Devolver Digital, Inc. Trading Update (1383I)

03 Agosto 2023 - 1:00AM

UK Regulatory

TIDMDEVO

RNS Number : 1383I

Devolver Digital, Inc.

03 August 2023

3 August 2023

The information contained within this announcement is deemed by

the company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of the

domestic law of the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018 (as amended) ("UK MAR"). Upon the publication

of this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

Devolver Digital, Inc.

("Devolver Digital", "Devolver" or the "Company", and the

Company together with all of its subsidiary undertakings "the

Devolver Group")

Trading Update

Devolver Digital, an award-winning digital publisher and

developer of indie video games, announces a trading update for the

six months to 30 June 2023, and updated guidance for the current

financial year ending 31 December 2023.

Our expectation for performance for 2023 has been impacted by

three key factors: delays to new title releases, a reduction in

revenue from subscription deals and a lower contribution from our

back-catalogue.

Our strategy is to maximise the appeal and success of new titles

by increasing investment in development, quality control and

marketing. While critical to our long-term growth, prioritising

quality to meet the standards and performance expected of Devolver

titles is resulting in delays, higher costs and greater complexity

for new releases. As such The Plucky Squire, a title that has been

tracking well with audiences, will now be released in 2024. It

joins other titles previously earmarked for release in 2023, such

as Anger Foot, Pepper Grinder and Stick It to the Stickman, which

were flagged earlier in 2023 as delayed in order to continue

value-add production to further improve their chances of success

and longevity. Devolver released one major title in 1H 2023, the

award-winning Terra Nil. In the second half of 2023, we expect to

release Wizard with a Gun and The Talos Principle 2, as well as

other titles in Q4 2023.

After a period of strong contribution during COVID, we have

turned down some subscription deal proposals in 2023 that we felt

did not adequately recognise the value of our titles. While

subscription deals with key platforms remain a part of our

long-term growth strategy, the management team has declined several

weaker propositions from major platform partners as we felt they

undervalued the proposed games' value and revenue opportunity in

2023 and 2024. We expect this trend of reduced revenues from

subscription deals to continue in 2024, compared to the period of

heightened subscription revenues in 2021 and 2022.

Back-catalogue sales have been softer following the weaker

performance of three key title releases in 2022, except for Cult of

the Lamb which has continued to perform strongly. As highlighted

earlier in 2023, a weaker overall economic environment continues to

soften back-catalogue momentum year-to-date.

In light of the performance year-to-date we expect Normalised

Adjusted EBITDA(1) to be negative in the first half of 2023. For

the full year ending 31 December 2023, we now expect Group

Normalised Adjusted EBITDA to be at least break-even. The Board

expects Normalised Adjusted EBITDA to return to growth in 2024 and

accelerate in 2025.

Devolver has a robust balance sheet with c.US$64m net cash on

hand as at end June 2023, which takes into account a c.US$7m

purchase of shares in the market in 1H 2023, which are now held in

Devolver's Employee Benefit Trust.

Devolver will provide further details on trading in its half

year results announcement, which is expected to be released in

September 2023.

Harry Miller, Executive Chairman of Devolver Digital, said:

"We are disappointed that 2023 performance will be lower than

expected, as we see an impact from delays to new titles, fewer

subscription deals and weaker back-catalogue revenues. We want to

ensure that we invest the right amount of time, effort and money

into our titles as the best way to do justice to our healthy

pipeline of releases scheduled for the next 24 months. We continue

to look for ways to improve our return from the back-catalogue, as

well as taking the right steps to maximise revenues from our new

releases.

We have seen a strong showing for upcoming Devolver titles at

the PlayStation Showcase 2023 in May, and have secured exciting

longer-term title wins such as Human Fall Flat 2. We are focusing

on our programme to translate the benefits of greater scale and

quality into improved revenues and margins beyond 2023, expecting a

return to growth in 2024 and 2025. As we work towards these

long-term goals, we will pursue a capital allocation strategy that

reflects our faith in the long-term strategy of the business. We

look forward to updating the market on our progress in the coming

months."

-ENDS-

Notes

1. Normalised adjusted EBITDA excludes: 1) stock compensation

(share-based payment) expenses and revaluation of contingent

consideration; 2) one-time expenses and other non-recurring items;

3) amortisation of IP (but does not exclude amortisation of

capitalised software development costs), and; 4) impairments of

goodwill, acquired IP and cancelled, unreleased games. Normalised

adjusted EBITDA does include impairments of capitalised software

development costs of underperforming released games.

About Devolver Digital

Devolver is an award-winning video games publisher in the indie

games space with a balanced portfolio of third-party and own-IP.

Devolver has an emphasis on premium games and has published more

than 100 titles, with more than 30 titles in the pipeline scheduled

for release over the next few years. Devolver has in-house studios

developing first-party IP titles and a complementary publishing

brand. Devolver is registered in Wilmington, Delaware, USA.

Enquiries

Devolver Digital, Inc. ir@devolverdigital.com

Harry Miller, Executive Chairman

Douglas Morin, Chief Executive Officer

Daniel Widdicombe, Chief Financial Officer

Zeus (Nominated Adviser and Sole Broker) +44 (0)20 3829 5000

Nick Cowles, Jamie Peel, Alexander Craig

(Investment Banking)

Ben Robertson (Equity Capital Markets

FTI Consulting (Communications Adviser) devolver@fticonsulting.com

Jamie Ricketts / Dwight Burden/ Valerija

Cymbal/ Usama Ali +44 (0)20 3727 1000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPTMBTMTJMTBJ

(END) Dow Jones Newswires

August 03, 2023 02:00 ET (06:00 GMT)

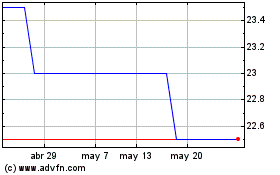

Devolver Digital (LSE:DEVO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Devolver Digital (LSE:DEVO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025