TIDMCARD

RNS Number : 0789A

Card Factory PLC

19 May 2023

19 May 2023

Card Factory plc

Annual Financial Report and Notice of AGM

Card Factory plc ("cardfactory" or the "Company") announces that

it has published its Annual Report and Accounts for the year ended

31 January 2023 and Notice of the Company's 2023 Annual General

Meeting.

The Annual General Meeting is to be held at the Company's

registered office, at Century House, Brunel Road, Wakefield 41

Industrial Estate, Wakefield, WF2 0XG at 11.00 a.m. on Thursday 22

June 2023.

Copies of the documents listed below have been posted to

shareholders on Thursday 18 May 2023:

1. Annual Report and Accounts 2023;

2. Notice of 2023 Annual General Meeting; and

3. Form of Proxy for the 2023 Annual General Meeting.

The Annual Report and Accounts and the Notice of the 2023 Annual

General Meeting will also be accessible later today via the

Company's investor relations website www.cardfactoryinvestors.com .

In compliance with LR 9.6.1, the Company has today submitted

electronic copies of the above documents to the National Storage

Mechanism appointed by the Financial Conduct Authority and these

will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

cardfactory's preliminary results announcement on 3 May 2023

(which is available via the Company's investor relations website

referred to above) included, in addition to the preliminary

financial results for the year ended 31 January 2023, information

on important events that occurred during the year and their impact

on those financial results. That information, together with the

information set out in the Appendix below is provided in compliance

with the requirements of DTR6.3.5(2)(b). This information is not a

substitute for reading the full Annual Report and Accounts for the

year ended 31 January 2023.

For further information:

Ciaran Stone, Group General Counsel Tel: 01924 839150

and Company Secretary

Card Factory plc

S

Appendix

Principal Risks and Uncertainties

The principal risks and uncertainties facing the cardfactory

group (the "Group") are set out below, together with details of how

these are currently mitigated. For further information on how the

Group manages risk, see pages 58 to 62 of the Strategic Report and

also pages 72 and 73 of the Corporate Governance Report within the

Annual Report and Accounts 2023 ("Annual Report").

Risk Description Mitigation

Strategic Risks

ESG compliance Failure to meet requirements An ESG strategy has been

and of institutional investors, devised with five key work

climate change customers and other stakeholders streams. Management will

risks when it comes to ESG requirements, focus on these to achieve

including provision of the ambition of growing

sustainable products and the business in a socially

reducing waste and plastics and environmentally responsible

(includes climate change way.

risks).

Various actions in environmental

and social have been implement.

Please refer to the ESG

section of the Annual Report

on pages 36 to 43 for further

actions being taken.

------------------------------------ -------------------------------------

Adapting Failure to anticipate and Broader delivery of the

to customer adapt to changes in customer overarching commercial

preferences preferences and shopping strategy must ensure continual

habits, market dynamics adaptation to changing

and competitor activity-channel customer preferences; in

shift. store, online and through

our business partners.

Historically, the business

has had limited access

to meaningful customer

and marketing insight to

drive improved decision

making. The creation of

a marketing and insight

function has improved decision

making.

The commercial planning

process continually reviews

and responds to changing

customer purchasing behaviour.

As the business becomes

fully omnichannel, the

customer demands for fulfilment

and service will increase

as a connected, seamless

experience becomes an expectation

rather than a desire. In

response, Click & Collect

and multi-ship have been

rolled out. Future developments

are being scoped.

------------------------------------ -------------------------------------

Brand customer Failure to manage and promote Brand strategy in place

experience the brand which could result which fully articulates

in loss of market share. cardfactory brand proposition

and strategic framework

to elevate the brand's

key attributes and to create

clarity around the omnichannel

proposition with cross

channel campaigns being

developed to support awareness

and growth including celebrate

life's moments.

We have significantly improved

customer insight and data

which is shaping our thinking

and decision making across

the business and we have

invested in, trialled and

launched a customer Service

Excellence programme, which

will continue to evolve.

Market data shows that

cardfactory has been successful

in retaining and attracting

customers through the strength

and value for money we

offer coupled with an increase

in range and sales of gifts

and celebration essentials.

Additionally, the communication

plan has a focus on investor

relations with an increased

focus on working with Corporate

Affairs agency to proactively

tell the cardfactory story.

See the 'Our brand' section

on pages 12 and 13 of the

Annual Report for further

information on our activities.

------------------------------------ -------------------------------------

Operational Risks

Enterprise Undergoing a design and To minimise these risks,

Resource phased implementation of we have successfully completed

Planning a new ERP systems to replace the initial implementation

(ERP) aging core IT infrastructure. phase, which encompassed

implementation This process carries inherent finance and master data

risks, including potential without any material disruption.

business disruption, data

loss, inability to achieve We have also restructured

expected benefits, and the project to adopt a

failure to provide the more incremental approach,

necessary foundation for which allows for smoother

executing our strategic transitions between phases,

plan. Key aspects of this reduced reliance on vulnerable

plan include developing legacy systems during peak

an omnichannel customer trading seasons, and enables

experience, enhancing engagement the achievement of critical

with retail partners, and strategic plan components.

driving operational efficiencies Furthermore, we have increased

in stores. our focus on business process

engineering, dedicated

resources and change management

strategies to support a

successful ERP implementation.

