Alliance Trust PLC - Publication of Prospectus and Circular

THIS ANNOUNCEMENT AND THE INFORMATION

CONTAINED IN IT ARE NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO, THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR

ANY JURISDICTION FOR WHICH THE SAME COULD BE

UNLAWFUL.

This announcement is not an offer to sell, or a

solicitation of an offer to acquire, securities in the United

States or in any other jurisdiction in which the same would be

unlawful. Neither this announcement nor any part of it shall form

the basis of or be relied on in connection with or act as an

inducement to enter into any contract or commitment whatsoever.

Legal Identity Identifier:

213800SZZD4E2IOZ9W55

12 September 2024

Alliance Trust PLC

Combination with Witan Investment Trust

plc to form Alliance Witan PLC

Publication of Prospectus and

Circular

Introduction

Further to the announcement of 26 June 2024, the

Board of Alliance Trust PLC (“Alliance Trust” or

the “Company”) is pleased to announce that the

Company has today published a circular (the

"Circular") and a prospectus (the

“Prospectus”) in connection with the proposed

combination with Witan Investment Trust plc

(“Witan”) to create Alliance Witan PLC

(“Alliance Witan”).

The combination will be effected by way of a

scheme of reconstruction and members' voluntary winding-up of Witan

pursuant to section 110 of the Insolvency Act 1986, which will see

Witan’s assets roll into Alliance Trust in exchange for the issue

of new Alliance Witan shares to the continuing Witan Shareholders

(the “Scheme”).

The Circular provides the Company's shareholders

(the "Shareholders") with further details of the

Scheme. A general meeting of the Company has been convened for

11:00 a.m. on Tuesday, 1 October 2024 (the "General

Meeting") to seek approval from Shareholders for the

implementation of the Scheme. Approval from Witan Shareholders will

also be required to implement the Scheme.

The Prospectus has been approved by the

Financial Conduct Authority, and the Prospectus and Circular will

shortly be available for inspection at the National Storage

Mechanism which is located at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism and on the

Company's website at www.alliancetrust.co.uk.

Background

On 26 June 2024, the boards of Alliance Trust

and Witan announced that the companies had entered into heads of

terms for a combination of the two companies to create Alliance

Witan PLC. This followed a comprehensive strategic review by the

board of Witan of its investment management arrangements.

The combination will build upon the distinctive

multi-manager approach already employed by Alliance Trust to create

an actively managed global equity portfolio that provides an even

more liquid, high profile and cost-efficient “one stop shop” for

investors. With expected net assets of c.£4.8 billion on completion

of the Scheme, significant economies of scale, the prospect of

eligibility for FTSE 100 inclusion, powerful and well-established

brand recognition on both sides, and proven marketing expertise

backed by dedicated resources and budget, Alliance Witan will aim

to be the UK’s leading global equity investment proposition, at the

core of retail investors' portfolios.

Alliance Trust's Investment Manager, Willis

Towers Watson (“WTW”), will have overall

responsibility for managing the assets of the combined Alliance

Witan, drawing upon its well-established management skills and deep

resources in employing the same proven approach as has been

successfully utilised by Alliance Trust since WTW's appointment in

2017 – selecting a diverse team of expert Stock Pickers, each of

whom invests in a customised selection of 10-20 of their 'best

ideas'.1

Benefits of the combination

The combination is expected to result in

substantial benefits for both Alliance Trust Shareholders and Witan

Ordinary Shareholders, as well as for future investors in Alliance

Witan:

- Greater

profile and prospect of FTSE 100 inclusion: Alliance Witan

is expected to have net assets of c.£4.8 billion on completion of

the Scheme Proposals (based on the last published Net Asset Values

of the two companies as at 6 September 2024). Alliance Witan may

also be eligible for inclusion in the FTSE 100 Index in due course

and should benefit from improved profile, which should help to

attract new investors to the Company, and improved secondary market

liquidity.

- Lower

management fees: WTW has agreed a new management fee

structure for Alliance Witan as detailed below. This will result in

an even more competitive blended fee rate for Alliance Witan and

its shareholders than is currently enjoyed by Alliance Trust's and

Witan's respective shareholders.

