TIDMIQG

RNS Number : 4366N

IQGeo Group PLC

25 September 2023

IQGeo Group plc

(the "Company" or the "Group")

Interim results for the six months ended 30 June 2023

IQGeo's market focus delivers continued revenue growth and

strong commercial momentum

IQGeo Group plc (AIM: IQG), a market leading provider of

geospatial productivity and collaboration software for the telecoms

and utility network industries, is pleased to announce its interim

results for the six months ended 30 June 2023.

Operational highlights:

-- The Group has achieved continued success in increasing its

recurring revenue base with Exit ARR* as at 30 June 2023 of GBP16.9

million (H1 2022: GBP10.3 million). ARR intake during the period

includes a follow-on contract with a top 5 Japanese utility company

and leading German broadband operator, as recently announced in

July.

Group financial highlights:

-- Total revenue has grown by 124% to GBP20.5 million (H1 2022:

GBP9.2 million), 83% of which is organic and the remainder from the

Comsof acquisition in August 2022

-- Recurring revenue growth of 61% to GBP7.2 million (H1 2022: GBP4.5 million)

-- Exit ARR* increased by 64% to GBP16.9 million (H1 2022: GBP10.3 million)

-- Adjusted EBITDA** of GBP2.7 million (H1 2022: GBP0.2 million)

-- Increasing recurring revenue net retention for the period of 114% (H1 2022: 103%)

-- Total order intake has grown by over 54% to GBP22.6 million (H1 2022: GBP14.7 million)

-- A loss before tax for the period of GBP0.2 million (H1 2022: GBP0.5 million loss)

-- Net cash balance of GBP6.9 million as at 30 June 2023 (31

December 2022: GBP8.1 million) after having settled the first

earn-out related to the Comsof acquisition (EUR1.5 million) in

April 2023

*Exit ARR is defined as the current go forward run rate of

annually renewable subscription and M&S agreements

**Adjusted EBITDA excludes amortisation, depreciation, share

option expense, foreign exchange gains/losses on intercompany

trading balances and non-recurring items and is reported as it

reflects the underlying performance of the Group.

Richard Petti, Chief Executive Officer, said:

"Over the last six months the business has stayed focused on our

core telecommunications and utility markets and our team has

delivered very strong growth across all key financial metrics. We

continue to see high levels of investment in fibre broadband

rollout and utility grid modernisation, as well as growth in the

adoption of our network management software. These positive trends

give us confidence in our targets for the second half of the year

and moving forward into 2024.

Given the technical burden demanded by managing multiple

software vendors, customers are responding well to our strategy of

developing a single fibre network and electric grid management

platform that supports their entire operational lifecycle. Our

lifecycle solutions are the foundation for our 'land & expand'

sales approach as customers add new workflow software to support

other areas of their business. The IQGeo revenue stream comprises a

healthy mix of new deals with large and small companies, and

expansion projects with existing customers. This model has also

allowed us to further establish our global footprint as we've

announced major contract wins in North America, Europe, and

Asia.

As the business grows, we are continuing to invest in top talent

and technical infrastructure to keep pace with market and customer

demand. Our team is moving quickly to capitalise on proven market

opportunities with our innovative software solutions, and will

continue to focus on these core fundamentals in the months

ahead."

For further information contact:

IQGeo Group plc +44 1223 606655

Richard Petti

Haywood Chapman

Cavendish Capital Markets Ltd +44 20 7220 0500

Henrik Persson, Seamus Fricker (Corporate Finance)

Tim Redfern, Charlotte Sutcliffe (ECM)

The Group's Nominated Adviser and Broker, finnCap Ltd, has now

changed its name to Cavendish Capital Markets Ltd following

completion of its own corporate merger.

Notes to Editors

About IQGeo

IQGeo(TM) (AIM: IQG), Telecommunication, fibre, and utility

operators are "Building better networks" with IQGeo's award-winning

network management software. The ability to powerfully model any

network requirement, integrate every system and data source, and

support field and office teams with continual innovation is helping

operators create the networks of the future. Our solutions ensure

greater cross-team collaboration and process efficiency throughout

the network lifecycle, from planning and design to construction,

operations, and sales.

Whether it's highly competitive fibre and 5G broadband rollouts

or complex utility grid modernisation projects, customers trust

IQGeo's Integrated Network and Adaptive Grid solutions. We partner

with large multinationals and smaller regional operators to deliver

the digital innovation they need to accelerate time-to-revenue,

increase network resilience, improve operational safety, and

deliver ROI. For more information visit: www.iqgeo.com/

Chief Executive Officer's statement

Overview

We are pleased with the performance of the company over the

first 6 months of this year and the consistent growth milestones we

have achieved over the most recent reporting periods. Notable

metrics include the 64% increase in exit ARR and our positive

adjusted EBITDA figure of GBP2.7 million. Investment remains strong

in our core target industries of telecommunications and utilities,

and we continue to grow market share for our network management

software in our key regions of North America, Europe, and

Japan.

Business innovation

We are investing in industry leading talent for the organisation

including the appointment of a new Chief Technology Officer and we

have expanded the ranks of our Engineering and Services teams. In

the first half of 2023 we launched a number of new products and

completed a second phase integration of our Comsof Fiber software

that was part of the Comsof acquisition in August of 2022. The

Comsof Fiber automated fibre planning software is a key component

of our IQGeo Integrated Network solution used by broadband

operators to manage the entire lifecycle of their fibre networks

including planning, design, construction, operations, and

sales.

