TIDMCTPE

RNS Number : 5266U

CT Private Equity Trust PLC

24 November 2023

To: Stock Exchange For immediate release:

24 November 2023

CT Private Equity Trust PLC

Quarterly results for the three months ended 30 September 2023

(unaudited)

-- Net asset value of 696.30p per Ordinary Share reflecting a

total return for the three months of 3.3 per cent for the Ordinary

Shares

-- Share price total return for the three-month period of 0.4%.

-- Total quarterly dividends of 20.97p per Ordinary Share year

to date representing an increase of 10.5% from the same period last

year.

o Quarterly dividend of 6.95p paid on 31 July 2023

o Quarterly dividend of 7.01p paid on 31 October 2023

o Quarterly dividend of 7.01p to be paid on 31 January 2024

-- Dividend yield of 5.9 per cent based on the period end share price (1).

-- As at 30 September 2023 net debt was GBP74.5 million equivalent to a gearing level of 12.8%.

(1) Calculated as dividends of 6.79p paid on 28 April 2023,

6.95p paid on 31 July 2023, 7.01p paid on 31 October 2023 and 7.01p

payable on 31 January 2024, divided by the Company's share price of

468.00p as at 30 September 2023.

Manager's Review

Introduction

As at 30 September 2023 the net assets of the Company were

GBP507.2 million giving a Net Asset Value ("NAV") per share of

696.30p which taking account of the dividend of 6.95p paid on 31

July 2023 gives a total return for the third quarter of +3.3% and

for the first nine months of 0.9%. This valuation is, as usual,

largely composed of 30 June valuations with around 11% of

valuations struck at 30 September 2023. The pound has been weaker

against most major currencies over the quarter and this has

increased NAV by approximately 1.3% during the three month period.

In the year to date there has been minimal impact of currency.

The share price total return over the quarter was 0.4%. The

discount to NAV at the latest practicable date, 23 November 2023,

is 33.2% which compares with 32.8% as at 30 September 2023.

At 30 September 2023 the Company had net debt of GBP74.5

million. The outstanding undrawn commitments were GBP215 million of

which GBP27 million was to funds where the investment period had

expired.

A dividend of 7.01p was paid on 31 October 2023. In accordance

with the Company's dividend policy the next dividend will be 7.01p

which will be paid on 31 January 2024 to shareholders on the

register on 5 January 2024 with an ex-dividend date of 4 January

2024.

New Investments

During the quarter we made three new commitments to funds and

two co-investments.

CAD$10 million has been committed to Torquest VI, one of the

leading Canadian mid-market buyout funds.

GBP10 million was committed to Inflexion Partnership Capital

III, the latest in the series of funds from this key relationship.

The latest fund is focused on European mid-market minority

buyout.

$5 million was committed to Purpose Brands, a US consumer

franchise co-investment fund. The fund is managed by American based

Level 5 Capital Partners, an emerging manager focused on consumer

franchise businesses.

Our dealflow of co-investments remains strong with two new

co-investments made during the quarter.

The first co-investment is an Industrial Internet of Things

(IIoT) software company which provides software solutions primarily

for manufacturing processes. EUR5.2 million has been invested.

Utimaco is a Germany based company providing mission critical

professional cybersecurity and data intelligence solutions for

critical infrastructures. EUR6.0 million has been invested.

The funds in the portfolio continue to build out their

portfolios with new investments. The larger individual investments

are as follows; Magnesium Capital 1, the energy transition fund

drew GBP0.9 million for SCADA (software and control systems for the

renewables sector) and Inpower (e-boilers for district and

industrial heating), Hg Saturn 3 drew GBP1.5 million for Access

(enterprise software) and IFS/Workwave (field service management

software). In the US Corsair Capital VI called GBP0.8 million for

Hungerush (all in one point of sale and restaurant management

platform).