- Lower

ongoing charges: The new management fee structure and the

economies of scale which the combination will bring will allow

Alliance Witan to target an ongoing charges ratio in the high 50s

(in basis points terms) in future financial years, an improvement

on both Witan's and Alliance Trust's current ongoing charge ratios

(which are 76bps and 62bps respectively).

-

Attractive and progressive dividend policy: As at

6 September 2024, the Company’s dividend yield was 2.25 per cent.

It is intended that Alliance Witan will increase its third and

fourth interim dividends for the financial year ending 31 December

2024 so that they are commensurate with Witan’s first interim

dividend payment to Witan Ordinary Shareholders of 1.51 pence per

Witan Ordinary Share. This is currently estimated to represent an

increase of 1.66 per cent. on Alliance Trust's first interim

dividend of the current financial year and a 6.15 per cent.

increase on Alliance Trust's fourth interim dividend for the year

ended 31 December 2023. Furthermore, it is expected that Alliance

Witan’s dividend for the financial year ending 31 December 2025

will be increased compared with the prior financial year so that

both Existing ATST Shareholders and Witan Ordinary Shareholders

will see a progression in their income in both 2024 and 2025.

- No cost

to Alliance Trust Shareholders: WTW has agreed to make a

significant contribution to the costs of the transaction. The value

of the contribution will be applied initially to meet the Company

Implementation Costs, with any excess applied firstly to offset any

remaining Witan Implementation Costs, and then accruing for the

benefit of Shareholders in the combined Alliance Witan.

-

Best-in-class investment management: The enlarged

portfolio will continue to benefit from the multi-manager strategy

employed by WTW for the benefit of Alliance Trust, providing access

to best-in-class2 Stock Pickers globally, many of whom

are not otherwise readily accessible by UK retail investors. The

investment proposition seeks to reduce risk and volatility relative

to the Benchmark in the near term, compared to an individual

manager strategy, meaning investors should not be left vulnerable

to the underperformance risk concomitant with a single manager at

the top of its performance cycle. As at 6 September 2024, Alliance

Trust's portfolio consisted of selections by ten Stock Pickers, and

centrally held cash or cash equivalents.

- Robust

investment performance track record: Since the appointment

of WTW as manager of Alliance Trust at the beginning of April 2017

to 30 August 2024, Alliance Trust’s NAV total return was 102.2 per

cent. against 101.7 per cent. for the MSCI All Country World Index

(Alliance Trust's comparative benchmark index). Over the past three

years to the same date, Alliance Trust's NAV total return was 23.1

per cent., against 23.9 per cent. for the MSCI All Country World

Index.

- Tangible

economic upside for Witan’s shareholders: Witan Ordinary

Shareholders have benefitted from an uplift in the value of their

shareholding, and will also be given the opportunity to elect for a

cash exit at a price close to NAV, for some or all of their

holding, as part of the Scheme. As described above, the benefit of

the Cash Uplift will be applied first to the Witan Implementation

Costs; and any amount remaining thereafter will be for the benefit

of all Alliance Witan Shareholders. Continuing Witan Ordinary

Shareholders are therefore expected to suffer minimal or no NAV

dilution, depending upon the level of take-up of the Cash Option

and any residual benefit flowing from the WTW Cost

Contribution.

Overview of the Scheme

The Scheme Proposals will be effected by way of

a scheme of reconstruction and members' voluntary winding-up of

Witan pursuant to section 110 of the Insolvency Act 1986 and the

associated transfer, to the Company, of part of Witan’s cash and

assets, and certain of Witan’s liabilities. In return, New Shares

will be issued by the Company to Witan Ordinary Shareholders who

elect, or are deemed to have elected, for the Rollover Option, with

the number of New Shares to be issued calculated on a formula asset

value ("FAV") for FAV basis. The assets

transferred by Witan to the Company will consist of investments

conforming to the Company’s investment objective and policy as at

the Effective Date, including cash and cash equivalents, and are

expected to very largely comprise highly liquid instruments so as

to allow for the prompt and cost-effective reinvestment of those

assets thereafter to align with the investment strategies of the

Company’s Stock Pickers (with the exception of Witan’s current

investment company holdings, all of which Alliance Witan will hold

within the portfolio). Alliance Witan will also then pay listing

fees in relation to the listing of the New Shares and any

acquisition costs and taxes on the transfer of the Rollover

Pool.