We have seen significant success with our strategy of providing

a lifecycle network management solution for both our telecom and

utility customers. Once deployed within a customer, our software

foundation enables expansion across a range of new operational

areas. This "land and expand" sales model continues to deliver

results as we have announced contracts with large new customers and

major expansion projects in all of our target geographies.

On 01 August 2023 we announced new packaging for our Network

Manager Telecom software with three editions called Insight,

Professional, and Enterprise. These editions are designed to

provide fibre operators of any size and scope with a network

management solution that meets their technical and budget

requirements. As this product configuration evolves, it will allow

IQGeo to address a wide range of potential customers through a

single software platform. This enables customers a seamless upgrade

path as their networks scale and affords IQGeo greater development

and support efficiency with a single core software platform. The

Insight edition is designed as a packaged solution that can be

running within hours with no need for integration services. The

Professional and Enterprise editions are for those customers that

demand more advanced configuration and customisation for their

network deployments.

The team continues to evolve our service offering to keep pace

with customer demand. We have launched new cloud hosting, software

training, and professional service offerings. Today we support our

larger, more sophisticated customers with a range of services

including: implementation, configuration, and customisation, as

well as data cleanup and import services.

Strategic priorities

As we continue to build on our demonstrated success, our core

strategic priorities for the Group remain consistent with those

documented in our 2022 Annual Report which was published in March

of 2023. The organisation is performing well against our strategic

objectives in the first half of 2023 and this positive performance

is reflected in our results for this period.

-- Global Growth: The Group has added 23 new customer logos

during the first six months of the year, with market share being

expanded in North America, Europe and Japan.

-- Recurring Revenues: The combination of new customers and

expansion orders from existing customers has added GBP3.3 million

of Annual Recurring Revenues ('ARR') through subscription and

M&S arrangements to our exit ARR, which stands at GBP16.9

million as at 30 June 2023.

-- Product Innovation: IQGeo has continued to grow investment in

the IQGeo product stack with product releases expanding

functionality in a number of our core products.

Current trading and outlook

The Board anticipates continued organic growth through achieving

positive net retention of its existing customer base and the

continued addition of new customers. Following the acquisition in

August 2022, Comsof continues to perform well and the wins and

results show that the upsell and cross-sell strategy is working.

The asset investment dynamics of the underlying markets we serve -

telecoms and utilities - have remained resilient and we see

continued long term investment in fibre optic networks and in

electric grid modernisation in all our key markets.

Our financial performance remains in-line with Board

expectations, and we remain very positive about the outlook for our

target markets in the telecommunication and utility industries.

Richard Petti

Chief Executive Officer

Financial Review

Principal events and overview

The Group continues to focus on increasing Annual Recurring

Revenue ("ARR") which arises from both subscription-based software

sales and also maintenance and support arrangements from perpetual

licence sales. During the period, the Group has been successful in

the markets in which it operates, continuing to grow Exit ARR which

stands at GBP16.9 million as at 30 June 2023 (GBP10.3 million as at

30 June 2022).

The growth achieved by IQGeo is reflected in the Group KPIs

below:

KPIs H1 2023 H1 2022

GBP'000 GBP'000

--------------------------------- -------- --------

Total revenue 20,537 9,186

Recurring revenue 7,240 4,499

Recurring revenue % 35% 49%

New ARR added in period 3,280 1,883

Exit recurring revenue run rate 16,896 10,295

Bookings of total orders 22,550 14,702

Gross margin % 59% 60%

Adjusted EBITDA profit 2,668 214

Loss for the period (332) (282)

Recurring revenue net retention 114% 103%

Cash 6,919 11,101

--------------------------------- -------- --------

Annual recurring revenues

During the first half of 2023, new ARR added has increased by

74% to GBP3.3 million (H1 2022: GBP1.9 million). This has been

achieved through winning 23 new customer logos combined with

expansion sales to existing customers. During the period, the Group

continues to record a positive net retention rate of 114% (H1 2022:

103%).

In addition to recurring revenue, revenue is derived from

consultancy services on own IP products and also consultancy

services connected to third-party products. Revenues from

third-party product services are consistent with the prior period

but are still expected to decline in future periods as the Group

focuses on growing recurring revenues connected with its own

intellectual property.

Orders

Bookings of total orders have increased by over 54% to GBP22.6

million during H1 2023 (H1 2022: GBP14.7 million) with new

customers being added in all three of our key markets (North

America, Europe and Japan).

Total order backlog (orders won, revenue not recognised) as of

30 June 2023 was GBP28.0 million (H1 2022: GBP21.7 million) with

the growth being due to increased order intake .

Revenue

Revenue composition by revenue stream is summarised in the table

below:

Revenue by stream H1 2023 % of total H1 2022 % of % Growth

GBP'000 revenue GBP'000 total

revenue

--------- ----------- --------- ---------

Recurring IQGeo product

revenue 7,240 35% 4,499 49% 61%

----------------------------- --------- ----------- --------- --------- ---------

Perpetual Software 1,882 9% 267 3% 605%

Demand Points 2,194 11% - 0% -

Services 8,831 43% 3,978 43% 122%

----------------------------- --------- ----------- --------- --------- ---------

Non-recurring IQGeo product

revenue 12,907 63% 4,245 46% 204%

Total IQGeo product revenue 20,147 98% 8,744 95% 135%

--------- ----------- --------- ---------

Geospatial services from

third party products 390 2% 442 5% (12%)

----------------------------- --------- ----------- --------- --------- ---------

Total revenue 20,537 100% 9,186 100% 124%

----------------------------- --------- ----------- --------- --------- ---------

Recurring revenues have increased by 61% to GBP7.2 million (H1

2022: GBP4.5 million) as a result of the ARR won during 2022. ARR

won during H1 2023 has had limited impact on revenues for the six

months ended 30 June 2023, with the increase in recurring revenues

to be realised in future periods. Sales of perpetual software

licences will continue to fluctuate in reporting periods as the

Group continues to focus on subscription sales and it is pleasing

the Group has posted a positive adjusted EBITDA without being

reliant on significant one-off perpetual licences. The increase in

deployments and expansion orders has led to a 122% increase in

associated service revenues which reflects the growing customer

base using IQGeo software. The Group continues to have visibility

of services revenues of around six months forward due to the strong

backlog of orders won.

