Compagnie de Saint-Gobain Issue of Debt (7538T)

16 Noviembre 2023 - 12:22PM

UK Regulatory

TIDMCOD

RNS Number : 7538T

Compagnie de Saint-Gobain

16 November 2023

SAINT-GOBAIN SUCCESSFULLY PRICED A DOUBLE TRANCHE

EUR 2 BILLION BOND ISSUE CONSISTING OF:

-- EUR 1 billion with a 3-year maturity and a 3.75% coupon

-- EUR 1 billion with a 7-year maturity and a 3.875% coupon

With this transaction Saint-Gobain took advantage of favorable

market conditions to anticipate the refinancing of upcoming bond

maturities, while optimizing its financing costs.

The bonds were about 2 times oversubscribed with about 200

investors demonstrating confidence in the Group's credit

quality.

Saint-Gobain's long-term senior debt is rated BBB+ (stable

outlook) by Standard & Poor's and Baa1 (stable outlook) by

Moody's.

Citi and Natixis acted as global coordinators and bookrunners,

while Barclays, BBVA, Deutsche Bank, Danske Bank, JP Morgan, La

Banque Postale, Mizuho and NatWest Markets, also acted as

bookrunners on this bond issue.

About Saint-Gobain

Worldwide leader in light and sustainable construction,

Saint-Gobain designs, manufactures and distributes materials and

services for the construction and industrial markets. Its

integrated solutions for the renovation of public and private

buildings, light construction and the decarbonization of

construction and industry are developed through a continuous

innovation process and provide sustainability and performance. The

Group's commitment is guided by its purpose, "MAKING THE WORLD A

BETTER HOME".

EUR51.2 billion in sales in 2022

168,000 employees, locations in 75 countries

Committed to achieving Carbon Neutrality by 2050

For more information about Saint-Gobain, visit

www.saint-gobain.com and follow us on

X @saintgobain .

Analyst/investor relations Press relations

-------------------------------------------------

Vivien Dardel: +33 1 88 54 29 77 Patricia Marie : +33 1 88 54 26 83

----------------------- ------------------ ----------------------------- ------------------

Floriana Michalowska: +33 1 88 54 19 09 Laure Bencheikh : +33 1 88 54 26 38

----------------------- ------------------ ----------------------------- ------------------

Alix Sicaud: +33 1 88 54 38 70 Flavio Bornancin-Tomasella : +33 1 88 54 27 96

----------------------- ------------------ ----------------------------- ------------------

James Weston: +33 1 88 54 01 24

----------------------- ------------------ ----------------------------- ------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IODNKABDFBDDCDD

(END) Dow Jones Newswires

November 16, 2023 13:22 ET (18:22 GMT)

Compagnie De Saint-gobain (LSE:COD)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

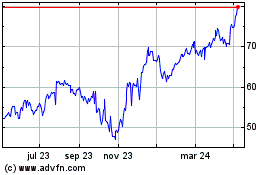

Compagnie De Saint-gobain (LSE:COD)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024