘‘goals’’, ‘‘intend’’, ‘‘may’’, “milestones”,

‘‘objectives’’, ‘‘outlook’’, ‘‘plan’’, ‘‘probably’’, ‘‘project’’,

‘‘risks’’, “schedule”, ‘‘seek’’, ‘‘should’’, ‘‘target’’, ‘‘will’’

and similar terms and phrases. Examples of forward-looking

statements may include statements with respect to timing and

progress of Pharming's preclinical studies and clinical trials of

its product candidates, Pharming's clinical and commercial

prospects, and Pharming's expectations regarding its projected

working capital requirements and cash resources, which statements

are subject to a number of risks, uncertainties and assumptions,

including, but not limited to the scope, progress and expansion of

Pharming's clinical trials and ramifications for the cost thereof;

and clinical, scientific, regulatory, commercial, competitive and

technical developments. In light of these risks and uncertainties,

and other risks and uncertainties that are described in Pharming's

2023 Annual Report and the Annual Report on Form 20-F for the year

ended December 31, 2023, filed with the U.S. Securities and

Exchange Commission, the events and circumstances discussed in such

forward-looking statements may not occur, and Pharming's actual

results could differ materially and adversely from those

anticipated or implied thereby. All forward-looking statements

contained in this press release are expressly qualified in their

entirety by the cautionary statements contained or referred to in

this section. Readers should not place undue reliance on

forward-looking statements. Any forward-looking statements speak

only as of the date of this press release and are based on

information available to Pharming as of the date of this release.

Pharming does not undertake any obligation to publicly update or

revise any forward-looking statement as a result of new

information, future events or other information.

Inside Information

This press release relates to the disclosure of information

that qualifies, or may have qualified, as inside information within

the meaning of Article 7(1) of the EU Market Abuse

Regulation.

Pharming Group N.V.

Condensed Consolidated Interim Financial

Statements in US Dollars (unaudited)