Gross profit

Gross profit H1 2023 Gross H1 2022 Gross Gross

GBP'000 margin GBP'000 margin margin

% % mvt

--------- -------- --------- --------

Gross profit/gross margin 12,137 59% 5,500 60% (1%)

--------------------------- --------- -------- --------- -------- --------

Gross margin percentage decreased by 1% compared with the prior

period. The decrease in margin % is largely due to the increased

services revenue. The absolute gross profit recognised by the Group

has increased by 121% to GBP12.1 million (H1 2022: GBP5.5

million).

Operating expenses and adjusted EBITDA

Operating expenses were GBP12.3 million (H1 2022: GBP6.0

million) and are summarised as follows:

H1 2023 H1 2022

GBP'000 GBP'000

--------------------------------------------- -------- --------

Employee related costs 7,900 4,813

Other operating expenses 1,569 473

Depreciation 270 175

Amortisation and impairment 1,542 990

Share option expense 442 159

Unrealised foreign exchange on intercompany

trading balances 238 (632)

Non-recurring items 293 5

Total operating expense 12,254 5,983

--------

Other operating expenses of the Group include sales, product

development, marketing, and administration costs excluding any

expenses relating to employee costs.

Employee related expenses during the period have increased due

to the Comsof acquisition in August 2022, and additional headcount

resource in the Group to support future revenue growth. Operating

expenses have also been impacted by inflation.

Adjusted EBITDA excludes amortisation and impairment,

depreciation, share option expense, foreign exchange gains/losses

on intercompany trading balances and non-recurring items and is

reported as it reflects the performance of the Group. Adjusted

EBITDA for the period was GBP2.7 million (H1 2022: GBP0.2

million).

The operating loss for the period was GBP0.1 million (H1 2022:

GBP0.5 million loss).

EPS and dividends

Adjusted diluted earnings per share was 1.6 pence (H1 2022: 0.9

pence loss). Reported basic and diluted loss per share was 0.5

pence (H1 2022: 0.5 pence loss).

Consolidated statement of financial position and cash flow

Cash as at 30 June 2023 was GBP6.9 million (31 December 2022:

GBP8.1 million, 30 June 2022: GBP11.1 million) with no external

bank debt.

Net cash inflows from operating activities materially improved

to GBP2.8 million (H1 2022: GBP1.3 million) due to the improved

trading performance.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Group's

performance, and the factors which mitigate these risks, have not

significantly changed from those set out on pages 46 to 49 of the

Group's Annual Report for 2022 (a copy of which is available from

our website www.iqgeo.com).

Condensed consolidated income statement

for the six months ended 30 June 2023

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

unaudited unaudited audited

Notes GBP'000 GBP'000 GBP'000

------------------------------------------- ----- ---------- ----------- ------------------

Revenue 4 20,537 9,186 26,592

Cost of revenues (8,400) (3,686) (10,927)

------------------------------------------- ----- ---------- ----------- ------------------

Gross profit 12,137 5,500 15,665

Operating expenses (12,254) (5,983) (17,191)

------------------------------------------- ----- ---------- ----------- ------------------

Operating loss (117) (483) (1,526)

------------------------------------------- ----- ---------- ----------- ------------------

Analysed as:

Gross profit 12,137 5,500 15,665

Other operating expenses (9,469) (5,286) (13,767)

------------------------------------------- ----- ---------- ----------- ------------------

Adjusted EBITDA 2,668 214 1,898

Depreciation (270) (175) (447)

Amortisation and impairment of intangible

assets (1,542) (990) (2,241)

Share option expense (442) (159) (303)

Unrealised foreign exchange gains/(losses)

on intercompany trading balances (238) 632 574

Non-recurring items 5 (293) (5) (1,007)

------------------------------------------- ----- ---------- ----------- ------------------

Operating loss (117) (483) (1,526)

------------------------------------------- ----- ---------- ----------- ------------------

Net finance costs (60) (43) (288)

Loss before tax (177) (526) (1,814)

Income tax (155) 244 901

------------------------------------------- ----- ---------- ----------- ------------------

Loss for the period (332) (282) (913)

Earnings/(Loss) per share

Basic and diluted 6 (0.5p) (0.5p) (1.6p)

------------------------------------------- ----- ---------- ----------- ------------------

Condensed consolidated statement of comprehensive income

for the six months ended 30 June 2023

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

-------------------------------------------- ---------- ----------- ------------

Loss for the period (332) (282) (913)

Other comprehensive income:

Items that may be reclassified subsequently

to profit and loss

Exchange difference on retranslation

of net assets and results of overseas

subsidiaries (41) 50 417

Total comprehensive loss for the period (373) (232) ( 496)

-------------------------------------------- ---------- ----------- ------------

Condensed consolidated statement of changes in equity

for the six months ended 30 June 2023

Share

Ordinary based Capital Merger

share Share payment redemption relief Translation Retained

capital premium reserve reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Balance at 1 January 2022 1,150 22,507 454 476 959 (1,616) (6,779) 17,151