It is expected that following implementation of

the Scheme, the portfolio of Alliance Witan will be managed in the

same way as the Company’s portfolio is managed currently, with risk

managed by WTW to ensure that the portfolio is well diversified and

risk balanced, with no excessive exposure relative to the Benchmark

to regions, sectors or styles.

Should the Scheme Proposals be implemented, the

Directors also propose to change the name of the Company to

‘Alliance Witan PLC’ and intend to change the Company’s ticker code

from ATST to ALW with effect from, or shortly after, the Effective

Date. The proposed change of name requires the approval of ATST

Shareholders at the General Meeting, as set out in further detail

below.

The Scheme is conditional on, among other

things, approval of the Scheme Resolution authorising the Issue by

ATST Shareholders at the General Meeting and the approval of the

Witan Resolutions by Witan Ordinary Shareholders at the Witan

Ordinary Shareholders’ Class Meeting and by Witan Shareholders at

the Witan General Meetings. Further details of the conditions

attaching to the Scheme are set out below.

Under the Scheme, Witan Ordinary Shareholders

will be entitled to elect to receive in respect of some or all of

their Witan Ordinary Shares:

- New Shares (the

"Rollover Option"); and/or

- Cash (the

"Cash Option").

The Cash Option is limited to 17.5 per cent. of

the Witan Ordinary Shares in issue (excluding Witan Ordinary Shares

held in treasury) as at the Calculation Date. Should total

elections and deemed elections for the Cash Option exceed such

limit, excess elections for the Cash Option will be scaled back

into New Shares in a manner that is, as near as practicable,

pari passu and pro rata, by reference to the

number of Witan Ordinary Shares elected under such excess

applications, among all Witan Shareholders who have made such

excess applications.

Witan Ordinary Shareholders who elect (or are

deemed to elect) for the Cash Option will receive an amount in cash

equal to the WTAN Scheme NAV per Share less a discount of 2.5 per

cent. multiplied by the number of Witan Ordinary Shares in respect

of which such Witan Ordinary Shareholder has elected (or been

deemed to elect) for the Cash Option and net of the costs of

realising the assets allocated to the Cash Pool, and subject to the

overall cap on such elections in aggregate of 17.5 per cent. of the

Witan Ordinary Shares. The benefit of this 2.5 per cent. discount

applied under the Cash Option (the "Cash Uplift")

will first be applied to offset the Witan Implementation Costs,

with any Excess Cash Uplift thereafter accruing for the benefit of

all shareholders in Alliance Witan.

New Shares in Alliance Trust will be issued as

the default option under the Scheme to the extent that Witan

Ordinary Shareholders do not make a valid election in respect of

some or all of their Witan Ordinary Shares under the Scheme or to

the extent that elections for the Cash Option are scaled back as a

result of the Cash Option being oversubscribed.

Witan Preference Shareholders will not

participate in the Scheme but will instead receive their

entitlements under Witan's articles of association in cash pursuant

to the winding-up of Witan.

Details of the Issue

As described in detail in Part 2 of the

Circular, the number of New Shares in Alliance Trust to which each

Eligible Witan Shareholder who elects (or is deemed to have

elected) for the Rollover Option will be entitled will be

calculated by dividing the WTAN FAV per Share by the ATST FAV per

Share and applying this ratio (which will be calculated to six

decimal places, with 0.0000005 rounded down) to the number of Witan

Ordinary Shares in respect of which that Eligible Witan Shareholder

has elected, or is deemed to have elected, for the Rollover

Option.