There were add on acquisitions to three co-investments; GBP0.9

million for Startraq where Farthest Gate, a London based provider

of parking, permitting and licensing software for local authorities

has been acquired, GBP0.8 million for 1Med which has acquired

Evamed, a French medical device focused clinical research

organisation (CRO) based in Caen and GBP0.5 million for funeral

homes company San Siro for prospective acquisitions.

The total of new co-investments and drawdowns for funds and

existing co-investments in the quarter was GBP24.1 million. Of this

approximately half is for fund drawdowns and half for

co-investments. Total new investment for 2023 to date is GBP98.7

million which is c.40% up on the same period in 2022.

Realisations

Although there has been a slowdown in exits by the third

quarter, there were several notable realisations in the

portfolio.

We have completed the sell down of energy services company

Ashtead Technology, which is now listed, with a final GBP5.5

million realised. This brings total proceeds to GBP20 million

representing 2.5x cost and an IRR of 19%. This investment was led

by Buckthorn with whom we have three other co-investments.

The Agilitas 2015 Fund has had a good exit with the sale of

Hydro International, the water services company to CRH plc. This

realised GBP2.1 million representing 3.1x cost.

ArchiMed II returned GBP1.0 million principally from the sale of

gene therapy company Polyplus. This represented 4.6x cost and an

IRR of 75%.

Other notable exits include the sale by Inflexion 2012

Co-investment Fund of the specialist design engineering services

company PDMS which sells to the oil and gas sector, returning

GBP0.7 million. Summa II, the Nordic sustainable fund returned

GBP0.5 million from the sale of construction sector software

company Infobric which returned 3.8x cost and an IRR of 36%.

In total realisations for the quarter were GBP14.1 million which

is slightly down on Q2. This brings realisations in 2023 to date to

GBP53.9 million which is just over 30% down on the same period in

2022.

Valuation Changes

There were many valuation movements this quarter. Most of these

were upwards and they were quite well balanced between the funds

and co-investment elements of the portfolio.

The largest individual uplift was for Italian investment company

Aliante Equity 3 (+GBP3.1 million) which has benefitted from a

revised third-party valuation, good progress in the portfolio and

debt reduction. August Equity IV and August Equity V were up by

GBP2.1 million and GBP1.0 million respectively. Our holding in US

fund Graycliff IV was up by GBP1.8 million reflecting good

fundamental progress across its portfolio. Amongst the

co-investment portfolio there were uplifts for TWMA (+GBP1.8

million), Utimaco (+GBP1.6 million), Jollyes (+GBP1.5 million) and

Coretrax (+GBP1.3 million). With the exception of Utimaco, these

are mature holdings well on the way towards exit.

Financing

The Company has maintained a strong investment programme

throughout the year which has turned out to exceed the total

proceeds from realisations for the year to date. This results in a

net increase in debt with net debt standing at GBP74.5 million at

30 September 2023. This equates to gearing of 12.8%, which is well

within our usual comfort range. The Company retains considerable

headroom in its borrowing facility. Our GBP116.7 million facility

is due to be renewed or extended by June 2024 and we have already

commenced discussions with the lenders on this topic.

Capital Allocation

The Company aims to maintain a fully invested portfolio and to

provide a strong dividend. The dividend which is 4% of NAV and is

paid at the same or higher levels is substantial and has grown in

tandem with NAV since the Company introduced this policy in 2012.

We believe that a growing and largely predictable dividend is

highly appreciated by our shareholders and we intend to direct and

manage the Company with the long term growth of the dividend as a

high priority.

The Company, in common with the rest of the Private Equity

investment trust sector, trades on a substantial discount to NAV.

Whilst the realisations from our portfolio have consistently been

at a substantial premium to previous carrying value, usually well

above 30%, this proof of the conservative nature of the valuations

does not seem to have had any bearing on the share ratings which

one could argue represent a 'double discount' to ultimate

value.

