TIDMHL.

RNS Number : 4306G

Hargreaves Lansdown PLC

19 July 2023

Trading update

19 July 2023

Hargreaves Lansdown plc today issues a trading update in respect

of the three months ended 30 June 2023 ("Q4").

Highlights

-- Net new business of GBP1.7 billion in the period, up 6% on the previous quarter.

-- Closing Assets under Administration ("AUA") of GBP134.0 billion, up 2% in the quarter.

-- Net client growth of 13,000 in the period, taking us to 1,804,000 clients.

Chris Hill, Chief Executive Officer, commented:

"We delivered net new business of GBP1.7 billion in the period,

up 6% on the previous quarter. The tax year end season remains a

critical time for our clients and this year we focused on

supporting them to navigate the changes to the tax landscape,

making the most of their allowances and delivering further value to

our overall client proposition.

The improvements in the previous quarter, including the launch

of a new cash ISA, three new Portfolio Funds and price reductions

on our LISA and JISA accounts, were further enhanced with the

removal of fees for dividend reinvestment and regular monthly

investing along with the addition of new partner banks to Active

Savings.

The breadth of and continued investment into our client

proposition, means we remain well positioned to grow and support

both new and existing clients with their investment and savings

needs."

Trading performance

-- Net new business of GBP1.7 billion in Q4 (Q4 FY22: GBP1.8bn),

despite moderated flows being seen across the market. This was 6%

up on the previous quarter to March with continued net flows on to

the platform as clients focused on utilising their ISA and SIPP tax

allowances, particularly in the final days of the 2023 tax year and

the start of the 2024 tax year.

-- Active Savings saw net inflows of GBP0.8 billion in the

quarter (Q4 FY22: GBP0.7 billion) as clients continue to manage

their cash savings through us and the broad access we provide to a

range of rates and banks.

-- Active client growth of 13,000 in the quarter (Q4 FY22:

13,000) with c lient retention at 92.0%, up on last year (Q4 FY22:

91.3%); asset retention of 89.7%, lower than last year (Q4 FY22:

91.5%) as expected, continuing the trend seen for much of this

year, where across the market, specific cohorts of clients are

making cash withdrawals to fund cost-of-living increases.

-- Closing AUA of GBP134.0 billion; GBP0.3 billion positive

market movement, combined with GBP1.7 billion of net new business

in the quarter.

-- Share dealing volumes have averaged 685,000 per month in the

quarter, 11% lower than the previous quarter and 12% lower than

prior year. Investor confidence across the quarter has been low

with cost-of-living issues, rising interest rates and market

volatility impacting deal volumes.

Financial calendar

Our full year results, including progress on our strategic

initiatives will be issued on 19 September 2023. Our Annual General

Meeting is scheduled to be held on 8 December 2023.

Contacts:

Investors Media

James Found, Head of Investor Danny Cox, Head of Communications

Relations +44(0)7989 672071

+44(0)7970 066634 Nick Cosgrove, Brunswick

0207 404 5959

Forward looking statements

This announcement contains forward-looking statements with

respect to the financial condition, results and business of the

Group. By their nature, forward-looking statements involve risk and

uncertainty because they relate to events, and depend on

circumstances, that will occur in the future. The Group's actual

results may differ materially from the results expressed or implied

in these forward-looking statements. Nothing in this announcement

should be construed as a profit forecast. This announcement is

unaudited. This statement should not be seen as a promotion or

solicitation to buy Hargreaves Lansdown plc shares. It should be

remembered that the value of shares can fall as well as rise and

therefore you could get back less than you invested.

