MARKET WRAPS

Forex:

The dollar edged lower and it could struggle to rise unless

concerns resurface that U.S. interest rates are likely to remain

higher for longer and rate-cut expectations are trimmed back again,

UniCredit Research said.

"A return of market expectations towards a high-for-longer

scenario in terms of U.S. policy rates is needed to provide the

greenback with much more strength."

Standard Chartered said sharp interest-rate cuts by the Federal

Reserve would be negative for the dollar, but the currency could

also fall on moderate easing.

"The dollar is likely to fall if weaker-than-expected activity

and inflation lead the Fed to exercise its put. But the consensus

soft landing also entails Fed policy rate cuts."

Standard Chartered thinks the full-scale dollar strength of late

2021 and 2022 is unlikely to return as it was driven by the Fed's

no-compromise stance regarding tackling inflation.

Energy:

Crude futures eased lower as concerns over the macroeconomic

outlook and global oil demand offset the impact of geopolitical

tensions in Russia and the Middle East.

Prices failed to gain momentum despite Ukraine's drone attack on

a Russian fuel terminal in the Baltic Sea on Sunday and growing

tensions in the Middle East amid increasing missile attacks

throughout the region.

Metals:

Base metals and gold were weaker, weighed by a mixed

macroeconomic environment and as investors awaited key monetary

policy decisions this week.

"Thursday's [European Central Bank] decision will be the most

impactful for our markets via the direction of the euro," Peak

Trading Research said.

TODAY'S TOP HEADLINES

Exxon Sues Two ESG Investors

Exxon Mobil is suing two sustainable investment firms in a bid

to block them from putting forward a shareholder proposal that

would commit the oil company to further curb its greenhouse-gas

emissions and target its customers' emissions.

In a federal lawsuit filed in Texas on Sunday, the Houston-based

oil giant said investment firms Arjuna Capital and Follow This

became Exxon shareholders only to put forward proposals that would

"diminish the company's existing business."

FDJ Agrees to $2.7 Billion Deal for Kindred Group

La Francaise des Jeux has agreed to acquire Kindred Group for

close to $2.7 billion, in a deal that would create one of Europe's

biggest online gambling companies.

The deal follows calls for the possible sale of Kindred, which

is listed in Stockholm, by Corvex Management, a New York activist

investor headed by Keith Meister.

China Benchmark Lending Rates Held Steady

China's benchmark lending rates were kept steady after the

central bank held its key policy rates unchanged earlier this

month, according to data released by the People's Bank of

China.

The one-year loan prime rate stayed at 3.45% while the five-year

rate was left at 4.2%, said the PBOC.

Stocks Are at Record Highs, but Things Will Only Get Harder From

Here

Wall Street entered 2024 betting the year would go perfectly,

but an up-and-down start for stocks and bonds suggests the going

won't be easy.

Stocks have climbed to records, driven by cooling inflation that

has spurred investors to anticipate as many as six interest-rate

cuts. Falling rates often boost share prices by reducing the

relative appeal of bonds and making it cheaper for companies and

consumers to borrow, lifting corporate profits.

Ocean Shipping Rates Surge as Red Sea Attacks Continue

Global shipping prices are continuing to rise as Houthi rebels

keep up attacks on cargo vessels in and around the Red Sea.

The disruptions are at a key point for ships passing through the

Suez Canal and are creating ripples across supply chains in Europe

and the U.S., delaying shipments and raising transportation

costs.

Rising Defaults May Give Misleading Picture on Consumer

Health

Obsessing over "vintage" isn't just for wine enthusiasts or

hipsters. It is also a crucial part of understanding what is

happening in credit. And it may help tell a more constructive story

about American spenders.

Many measures of credit performance for things such as

credit-card or auto loans are moving in the wrong direction, like

the percentage of payments that are late, or the share of debts

being written off. For example, in Discover Financial Services

latest quarterly report, the lender guided toward a jump in net

charge-offs from 3.42% in 2023 to a range of 4.9% to 5.3% in 2024.