The Company routinely takes buy-back powers and has used these

sparingly when necessary over the years. A purchase of a loose line

of stock by the Company is usually in the interests of all

shareholders acting to stabilise the share price. At a substantial

discount to NAV this also immediately enhances NAV per share. This

is a one-off benefit, but it does act to reduce the asset base of

the Company potentially permanently and the capital used for

buy-backs cannot subsequently be used for longer term multi-year

investments nor to fund the dividend or to repay debt. The

importance of the dividend has been mentioned above.

The long-term annualised return from investments is substantial

and these returns should be compared with the return from a share

buy-back using the same capital. The last 149 exits from the

Company, which gave proceeds of GBP318 million, from 2020 to 30

September 2023 have produced an average return of 3.6x cost and an

IRR of 27%, a strong annual return over a median holding period of

5.6 years. Whilst the past is not necessarily a guide to the

future, these statistics provide some idea of the opportunity cost

of using this capital for buy-backs. These factors, namely the

protection of a growing dividend, the potential returns of new

investments and the immediate enhancement of NAV from buy-backs at

a discount are carefully considered by the Company's directors and

management on a tactical and strategic basis when determining the

use of the Company's precious capital.

It is worth recording that the Company has recently underwritten

the purchase of its own shares in the recent past when a loose line

of stock was in the market. On that occasion it was not ultimately

necessary for the shares to be bought back. It should also be noted

that the Company's substantial dividend policy was initiated more

than a decade ago as a means of allowing our shareholders to

benefit from the steady flow of realisations that the Company

achieves without the need to sell any of their shareholdings. Many

shareholders choose to reinvest their dividends back into the

shares which, as the Company routinely observes, is a good way of

building up a larger shareholding over time.

Outlook

The private equity sector internationally has gone through an

adjustment phase this year. Inflation and interest rates have been

high and there is either sluggish growth or mild recession in most

of our target markets. The banking environment is somewhat tighter

than previously and some highly rated sectors no longer command

very high prices unconditionally. The international environment is

volatile with the external shock risk elevated. It is therefore

taking longer for deals to be confirmed with buyers and sellers

starting off with differing price expectations. That all said,

business confidence is robust and there remain healthy levels of

turnover in private companies. Our dealflow of investable companies

is excellent. The exit boom of recent years is now past and we are

returning to more 'normal' conditions. The Company's portfolio is

fundamentally sound, conservatively valued and deriving strength

through its comprehensive diversification whilst having plenty of

meaningful holdings in companies with potential for superior

returns. As we approach the end of 2023 the prospects for further

returns for shareholders in line with our long-term growth trend is

good. Your Company was recently named as Private Equity and Growth

Capital Investment Trust of the year by Investment Week.

Hamish Mair

Investment Manager

Columbia Threadneedle Investment Business Limited

Portfolio Summary

Portfolio Distribution at 30 September % of Total % of Total

2023 30 September 2023 31 December 2022

======================================== =================== ==================

Buyout Funds - Pan European* 10.0 11.1

======================================== =================== ==================

Buyout Funds - UK 16.5 15.4

======================================== =================== ==================

Buyout Funds - Continental Europe 17.6 20.1

======================================== =================== ==================

Secondary Funds 0.1 0.1

======================================== =================== ==================

Private Equity Funds - USA 5.3 4.3

======================================== =================== ==================

Private Equity Funds - Global 1.6 1.2

======================================== =================== ==================

Venture Capital Funds 3.5 3.7

======================================== =================== ==================

Direct - Quoted - 1.1

======================================== =================== ==================

Direct Investments/Co-investments 45.4 43.0

======================================== =================== ==================

100.0 100.0

======================================== =================== ==================

* Europe including the UK.

Europe excluding the UK.