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Loss for the period - - - - - - (282) (282)

Exchange difference on

retranslation

of net assets and

results

of overseas subsidiaries - - - - - 50 - 50

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Total comprehensive loss

for the period - - - - - 50 (282) (232)

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Issue of shares -

acquisition 4 - - - 237 - - 241

Exercise of share options 2 62 (14) - - - 14 64

Equity-settled

share-based

payment - - 159 - - - - 159

Transactions with owners 6 62 145 - 237 - 14 464

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Balance at 30 June 2022 1,156 22,569 599 476 1,196 (1,566) (7,047) 17,383

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Loss for the period - - - - - - (631) (631)

Exchange difference on

retranslation

of net assets and

results

of overseas subsidiaries - - - - - 367 - 367

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Total comprehensive loss

for the period - - - - - 367 (631) (264)

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Issue of shares -

acquisition 12 - - - 720 - - 732

Exercise of share options 2 47 (16) - - - 16 49

Lapse of share options - - (93) - - - 93 -

Equity-settled

share-based

payment - - 144 - - - - 144

Deferred consideration 3 - - - 237 - - 240

Issue of shares -

associated

costs - (95) - - - - - (95)

Issue of shares -

fundraise 56 3,444 - - - - - 3,500

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Transactions with owners 73 3,396 35 - 957 - 109 4,570

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Balance at 31 December

2022 1,229 25,965 634 476 2,153 (1,199) (7,569) 21,689

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Profit/(loss) for the

period - - - - - - (332) (332)

Exchange difference on

retranslation

of net assets and

results

of overseas subsidiaries - - - - - (41) - (41)

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Total comprehensive loss

for the period - - - - - (41) (332) (373)

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Exercise of share options 2 63 (22) - - - 22 65

Lapse of share options - - (11) - - - 11 -

Equity-settled

share-based

payment - - 442 - - - - 442

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Transactions with owners 2 63 409 - - - 33 507

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Balance at 30 June 2023 1,231 26,028 1,043 476 2,153 (1,240) (7,868) 21,823

------------------------- -------- -------- -------- ----------- -------- ----------- --------- --------

Condensed consolidated statement of financial position

for the six months ended 30 June 2023

At At At

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

------------------------------------ ----- ---------- ----------- ------------

Assets

Intangible assets 7 20,148 9,929 20,029

Property, plant, and equipment 378 209 310

Right of use assets 1,394 1,428 1,480

Total non-current assets 21,920 11,566 21,819

------------------------------------ ----- ---------- ----------- ------------

Current assets

Trade and other receivables 13,902 5,411 11,064

Corporation tax receivable - - 662

Cash and cash equivalents 6,919 11,101 8,055

------------------------------------ ----- ---------- ----------- ------------

Total current assets 20,821 16,512 19,781

------------------------------------ ----- ---------- ----------- ------------

Total assets 42,741 28,078 41,600

------------------------------------ ----- ---------- ----------- ------------

Liabilities

Current liabilities

Trade and other payables 8 (18,314) (8,875) (16,217)

Lease obligation (798) (336) ( 417)

Total current liabilities (19,112) (9,211) ( 16,634)

------------------------------------ ----- ---------- ----------- ------------

Non-current liabilities

Deferred tax (802) - (802)

Trade and other payables (27) - (996)

Lease obligation (977) (1,484) ( 1,479)

Total non-current liabilities (1,806) (1,484) (13,277)

------------------------------------ ----- ---------- ----------- ------------

Total liabilities (20,918) (10,695) (19,911)

------------------------------------ ----- ---------- ----------- ------------

Net assets 21,823 17,383 21,689

------------------------------------ ----- ---------- ----------- ------------

Equity attributable to shareholders

of the Company

Ordinary share capital 9 1,231 1,156 1,229

Share premium 9 26,028 22,569 25,965

Share based payment reserve 1,043 599 634

Capital redemption reserve 476 476 476

Merger relief reserve 2,153 1,196 2153

Translation reserve (1,240) (1,566) (1,199)

Retained earnings (7,868) (7,047) (7,569)

------------------------------------ ----- ---------- ----------- ------------

Equity attributable to shareholders

of the Company 21,823 17,383 21,689

------------------------------------ ----- ---------- ----------- ------------

Condensed consolidated statement of cash flows

for the six months ended 30 June 2023

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

unaudited unaudited audited

Notes GBP'000 GBP'000 GBP'000

-------------------------------------------- ----- ---------- ----------- ------------

Loss before tax from operating activities (177) (526) ( 1,814)

Adjustments for:

Depreciation 270 175 447

Amortisation and impairment 1,542 990 2,241

Revaluation of intercompany balances 238 (632) (574)

Share-based payment charge 442 159 303

Finance costs 60 43 288

-------------------------------------------- ----- ---------- ----------- ------------

Operating cash flows before working

capital movement 2,375 209 891

Change in receivables (2,175) 63 (6,039)

Change in payables 2,097 1,021 7,051

-------------------------------------------- ----- ---------- ----------- ------------

Cash generated from operations before

tax 2,297 1,293 1,903

-------------------------------------------- ----- ---------- ----------- ------------

Net income taxes received/(paid) 507 (4) 607

-------------------------------------------- ----- ---------- ----------- ------------

Net cash flows from operating activities 2,804 1,289 2,510

-------------------------------------------- ----- ---------- ----------- ------------

Cash flows from investing activities

Purchases of property, plant, and equipment (156) (62) (170)

Expenditure on intangible assets (2,096) (979) (2,900)

Acquisition of subsidiaries, net of

cash acquired 8 (1,325) (625) (5,613)

