MARKET WRAPS

Watch For:

Euro area inflation flash estimate; Germany unemployment; France

provisional CPI, PPI, detailed GDP figures, housing starts,

consumer spending, Italy provisional CPI, GDP; trading updates from

Fresenius Medical Care, Hapag-Lloyd, IAG, SAS, Renishaw, Evraz

Opening Call:

Shares may notch gains at Wednesday's open after China outlined

plans to bolster Covid-19 vaccinations, boosting hopes for the end

of lockdowns. In Asia, major stock benchmarks were mostly higher;

Treasury yields fell; the dollar slipped; while oil and gold were

firmer. In Asia, stock benchmarks were mostly higher; Treasury

yields fell; the dollar slipped; while oil and gold were

firmer.

Equities:

European shares appear set to open on a firm note on Wednesday

after closing mixed overnight, as investors focus on an upcoming

speech by Federal Reserve Chairman Jerome Powell, as well as

progress in China's eventual reopening.

The market is overall skeptical about the more positive China

developments, but the same can't be said of the FTSE 100, IG

said.

"Solid gains from Asia-focused names HSBC and Standard Chartered

show that at least some investors think the government in China

will respond by loosening Covid restrictions, while the lower

dollar has boosted commodity prices and thus given the raw

materials and energy sector a boost," IG said.

China's government has said it will prioritize increasing

vaccination rates among the elderly, which is seen as a sign that

the country is slowly progressing towards reopening, SPI Asset

Management noted.

Whatever Powell says at the Brookings Institution could be a

preview of the next rate-setting meeting on Dec. 13-14, said UBS

Global Wealth Management.

There is some concern that a hawkish tone from Powell could undo

the gains that equities have made over the past two months.

"There's a little bit of fear," UBS Global said.

Forex:

The dollar was weaker ahead of Powell's speech and key U.S. data

later in the week.

"Optimism that China may be inching away from Covid-zero has

lifted too, but the path is likely to be a gradual one, and U.S.

stocks came off overnight despite China's strong showing

yesterday," ANZ said.

Forex markets are seeing a lot of themes other than Fed rate

increases, Silicon Valley Bank said. "It's not just dollar up or

dollar down vs. everything."

China is dominating headlines, Silicon Valley Bank said, with

some optimism on signs of the economy reopening. That's not only

strengthening the renminbi but also commodity currencies "with the

assumption that a fully functioning Chinese economy is good for

commodities," it said.

Meanwhile Germany's CPI came in softer than expected, but

inflation there is still in the double digits, it said, with "the

euro catching some weakness on that."

Bonds:

Treasury yields weakened ahead of U.S. employment data, and with

investors absorbing the latest hawkish comments from Fed officials,

who indicated they will probably leave borrowing costs high for

years to come.

The odds of a 75-basis-point rate increase in December rose to

32.5% in the CME's FedWatch tool, from 24.2% a week ago. The

highest odds are for a 50-basis-point rate hike.

Investors have also recently been considering the prospects of

slowing global economic growth, stemming from Covid-19 lockdowns in

China and Russia's invasion of Ukraine. The Treasury curve remains

at one of its most negative levels since 1981-1982.

The ADP November report is expected to show a slowdown in job

creation.

Energy:

Oil prices rose in Asia, extending overnight gains amid hopes

that China, the world's largest oil importer, might loosen its

Covid-19 restrictions.

"The hope stems from the conciliatory tone taken by China's

National Health Commission, particularly the concession that there

was an excessive implementation of Covid controls," CBA said.

"The announcement follows unprecedented street protests against

President Xi [Jinping], and is the first indication that Beijing

may be considering a relaxation of its draconian Covid-control

policies. The prospect of a return to normality, in an economy that

is the world's largest oil importer, was enough to make oil prices

jump, in the first significant price rebound of the last two

weeks," ActivTrades said.

Market focus will also be on the OPEC+ meeting on Dec. 4, where

members will decide on oil-production levels.