Ten Largest Holdings Total Valuation GBP'000 % of Total Portfolio

As at 30 September 2023

============================= ================================ ===============================

Sigma 16,457 2.8

============================= ================================ ===============================

Inflexion Strategic Partners 15,346 2.6

============================= ================================ ===============================

Coretrax 14,554 2.5

============================= ================================ ===============================

Jollyes 13,485 2.3

============================= ================================ ===============================

TWMA 11,765 2.0

============================= ================================ ===============================

Aliante Equity 3 11,528 1.9

============================= ================================ ===============================

Aurora Payment Solutions 10,618 1.8

============================= ================================ ===============================

San Siro 10,240 1.7

============================= ================================ ===============================

August Equity Partners V 9,780 1.6

============================= ================================ ===============================

SEP V 9,395 1.6

============================= ================================ ===============================

123,168 20.8

=============================================================== ===============================

Portfolio Holdings

Investment Geographic Focus Total % of Total

Valuation Portfolio

GBP'000

====================================== ================== ============================ ==========

Buyout Funds - Pan European

Apposite Healthcare II Europe 8,865 1.5

F&C European Capital Partners Europe 8,858 1.5

Stirling Square Capital II Europe 8,277 1.4

Apposite Healthcare III Europe 7,381 1.3

ArchiMed II Western Europe 4,132 0.7

Agilitas 2015 Fund Northern Europe 3,639 0.6

Magnesium Capital 1 Europe 3,265 0.6

Astorg VI Western Europe 3,188 0.5

KKA II Europe 1,513 0.3

Summa III Northern Europe 1,480 0.3

Volpi III Northern Europe 1,316 0.2

Silverfleet European Dev Fund Europe 1,233 0.2

Agilitas 2020 Fund Europe 1,199 0.2

TDR Capital II Western Europe 1,175 0.2

TDR II Annex Fund Western Europe 1,012 0.2

Verdane XI Northern Europe 732 0.1

Med Platform II Global 714 0.1

ArchiMed MED III Global 649 0.1

Volpi Capital Northern Europe 76 -

Wisequity VI Italy 71 -

Verdane Edda III Northern Europe 25 -

Total Buyout Funds - Pan European 58,800 10.0

====================================== ================== ============================ ==========

Buyout Funds - UK

Inflexion Strategic Partners United Kingdom 15,346 2.6

August Equity Partners V United Kingdom 9,780 1.6

August Equity Partners IV United Kingdom 8,166 1.4

Axiom 1 United Kingdom 6,266 1.1

Inflexion Supplemental V United Kingdom 6,211 1.1

Apiary Capital Partners I United Kingdom 5,898 1.0

Inflexion Buyout Fund V United Kingdom 5,657 1.0

Kester Capital II United Kingdom 4,236 0.7

Piper Private Equity VI United Kingdom 4,066 0.7

Inflexion Buyout Fund IV United Kingdom 3,416 0.6

Inflexion Partnership Capital II United Kingdom 3,100 0.5

Inflexion Enterprise Fund IV United Kingdom 3,015 0.5

FPE Fund III United Kingdom 2,850 0.5

FPE Fund II United Kingdom 2,752 0.5

Inflexion Buyout Fund VI United Kingdom 2,275 0.4

Inflexion Enterprise Fund V United Kingdom 2,152 0.4

RJD Private Equity Fund III United Kingdom 2,030 0.3

Inflexion Supplemental IV United Kingdom 1,545 0.3

GCP Europe II United Kingdom 1,495 0.2

Horizon Capital 2013 United Kingdom 1,265 0.2

Piper Private Equity VII United Kingdom 1,146 0.2

Primary Capital IV United Kingdom 1,126 0.2

Inflexion Partnership Capital I United Kingdom 1,019 0.2

Dunedin Buyout Fund II United Kingdom 860 0.1

Kester Capital III United Kingdom 796 0.1

Piper Private Equity V United Kingdom 387 0.1

Inflexion 2012 Co-Invest Fund United Kingdom 127 -

Inflexion 2010 Fund United Kingdom 89 -

Total Buyout Funds - UK 97,071 16.5

====================================== ================== ============================ ==========

