German Economy Stuck In Recession

15 Enero 2025 - 12:44AM

RTTF2

The German economy shrank for the second straight year in 2024

as the euro area struggles with global headwinds and the political

and structural problems on the domestic front. Gross domestic

product contracted 0.2 percent in 2024 after a 0.3 percent decline

in 2023, Destatis reported Wednesday.

"Cyclical and structural pressures stood in the way of better

economic development in 2024," Destatis President Ruth Brand said

at the press conference held in Berlin.

"These include increasing competition for the German export

industry on key sales markets, high energy costs, an interest rate

level that remains high, and an uncertain economic outlook. Against

this backdrop, the German economy contracted once again in 2024,"

Brand added.

Due to the sharp declines in the manufacture of machinery and

equipment and automotive industry, manufacturing shrank 3.0

percent. The construction industry reported a more pronounced

decline of 3.8 percent. On the other hand, the service sector

logged an expansion of 0.8 percent.

On the expenditure-side, gross fixed capital formation declined

2.8 percent, reflecting falls in construction, and machinery and

equipment investment.

Household consumption expenditure moved up 0.3 percent boosted

by pay hikes and the slowing inflation. Government spending gained

2.6 percent due to higher social benefits in kind provided by the

government.

The difficult conditions were reflected in foreign trade too.

Exports decreased 0.8 percent, while imports grew 0.2 percent.

Regarding the labor market, Destatis said employment increased

72,000 from the last year to a new record high of 46.1 million.

These gains were entirely attributable to the service sector.

Data showed that the general government deficit ratio remained

unchanged at 2.6 percent of GDP in 2024. It remained below the 3

percent reference value of the European Stability and Growth

Pact.

Capital Economics' economist Franziska Palmas said the data

suggests that there is still no sign of the country exiting

stagnation.

Although a slight recovery in real household incomes and falling

interest rates might boost consumption and construction investment,

this would be mostly offset by a continued drag from high energy

prices, weak demand for industrial goods and adverse demographics,

the economist noted.

The firm forecasts a very small cyclical recovery in 2025, but

even that could prove too optimistic, Palmas added.

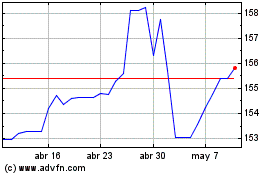

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Dic 2024 a Ene 2025

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Ene 2024 a Ene 2025