The number of New Shares to be issued under the

Scheme is not known as at the date of this announcement as it will

be calculated as at the Calculation Date (expected to be 3 October

2024) and will depend on the elections and deemed elections made

under the Scheme. The number of New Shares in Alliance Trust to be

issued will be announced through an RIS announcement on the

Effective Date (expected to be 9 October 2024). The Issue is not

being underwritten.

For illustrative purposes only, had the

Calculation Date been 9.00 p.m. on 6 September 2024 and assuming

that there were no Dissenting Witan Shareholders and that the Cash

Option were taken up in full, the WTAN FAV per Share would have

been 275.928856 pence and the Cash Pool NAV per Share would have

been 268.732489 pence. The WTAN FAV per Share and the Cash Pool NAV

per Share may be compared with the Witan Share price and cum-income

WTAN Scheme NAV per Share as at 6 September 2024 which were 258.50

pence and 275.62 pence, respectively.

For illustrative purposes only, and on the basis

of the assumptions above, the ATST FAV per Share would have been

1,228.070474 pence, which may be compared with the Share price and

cum-income NAV per Share as at 6 September 2024 which were 1,154.0

pence and 1,228.1 pence, respectively.

On the basis of the above illustrative figures,

the Rollover Option would have produced a conversion ratio of

0.224684 and, in aggregate, 110,459,662 New Shares would have been

issued under the Scheme, representing approximately 28.2 per cent.

of the issued ordinary share capital of Alliance Witan immediately

following the completion of the Scheme.

Dividends

If the Scheme is implemented, it is intended

that Alliance Witan will increase its third and fourth interim

dividends for the financial year ending 31 December 2024 so that

they are commensurate with Witan’s first interim dividend payment

to Witan Ordinary Shareholders of 1.51 pence per Witan Ordinary

Share. This is currently estimated to represent an increase of 1.66

per cent. on the Company’s first interim dividend of the current

financial year (ending 31 December 2024) and a 6.15 per cent.

increase on the Company’s fourth interim dividend for the year

ended 31 December 2023. Furthermore, if the Scheme is implemented,

it is expected that Alliance Witan’s dividend for the financial

year ending 31 December 2025 will be increased compared with the

prior financial year so that both Existing ATST Shareholders and

Witan Ordinary Shareholders will continue to see a progression in

their income in both 2024 and 2025.

For illustrative purposes only, on the basis of

the published Net Asset Values of Alliance Trust and Witan as at 6

September 2024 (being the latest practicable date prior to the

publication of the Scheme documentation), each of Alliance Witan’s

third and fourth interim dividends would be approximately 6.73

pence per Share. The illustrative increase in Alliance Witan’s

third and fourth dividends per Share would result in an aggregate

dividend paid to a current Alliance Trust Shareholder/future

Alliance Witan Shareholder in respect of the financial year ending

31 December 2024 amounting to 26.7 pence per Share (a 5.95 per

cent. increase over Alliance Trust’s aggregate dividend of 25.2

pence per Share for the financial year ended 31 December 2023). For

Witan Ordinary Shareholders, each of those dividends would be

equivalent to an estimated 1.51 pence per Witan Ordinary Share

prior to the combination of the two companies; and would mean that

the estimated full year dividend (pre and post combination) for

2024 for current Witan Ordinary Shareholders/future Alliance Witan

Shareholders would be equivalent to approximately 6.28 pence per

Witan Ordinary Share (taking into account the second interim

dividend to be paid by Witan of 1.75 pence per Witan Ordinary

Share), an increase of 4.0 per cent. over the 6.04 pence per Witan

Ordinary Share paid by Witan in respect of 2023.

This progressive dividend increase will extend

Alliance Trust’s record of increasing dividends for 57 years in a

row; and will represent a fiftieth consecutive year of dividend

increases for Witan Ordinary Shareholders as the combination takes

effect. It is expected that Alliance Witan’s dividend for the

financial year ending 31 December 2025 will be increased compared

to 2024 such that Alliance Witan Shareholders from both backgrounds

see a further rise in income.

