Euro Higher Against Majors

17 Abril 2024 - 8:02AM

RTTF2

The euro was higher against its major counterparts in the

European session on Wednesday, as investors cheered inflation data

out of U.K and Eurozone.

U.K. consumer price inflation rose by less than expected to 3.2

percent in March from 3.4 percent in February, making it likely

that the Bank of England will lower its key interest rate later

this year.

Final data from Eurostat revealed that inflation in the 20

nations sharing the euro currency slowed across the board last

month, raising expectations for an ECB rate cut in June.

Euro zone inflation slowed to 2.4 percent from 2.6 percent in

February, matching the preliminary estimate released earlier this

month.

Investors looked past Tuesday's comments from Federal Reserve

Chair Jerome Powell that pushed back expectations for rate

cuts.

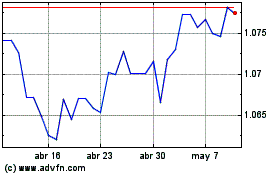

The euro rose to 1.0652 against the greenback and 0.9711 against

the franc, from an early low of 1.0605 and a multi-week low of

0.9676, respectively. The euro is poised to challenge resistance

around 1.08 against the greenback and 0.98 against the franc.

The euro touched 164.75 against the yen, setting a 1-week high.

On the upside, 166.00 is likely seen as its next resistance

level.

The euro recovered to 0.8540 against the pound, from an early

multi-week low of 0.8521. This may be compared to a prior 2-day

high of 0.8551. If the currency rises further, it may find

resistance around the 0.88 level.

The euro recovered to 1.6581 against the aussie, from an early

low of 1.6536. The euro is likely to find resistance around the

1.68 level.

The euro rebounded to 1.8037 against the kiwi, from an early

2-day low of 1.7961. This may be compared to a prior nearly 5-month

high of 1.8108. The next possible resistance for the euro is seen

around the 1.82 level.

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024