Headlam Group PLC Trading Update (4062W)

12 Diciembre 2023 - 1:00AM

UK Regulatory

TIDMHEAD

RNS Number : 4062W

Headlam Group PLC

12 December 2023

12 December 2023

Headlam Group plc

('Headlam' or the 'Group')

Trading Update

Robust performance in challenging market conditions

Headlam Group plc (LSE: HEAD), the UK's leading floorcoverings

distributor, is providing a trading update in respect of the eleven

months of the year to 30 November 2023 (the 'Period').

Overall, the Group expects full year 2023 results to be broadly

in line with expectations, based on the trading patterns observed

to date. After a relatively robust summer trading period, the

market in September and October was weaker than expected,

reflecting the impact of the cost-of-living crisis on residential

RMI* as consumers cut back spending on home improvement projects.

However, the Group's November trading was improved, with a step up

in average daily sales compared to October, albeit volumes and

revenue remained below the previous year and typical seasonal

uplifts.

In the UK the revenue for the Period is slightly positive

year-on-year, offset by revenue decline in Continental Europe,

resulting in Group revenue being flat year-on-year for the first

eleven months. In the UK, the Group saw a 5% volume decline year on

year, although this is in line with the overall market according to

data** for the 12 months to October 2023. Despite the general

market backdrop, revenue from Larger Customers and Trade Counters

has remained strong, with year-to-date growth of 27% and 9%

respectively; November itself was a record month for revenue from

Larger Customers.

Gross margin and costs remain well controlled and good progress

has been made in the mitigating actions set out in our half year

results announcement, including the successful implementation of

dynamic route planning which brings efficiencies in transport

costs. Operating cost inflation in H2 remains elevated, as seen in

H1, but is expected to moderate next year.

Building on the strong operating cash generation in H1, the

Group has subsequently agreed a settlement with insurers for the

Kidderminster building, which was destroyed by a fire in 2021. This

has resulted in cash proceeds of GBP8.6m, already received. Stock

levels continue to be well controlled and will show a reduction

over the year.

As previously reported, volume of sales in the UK market are

around 20% lower** than in 2019 on a rolling 12-month basis. Whilst

there is uncertainty over the short-term outlook for the market, we

remain optimistic about the medium-term prospects for both the

market and our opportunities to grow market share. The Group's

strong cash generation, along with the positive medium-term

prospects, enables us to continue to invest in broadening market

presence and building capabilities, to position the business well

as the market improves and volumes recover.

* RMI = repair, maintenance and improvement

** Source: commissioned specialist research from MTW

Research

Enquiries:

Headlam Group plc Tel: 01675 433 000

Chris Payne, Chief Executive Email: headlamgroup@headlam.com

Adam Phillips, Chief Financial

Officer

Panmure Gordon (UK) Limited (Corporate Tel: 020 7886 2500

Broker)

Tom Scrivens / Atholl Tweedie

Peel Hunt LLP (Corporate Broker) Tel: 020 7418 8900

George Sellar / John Welch

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKDBPCBDDNBD

(END) Dow Jones Newswires

December 12, 2023 02:00 ET (07:00 GMT)

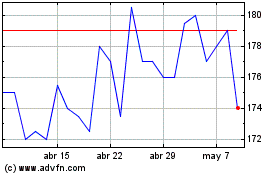

Headlam (LSE:HEAD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Headlam (LSE:HEAD)

Gráfica de Acción Histórica

De May 2023 a May 2024