For the period ended September 30, 2024

- Condensed consolidated interim

statement of income

- Condensed consolidated interim

statement of comprehensive income

- Condensed consolidated interim

balance sheet

- Condensed consolidated interim

statement of changes in equity

- Condensed consolidated interim

statement of cash flows

|

CONDENSED CONSOLIDATED INTERIM STATEMENT OF

INCOME |

| For the

period ended September 30 |

|

|

|

Amounts in US$ ‘000 |

3Q 2024 |

3Q 2023 |

9M 2024 |

9M 2023 |

|

Revenues |

74,849 |

66,661 |

204,528 |

164,099 |

|

Costs of sales |

(6,819) |

(8,295) |

(23,186) |

(18,094) |

|

Gross profit |

68,030 |

58,366 |

181,342 |

146,005 |

|

Other income |

777 |

304 |

2,034 |

22,811 |

|

Research and development |

(20,721) |

(20,753) |

(60,839) |

(57,287) |

|

General and administrative |

(15,292) |

(10,886) |

(45,999) |

(31,849) |

|

Marketing and sales |

(28,686) |

(25,123) |

(91,863) |

(86,136) |

|

Other Operating Costs |

(64,699) |

(56,762) |

(198,701) |

(175,272) |

|

Operating profit (loss) |

4,108 |

1,908 |

(15,325) |

(6,456) |

|

Fair value gain (loss) on revaluation |

21 |

— |

5,159 |

— |

|

Other finance income |

825 |

1,251 |

3,760 |

2,050 |

|

Other finance expenses |

(2,998) |

633 |

(7,488) |

(4,621) |

|

Finance result, net |

(2,152) |

1,884 |

1,431 |

(2,571) |

|

Share of net profits (loss) in associates using the equity

method |

(442) |

(485) |

(1,276) |

(954) |

|

Profit (loss) before tax |

1,514 |

3,307 |

(15,170) |

(9,981) |

|

Income tax credit (expense) |

(2,548) |

157 |

470 |

2,556 |

|

Profit (loss) for the period |

(1,034) |

3,464 |

(14,700) |

(7,425) |

|

Basic earnings per share (US$) |

(0.002) |

0.005 |

(0.022) |

(0.011) |

|

Diluted earnings per share (US$) |

(0.002) |

0.005 |

(0.022) |

(0.011) |

|

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME |

| For the

period ended September 30 |

|

|

|

Amounts in US$ ‘000 |

3Q 2024 |

3Q 2023 |

9M 2024 |

9M 2023 |

|

Profit (loss) for the period |

(1,034) |

3,464 |

(14,700) |

(7,425) |

|

Currency translation differences |

2,883 |

(5,158) |

(1,352) |

(2,079) |

|

Items that may be subsequently reclassified to profit or

loss |

2,883 |

(5,158) |

(1,352) |

(2,079) |

|

Fair value remeasurement investments |

1 |

281 |

79 |

419 |

|

Items that shall not be subsequently reclassified to profit

or loss |

1 |

281 |

79 |

419 |

|

Other comprehensive income (loss), net of tax |

2,884 |

(4,877) |

(1,273) |

(1,660) |

|

Total comprehensive income (loss) for the

period |

1,850 |

(1,413) |

(15,973) |

(9,085) |

| CONDENSED

CONSOLIDATED INTERIM BALANCE SHEET |

|

|

|

|

|

|

|

Amounts in US$ ‘000 |

September 30, 2024 |

December 31, 2023 |

|

Non-current assets |

|

|

|

Intangible assets |

67,096 |

71,267 |

|

Property, plant and equipment |

8,692 |

9,689 |

|

Right-of-use assets |

21,975 |

23,777 |

|

Long-term prepayments |

93 |

92 |

|

Deferred tax assets |

36,752 |

29,761 |

|

Investment accounted for using the equity method |

1,016 |

2,285 |

|

Investments in equity instruments designated as at FVTOCI |

— |

2,020 |

|

Investment in debt instruments designated as at FVTPL |

6,150 |

6,093 |

|

Restricted cash |

1,548 |

1,528 |

|

Total non-current assets |

143,322 |

146,512 |

|

Current assets |

|

|

|

Inventories |

62,227 |

56,760 |

|

Trade and other receivables |

48,199 |

46,158 |

|

Marketable securities |

111,104 |

151,683 |

|

Cash and cash equivalents |

60,662 |

61,741 |

|

Total current assets |

282,192 |

316,342 |

|

Total assets |

425,514 |

462,854 |

|

Equity |

|

|

|

Share capital |

7,750 |

7,669 |

|

Share premium |

487,079 |

478,431 |

|

Other reserves |

9,334 |

(2,057) |

|

Accumulated deficit |

(278,371) |

(265,262) |

|

Shareholders’ equity |

225,792 |

218,781 |

|

Non-current liabilities |

|

|

|

Convertible bonds |

92,099 |

136,598 |

|

Lease liabilities |

27,784 |

29,507 |

|

Total non-current liabilities |

119,883 |

166,105 |

|

Current liabilities |

|

|

|

Convertible bonds |

3,319 |

1,824 |

|

Trade and other payables |

72,638 |

72,528 |

|

Lease liabilities |

3,882 |

3,616 |

|

Total current liabilities |

79,839 |

77,968 |

|

Total equity and liabilities |

425,514 |

462,854 |

|

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN

EQUITY |

| For the

period ended September 30 |

|

Attributable to owners of the parent |

|

|

|

|

|

|

|

|

Amounts in US$ ‘000 |

Share capital |

Share premium |

Other reserves |

Accumulated deficit |

Total equity |

|

Balance at January 1, 2023 |

7,509 |

462,297 |

(8,737) |

(256,431) |

204,638 |

|

Profit (loss) for the period |

— |

— |

— |

(7,425) |

(7,425) |

|

Reserves |

— |

— |

— |

— |

— |

|

Other comprehensive income (loss) for the period |

— |

— |

(1,660) |

— |

(1,660) |

|

Total comprehensive income (loss) for the

period |

— |

— |

(1,660) |

(7,425) |

(9,085) |

|

Other reserves |

— |

— |

(518) |

