Cornerstone FS PLC 2023 Full Year Trading Update (1529Z)

10 Enero 2024 - 1:00AM

UK Regulatory

TIDMCSFS

RNS Number : 1529Z

Cornerstone FS PLC

10 January 2024

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain.

10 January 2024

Cornerstone FS plc

("Cornerstone" or "the Company" or "the Group")

2023 Full Year Trading Update

Doubling of revenue and delivery of maiden full year adj.

EBITDA

Cornerstone FS plc (AIM: CSFS), a foreign exchange and payments

solutions company offering multi-currency accounts to businesses

and individuals through its proprietary technology platform, is

pleased to provide an update on trading for the year ended 31

December 2023. The information contained herein has not been

audited and may be subject to further review and amendment.

Highlights

-- Revenue growth of 100% to c. GBP9.6m (2022: GBP4.8m)

-- Gross margin improvement to c. 63% (2022: 60.9%)

-- Adj. EBITDA (1) of not less than c. GBP1.4m (2022: GBP0.9m adj. EBITDA loss)

-- Net cash generated from operating activities of c. GBP1.4m

(2022: net outflow from operating activities of GBP0.8m)

-- Cash and cash equivalents at 31 December 2023 of c. GBP2.3m

(30 June 2023: GBP0.8m; 31 December 2022: GBP0.7m)

The Group is pleased to confirm that the previously reported

strong trading momentum was sustained to year end and, as a result,

it expects to report a year-on-year increase in revenue of

approximately 100% to GBP9.6m (2022: GBP4.8m), ahead of market

expectations. The significant growth reflects the advancements made

across the business driving year-on-year increases in active

customers(2) (2023: 906, 2022: 803) and average transaction value.

Key elements of this have been growth in the sales team and

enhancing and expanding the Group's offering, in particular

increasing the number of counterparties to broaden the range of

currencies and countries where it can transact.

The Group expects to report an improvement in gross margin to c.

63% for 2023 (2022: 60.9%), reflecting a lower proportion of

revenue derived from white label partners following the strategic

decision to manage down almost all of its historic white label

business. The Group also saw an improvement resulting from the

change in commission arrangements agreed with Robert O'Brien,

General Manager APAC and Middle East, in the first half of the

year.

With the increase in revenue and gross margin, as well as

continued careful management of the cost base, the Group expects to

report adjusted EBITDA for 2023 of not less than GBP1.4m, which is

significantly ahead of current market expectations, compared with

an adjusted EBITDA loss of GBP0.9m for the previous year. The Group

generated a net cash inflow of c. GBP1.6m during the year,

including a cash inflow from operating activities of c. GBP1.4m

(2022: net cash outflow from operating activities of GBP0.8m), with

cash and cash equivalents at 31 December 2023 of GBP2.3m (30 June

2023: GBP0.8m; 31 December 2022: GBP0.7m).

(1) Adjusted to exclude share-based compensation, transaction

costs, other operating income and profit on a disposal of a

subsidiary

(2) Defined as customers who traded through Cornerstone in the

preceding 12 months

James Hickman, CEO of Cornerstone, said: "It has been an

excellent year for Cornerstone as we made substantial strategic

progress culminating in a set of strong financial results which

significantly exceeded the Board's expectations this time last

year. We have enhanced our sales team and expanded our offering,

which has resulted in us executing higher value transactions and

with a greater number of active customers. With a highly scalable

platform, along with careful management of our cost base, we are

also benefitting from the operating leverage within our business

and 2023 has seen us report our maiden full year adjusted EBITDA.

We look forward to updating the market on our success as we

progress through 2024."

Investor Presentation

The Group gives notice that James Hickman, CEO, Judy Happe, CFO,

and Jordanna Curtis, COO, will be presenting via Investor Meet

Company on 16 January 2024 at 10.00am GMT to provide investors with

an update on the Group's strategy.

Questions can be submitted pre-event via the Investor Meet

Company platform up until 9.00am GMT the day before the meeting or

at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet Cornerstone via:

https://www.investormeetcompany.com/cornerstone-fs-plc/register-investor

Enquiries

Cornerstone FS plc +44 (0)203 971 4865

James Hickman, Chief Executive Officer

Judy Happe, Chief Financial Officer

SPARK Advisory Partners Limited (Nomad) +44 (0)203 368 3550

Mark Brady, Adam Dawes

Shore Capital (Broker) +44 (0)207 408 4090

Daniel Bush, Tom Knibbs (Corporate

Advisory)

Guy Wiehahn (Corporate Broking)

Gracechurch Group (Financial PR) +44 (0)204 582 3500

Harry Chathli, Claire Norbury

About Cornerstone FS plc

Cornerstone FS plc (AIM: CSFS) is a foreign exchange and

payments company offering multi-currency accounts and payment

solutions to businesses and individuals. Headquartered in the City

of London, Cornerstone combines a proprietary technology platform

with a high level of personalised service to support clients with

payments in over 150 countries in 58 currencies. With a track

record of over 12 years, Cornerstone has the expertise, experience

and expanding global partner network to be able to execute complex

cross-border payments. It is fully regulated by the Financial

Conduct Authority as an Electronic Money Institution through its

wholly owned subsidiary company Cornerstone Payment Solutions

Limited. www.cornerstonefs.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTZZGGMNLVGDZM

(END) Dow Jones Newswires

January 10, 2024 02:00 ET (07:00 GMT)

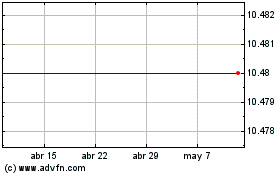

Finseta (LSE:FIN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Finseta (LSE:FIN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025