Euro Rises Ahead Of ECB Lagarde's Speech

26 Febrero 2024 - 1:43AM

RTTF2

The euro strengthened against other major currencies in the

European session on Monday, as traders turned their attention

towards the ECB President Christine Lagarde's speech later on the

day.

European Central Bank president Christine Lagarde will speak in

a plenary debate on the ECB Annual Report 2022 in Strasbourg,

France later today.

U.S. PCE numbers and Eurozone inflation data due this week may

also offer important clues on the timing and pace of interest-rate

cuts in the U.S. and Europe.

Friday, ECB's Yannis Stournaras ruled out the possibility of

rate cuts in March.

The euro held steady against its major rivals in the Asian

session today.

In the European trading now, the euro rose to 4-day highs of

0.8558 against the pound and 1.0855 against the Swiss franc, from

early lows of 0.8537 and 1.0812, respectively. If the euro extends

its uptrend, it is likely to find resistance around 0.86 against

the pound and 1.09 against the greenback.

Against the Swiss franc, the euro climbed to nearly a 3-month

high of 0.9549 from an early low of 0.9532. On the upside, 0.96 is

seen as the next resistance level for the euro.

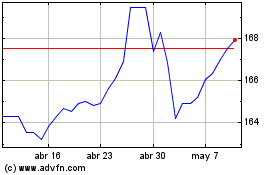

Moving away from an early 4-day low of 162.56 against the yen,

the euro advanced to nearly a 3-month high of 163.52. The euro may

test resistance around the 164.00 region.

Looking ahead, U.S. building permits for January, Canada

manufacturing and wholesale sales data for January, U.S. new home

sales data for January and Dallas Fed manufacturing index for

February are slated for release in the New York session.

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

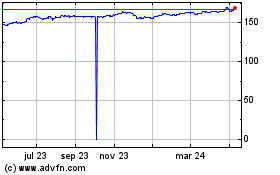

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024