Discover shares tumbled more than 10% on Thursday.

Ahead of New Hampshire Primary, Underdog Nikki Haley Gets

One-on-One Race With Donald Trump

DERRY, N.H.-Nikki Haley finally secured the one-on-one matchup

against Donald Trump that she had long sought after Ron DeSantis

dropped out of the Republican presidential nomination race two days

before the New Hampshire primary. It might be too late.

The Florida governor, who endorsed the former president, wasn't

expected to be a major factor in Tuesday's GOP primary. A poll

released Sunday showed him at just 6% in the state.

Ron DeSantis Drops Out of the 2024 Presidential Race, Endorses

Trump

MANCHESTER, N.H.-Ron DeSantis ended his presidential bid, a

crushing defeat for a figure who once represented the strongest

hope for Republicans wanting to move past Donald Trump but one who

misread the former president's durability, overestimated his own

political skill and struggled through reboot after reboot.

The Florida governor withdrew on Sunday and endorsed Trump, two

days before New Hampshire voters were poised to hand Trump another

primary win. Now the race is down to Trump and Nikki Haley, the

former South Carolina governor, who has been the closest competitor

in New Hampshire, even though the former president remains dominant

in polls there and the states to follow on the primary

calendar.

Stefanik's Fierce Support for Trump Puts Her in the VP

Conversation

WASHINGTON-The political evolution of Rep. Elise Stefanik from a

moderate into a strong defender of Donald Trump helped catapult her

into House GOP leadership. Is the No. 2 role in the White House

next?

The highest-ranking woman among House Republicans grabbed the

spotlight when she grilled the leaders of elite colleges over

antisemitism on campus, setting off a chain of events that led to

the resignations of the presidents of the University of

Pennsylvania and Harvard University. Her performance drew broad

praise from conservatives, and she is now being actively floated as

a potential running mate for Trump this year.

Biden Has a Michigan Problem, Endangering His Re-Election

DETROIT-Michigan is flashing warning signs for President Biden's

re-election bid.

Top Democrats in this state that will help decide the

presidential race are sounding alarms about recent polls showing

Biden trailing Donald Trump, the Republican presidential

front-runner, by nearly double-digits. Michigan Rep. Elissa

Slotkin, who is seeking to succeed retiring Democratic Sen. Debbie

Stabenow in the state's Senate race, has expressed concerns that

Biden's bad poll numbers could hurt her race and other down-ballot

contests, according to people who have spoken with her.

Write to paul.larkins@dowjones.com TODAY IN CANADA

Earnings:

None scheduled

Economic Calendar:

Nothing scheduled

Stocks to Watch:

OreCorp Received Confidential, Conditional Takeover Proposal

From Perseus on Friday; Has Notified Perseus It Does Not Consider

Takeover Offer to be Superior to Silvercorp Bid; is 'Working

Through' Perseus Announcement Monday; Board Has Not Changed

Existing Unanimous Recommendation in Favor of Silvercorp Offer

Expected Major Events for Monday

05:00/JPN: Dec Convenience Store Sales

11:00/UK: Dec Aluminium Production report

15:00/US: Dec Leading Indicators

All times in GMT. Powered by Kantar Media and Dow Jones.

Expected Earnings for Monday

AGNC Investment Corp (AGNC) is expected to report $0.61 for

4Q.

Agilysys (AGYS) is expected to report $0.14 for 3Q.

Bank of Hawaii Corp (BOH) is expected to report $0.83 for

4Q.

Brown & Brown (BRO) is expected to report $0.52 for 4Q.

C&F Financial Corporation (CFFI) is expected to report for

4Q.

Commercial National Financial Corp (CNAF) is expected to report

for 4Q.

CrossFirst Bankshares Inc (CFB) is expected to report for

4Q.

Enterprise Financial Services Corp (EFSC) is expected to report

$1.19 for 4Q.