Net cash flows used in investing activities (3,577) (1,666) (8,683)

-------------------------------------------- ----- ---------- ----------- ------------

Cash flows from financing activities

Payment of lease liability (275) (171) (444)

Proceeds from the issue of ordinary

share capital on exercise of options 65 64 103

Proceeds from the issue of ordinary

share capital from fundraising, net

of associated costs - - 3.405

Net cash outflows from financing activities (210) (107) 3,064

-------------------------------------------- ----- ---------- ----------- ------------

Net decrease in cash and cash equivalents (982) (484) (3,109)

Cash and cash equivalents at start of

period 8,055 11,499 11,499

Exchange differences on cash and cash

equivalents (154) 86 (335)

-------------------------------------------- ----- ---------- ----------- ------------

Cash and cash equivalents at end of

period 6,919 11,101 8,055

-------------------------------------------- ----- ---------- ----------- ------------

Notes to the interim consolidated financial statements

1 General information

IQGeo Group plc ("the Company") and its subsidiaries (together,

"the Group") delivers geospatial software solutions that integrate

data from any source - geographic, real-time asset, GPS, location,

corporate and external cloud-based sources - into a live geospatial

common operating picture, empowering all users in the customer's

organisation to access, input and analyse operational intelligence

to proactively manage their networks, respond quickly to emergency

events and effectively manage day-to-day operations.

The Company is a public limited company which is listed on the

Alternative Investment Market ("AIM") of the London Stock Exchange

(IQG) and is incorporated and domiciled in the United Kingdom.

The address of its registered office is Nine Hills Road,

Cambridge, United Kingdom, CB2 1GE .

The Group has its operations in the UK, USA, Belgium, Canada,

Germany and Japan, and sells its products and services in North

America, Japan, UK and Europe. The Group legally consists of seven

subsidiary companies headed by IQGeo Group plc as at 30 June 2023.

On 1 January 2023, Comsof Technologies America,Ltd, acquired as a

result of the Comsof acquisition, was amalgamated with IQGeo

Solutions Canada Inc.

The condensed consolidated interim financial statements were

approved by the Board of Directors for issue on 25 September

2023.

The condensed consolidated interim financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

December 2022 were approved by the Board of Directors on 24 March

2023 and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain a

material uncertainty related to going concern paragraph and did not

contain any statement under section 498 of the Companies Act

2006.

The condensed consolidated interim financial statements have

been reviewed, not audited.

2 Basis of preparation

These condensed consolidated interim financial statements should

be read in conjunction with the annual financial statements of the

Group for the year ended 31 December 2022 and are prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 ('IFRS'). This

consolidated interim financial statement for the half-year

reporting period ended 30 June 2023 has been prepared in accordance

with IAS 34 Interim Financial Reporting.

Going concern basis

The Directors have adopted the going concern basis in preparing

the financial statements. In assessing whether the going concern

assumption is appropriate, the Directors have taken into account

all relevant information about the current status of the business

operations. The Directors have a reasonable expectation that the

Group has adequate resources to continue operations for the

foreseeable future and for at least 12 months following the

approval of these condensed consolidated interim financial

statements. Management prepares detailed cash flow forecasts which

are reviewed by the Board on a regular basis. The forecasts include

assumptions regarding the opportunity funnel from both existing and

new clients, growth plans, risks and mitigating actions. Management

have performed sensitivity analysis on these forecasts and have

considered the cash outflows associated with the deferred

consideration payable in relation to the acquisition of Comsof in

2022.

For the purposes of the preparation of the consolidated

financial statements, the Group has applied all standards and

interpretations in accordance with UK-adopted international

accounting standards that are effective and applicable for

accounting periods beginning on or before 1 January 2023. There are

no standards in issue and not yet adopted that will have a material

impact on the financial statements.

3 Accounting policies

The accounting policies adopted in the preparation of the

condensed consolidated interim financial statements are unchanged

from those set out in the Group's consolidated financial statements

for the year ended 31 December 2022.

Revenue recognition

Revenue represents the consideration that the entity expects to

receive for the sales of goods and services net of discounts and

sales taxes. Revenue is recognised based on the distinct

performance obligations under the relevant customer contract as set

out below. Where goods and/or services are sold in a bundled

transaction or on a subscription basis, the Group allocates the

total consideration under the contract to the different individual

elements based on actual amounts charged by the Group on a

standalone basis.

Notes to the interim consolidated financial statements

(continued)

Perpetual software

Software is also sold under perpetual licence agreements. Under

these arrangements revenue is recognised at a point in time, when

the software is made available to the customer for use, provided

that all obligations associated with the sale of the licence have

been made fulfilled.

If contracts include performance obligations which result in

software being customised or altered, the software cannot be

considered distinct from the labour service. Revenue recognition is

dependent on the contract terms and assessment of whether the

performance obligation is satisfied over time. If the conditions of

IFRS 15 to recognise revenue over time are not satisfied, revenue

is deferred until the software is available for customer use,

because once software has been installed by the customer, the Group

has no further obligations to satisfy.

Recurring IQGeo Product revenue - maintenance and support

Maintenance and support is recognised on a straight-line basis

over the term of the contract, which is typically one year. Revenue

not recognised in the consolidated income statement is classified

as deferred revenue on the consolidated statement of financial

position.

Recurring IQGeo Product revenue - subscription

Subscription services, which may include hosting services, are

considered to be a single distinct performance obligation due to

the promises stated within the contract. Revenue is recognised

evenly over the subscription period as the customer receives the

benefits of the subscription services.