LEI Number: 2138008ZCE93ZDSESG90

Clients, retention rates and share dealing volumes

Key metrics 3 months 3 months 3 months 3 months 3 months

to 30 June to 31 March to 31 December to 30 September to 30 June

2023 2023 2022 2022 2022

Net new clients 13,000 23,000 14,000 17,000 13,000

------------ ------------- ---------------- ----------------- ------------

Total active

clients 1,804,000 1,791,000 1,768,000 1,754,000 1,737,000

------------ ------------- ---------------- ----------------- ------------

Client Retention

Rate (%) 92.0 92.0 92.6 92.2 91.3

------------ ------------- ---------------- ----------------- ------------

Asset Retention

Rate (%) 89.7 89.1 91.1 91.7 91.5

------------ ------------- ---------------- ----------------- ------------

Share dealing

volumes per

month 685,000 770,000 627,000 700,000 779,000

------------ ------------- ---------------- ----------------- ------------

Assets under administration (AUA)

AUA (GBPbillion) 3 months 3 months 3 months 3 months 3 months

to 30 June to 31 March to 31 December to 30 September to 30 June

2023 2023 2022 2022 2022

Opening AUA 132.0 127.1 122.7 123.8 134.7

------------ ------------- ---------------- ----------------- ------------

Net new business

- platform 0.9 0.9 (0.1) - 1.1

------------ ------------- ---------------- ----------------- ------------

Net new business

- Active

Savings 0.8 0.7 1.0 0.7 0.7

------------ ------------- ---------------- ----------------- ------------

Total net

new business 1.7 1.6 0.9 0.7 1.8

------------ ------------- ---------------- ----------------- ------------

Market movements

and other 0.3 3.3 3.5 (1.8) (12.7)

------------ ------------- ---------------- ----------------- ------------

Closing AUA 134.0 132.0 127.1 122.7 123.8

------------ ------------- ---------------- ----------------- ------------

Closing As at 30 As at 31 As at 31 As at 30 As at 30

AUA (GBPbillion) June 2023 March 2023 December September June 2022

2022 2022

Funds 62.2 61.6 59.6 57.4 58.2

----------- ------------ ---------- ----------- -----------

Shares 50.8 49.8 47.1 45.2 45.9

----------- ------------ ---------- ----------- -----------

Cash 13.1 13.5 14.1 14.8 15.0

----------- ------------ ---------- ----------- -----------

HL Funds 8.7 8.6 8.3 7.8 8.0

----------- ------------ ---------- ----------- -----------

Active Savings 7.8 7.0 6.3 5.3 4.6

----------- ------------ ---------- ----------- -----------

Double count(1) (8.6) (8.5) (8.3) (7.8) (7.9)

----------- ------------ ---------- ----------- -----------

Total 134.0 132.0 127.1 122.7 123.8

----------- ------------ ---------- ----------- -----------

Average 3 months 3 months 3 months 3 months 3 months

AUA (GBPbillion) to 30 June to 31 March to 31 December to 30 September to 30 June

2023 2023 2022 2022 2022

Funds 62.1 61.8 59.2 59.8 61.0

------------ ------------- ---------------- ----------------- ------------

Shares 50.4 50.1 47.3 47.5 48.7

------------ ------------- ---------------- ----------------- ------------

Cash 13.4 13.6 14.3 14.8 14.8

------------ ------------- ---------------- ----------------- ------------

HL Funds 8.7 8.6 8.2 8.1 8.3

------------ ------------- ---------------- ----------------- ------------

Active Savings 7.5 6.8 6.0 5.1 4.3

------------ ------------- ---------------- ----------------- ------------

Double count(1) (8.6) (8.5) (8.1) (8.1) (8.3)

------------ ------------- ---------------- ----------------- ------------

Total 133.5 132.4 126.9 127.2 128.8

------------ ------------- ---------------- ----------------- ------------

(1) All HL Funds are held in Vantage or the Portfolio Management

Service (PMS) and are included in the Funds category of the table

with the exception of a small balance held off platform by third

parties. To avoid double counting the amount held in Vantage or PMS

has been deducted.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRGDRBGBDGXI

(END) Dow Jones Newswires

July 19, 2023 02:00 ET (06:00 GMT)

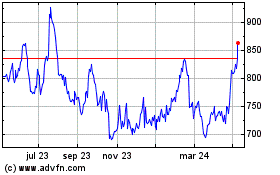

Hargreaves Lansdown (LSE:HL.)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

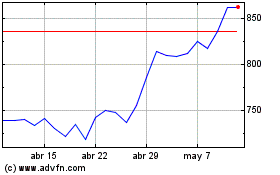

Hargreaves Lansdown (LSE:HL.)

Gráfica de Acción Histórica

De May 2023 a May 2024