518 |

— |

|

Income tax benefit from excess tax deductions related to

share-based payments |

— |

— |

— |

574 |

574 |

|

Share-based compensation |

— |

— |

— |

5,935 |

5,935 |

|

Options exercised / LTIP shares issued |

141 |

13,686 |

— |

(5,947) |

7,880 |

|

Value of conversion rights of convertible bonds |

— |

— |

— |

— |

— |

|

Total transactions with owners, recognized directly in

equity |

141 |

13,686 |

(518) |

1,080 |

14,389 |

|

Balance at September 30, 2023 |

7,650 |

475,983 |

(10,915) |

(262,776) |

209,942 |

|

|

|

|

|

|

|

|

Balance at January 1, 2024 |

7,669 |

478,431 |

(2,057) |

(265,262) |

218,781 |

|

Profit (loss) for the period |

— |

— |

— |

(14,700) |

(14,700) |

|

Reserves |

— |

— |

1,560 |

(1,560) |

— |

|

Other comprehensive income (loss) for the period |

— |

— |

(1,273) |

— |

(1,273) |

|

Total comprehensive income (loss) for the

period |

— |

— |

287 |

(16,260) |

(15,973) |

|

Other reserves |

— |

— |

(31) |

31 |

— |

|

Income tax benefit from excess tax deductions related to

share-based payments |

— |

— |

— |

(241) |

(241) |

|

Share-based compensation |

— |

— |

— |

8,605 |

8,605 |

|

Options exercised / LTIP shares issued |

81 |

8,648 |

— |

(5,244) |

3,485 |

|

Value of conversion rights of convertible bonds |

— |

— |

11,135 |

— |

11,135 |

|

Total transactions with owners, recognized directly in

equity |

81 |

8,648 |

11,104 |

3,151 |

22,984 |

|

Balance at September 30, 2024 |

7,750 |

487,079 |

9,334 |

(278,371) |

225,792 |

|

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH

FLOWS |

| For

the period ended September 30 |

|

|

|

Amounts in $’000 |

3Q 2024 |

3Q 2023 |

9M 2024 |

9M 2023 |

|

Profit (loss) before tax |

1,514 |

3,307 |

(15,170) |

(9,981) |

|

Adjustments to reconcile net profit (loss) to net cash

used in operating activities: |

|

|

|

|

|

Depreciation, amortization, impairment of non-current assets |

2,743 |

2,902 |

8,371 |

8,370 |

|

Equity settled share based payments |

2,918 |

1,965 |

8,605 |

5,935 |

|

Fair value loss (gain) on revaluation |

(21) |

— |

(5,159) |

— |

|

Gain on disposal from PRV sale |

— |

— |

— |

(21,080) |

|

Other finance income |

(182) |

(1,251) |

(3,117) |

(2,050) |

|

Other finance expenses |

2,315 |

(633) |

6,765 |

4,621 |

|

Share of net result in associates using the equity method |

442 |

485 |

1,276 |

954 |

|

Other |

— |

1,055 |

— |

(1,130) |

|

Operating cash flows before changes in working

capital |

9,729 |

7,830 |

1,571 |

(14,361) |

|

Changes in working capital: |

|

|

|

|

|

Inventories |

(2,133) |

(396) |

(5,248) |

(11,113) |

|

Trade and other receivables |

2,919 |

(7,363) |

(2,044) |

(12,902) |

|

Payables and other current liabilities |

6,560 |

3,242 |

4,305 |

8,075 |

|

Restricted cash |

— |

(47) |

— |

363 |

|

Total changes in working capital |

7,346 |

(4,563) |

(2,987) |

(15,577) |

|

|

|

|

|

|

|

Interest received |

1,784 |

260 |

4,154 |

1,059 |

|

Income taxes received (paid) |

(9,117) |

— |

(13,864) |

— |

|

Net cash flows generated from (used in) operating

activities |

9,742 |

3,527 |

(11,126) |

(28,879) |

|

|

|

|

|

|

|

Capital expenditure for property, plant and equipment |

(366) |

(147) |

(660) |

(1,133) |

|

Proceeds on PRV sale |

— |

— |

— |

21,080 |

|

Investment intangible assets |

— |

23 |

— |

23 |

|

Disposal of investment designated as at FVOCI |

8 |

— |

1,972 |

— |

|

Purchases of marketable securities |

(109,796) |

(144,554) |

(222,249) |

(231,901) |

|

Proceeds from sale of marketable securities |

114,504 |

86,451 |

262,345 |

86,451 |

|

Net cash flows generated from (used in) investing

activities |

4,350 |

(58,227) |

41,408 |

(125,480) |

|

|

|

|

|

|

|

Payment of lease liabilities |

(918) |

(1,007) |

(2,485) |

(3,022) |

|

Interests on lease liabilities |

(258) |

(270) |

(784) |

(825) |

|

Net proceeds of issued convertible bonds |

(263) |

— |

104,539 |

— |

|

Repurchase of convertible bonds |

(9) |

— |

(134,931) |

— |

|

Interests on convertible bonds |

(8) |

(2,029) |

(2,032) |

(4,052) |

|

Settlement of share based compensation awards |

23 |

8,546 |

3,485 |

7,880 |

|

Net cash flows generated from (used in) financing

activities |

(1,433) |

5,240 |

(32,208) |

(19) |

|

|

|

|

|

|

|

Increase (decrease) of cash |

12,659 |

(49,460) |

(1,926) |

(154,378) |

|

Exchange rate effects |

861 |

(913) |

847 |

1,689 |

|

Cash and cash equivalents at the beginning of the period |

47,142 |

105,026 |

61,741 |

207,342 |

|

|

|

|

|

|

|

Total cash and cash equivalents at September

30 |

60,662 |

54,653 |

60,662 |

54,653 |

- Pharming reports 3Q24 financial results_EN_24OCT24

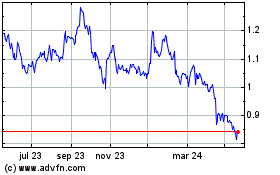

Pharming Group NV (EU:PHARM)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

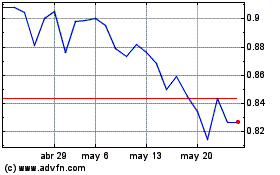

Pharming Group NV (EU:PHARM)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025