Demand Points revenue (Comsof products)

Annual licence revenue

For Comsof software products which are sold within an agreement

based on Demand Points and which contain an annual licence renewal,

revenue is recognised annually upfront. Hosting or associated

services within the same agreement are recognised over time. This

reflects that whilst the contractual term may extend across

multiple annual renewals, there is a trigger at the annual renewal

which if not met could cause the contract to be terminated.

Term licence revenue

For Comsof software products which are sold within an agreement

based on Demand Points, which is for a fixed period, but which does

not contain an annual licence renewal, revenue is recognised in

full upfront. Hosting or associated services within the same

agreement are recognised over time. This reflects that the customer

has the benefit of the software for the duration of the term

contract.

Services

Services revenue includes consultancy and training. Services

revenue from time and materials contracts is recognised in the

period that the services are provided on the basis of time worked

at agreed contractual rates and as direct expenses are

incurred.

Revenue from fixed price, long-term customer specific contracts

is recognised over time following assessment of the stage of

completion of each assignment at the period end date compared to

the total estimated service to be provided over the entire contract

where the outcome can be estimated reliably. If a contract outcome

cannot be estimated reliably, revenues are recognised equal to

costs incurred, to the extent that costs are expected to be

recovered. An expected loss on a contract is recognised immediately

in the consolidated income statement.

Timing of payment

Maintenance and support income and subscription income is

invoiced annually in advance at the commencement of the contract

period. Other revenue is invoiced based on the contract terms in

accordance with performance obligations. Amounts recoverable in

contracts (contract assets) relate to our conditional right to

consideration for completed performance obligations under the

contract prior to invoicing. Deferred income (contract liabilities)

relates to amounts invoiced in advance of services performed under

the contract.

Notes to the interim consolidated financial statements

(continued)

4 Segmental information

4.1 Operating segments

Management provides information reported to the Chief Operating

Decision Maker (CODM) for the purpose of assessing performance and

allocating resources. The CODM is the Chief Executive Officer.

The business delivers software solutions that integrate data

from any source - geographic, real-time asset, GPS, location,

corporate and external cloud-based sources - into a live geospatial

common operating picture, empowering all users in the customer's

organisation to access, input and analyse operational intelligence

to proactively manage their networks, respond quickly to emergency

events and effectively manage day-to-day operations. These

geospatial operations are reported to the CODM as a single

operating segment which includes the operations of Comsof acquired

in 2022. Whist the Comsof brand will be retained as part of the

Company's product portfolio, the operations, people, sales,

development, administration and systems have all been fully

integrated into the IQGeo group and amalgamated within the existing

single operating segment.

4.2 Revenue by type

The following table presents the different revenue streams of

the Geospatial business unit:

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

-------------------------------------------- ---------- ----------- ------------

Subscription 5,734 3,512 8,107

Maintenance and support 1,506 987 2,503

--------------------------------------------- ---------- ----------- ------------

Recurring IQGeo product revenue 7,240 4,499 10,610

--------------------------------------------- ---------- ----------- ------------

Software 1,882 267 4,495

Demand points 2,194 - 3,357

Services 8,831 3,978 10,527

--------------------------------------------- ---------- ----------- ------------

Non-recurring IQGeo product revenue 12,907 4,245 15,022

--------------------------------------------- ---------- ----------- ------------

Total revenue generated from IQGeo products 20,147 8,744 25,632

--------------------------------------------- ---------- ----------- ------------

Geospatial services from third party

products 390 442 960

--------------------------------------------- ---------- ----------- ------------

Total revenue 20,537 9,186 26,592

--------------------------------------------- ---------- ----------- ------------

4.3 Geographical areas

The Board and Management Team also review the revenues on a

geographical basis, based around the regions where the Group has

its significant subsidiaries or markets.

The Group's revenue from external customers in the Group's

domicile, the UK, and its major worldwide markets have been

identified on the basis of the customers' geographical location and

is presented below:

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

-------------- ---------- ----------- ------------

UK 1,169 289 1,133

Europe 2,013 242 1,983

USA 13,468 6,071 17,867

Canada 1,709 1,419 2,893

Japan 1,969 1,050 1,867

Rest of World 209 115 849

--------------- ---------- ----------- ------------

Total revenue 20,537 9,186 26,592

--------------- ---------- ----------- ------------

Notes to the interim consolidated financial statements

(continued)

5 Non-recurring items

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

-------------------------- ---------- ----------- ------------

Acquisition costs (293) (5) (1,007)

Total non-recurring items (293) (5) (1,007)

On 12 August 2022 the Group acquired Comsof. Costs have been

expensed as they were incurred.

6 Earnings/(Loss) per share (EPS)

6 months 12 months

6 months to to

to 30 June 2022 31 December

30 June unaudited 2022

2023 GBP'000 audited

unaudited (restated)

GBP'000 GBP'000

----------------------------------------------- ---------- ------------- ------------

Earnings attributable to Ordinary Shareholders

Profit/(loss) from operations (332) (282) ( 913)

----------------------------------------------- ---------- ------------- ------------

Number of shares

Weighted average number of ordinary shares

for the purposes of basic EPS ('000) 61,527 57,542 58,816

Effect of dilutive potential ordinary

shares:

- Share options ('000) 3,863 2,443 2,957

----------------------------------------------- ---------- ------------- ------------

Weighted average number of ordinary shares

for the purposes of diluted EPS ('000) 65,390 59,985 61,773

----------------------------------------------- ---------- ------------- ------------

EPS

Basic and diluted EPS (pence) (0.5) (0.5) (1.6)

----------------------------------------------- ---------- ------------- ------------

Basic earnings per share is calculated by dividing profit/(loss)

for the period attributable to ordinary shareholders of the Company

by the weighted average number of ordinary shares outstanding

during the period. For diluted earnings per share, the weighted

average number of shares is adjusted to allow for the effects of

all dilutive share options and warrants outstanding at the end of

the year. Options have no dilutive effect in loss-making years and

are therefore not classified as dilutive for EPS since their

conversion to ordinary shares does not decrease earnings per share

or increase loss per share.