------------------------------------ -------------------------------------

IT infrastructure Unsupported and legacy The IT strategy implementation

and security software, some of which includes ongoing specialist

is subject to material support for legacy systems

tailoring, requires ongoing and migration to new systems,

support to maintain functionality including the ERP implementation

and significant transactional with dedicated teams in

volumes. There is a reliance place to manage the transition.

on IT systems to support

all operations, which could Cyber expertise is employed

be exposed to cyber risk. within the business and

appropriate cyber controls

are in place. Plans designed

to continue to address

multiple cyber risks, alongside

further risk mitigations

arising from replacement

of legacy systems, are

also in place.

------------------------------------ -------------------------------------

Business Prolonged loss or server A business continuity and

continuity disruption to Printcraft disaster recovery plan

print and production facilities, is in place, which includes

web fulfilment centre and the use of alternative

supply chain. suppliers for any impacted

production processes.

In relation to online fulfilment,

any short-term outages

can be mitigated by adjustment

of delivery times for online

orders. Business continuity

plans are in place, which

include the use of third

parties.

Planning permission has

been obtained and groundworks

completed on an additional

building to create capacity

for online fulfilment,

to relieve capacity constraints.

------------------------------------ -------------------------------------

Supplier Supplier CSR breach resulting Processes for suppliers

CSR breach in a potential breach of to agree to appropriate

legislation (eg. Modern standards, which are subject

Slavery, Anti Bribery & to regular audit and inspection

Corruption) and for products by cardfactory teams (or

supplied (eg. Safety and receipt of alternative

labelling standards), which adequate independent report)

could damage cardfactory's to validate compliance,

reputation and reduce sales. with a strict 'no audit

- no order' policy adopted.

Testing and pre-shipment

sampling of production

models is being undertaken.

All product testing and

quality control inspections

is undertaken by authorised

accredited providers. A

dedicated quality control

team is in place to test

pre-shipment sampling of

production models.

The risk profile for most

suppliers to Getting Personal

is significantly lower,

with limited supplies from

the Far East. Plans are

being developed to extend

the quality control and

technical teams' scope

to include these suppliers

with adoption of appropriate

requirements to mitigate

risks.

------------------------------------ -------------------------------------

Retail partner cardfactory may not realise A business development

exposure the growth in profitable team has been formed to

revenue from retail partners, build relationships with

which is a significant existing partners and develop

component for future growth a pipeline of future partners.

of the business and the

brand or reputation could Brand standard requirements

be damaged by the actions are in place to provide

of retail partners. a clear framework for partners,

with regular reviews adopted.

Enhanced requirements will

be incorporated in any

future retail partner requirements.

------------------------------------ -------------------------------------

Financial Risks

Geopolitical Geopolitical instability Suppliers:

instability leading to - Diversifying the supply

restrictions on trade base by bringing more production

Suppliers: Operating with back to the UK while also

a supply base whereby we exploring other geographical

have the total business territories.

or specific categories - Buyers have extensive

solely dependent on industry knowledge, know

one supplier, region or of alternative suppliers

country carries significant if mitigation needs arise

stock supply risk. China and manage any supply issues

remains our biggest supply or problems.

route. Customers: Moving supply

Customers: Restrictions to new territories and

on supply from certain using UK-based suppliers

countries may impact availability (non-exclusive product)

and retail selling prices. will mitigate the supply

Geographies and governments: issue at the shelf edge,

New legislation and import but could potentially drive

tariffs may force resourcing increased cost, with price

decisions. elasticity assessments

to provide insights on

consequences of future

price increases.

Geographies and governments:

Continual review of the

import tariff duties and

'live' government legislative

changes to ensure we are

always sourcing from the

best source to support

the overall business.

------------------------------------ -------------------------------------

Directors' Responsibility Statement

The Annual Report and Accounts 2023 contains a statement of

directors' responsibility by Darcy Willson-Rymer, Chief Executive

Officer, by order of the Board in the following form:

"We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole; and

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

issuer and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face.

We consider the Annual Report and Accounts, taken as a whole, is

fair, balanced and understandable and provides the information

necessary for shareholders to assess the Group's position and

performance, business model and strategy."

Related Party Transactions

Details of the only material transactions with related parties

during the financial year ended 31 January 2023 are set out in note

28 of the financial statements on page 142 of the Annual Report and

Accounts.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSSFFFDUEDSEDI

(END) Dow Jones Newswires

May 19, 2023 09:34 ET (13:34 GMT)

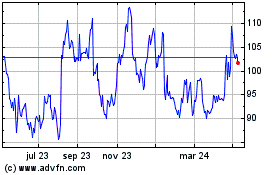

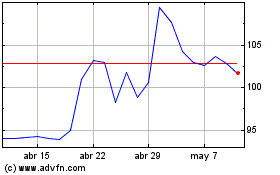

Card Factory (LSE:CARD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Card Factory (LSE:CARD)

Gráfica de Acción Histórica

De May 2023 a May 2024