TIDMDKL

RNS Number : 4812P

Dekel Agri-Vision PLC

10 October 2023

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

10 October 2023

Dekel Agri-Vision Plc / Index: AIM / Epic: DKL / Sector: Food

Producers

Dekel Agri-Vision Plc

('Dekel' or the 'Company')

September Palm Oil Production & Q3 2023 Cashew Operation

Update

Dekel Agri-Vision Plc (AIM: DKL) , the West African agriculture

company focused on building a portfolio of sustainable and

diversified projects, is pleased to provide its Q3 2023 production

for the Ayenouan palm oil project in Côte d'Ivoire ('Palm Oil

Operation') and the cashew processing plant at Tiebissou, Côte

d'Ivoire (the 'Cashew Operation').

Palm Oil Operation Update

-- The Palm Oil Operation continued to deliver strong volumes

during Q3 2023 with Fresh Fruit Bunch ('FFB') volumes and Crude

Palm Oil ('CPO') production increasing 90.7% and 78.4% respectively

compared to Q3 2022. This was also our 7(th) successive month of

significantly higher production compared to 2022.

-- CPO sales quantities increased 192.4% in Q3 2023 compared to

last year. A large portion of the higher than normal CPO inventory

at the end of H1 2023 (due to the late high season), has now been

successfully sold and inventory levels have normalised.

-- The Q3 2023 average CPO sales price achieved was EUR817 per

tonne, a 20.1% decrease from the record Q3 2023 CPO sales prices.

The local CPO price in September 2023 increased slightly to EUR822

per tonne despite some softening of the international CPO price

from c.EUR900 per tonne to c.EUR850 per tonne as local stock levels

start to tighten following the strong production high season.

-- The CPO extraction rate for Q3 2023 of 19.3% was slightly

lower than Q3 2022, albeit we saw an improvement in the extraction

rate in September to 19.8%.

-- Overall, largely due to the 192.2% increase in CPO sales

volumes in Q3 2023 compared to Q3 2022, we maintain overview our

guidance that H2 2023 is well positioned to materially outperform

H2 2022.

Sept-23 Sept-22 Change Q3-2023 Q3-2022 Change

FFB processed (tonnes) 10,866 6,074 78.9% 30,084 15,777 90.7%

CPO Extraction Rate 19.8% 21.3% -7.0% 19.3% 20.6% -6.3%

CPO production (tonnes) 2,149 1,296 65.8% 5,797 3,249 78.4%

CPO Sales (tonnes) 2,734 1,076 154.1% 10,143 3,471 192.2%

Average CPO price

per tonne EUR822 EUR1,030 -20.2% 817 1,022 -20.1%

Palm Kernel Oil ('PKO')

production (tonnes) 97 105 -7.6% 489 286 71.0%

PKO Sales (tonnes) 105 53 98.1% 1,463 464 215.3%

Average PKO price

per tonne EUR838 EUR1,176 -28.7% EUR783 EUR1,372 -42.9%

Cashew Operation Update

-- The volume of Raw Cashew Nut ('RCN') processed in Q3 2023

increased 134.5% compared to Q2 2023. This was due to gradual

improvements in the production value chain and less operational

interruption following the successful completion of the BRC Global

Food standard assessment which took place in Q2 2023.

-- Whilst we have seen improvements in daily processing levels,

the performance of various items of equipment provided by our

Italian supplier remain below technical specifications, most

notably the peeling and shelling machinery. We have taken further

actions to supplement the Italian equipment including ordering

additional shelling machines from an external party which are

expected to be installed in November 2023. We have successfully

used these alternate shelling machines when initially awaiting

delayed equipment from the Italian supplier and the installation of

these machines should drive a further a material increase in

processing volumes.

-- The other main value drivers of the Cashew Operation

including the price of Raw Cashew Nut ('RCN'), the Cashew

extraction rate and sales prices are delivering in line with

expectations.

Q3-2023

RCN Inventory

Opening RCN Inventory (tonnes) 2,460

RCN Purchased (tonnes) 41

RCN Processed (tonnes) 530

Closing RCN Inventory (tonnes) 1,971

Cashew Processing

Opening Cashews (tonnes) 118

RCN Processed (tonnes) 530

Cashew Extraction Rate 22.4%

Cashew Produced (tonnes) 119

Cashew Sales (tonnes) 35

Closing Cashews (tonnes) 202

Average Sales prices per

tonne

* Unpeeled Cashews EUR3,300

* Peeled Cashews EUR4,500

Lincoln Moore, Dekel 's Executive Director , said: "A 192%

increase in Q3 CPO sales volumes compared to Q3 2022 has kicked off

a very strong start to the H2 2023 financial performance of the

Palm Oil Operation which is performing at close to record

levels."

"It is pleasing to see a 134% increasing in the Cashew Operation

processing rate compared to Q2 2023 and we are taking further

measures to drive the next step up in production volumes over the

coming months as we strive to enhance production volumes and

deliver positive operating cashflow from the Cashew Operation."

** ENDS **

For further information, please visit the Company's website

www.dekelagrivision.com or contact:

Dekel Agri-Vision Plc

Youval Rasin

Shai Kol

Lincoln Moore +44 (0) 207 236 1177

WH Ireland Ltd (Nomad and Joint Broker)

James Joyce

Darshan Patel

Isaac Hooper +44 (0) 20 7220 1666

Optiva Securities Limited (Joint Broker)

Christian Dennis

Daniel Ingram +44 (0) 203 137 1903

Notes:

Dekel Agri-Vision Plc is a multi-project, multi-commodity

agriculture company focused on West Africa. It has a portfolio of

projects in Côte d'Ivoire at various stages of development: a fully

operational palm oil project in Ayenouan where fruit produced by

local smallholders is processed at the Company's 60,000tpa capacity

crude palm oil mill and a cashew processing project in Tiebissou,

which is currently transitioning to full commercial production in

2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFFAIALAIIV

(END) Dow Jones Newswires

October 10, 2023 02:00 ET (06:00 GMT)

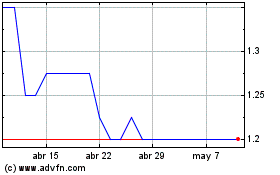

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De May 2023 a May 2024