First Bancorp NC (FBNC) is expected to report $0.65 for 4Q.

First Community Bankshares Inc (FCBC) is expected to report

$0.67 for 4Q.

Franklin Financial Services Corp (FRAF) is expected to report

for 4Q.

Great Southern Bancorp (GSBC) is expected to report $1.15 for

4Q.

Home Bancorp Inc (HBCP) is expected to report $1.05 for 4Q.

Independent Bank Group (IBTX) is expected to report $0.61 for

4Q.

Luther Burbank Corp (LBC) is expected to report $0.06 for

4Q.

MainStreet Bancshares Inc (MNSB) is expected to report $0.63 for

4Q.

Northwest Bancshares Inc (NWBI) is expected to report $0.24 for

4Q.

Orrstown Financial Services Inc (ORRF) is expected to report

$0.80 for 4Q.

PACCAR Inc (PCAR) is expected to report $2.22 for 4Q.

Park National Corp (PRK) is expected to report $1.72 for 4Q.

Peoples Bancorp of NC (PEBK) is expected to report for 4Q.

Petrotal Corp (TAL.T) is expected to report.

RBB Bancorp (RBB) is expected to report $0.40 for 4Q.

SmartFinancial Inc (SMBK) is expected to report $0.41 for

4Q.

Trustco Bank Corp (TRST) is expected to report for 4Q.

United Airlines Holdings Inc (UAL) is expected to report $1.64

for 4Q.

Zions Bancorp NA (ZION) is expected to report $0.88 for 4Q.

Powered by Kantar Media and Dow Jones.

ANALYST RATINGS ACTIONS

AT&T Raised to Outperform From Perform by Oppenheimer

Blackstone Cut to Neutral From Buy by Citigroup

Blackstone Inc Cut to Neutral From Buy by Citigroup

Carlyle Group Cut to Neutral From Buy by Citigroup

Celsius Holdings Cut to Neutral From Buy by B of A

Securities

Chegg Cut to Sell From Neutral by Goldman Sachs

Coursera Cut to Sell From Neutral by Goldman Sachs

Crown Castle Raised to Market Perform From Underperform by BMO

Capital

Cummins Cut to Underperform From Neutral by B of A

Securities

Discover Financial Cut to Hold From Buy by HSBC

DraftKings Cut to Underperform From Neutral by Exane BNP

Paribas

DraftKings Raised to Buy From Hold by Stifel

Duolingo Cut to Sell From Neutral by Goldman Sachs

Hertz Global Cut to Hold From Buy by Jefferies

IBM Raised to Outperform From In-Line by Evercore ISI Group

IBM Raised to Outperform From In-Line by Evercore Partners

Itron Raised to Outperform From Perform by Oppenheimer

LCI Industries Cut to Hold From Buy by Truist Securities

Mueller Industries Cut to Neutral From Buy by Northcoast

Research

Paccar Raised to Neutral From Underperform by B of A

Securities

Roku Raised to Neutral From Sell by Seaport Global

Silk Road Medical Raised to Buy From Hold by Stifel

Terex Cut to Underperform From Neutral by B of A Securities

Texas Instruments Raised to Buy From Neutral by UBS

Universal Display Cut to Neutral From Buy by Citigroup

ZipRecruiter Cut to Neutral From Buy by Goldman Sachs

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 22, 2024 06:14 ET (11:14 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

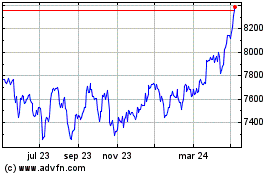

FTSE 100

Gráfica de índice

De Oct 2024 a Nov 2024

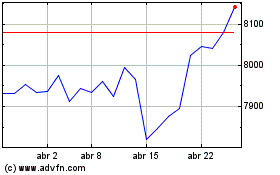

FTSE 100

Gráfica de índice

De Nov 2023 a Nov 2024