"We think the group will keep output levels unchanged,

particularly given the group is set to meet virtually," CBA

added.

Metals:

Gold was little changed, after rising overnight as the dollar

stabilized.

The precious metal may be supported in the near term, if China's

health authority offers some clear signals that the country is

close to tweaking the zero-Covid policy, Oanda said.

"Gold needs a strong China as it drives risk appetite and could

bolster demand for jewelry," Oanda added.

"A potential recovery in the dollar and still-rising interest

rates around the world means investors might shy away from low- and

zero-yielding assets like gold," said Fawad Razaqzada, market

analyst at City Index and Forex.com.

The factor that "matters the most" is the Federal Reserve's

stance towards its monetary policy, said AvaTrade.

A strong U.S. jobs number, due out Friday, could make the Fed

think about its monetary policy, it said. The central bank "could

adopt an ultra-hawkish monetary policy like before but so far, "the

hope...is that the Fed will slow the roll in terms of increasing

the interest rate."

---

Base metals prices rose. Prices are stronger amid signs that

China may be loosening some of its restrictive measures of their

Covid-zero policies, ANZ said.

Following the weekend protests, the country is now pushing for

greater vaccination of the elderly, driving speculation that

Covid-related restrictions could be eased further, the bank

added.

---

Chinese iron-ore futures fell, taking a breather after a recent

uptrend.

The steelmaking material could come under pressure from

seasonality factors and Covid-19 outbreaks across China that are

hampering demand for steel, Guotai Junan Futures said.

However, the supportive measures that regulators rolled out

recently for the real-estate sector may help buoy sentiment toward

the raw material in the near term, it added.

TODAY'S TOP HEADLINES

China's Factory, Construction, Service Activities Contract

Further in November

China's official gauges measuring factory, construction and

service activities slipped further into contraction in November,

weighed by the country's stringent Covid restrictions that have

throttled production, along with a deepening property slump and

slowing global demand.

The official manufacturing purchasing managers index fell to

48.0 in November, down from 49.2 in October, the National Bureau of

Statistics said Wednesday. It was also lower than the 48.9 reading

expected by economists polled by The Wall Street Journal and the

lowest level since April, when Shanghai-China's financial and

manufacturing hub-was locked down.

China Officials Soften Tone on Covid Curbs Amid Protests

Chinese health officials softened their messaging on the risks

of Covid-19, urging local governments to avoid unnecessary and

lengthy lockdowns, after protesters across the country denounced

the strict controls.

The Omicron variant has caused fewer deaths and less severe

sickness than previous Covid variants, a health official said at a

press conference Tuesday.

OPEC+ Leans Toward Maintaining Flat Production, Delegates

Say

OPEC and other big oil producers are likely to decide to keep

output levels flat at their meeting Sunday, the group's delegates

said, amid mounting concerns over returning Covid-related lockdowns

in China and lingering uncertainty over Russia's ability to

pump.

The 13-member Organization of the Petroleum Exporting Countries

and a separate group of producers led by Russia-collectively as

OPEC+-are leaning toward approving the same production levels

agreed to in October, when they greenlighted a 2 million barrels a

day output cut, the delegates said. Sunday's meeting was planned to

take place in person at OPEC's headquarters in Vienna, but it will

now be held remotely to avoid negative media scrutiny, the

delegates said.

RBC Bets on Immigration in $10.1 Billion HSBC Canada Deal

Royal Bank of Canada said it would pay US$10.1 billion for HSBC

Holdings PLC's Canadian operations, a move meant to position

Canada's biggest bank to expand during an expected immigration

surge.

HSBC, a London-based bank with a huge Hong Kong presence, serves

more than 780,000 customers through 130 branches in Canada. As part

of the deal, it will refer clients who are moving to Canada to RBC,

said Dave McKay, RBC's chief executive.

