TIDMI3E

RNS Number : 9951B

i3 Energy PLC

08 June 2023

8 June 2023

i3 Energy plc

("i3", "i3 Energy", or the "Company")

Reduction of Capital

i3 Energy PLC (AIM:I3E) (TSX:ITE), an independent oil and gas

company with assets and operations in the UK and Canada, today

announces that its Notice of Annual General Meeting (the

"Circular") was posted to Shareholders yesterday. The Circular

contains details of, among other things, a proposed reduction of

capital (the "Capital Reduction").

Terms used in this announcement have the same meaning given to

them in the Circular.

Notice of Annual General Meeting ("AGM" )

The Circular, which was posted to Shareholders yesterday, is

available on the Company's website at https://i3.energy.

The AGM is to be held at the offices of W H Ireland Limited at

24 Martin Lane, London, EC4R 0DR at 11 a.m. (BST) on 30 June

2023.

Shareholders are strongly encouraged to appoint the Chair of the

meeting as their proxy for the AGM. This will ensure that your vote

will be counted even if attendance at the AGM is restricted or you

are unable to attend.

The results of the votes on the resolution proposed at the AGM

will be announced as soon as practicable after the conclusion of

the AGM and will be available on the Company's website.

Proposed Capital Reduction

The Board considers it highly desirable that the Company has the

maximum flexibility to consider the payment of dividends and

otherwise return value to Shareholders. However, the Company will

be precluded from the payment of any dividends or other

distributions or the redemption or buy-back of its shares in the

absence of it having sufficient distributable reserves.

The Company's share premium account currently stands at

approximately GBP51,000,000. As at 31 May 2023, the Company had

retained earnings of approximately GBP6,000,000. It is proposed

that the Company's share premium account be cancelled (the "Capital

Reduction"). The proposed Capital Reduction is intended to increase

retained earnings by an amount equal to the amount standing to the

credit of the Company's share premium account.

The purpose of the Company's cancellation of its share premium

account is to create further distributable reserves in the Company

to facilitate the future payment of dividends (in cash or

otherwise) to Shareholders, where justified by the profits of the

Company, or to allow the redemption or buy-back of the Company's

shares (or other distributions to Shareholders).

If the proposed cancellation of the Company's share premium

account is approved by Shareholders at the AGM, it will be subject

to the scrutiny of, and confirmation by, the High Court of England

and Wales (the "High Court") which will take due account of the

protection of creditors. Subject to that confirmation and

registration by the Registrar of Companies in England and Wales of

the order of the High Court, the Capital Reduction is expected to

take effect later this year.

The Board anticipates that the cancellation of the Company's

share premium account will result in the creation of further

distributable reserves. However, this is subject to: (i) there

being no materially negative change in the financial position or

prospects of the Company; and (ii) any provision that the court

requires the Company to make for the protection of its creditors

(although the Board does not expect any undertakings or similar

measures to be required). This will give the Company the maximum

flexibility to consider the payment of dividends and otherwise

return value to the Shareholders, should the Board consider it

appropriate. It should however be noted that if the Company is

required to give undertakings to the High Court, this may delay the

Company's ability to pay dividends and otherwise return value to

Shareholders.

Following the implementation of the Capital Reduction, there

will be no change in the nominal value of the Company's shares or

the number of shares in issue. The Capital Reduction in itself will

not involve any distribution or repayment of share premium by the

Company and will not reduce the underlying net assets of the

Company.

The Directors reserve the right to abandon or discontinue any

application to the High Court for confirmation of the Capital

Reduction if the Directors believe that the terms required to

obtain confirmation are unsatisfactory to the Company or if, as the

result of a material unforeseen event, the Directors consider that

to continue with the Capital Reduction would be inappropriate or

inadvisable.

Timetable of Principal Events

The expected timetable of principal events with respect to the

Capital Reduction are as follows (more precise dates will be

announced following the conclusion of the AGM):

PRINCIPAL EVENT TIME AND DATE

Annual General Meeting 11 a.m. (BST) on 30 June 2023

------------------------------

Expected date for the directions July 2023

hearing for the High Court to

consider the Capital Reduction

application

------------------------------

Expected date for the hearing Late July / August 2023

by the High Court to confirm

the Capital Reduction

------------------------------

Expected date that the Capital August 2023

Reduction becomes effective

------------------------------

Notes

1. The dates set out in this timetable and throughout this

document that fall after the date of publication of this document

are based on the Company's current expectations and are subject to

change. The times and dates are indicative only and will depend,

among other things, on the date upon which the High Court of

England and Wales confirms the Capital Reduction. The provisional

final hearing date will be subject to change and dependent on the

High Court.

2. The timetable assumes that there is no adjournment of the

AGM. If the scheduled date for the AGM changes, the revised date

and/or time will be notified to Shareholders by an announcement

made by the Company through a RIS.

3. All times shown are London times unless otherwise stated.

Enquiries:

i3 Energy plc c/o Camarco

Majid Shafiq (CEO) Tel: +44 (0) 203 781 8338

WH Ireland Limited (Nomad

and Joint Broker) Tel: +44 (0) 207 220 1666

James Joyce, Darshan Patel

Tennyson Securities (Joint

Broker) Tel: +44 (0) 207 186 9030

Peter Krens

Stifel Nicolaus Europe Limited

(Joint Broker) Tel: +44 (0) 20 7710 7600

Ashton Clanfield, Callum Stewart

Camarco

Georgia Edmonds, Violet Wilson, Tel: +44 (0) 203 781 8338

Sam Morris

Notes to Editors:

i3 Energy is an oil and gas Company with a low cost,

diversified, growing production base in Canada's most prolific

hydrocarbon region, the Western Canadian Sedimentary Basin and

appraisal assets in the North Sea with significant upside.

The Company is well positioned to deliver future growth through

the optimisation of its existing 100% owned asset base and the

acquisition of long life, low decline conventional production

assets.

i3 is dedicated to responsible corporate practices and the

environment, and places high value on adhering to strong

Environmental, Social and Governance ("ESG") practices. i3 is proud

of its performance to date as a responsible steward of the

environment, people, and capital management. The Company is

committed to maintaining an ESG strategy, which has broader

implications for long-term value creation, as these benefits extend

beyond regulatory requirements.

i3 Energy is listed on the AIM market of the London Stock

Exchange under the symbol I3E and on the Toronto Stock Exchange

under the symbol ITE. For further information on i3 Energy please

visit https://i3.energy/ .

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CARSSUFDWEDSEIM

(END) Dow Jones Newswires

June 08, 2023 02:00 ET (06:00 GMT)

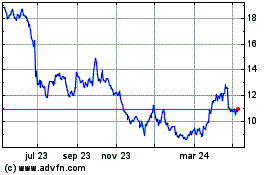

I3 Energy (LSE:I3E)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

I3 Energy (LSE:I3E)

Gráfica de Acción Histórica

De May 2023 a May 2024