Investment Geographic Focus Total % of Total

Valuation Portfolio

GBP'000

====================================== ================== ============================ ==========

Buyout Funds - Continental Europe

Aliante Equity 3 Italy 11,528 1.9

Bencis V Benelux 9,348 1.6

DBAG VII DACH 5,388 0.9

Vaaka III Finland 5,269 0.9

Capvis III CV DACH 5,152 0.9

Avallon MBO Fund III Poland 4,769 0.8

Montefiore IV France 4,677 0.8

Italian Portfolio Italy 4,623 0.8

Chequers Capital XVII France 4,148 0.7

Procuritas VI Nordic 3,999 0.7

DBAG VIII DACH 3,945 0.7

Summa II Nordic 3,836 0.7

Verdane Edda Nordic 3,511 0.6

ARX CEE IV Eastern Europe 3,101 0.5

Montefiore V France 2,979 0.5

Capvis IV DACH 2,727 0.5

Corpfin Capital Fund IV Spain 2,675 0.4

Procuritas Capital IV Nordic 2,442 0.4

NEM Imprese III Italy 2,338 0.4

Procuritas VII Nordic 2,271 0.4

Corpfin V Spain 2,122 0.4

Summa I Nordic 2,100 0.4

DBAG Fund VI DACH 1,710 0.3

Portobello Fund III Spain 1,355 0.2

Vaaka II Finland 1,345 0.2

Vaaka IV Finland 1,319 0.2

Avallon MBO Fund II Poland 1,037 0.2

DBAG VIIB DACH 998 0.2

Chequers Capital XVI France 800 0.1

DBAG VIIIB DACH 608 0.1

Ciclad 5 France 553 0.1

PineBridge New Europe II Eastern Europe 458 0.1

Procuritas Capital V Nordic 126 -

Gilde Buyout Fund III Benelux 93 -

Capvis III DACH 51 -

N+1 Private Equity Fund II Iberia 42 -

Montefiore Expansion France 26 -

Ciclad 4 France 18 -

DBAG Fund V DACH 5 -

====================================== ================== ============================ ==========

Total Buyout Funds - Continental

Europe 103,492 17.6

====================================== ================== ============================ ==========

Secondary Funds

The Aurora Fund Europe 678 0.1

===================================================== ================= ========== ==========

Total Secondary Funds 678 0.1

===================================================== ================= ========== ==========

Investment Geographic Focus Total % of Total

Valuation Portfolio

GBP'000

========================================================== ================= ========== ==========

Total Private Equity Funds - USA

Blue Point Capital IV North America 8,088 1.4

Graycliff IV North America 4,648 0.8

Camden Partners IV United States 3,268 0.6

Graycliff III United States 3,235 0.5

Stellex Capital Partners North America 3,109 0.5

Blue Point Capital III North America 2,822 0.5

Purpose Brands (Level 5) United States 2,458 0.4

Level 5 Fund II United States 2,286 0.4

MidOcean VI United States 1,069 0.2

Blue Point Capital II North America 156 -

HealthpointCapital Partners III United States 36 -

========================================== ================= ========== ==========

Total Private Equity Funds - USA 31,175 5.3

============================================================= ========== ==========

Private Equity Funds - Global

Corsair VI Global 5,099 0.9

Hg Saturn 3 Global 2,589 0.4

PineBridge GEM II Global 865 0.2

F&C Climate Opportunity Partners Global 725 0.1

AIF Capital Asia III Asia 69 -

PineBridge Latin America II South America 58 -

Hg Mercury 4 Global 34 -

Warburg Pincus IX Global 9 -

Total Private Equity Funds - Global 9,448 1.6

============================================================= ========== ==========

