Australian, NZ Dollars Weaken Amid Rising Risk Aversion

21 Junio 2022 - 11:10PM

RTTF2

The Australian and NZ dollars fell against their major

counterparts in the Asian session on Wednesday, as risk sentiment

dampened on fears about a recession in the wake of aggressive rate

hikes by the Federal Reserve to tame inflation.

Chair Jerome Powell will testify on the semi-annual monetary

policy report in the Senate later today.

Investors will closely watch Powell's comments for clues on the

aggressiveness of the tightening cycle in the light of high

inflation.

Markets are assigning a 90 percent probability of a 75 basis

point rate hike next month, according to the CME FedWatch tool.

Oil prices fell as U.S. President Joe Biden is set to call on

Congress to temporarily suspend the federal gasoline tax during the

summer months.

The aussie weakened to a 5-day low of 0.6904 against the

greenback and a 1-week low of 0.8953 against the loonie, reversing

from its early highs of 0.6972 and 0.9008, respectively. The aussie

is seen finding support around 0.67 against the greenback and 0.88

against the loonie.

The aussie pulled back from its prior highs of 1.5099 versus the

euro and 95.29 against the yen, dropping to 1.5200 and 93.91,

respectively. If the aussie falls further, it is likely to test

support around 1.55 versus the euro and 90.00 against the yen.

The kiwi touched a 1-week low of 1.6789 against the euro and a

6-day low of 0.6253 against the greenback, down from its early

highs of 1.6619 and 0.6335, respectively. The kiwi is likely to

challenge support around 1.69 against the euro and 0.61 against the

greenback.

The kiwi depreciated to a 5-day low of 1.1051 against the aussie

and a 2-day low of 85.08 against the yen, after rising to 1.0995

and near a 2-week high of 86.57, respectively earlier in the

session. The kiwi may locate support around 1.12 against the aussie

and 83.00 against the yen.

Looking ahead, Canada inflation data for May will be featured in

the New York session.

At 9:30 am ET, Federal Reserve Chair Jerome Powell will testify

on the semi-annual monetary policy report before the Senate Banking

Committee in Washington DC.

Eurozone flash consumer sentiment index for June will be

released at 10:00 am ET.

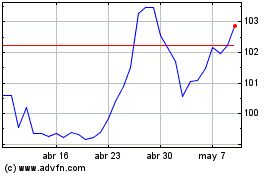

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024