In determining the level of future dividends,

the Board will take into account factors such as any anticipated

increase or decrease in dividend cover, projected income, inflation

and the yield on similar investment trusts. The Board will continue

to take advantage of the Company’s structure as an investment trust

and will use both its investment income and its accumulated

distributable reserves to fund dividend payments.

New Management Fee

Structure

As part of the Scheme Proposals, and conditional

upon the Scheme Proposals being implemented, the Board and WTW have

agreed a new management fee structure pursuant to which WTW will be

paid an annual fee for its management services to Alliance Witan,

such fee accruing daily (based on the market capitalisation of the

Company as at close of business on the previous Business Day) and

payable monthly in arrears, as follows:

- 0.52 per cent.

per annum on the first £2.5 billion of Alliance Witan’s market

capitalisation;

- 0.49 per cent.

per annum on market capitalisation that exceeds £2.5 billion but is

less than or equal to £5.0 billion; and

- 0.46 per cent.

per annum on market capitalisation in excess of £5.0 billion.

The new management fee structure will apply on

completion of the Scheme Proposals. As part of the reformulation of

the structure, some allowances for external distribution services

including marketing and promotional activities not directly

undertaken by WTW, which were previously included within the

investment management fee paid to WTW, will no longer be

incorporated; and Alliance Witan will instead pay such costs

directly, giving the Board more flexibility in this area. This will

not result in any change to the services provided to the

Company.

Gearing

The Board is responsible for setting the

Company’s gearing strategy. WTW manages the gearing level for the

Company in accordance with the parameters agreed with the Board.

The Board has set a strategic target of 10 per cent. gross gearing,

with WTW given flexibility to manage it in the range of 7.5 per

cent. to 12.5 per cent. Board consultation and approval is required

for gross gearing levels outside that range. The Company’s gross

gearing as at 6 September 2024 (being the latest practicable date

prior to publication of the Circular) was 8.1 per cent.

It is expected that the Company’s gearing

strategy and policy, as described above, will remain unchanged

following completion of the Scheme Proposals, with a combination of

structured long-term debt and shorter-term bank facilities

continuing to be utilised. Assuming the Scheme is implemented, the

Company’s existing drawn borrowings remain unchanged and Witan

Ordinary Shareholders utilise the full 17.5 per cent. exit offered

under the Cash Option, it is expected that the Company’s gross

gearing immediately following implementation of the Scheme will be

approximately 9.0 per cent. (based on data as at 6 September

2024).

Novation of the Witan Secured Notes to

the Company

Witan's 3.29 per cent. secured notes due 2035,

3.47 per cent. secured notes due 2045, 2.39 per cent. secured notes

due 2051 and 2.74 per cent. secured notes due 2054 (together, the

"Witan Secured Notes") are secured by floating

charges over the assets of Witan held by M&G Trustee Company

Limited (formerly known as Prudential Trustee Company Limited)

("M&G") in favour of the holders of the Witan

Secured Notes (the "Witan Noteholders") and have a

total redemption value of £155 million. As part of the Scheme

Proposals, and in order to secure the benefit of long-term low-cost

borrowing for Alliance Witan in line with its gearing policy, the

current floating charges held by M&G will be released, the

Witan Secured Notes will be novated to the Company and the Company

will be substituted as the issuer and sole debtor of the Witan

Secured Notes in place of Witan (the "Novation").

The Witan Secured Notes will be secured following the Novation by a

new English floating charge and Scottish floating charge granted in

favour of The Law Debenture Trust Corporation P.L.C. as security

trustee for the Witan Noteholders and Alliance Trust's existing

secured creditors.

On 11 September 2024, the Witan Noteholders

entered into deeds of novation, amendment and restatement of the

Witan Note Purchase Agreements (the “Deeds of Novation,

Amendment and Restatement”) approving,

among other matters, the Novation in conjunction with the Scheme

and with effect from the Effective Date of the Scheme. For the

avoidance of doubt, other than the work fee paid by Witan to the

Witan Noteholders in connection with the Novation, amendment and

restatement of the Witan Secured Notes there will be no repayment

or premium payable to Witan Noteholders as a result of the

Novation.