Venture Capital Funds

SEP V United Kingdom 9,395 1.6

MVM V Global 4,151 0.7

Kurma Biofund II Europe 2,704 0.5

SEP IV United Kingdom 1,268 0.2

Northern Gritstone United Kingdom 1,010 0.2

SEP VI Europe 927 0.1

1Pentech Fund II United Kingdom 436 0.1

MVM VI Global 423 0.1

SEP II United Kingdom 273 -

Life Sciences Partners III Western Europe 251 -

Environmental Technologies Fund Europe 56 -

SEP III United Kingdom 43 -

Total Venture Capital Funds 20,937 3.5

Investment Geographic Focus Total % of Total

Valuation Portfolio

GBP'000

========================================== ================= ========== ==========

Direct Investments/Co-investments

Sigma United States 16,457 2.8

Coretrax United Kingdom 14.554 2.5

Jollyes United Kingdom 13,485 2.3

TWMA United Kingdom 11,765 2.0

Aurora Payment Solutions United States 10,618 1.8

San Siro Italy 10,240 1.7

ATEC (CETA) United Kingdom 9,113 1.5

Amethyst Radiotherapy Europe 8,296 1.4

Cyclomedia Netherlands 8,013 1.4

AccuVein United States 7,679 1.3

Utimaco DACH 7,200 1.2

Leader96 Bulgaria 7,107 1.2

Velos IoT (JT IoT) United Kingdom 7,050 1.2

Prollenium North America 6,809 1.2

Rosa Mexicano United States 6,761 1.1

Asbury Carbons North America 6,554 1.1

Swanton United Kingdom 6,477 1.1

Cyberhawk United Kingdom 5,632 1.0

Orbis United Kingdom 5,477 0.9

Weird Fish United Kingdom 5,465 0.9

Family First United Kingdom 5,431 0.9

1Med Switzerland 5,339 0.9

Cybit (Perfect Image) United Kingdom 5,116 0.9

123Dentist Canada 4,848 0.8

Dotmatics United Kingdom 4,538 0.8

SEP VI Co-investment 3 France 4,479 0.8

Omlet United Kingdom 4,371 0.7

StarTraq United Kingdom 4,240 0.7

Agilico (DMC Canotec) United Kingdom 4,159 0.7

LeadVenture United States 3,954 0.7

Walkers Transport United Kingdom 3,908 0.7

Habitus Denmark 3,752 0.6

MedSpa Partners Canada 3,721 0.6

PathFactory Canada 3,608 0.6

Ambio Holdings United States 3,557 0.6

Alessa (Tier1 CRM) Canada 3,540 0.6

Contained Air Solutions United Kingdom 3,501 0.6

Avalon United Kingdom 3,441 0.6

Vero Biotech United States 2,733 0.5

Collingwood Insurance Group United Kingdom 2,671 0.5

CARDO Group (Sigma II) United Kingdom 2,661 0.5

Neurolens United States 2,453 0.4

GT Medical United States 1,963 0.3

Rephine United Kingdom 1,575 0.3

Bomaki Italy 1,484 0.3

OneTouch United Kingdom 1,450 0.2

TDR Algeco/Scotsman Europe 264 -

Babington United Kingdom 75 -

Total Direct - Investments/Co-investments 267,584 45.4

============================================================= ========== ==========

Total Portfolio 589,185 100.0

============================================================= ========== ==========

CT PRIVATE EQUITY TRUST PLC

Statement of Comprehensive Income for the

nine months ended 30 September 2023 (unaudited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

------------------------------------------ --------- --------- ---------

Income

Gains on investments held at fair value - 14,181 14,181

Exchange gains - 759 759

Investment income 1,618 - 1,618

Other income 552 - 552

------------------------------------------ --------- --------- ---------

Total income 2,170 14,940 17,110

------------------------------------------ --------- --------- ---------

Expenditure

Investment management fee - basic fee (354) (3,187) (3,541)

Investment management fee - performance

fee - (5,017) (5,017)

Other expenses (816) - (816)

------------------------------------------ --------- --------- ---------

Total expenditure (1,170) (8,204) (9,374)

------------------------------------------ --------- --------- ---------

Profit before finance costs and taxation 1,000 6,736 7,736

Finance costs (336) (3,026) (3,362)