Twitter's Former Trust and Safety Chief Says He Left When System

of Governance Went Away

Yoel Roth, Twitter Inc.'s former head of trust and safety, said

several factors led to his decision to leave the platform after

almost eight years, including the disruptions created by rapid-fire

changes from the company's new owner.

He said he left the company following the botched launch of the

upgraded Twitter Blue subscription program after Chief Executive

Elon Musk ignored his team's warnings about possible issues tied to

the rollout.

Rio Tinto Plans $600 Million Investment in Solar, Battery

Storage for Australia's Pilbara

Rio Tinto PLC said it intends to invest $600 million to build

two solar farms and battery storage in Australia's Pilbara region,

to help lower the emissions from its iron-ore mining operations

there.

The world's second-biggest miner by market value said it plans

to construct two 100-megawatt solar-power facilities and

200-megawatt-hours of on-grid battery storage in the remote part of

northwest Australia by 2026.

Twitter Under Elon Musk Abandons Covid-19 Misinformation

Policy

Twitter Inc. has stopped enforcing a policy aimed at curbing the

spread of Covid-19 misinformation on its platform in the company's

latest move to loosen moderation guidelines on the site.

The social-media company announced the change by placing a

notice on its website, saying it was no longer policing Covid-19

misinformation as of Nov. 23.

Write to singaporeeditors@dowjones.com

Expected Major Events for Wednesday

00:01/UK: CBI Service Sector Survey

00:01/UK: Nov Shop Price Index

05:30/NED: Oct PPI

05:30/NED: Oct Retail turnover

06:00/FIN: 3Q GDP

07:00/DEN: Oct Unemployment

07:00/DEN: 3Q Preliminary GDP

07:00/TUR: 3Q GDP

07:45/FRA: Oct Housing starts

07:45/FRA: Oct Household consumption expenditure in manufactured

goods

07:45/FRA: Oct PPI

07:45/FRA: Nov Provisional CPI

07:45/FRA: 3Q GDP - detailed figures

08:00/SPN: Oct Retail Sales

08:00/SWI: Nov KOF economic barometer

08:00/HUN: Oct PPI

08:55/GER: Nov Labour market statistics (incl unemployment)

09:00/BUL: Oct PPI

09:00/POL: 3Q GDP

09:00/ICE: 3Q GDP

09:00/ITA: 3Q GDP

10:00/MLT: Oct PPI

10:00/CRO: Oct Industrial Production Volume Index

10:00/CYP: Oct PPI

10:00/GRE: Oct PPI

10:00/GRE: Sep Turnover Index in Retail Trade

10:00/ITA: Nov Provisional CPI

10:00/ITA: Nov Cities CPI

10:00/BEL: 3Q Final GDP

10:00/LUX: Oct PPI

10:00/CRO: Oct Retail trade

10:00/EU: Nov Flash Estimate euro area inflation

11:00/POR: Oct Retail trade

11:00/POR: 3Q GDP

11:00/IRL: Nov Monthly Unemployment

15:59/UKR: Oct Industrial Production

16:59/SPN: Oct Budget deficit

16:59/SPN: Sep Monthly Balance of Payments

16:59/BEL: Oct PPI

All times in GMT. Powered by Onclusive and Dow Jones.

Write to us at newsletters@dowjones.com

We offer an enhanced version of this briefing that is optimized

for viewing on mobile devices and sent directly to your email

inbox. If you would like to sign up, please go to

https://newsplus.wsj.com/subscriptions.

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

November 30, 2022 00:28 ET (05:28 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

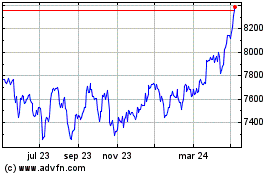

FTSE 100

Gráfica de índice

De Mar 2024 a Abr 2024

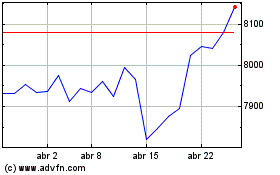

FTSE 100

Gráfica de índice

De Abr 2023 a Abr 2024