The Group also presents an adjusted diluted earnings per share

figure which excludes amortisation and impairment of acquired

intangible assets, share-based payments charge, unrealised foreign

exchange gains/(losses) on intercompany trading balances and

non-recurring items from the measurement of profit for the

period.

6 months 6 months 12 months

to to to

30 June 30 June 2022 31 December

2023 unaudited 2022

unaudited GBP'000 audited

GBP'000 GBP'000

------------------------------------------------------ ------------- ------------

Earnings for the purposes of diluted EPS

being net loss attributable to equity holders

of the parent company (GBP'000) (332) (282) (913)

Adjustments:

Amortisation and impairment of acquired

intangible assets (GBP'000) 403 204 555

Reversal of share-based payments charge

(GBP'000) 442 159 303

Unrealised foreign exchange gains/(losses)

on intercompany trading balances 238 (632) (574)

Reversal of non-recurring items (GBP'000) 293 5 1,007

------------------------------------------------ ----- ------------- ------------

Net adjustments (GBP'000) 1,376 (264) 1,291

------------------------------------------------ ----- ------------- ------------

Adjusted earnings (GBP'000) 1,044 (546) 378

------------------------------------------------ ----- ------------- ------------

Adjusted basic EPS (pence) 1.7 (0.9) 0.6

------------------------------------------------ ----- ------------- ------------

Adjusted diluted EPS (pence) 1.6 (0.9) 0.6

------------------------------------------------ ----- ------------- ------------

The adjusted EPS information is considered to provide a fairer

representation of the Group's trading performance. Options have no

dilutive effect in loss-making years.

Notes to the interim consolidated financial statements

(continued)

7 Intangible assets

At 30 June At 30 June At 31 December

2023 2022 2022

unaudited unaudited audited

Net book amount GBP'000 GBP'000 GBP'000

-------------------------------- ---------- ---------- --------------

Goodwill 11,170 4,937 11,516

Acquired customer relationships 3,466 1,978 3,761

Acquired software products 589 264 742

Acquired brands 213 16 255

Capitalised product development 4,579 2,720 3,743

Software 131 14 12

Total intangible assets 20,148 9,929 20,029

-------------------------------- ---------- ---------- --------------

8 Trade and other payables

At 30 June At 30 June At 31 December

2023 2022 2022

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

------------------------------------- ---------- ---------- --------------

Trade and other payables due within

1 year:

Deferred income 8,236 5,434 7,450

Trade payables 1,846 336 1,247

Trade accruals 6,056 2,566 5,371

Other taxation and social security 877 507 866

Contingent acquisition consideration 1,184 - 1,211

Other payables 115 32 72

Trade and other payables due within

1 year 18,314 8,875 16,217

------------------------------------- ---------- ---------- --------------

On 11(th) August 2022 the Group acquired 100% of the equity

instruments of the Comsof business with operations in Europe &

North America, thereby obtaining control. The purchase agreement

included two consideration payments both for EUR1.5 million, one of

which was settled during the first half of 2023, and the second is

due to be paid in the second half of 2023 and is included in the

table above.

Other payables

In 2022, the Group received notification that a potential tax

claim has been issued by a foreign tax authority relating to the

sale of the RTLS business in 2018. The Group is currently disputing

the claim. As the outcome remains uncertain and any liability

cannot reliably be deduced, it is not practical to estimate the

potential claim on the Group.

Within the current period, the group has entered into a Bank

Guarantee for EUR200,000 as part of the tender process for a

potential customer. This expired on 12(th) September 2023.

Notes to the interim consolidated financial statements

(continued)

9 Share capital and premium

Number Merger

of relief

ordinary reserve

shares Share Share GBP'000

of GBP0.02 capital premium Total

each GBP'000 GBP'000 GBP'000

--------------------------------------- ----------- -------- -------- -------- --------

Balance at 1 January 2022 57,515,696 1,150 22,507 959 24,616

--------------------------------------- ----------- -------- -------- -------- --------

Issued under share-based payment

plans 100,000 2 62 - 64

Issued as part consideration for

acquisition 160,266 4 - 237 241

--------------------------------------- ----------- -------- -------- -------- --------

Balance at 30 June 2022 57,775,962 1,156 22,569 1,196 24,921

--------------------------------------- ----------- -------- -------- -------- --------

Issued under share-based payment

plans 84,998 2 47 - 49

Issue of shares - acquisition (Comsof) - - - 957 957

Issued on placing to institutional

investors - legal fees - - (95) - (95)

I ssued on placing to institutional

investors 2,800,000 56 3,444 - 3,500

Issued as part consideration for

acquisition 777,657 12 - - 12

Deferred consideration - OSPI - 3 - - 3

--------------------------------------- ----------- -------- -------- -------- --------

Balance at 1 January 2023 61,438,617 1,229 25,965 2,153 29,347

--------------------------------------- ----------- -------- -------- -------- --------

Issued under share-based payment

plans 113,542 2 63 - 65

Balance at 30 June 2023 61,552,159 1,231 26,028 2,153 29,412

--------------------------------------- ----------- -------- -------- -------- --------

The Company has one class of ordinary shares which carry no

right to fixed income.

10 Share options

At 30 June 2023, the Group had the following share-based payment

arrangements.