Witan also has two classes of Witan Preference

Shares with an aggregate par value of £2.6 million. The Witan

Preference Shares will be repaid at par by Witan as part of the

Scheme Proposals.

Proposed change of Company

name

It is also proposed to change the Company's

name, conditional on the Scheme Proposals becoming effective, to

'Alliance Witan PLC'. The proposed change of name requires the

approval of Alliance Trust Shareholders by way of a special

resolution at the General Meeting. Subject to such approval, the

Scheme Proposals taking effect and the necessary filings being made

and accepted, it is expected that the change of name will become

effective on, or shortly after, the Effective Date (expected to be

9 October 2024). It is also intended that, should the Scheme

Proposals become effective, the ticker code for the Alliance Witan

Shares will be changed at the same time to ALW.

The change of the name of the Company and ticker

symbol will be announced to the market by way of RIS announcement

on, or shortly after, the Effective Date.

Board composition

The agreed objective of the two companies is to

create a broadly balanced ongoing Alliance Witan Board with strong

representation from both sides. Acknowledging the significant work

to be done in bringing the two companies together, the Alliance

Witan Board will initially comprise ten directors, with four

directors (Andrew Ross, Rachel Beagles, Shauna Bevan, and Jack

Perry) joining from the Witan Board. Dean Buckley, current Chair of

Alliance Trust, will be Chair and Andrew Ross, current Chair of

Witan, will be Deputy Chair. Jo Dixon will continue as Chair of the

Audit and Risk Committee and Sarah Bates will continue as Senior

Independent Director. It is envisaged that the Board will then

reduce in size to a maximum of eight directors following the next

annual general meeting of Alliance Witan in May 2025.

Costs and expenses of the Scheme and the

Scheme Proposals

Subject as noted below, the Company and Witan

have each agreed to bear their own costs associated with the Scheme

and the Scheme Proposals, whether or not the Scheme Proposals

proceed. The costs incurred (or to be incurred) by the Company in

implementing the Scheme Proposals primarily comprise legal fees,

financial advisory fees, costs incurred in relation to

documentation of the Novation of the Witan Secured Notes, other

professional advisory fees, printing costs and other applicable

expenses, in each case including any related VAT and disbursements

(the “Company Implementation Costs”). However, the

Company Implementation Costs of the Scheme payable by the Company

are expected to be nil, after taking into account the estimated

value of the WTW Cost Contribution (as set out below) based on the

Company’s and Witan’s respective Net Asset Values as at 6 September

2024.

For the avoidance of doubt, any costs of

realignment and/or realisation of the Witan Portfolio incurred

prior to the Effective Date will be borne by Witan. Any stamp duty,

stamp duty reserve tax or other transaction tax, or investment

costs incurred pursuant to the acquisition of the Witan Portfolio

or the deployment of the cash therein upon receipt, or any London

Stock Exchange listing or admission fees payable in respect of the

New Shares, will be borne by Alliance Witan.

WTW, the Company’s investment manager, has

agreed to make a contribution to the costs of the Scheme Proposals

of an amount equal to 0.52375 per cent. of the value of the net

assets (calculated in accordance with the terms of the Scheme and

as at the Calculation Date) to be transferred by Witan to the

Company (the “WTW Cost Contribution”), such

contribution amounting to approximately £7.1 million (based on

Witan’s published Net Asset Value as at 6 September 2024, being the

latest practicable date prior to the publication of the Circular,

and assuming there are no Dissenting Witan Shareholders and the

Cash Option is taken up in full).

The benefit of the WTW Cost Contribution will be

first applied to offset the Company Implementation Costs, with any

excess applied to offset any Witan Implementation Costs which have

not been covered by the Cash Uplift (being an amount equal to 2.5

per cent. of the WTAN Scheme NAV per Share multiplied by the total

number of Witan Ordinary Shares elected or deemed to be elected for

the Cash Option under the Scheme). Any amount remaining thereafter

will be for the benefit of all Alliance Witan Shareholders (the

“Alliance Witan Cost Contribution”). The WTW Cost

Contribution will be effected through an offset against management

fees incurred following the Effective Date.