------------------------------------------ --------- --------- ---------

Profit before taxation 664 3,710 4,374

Taxation - - -

Profit for period/total comprehensive

income 664 3,710 4,374

Return per Ordinary Share 0.91p 5.09p 6.00p

CT PRIVATE EQUITY TRUST PLC

Statement of Comprehensive Income for the

nine months ended 30 September 2022 (unaudited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

------------------------------------------ --------- --------- ---------

Income

Gains on investments held at fair value - 71,703 71,703

Exchange losses - (1,757) (1,757)

Investment income 3,971 - 3,971

Other income 121 - 121

------------------------------------------ --------- --------- ---------

Total income 4,092 69,946 74,038

------------------------------------------ --------- --------- ---------

Expenditure

Investment management fee - basic fee (343) (3,084) (3,427)

Investment management fee - performance

fee - (5,443) (5,443)

Other expenses (822) - (822)

------------------------------------------ --------- --------- ---------

Total expenditure (1,165) (8,527) (9,692)

------------------------------------------ --------- --------- ---------

Profit before finance costs and taxation 2,927 61,419 64,346

Finance costs (182) (1,639) (1,821)

------------------------------------------ --------- --------- ---------

Profit before taxation 2,745 59,780 62,525

Taxation - - -

Profit for period/total comprehensive

income 2,745 59,780 62,525

Return per Ordinary Share 3.73p 81.32p 85.05p

CT PRIVATE EQUITY TRUST PLC

Statement of Comprehensive Income for the

year ended 31 December 2022 (audited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

-------------------------------------------- --------- --------- ---------

Income

Gains on investments held at fair value - 77,330 77,330

Exchange gains - (2,083) (2,083)

Investment income 4,550 - 4,550

Other income 186 - 186

-------------------------------------------- --------- --------- ---------

Total income 4,736 75,247 79,983

-------------------------------------------- --------- --------- ---------

Expenditure

Investment management fee - basic fee (464) (4,172) (4,636)

Investment management fee - performance

fee - (5,402) (5,402)

Other expenses (1,077) - (1,077)

-------------------------------------------- --------- --------- ---------

Total expenditure (1,541) (9,574) (11,115)

-------------------------------------------- --------- --------- ---------

Profit before finance costs and taxation 3,195 65,673 68,868

Finance costs (254) (2,294) (2,548)

-------------------------------------------- --------- --------- ---------

Profit before taxation 2,941 63,379 66,320

Taxation - - -

Profit for year/total comprehensive income 2,941 63,379 66,320

Return per Ordinary Share 4.01p 86.42p 90.43p

CT PRIVATE EQUITY TRUST PLC

Balance Sheet

As at 30 As at 30 As at 31

September September December

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

----------------------------------- ------------ ------------ ----------

Non-current assets

Investments at fair value through

profit or loss 589,185 548,871 528,557

----------------------------------- ------------ ------------ ----------

Current assets

Other receivables 1,551 717 389

Cash and cash equivalents 3,995 14,062 34,460

----------------------------------- ------------ ------------ ----------

5,546 14,779 34,849

Current liabilities

Other payables (9,036) (7,364) (7,411)

Interest-bearing bank loan (78,477) (16,437) (16,618)

----------------------------------- ------------ ------------ ----------

(87,513) (23,801) (24,029)

Net current (liabilities)/assets (81,967) (9,022) 10,820

----------------------------------- ------------ ------------ ----------

Interest-bearing bank loan - (21,373) (21,702)