Awards Awards Awards

outstanding Granted Exercised Forfeited outstanding exercisable

at during during during at at

Award Exercise Currency 1 Jan the the the 30 June 30 June

date Vests Expires price 2023 period period period 2023 2023

Arrangement Year Years Year GBP Number Number Number Number Number Number

------------ ------ ------ -------- --------- --------- ----------- ------- --------- --------- ----------- -----------

2014

Options 2013 -16 2023 2.055 GBP 21,750 - (1,875) (19,875) - -

2019 -

2018 21 2028 0.555 GBP 350,000 - (70,000) - 280,000 280,000

2020 -

2020 23 2030 $0.783 USD 845,000 - - (60,000) 785,000 785,000

2020 -

2020 23 2030 0.625 GBP 110,000 - - - 110,000 110,000

2020 -

2020 23 2030 0.460 GBP 1,862,670 - (36,667) - 1,826,003 1,826,003

2020 -

2020 23 2030 0.675 GBP 500,000 - - - 500,000 333,333

2021 -

2021 24 2031 1.050 GBP 485,000 - (5,000) - 480,000 156,667

2021 -

2021 24 2031 $1.730(1) USD 320,000 - - (35,000) 285,000 95,000

2022 -

2022 25 2032 1.430 GBP 705,000 - - (20,000) 685,000 -

2022 -

2022 25 2032 $1.690 USD 707,000 - - (30,000) 677,000 -

2022 -

2022 25 2032 1.050 GBP 200,000 - - - 200,000 -

2022 -

2022 25 2032 1.134 GBP 230,000 - - - 230,000 -

2022 -

2022 25 2032 1.725 GBP 75,000 - - - 75,000 -

2023 -

2023 26 2033 2.087 GBP - 80,000 - - 80,000 -

------ ------ --------------------- --------- --------- ----------- ------- --------- --------- ----------- -----------

Total 6,411,420 80,000 (113,452) (164,875) 6,213,003 3,586,003

Weighted average exercise

price (GBP) 0.600 2.087 0.571 1.175 0.892 0.575

-------------------------------------- --------- --------- ----------- ------- --------- --------- ----------- -----------

1. Option awards granted in 2021 in USD were at an exercise

price below market value, in line with the GBP awards issued on the

same date. Following tax advice, this treatment has been identified

to be inefficient for both the awardees and the Company. By

agreement with all remaining awardees, these options have been

"cured" and the exercise cost rebased to market value at the time

of the award. The table above reflects the rebased exercise

price.

2023 granted share options

During the period, IQGeo Group plc granted a total of 80,000

options of two pence each in the Company with exercise price of

GBP2.087. The options vest in portions of one third on the first,

second and third anniversaries of grant and have no further

performance conditions other than ongoing employment on the date of

vesting and of exercise. Awards will be subject to a two-year

holding period from vesting point, with participants only permitted

to sell shares sufficient to cover the exercise cost and any tax

liability within this holding period.

Independent auditor's review report on Interim Financial

Information to IQGeo Group plc

Conclusion

We have reviewed the condensed set of financial statements in

the half-yearly financial report of IQGeo Group plc (the 'company')

and its subsidiaries (together called the 'group') for the six

months ended 30 June 2023 which comprises the condensed

consolidated income statement, the condensed consolidated statement

of comprehensive income, the condensed consolidated statement of

changes in equity, the condensed consolidated statement of

financial position, the condensed consolidated statement of cash

flows and related notes to the interim consolidated financial

statements.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with UK adopted International Accounting Standard 34, 'Interim

Financial Reporting'.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) (ISRE (UK)) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" (ISRE (UK) 2410). A review of interim financial

information consists of making inquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with UK adopted IFRSs. The

condensed set of financial statements included in this half yearly

financial report has been prepared in accordance with UK adopted

International Accounting Standard 34, "Interim Financial

Reporting".

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis of conclusion

section of this report, nothing has come to our attention to

suggest that management have inappropriately adopted the going

concern basis of accounting or that management have identified

material uncertainties relating to going concern that are not

appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with this ISRE UK, however future events or conditions

may cause the entity to cease to continue as a going concern.

In our evaluation of the directors' conclusions, we considered

the inherent risks associated with the group's business model

including effects arising from macro-economic uncertainties such as

increase in market interest rates and cost of inflation in the UK,

we assessed and challenged the reasonableness of estimates made by

the directors and the related disclosures and analysed how those

risks might affect the group's financial resources or ability to

continue operations over the going concern period.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors.

In preparing the half-yearly financial report, the directors are

responsible for assessing the group's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company and/or

subsidiaries or to cease operations, or have no realistic

alternative but to do so.

Auditor's Responsibilities for the review of the financial

information

Our responsibility is to express a conclusion to the group on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Our conclusion, including our Conclusions relating to going

concern, are based on procedures that are less extensive than audit

procedures, as described in the Basis for conclusion paragraph of

this report.

Use of our report

This report is made solely to the group, as a body, in

accordance with ISRE (UK) 2410. Our review work has been undertaken

so that we might state to the group those matters we are required

to state to it in an independent review report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the group as a body,

for our review work, for this report, or for the conclusion we have

formed.

Grant Thornton UK LLP

Statutory Auditor, Chartered Accountants

Cambridge

22 September 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UUUOROVUKUUR

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

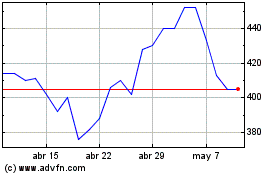

Iqgeo (LSE:IQG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Iqgeo (LSE:IQG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024