The financial value of the WTW Cost Contribution

will be satisfied by WTW by means of a partial waiver of its fees

payable by Alliance Witan over a period of no more than twelve

months following completion of the Scheme; but some or all of the

value of this contribution (namely the proportion comprising the

ATST Cost Contribution and the Witan Cost Contribution) will be

credited to the respective FAVs utilised for the purposes of the

Scheme. For the avoidance of doubt, the Alliance Witan Cost

Contribution (if any) will not be taken into account in the

calculation of the formula asset values for the purposes of the

Scheme.

The WTW Cost Contribution is subject to a

clawback provision such that, in the event of the termination of

WTW’s appointment as AIFM and investment manager to the Company on

a no-fault basis within 36 months of the Effective Date, WTW will

be entitled to claim back some or all of the WTW Cost Contribution

from Alliance Witan. All of the WTW Cost Contribution will be

subject to clawback in the event of such termination occurring

within 12 months of the Effective Date; two thirds of the WTW Cost

Contribution will be subject to clawback in the event of such

termination occurring between 12 and 24 months of the Effective

Date; and one third of the WTW Cost Contribution will be subject to

clawback in the event of such termination occurring after more than

24 months (but less than 36 months) of the Effective Date.

Conditions of the Scheme

Implementation of the Scheme is subject to a

number of conditions, including:

- the passing of

the Witan Resolutions to approve the Scheme and the winding-up of

Witan at the Witan Ordinary Shareholders' Class Meeting (to be held

on 30 September 2024) and the Witan General Meetings (to be held on

30 September 2024 and 9 October 2024), or any adjournment thereof,

any conditions of such Witan Resolutions being fulfilled and the

Scheme becoming unconditional in all respects (including the

Transfer Agreement becoming unconditional in all respects);

- the passing of the Scheme Resolution

by ATST Shareholders to approve the issue of the New Shares

pursuant to the Scheme at the General Meeting, or any adjournment

thereof, and such Scheme Resolution becoming unconditional in all

respects;

- the

unconditional approval of the Board and the ATST Noteholders to the

entering into of the Novation Documents, the entering into of the

Novation Documents by the parties thereto and the Novation

Documents becoming unconditional in all respects other than any

condition relating to the Scheme becoming effective and other

ancillary conditions precedent thereunder;

- the FCA agreeing

to admit the New Shares to the closed-ended investment funds

category of the Official List and the London Stock Exchange agreeing

to admit the New Shares to trading on the Main Market, subject only

to allotment; and

- the Directors

and the Witan Directors resolving to proceed with the Scheme.

General Meeting

Shareholders will be asked to consider and, if

thought fit, approve the Resolutions at the General Meeting. The

Notice convening the General Meeting, to be held at 11.00 a.m. on

Tuesday, 1 October 2024 at the Apex City Quay Hotel & Spa, 1

West Victoria Dock Road, Dundee DD1 3JP, is set out on in the

Circular.

The Board, which has been so advised by Investec

Bank PLC, considers that the Proposals and the Resolutions are in

the best interests of the Company and of Shareholders as a whole.

Accordingly, the Board unanimously recommends that Shareholders

vote in favour of all of the Resolutions (and, in particular, the

Scheme Resolution) to be proposed at the General Meeting, as the

Directors intend to do in respect of their own beneficial holdings,

which, in aggregate, amount to 62,751 Shares, representing

approximately 0.02 per cent. of the Company’s issued Share capital

(excluding Shares held in treasury) as at 6 September 2024.

Admission and Dealings

Applications will be made by the Company to the

FCA for the New Shares to be admitted to listing on the

closed-ended investment funds listing category of the Official List

and to the London Stock Exchange for the New Shares to be admitted

to trading on the Main Market. If the Scheme Proposals become

effective, it is expected that the New Shares will be admitted to

the Official List and the first day of dealings in such shares on

the Main Market will be 10 October 2024.

