Swiss Franc Slides As Soft Inflation Data Spurs SNB Rate Cut

04 Abril 2024 - 12:00AM

RTTF2

The Swiss franc weakened against other major currencies in the

European session on Thursday, as Swiss consumer price inflation

unexpectedly weakened to the lowest since September 2021 signaled a

growing chance that the Swiss National Bank will reduce policy rate

at its next meeting in June.

Data from the Federal Statistical Office showed that the

consumer prices logged an annual increase of 1.0 percent in March,

following a 1.2 percent rise in February. This was the lowest since

September 2021, when the rate was 0.9 percent. Economists had

forecast prices to climb 1.3 percent.

On a monthly basis, the consumer price index remained flat. Core

consumer prices gained 0.1 percent on month in March and increased

1.0 percent from the same period last year.

There is a growing chance that the Swiss National Bank will act

at its next meeting in June, the economist added.

In March, the SNB unexpectedly reduced the policy rate by 25

basis points to 1.50 percent.

The SNB forecast consumer prices to rise 1.4 percent this year

and 1.2 percent in 2025.

The European stocks rose after revised data showed economic

activity in the eurozone's private sector expanded for the first

time in ten months in March. The eurozone services PMI improved to

51.5 from 50.2 in February.

Minutes from the European Central Bank's latest policy meeting

is awaited later in the day.

In the Asian trading today, the Swiss franc held steady against

its major rivals.

In the European trading now, the Swiss franc fell to nearly one

year lows of 0.9851 against the euro and 1.1486 against the pound,

from early highs of 0.9786 and 1.1421, respectively. If the franc

extends its downtrend, it is likely to find support around 0.99

against the euro and 1.15 against the pound.

Moving away from an early 3-day high of 0.9026 against the U.S.

dollar, the franc edged down to 0.9074. The franc may test support

near the 0.91 region.

Against the yen, the franc dropped to 167.14 from an early high

of 167.99. On the downside, 166.00 is seen as the next support

level for the franc.

Looking ahead, the ECB is set to publish the account of the

monetary policy meeting of the Governing Council held on March 6

and 7, at 7:30 am ET.

In the New York session, U.S. weekly jobless data and U.S. and

Canada trade data for February are slated for release.

At 12:15 pm ET, Federal Reserve Bank of Richmond President

Thomas Barkin will give a new speech on the economic outlook before

the Home Building Association of Richmond, in Richmond, U.S.

Half-an-hour later, Federal Reserve Bank of Chicago President

Austan Goolsbee will participate in a moderated question-and-answer

session before the Multi-Chamber Economic Outlook Luncheon and

Expo, in Oak Brook, U.S.

At 2:00 pm ET, Federal Reserve Bank of Cleveland President

Loretta Mester will participate in a conversation on the economic

outlook before virtual Global Interdependence Center Executive

Briefing, in Cleveland, U.S.

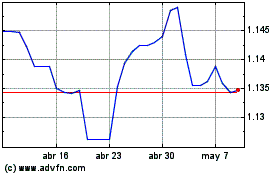

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024