Net assets 507,218 518,476 517,675

----------------------------------- ------------ ------------ ----------

Equity

Called-up ordinary share capital 739 739 739

Share premium account 2,527 2,527 2,527

Special distributable capital

reserve 10,026 10,026 10,026

Special distributable revenue

reserve 31,403 31,403 31,403

Capital redemption reserve 1,335 1,335 1,335

Capital reserve 461,188 472,446 471,645

Shareholders' funds 507,218 518,476 517,675

----------------------------------- ------------ ------------ ----------

Net asset value per Ordinary

Share 696.30p 711.75p 710.65p

CT PRIVATE EQUITY TRUST PLC

Reconciliation of Movements in Shareholders' Funds

Nine months Nine months Year ended

ended 30 September ended 30 31 December

2023 September 2022

2022

(unaudited) (unaudited) (audited)

------------------------------ -------------------- ------------ -------------

GBP'000 GBP'000 GBP'000

Opening shareholders' funds 517,675 473,447 473,447

Buyback of ordinary shares - (5,014) (5,014)

Profit for the period/total

comprehensive income 4,374 62,525 66,320

Dividends paid (14,831) (12,482) (17,078)

------------------------------ -------------------- ------------ -------------

Closing shareholders' funds 507,218 518,476 517,675

------------------------------ -------------------- ------------ -------------

Notes (unaudited)

1. The unaudited quarterly results have been prepared on the

basis of the accounting policies set out in the statutory accounts

of the Company for the year ended 31 December 2022. Earnings for

the nine months to 30 September 2023 should not be taken as a guide

to the results for the year to 31 December 2023.

2. Investment management fee:

Nine months ended Nine months ended Year ended 31 December

30 September 2023 30 September 2022 2021

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

Investment

management

fee - basic fee 354 3,187 3,541 343 3,084 3,427 464 4,172 4,636

Investment

management

fee - performance

fee - 5,017 5,017 - 5,443 5,443 - 5,402 5,402

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

354 8,204 8,558 343 8,527 8,870 464 9,574 10,038

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

3. Finance costs:

Nine months ended Nine months ended Year ended 31 December

30 September 2023 30 September 2022 202 2

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- --------- --------- --------- --------- --------- --------- --------- ---------

Interest payable

on bank loans 336 3,026 3,362 182 1,639 1,821 254 2,294 2,548

4. Returns and net asset values

Nine months ended Nine months Year ended 31

30 September 2023 ended 30 September December 2022

2022

(unaudited) (unaudited) (audited)

The returns and net asset

values per share are based

on the following figures:

Revenue Return GBP664,000 GBP2,745,000 GBP2,941,000

Capital Return GBP3,710,000 GBP59,780,000 GBP63,379,000

Net assets attributable GBP507,218,000 GBP518,476,000 GBP517,675,000

to shareholders

Number of shares in issue

at end of period (excluding

shares held in treasury) 72,844,938 72,844,938 72,844,938

Weighted average number

of shares in issue during

the period

(excluding shares held in

treasury) 72,844,938 73,509,913 73,342,303

5. The financial information for the nine months ended 30

September 2023, which has not been audited or reviewed by the

Company's auditor, comprises non-statutory accounts within the

meaning of Section 434 of the Companies Act 2006. Statutory

accounts for the year ended 31 December 2022, on which the auditor

issued an unqualified report, have been lodged with the Registrar

of Companies. The quarterly report is available on the Company's

website www.ctprivateequitytrust.com

Legal Entity Identifier: 2138009FW98WZFCGRN66

For more information, please contact:

Hamish Mair (Investment Manager) 0131 573 8314

Scott McEllen (Company Secretary) 0131 573 8372

hamish.mair@columbiathreadneedle.com / scott.mcellen@columbiathreadneedle.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTFLFITLLLVFIV

(END) Dow Jones Newswires

November 24, 2023 02:00 ET (07:00 GMT)

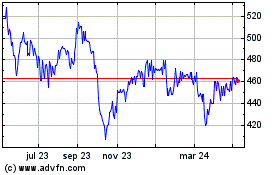

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

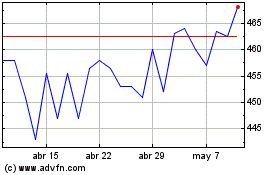

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024