Expected Timetable

| |

2024

|

| Publication of

the Circular and Prospectus |

12 September

|

Latest time and

date for receipt of Forms of Direction for the General Meeting

|

11.00 a.m. on Tuesday, 24 September |

Latest time and

date for receipt of Forms of Proxy, electronic proxy instructions

and CREST voting instructions for the General Meeting

|

11.00 a.m. on Friday, 27 September |

General

Meeting

|

11.00 a.m. on Tuesday, 1 October |

Announcement of

results of the General Meeting

|

Tuesday, 1 October |

Calculation Date

for the Scheme

|

Thursday, 3 October |

Effective Date

for implementation of the Scheme

|

Wednesday, 9 October |

Announcement of

the results of the Witan Ordinary Shareholder elections, the WTAN

FAV per Share, the Cash Pool NAV per Share and the ATST FAV per

Share

|

Wednesday, 9 October |

Admission and

dealing in New Shares commence

|

8.00 a.m. on Thursday, 10 October |

CREST accounts

credited in respect of New Shares in uncertificated form

|

as soon as is reasonably practicable on Thursday, 10 October |

Share

certificates in respect of New Shares held in certificated form

despatched

|

week commencing Monday, 14 October |

Note: All

references to time in this announcement are to UK time. Each of the

times and dates in the above expected timetable (other than in

relation to the General Meeting) may be extended or brought

forward. If any of the above times and/or dates change, the revised

time(s) and/or date(s) will be notified to Shareholders by an

announcement through a Regulatory Information Service.

Capitalised terms used but not defined in this

announcement will have the same meaning as set out in the

Circular.

Enquiries

Alliance Trust PLC

Dean Buckley

|

|

Via Willis Towers

Watson or Juniper Partners |

Investec Bank plc (Lead Financial Adviser, Sole Sponsor and

Corporate Broker to Alliance Trust)

David Yovichic, Denis Flanagan, Tom Skinner and Lucy Lewis

|

|

+44 (0)20 7597

4000

|

Dickson Minto Advisers LLP

(Joint Financial Adviser to Alliance Trust)

Douglas Armstrong

|

|

+44 (0)20 7649

6823

|

Willis Towers Watson

(Investment Manager, Alliance Trust)

Mark Atkinson

|

|

+44 (0)7918

724303

|

Juniper Partners Limited

(Company Secretary, Alliance Trust)

|

|

+44 (0)131 378

0500

|

Important Information

This announcement is an advertisement for the

purposes of the Prospectus Regulation Rules of the UK Financial

Conduct Authority ("FCA") and is not a prospectus.

This announcement does not constitute or form part of, and should

not be construed as, an offer for sale or subscription of, or

solicitation of any offer to subscribe for or to acquire, any

ordinary shares in the Company in any jurisdiction, including in or

into Australia, Canada, Japan, the Republic of South Africa, the

United States of America or any member state of the EEA.

This announcement is not for publication or

distribution, directly or indirectly, in or into the United States

of America. This announcement is not an offer of securities for

sale into the United States. The securities referred to herein have

not been and will not be registered under the U.S. Securities Act

of 1933, as amended, and may not be offered or sold in the United

States, except pursuant to an applicable exemption from

registration. No public offering of securities is being made in the

United States.

This announcement does not contain all the

information set out in the Circular. Shareholders should read the

Circular in full before deciding what action to take in respect of

the proposals.

Approval of the Prospectus by the FCA should not be understood as

an endorsement of the securities that are the subject of the

Prospectus. Witan Shareholders are recommended to read the

Prospectus before making a decision in order to fully understand

the potential risks associated with a decision to invest in the

Company's securities.

1 Save for GQG Partners LLC, who also manage a

dedicated emerging markets mandate for Alliance Trust with up to 60

stocks.

2 As rated by WTW

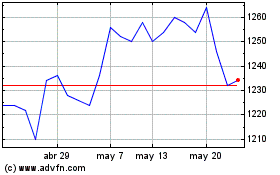

Alliance (LSE:ATST)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Alliance (LSE:ATST)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024