TIDMJADE

RNS Number : 1453O

Jade Road Investments Limited

29 September 2023

29 September 2023

JADE ROAD INVESTMENTS LIMITED

(" Jade Road Investments ", " JADE ", the " Company " or the "

Group ")

INTERIM CONSOLIDATED RESULTS FOR THE SIX MONTHSED 30 JUNE

2023

Jade Road Investments Limited (AIM: JADE), the London quoted

pan-Asian diversified investment vehicle focused on providing

shareholders with attractive uncorrelated, risk-adjusted long-term

returns, is pleased to announce its interim results for the six

months ended 30 June 2023.

Financial Highlights:

-- Total income decreased to US$0.59 million and was derived

from interest income as dividend income from investees, as opposed

to interest income from Jade's own cash (H1 2022: US$1.56

million).

-- Net loss of $ 1.4 million (H1 2022: US$ 1.02 million profit).

-- Consolidated basic / diluted loss per share of US$ 0.75 cents

(H1 2022: profit per share US$ 0.88 cents).

-- Consolidated NAV at 30 June 2023 increased by 3% to US$ 15.46

million/GBP 12.69 million (31 December 2022: US$15.13 million/GBP

12.4 million).

-- NAV per share at 30 June 2023 US$ 0.05 (GBP 0.04) (31 December 2022: US$0.13 / GBP 0.11 ).

-- Period end cash position of US$ 0.1 million (31 December 2022 : US$ 0.3 million).

Investment and Operational Highlights:

-- Future Metal Holdings Limited ( "Future Metal ")

o Pursuant to its latest Investment Policy, the Company has been

actively seeking divestment opportunities for this asset.

o In August 2023, the Quarry successfully renewed its mining

licence for another two years, which extended the validity period

to August 2025. As the Quarry's mining zone covers secondary

forestland for public welfare and farming land, the mining zone is

narrowed down from 2.3 square kilometres to 1.7 square kilometres.

However, the mineral reserves of the Quarry have not been

negatively impacted.

o As of the release of this interim report, the Company is

finalising the share purchase agreement and other transaction

documents with the local buyer.

-- Meize Energy Industries Holdings Limited (" Meize ")

o The Company is seeking a full divestment concerning the

remaining Series B preferred shares it holds after the successful

completion of the partial divestment in August 2022

o As of Q2 2023, as customer contracts were secured, Meize's

Xinjiang Plant produced 840 wind turbines and its Inner Mongolia

Plant produced 360 wind turbines.

o Based on Meize's management team's estimation, the total

output value of Meize would amount to USD21.0MM by the end of

2023.

-- DocDoc Pte Ltd (" DocDoc ")

o DocDoc is an asset-light and intellectual property-heavy

pan-Asian insurance fintech company.

o DocDoc's management team aims to generate SGD5MM from gross

insurance premiums in Singapore by the end of 2023, which would be

first revenues for the business.

-- Outlook:

o Future investments will be made in asset backed

income-generating investments as the Company disposes of all of its

legacy Asia-based assets and your Board hopes to be able to make

further announcements on this in the near future.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Jade Road Investments Limited +44 (0) 778 531 5588

John Croft

WH Ireland Limited - Nominated

Adviser +44 (0) 20 7220 1666

James Joyce

Andrew de Andrade

Hybridan LLP - Corporate Broker +44 (0) 203 764 2341

Claire Noyce

Lionsgate Communications - Communications

Adviser +44 (0) 779 189 2509

Jonathan Charles

About Jade Road Investments

Jade Road Investments Limited is quoted on the AIM Market of the

London Stock Exchange and is committed to providing shareholders

with attractive uncorrelated, risk-adjusted long-term returns from

a combination of realising sustainable capital growth and

delivering dividend income.

The Company is focused on asset-backed and revenue-generating

investment opportunities which will provide more certainty when

predicting future cash flow. This allows the Company to plan an

appropriate dividend policy in due course. It is believed that this

will allow for the optimal delivery of shareholder value in the

form of the payment of a safe, consistent dividend yield at an

attractive spread to other yielding options, while growing the

underlying capital base of the Company.

The Company's investment manager, Harmony Global Partners

Limited ("Harmony Capital"), will advise the Board and the Company

on the orderly disposal of the legacy portfolios and advise on any

proposed new investments to be made in accordance with the

Company's new Investment Policy recently approved by

shareholders.

Harmony Capital shall, subject to the overall supervision and

control of the Board, also undertake general administrative,

investor relations, marketing, portfolio management and risk

management functions for the Company.

Chairman's Statement

As mentioned in my statement in our 2022 Annual Results, 2023 is

a year of ongoing transition for the Company as it moves away from

its previous focus on Asia to a more geographically diverse

investment strategy characterised by investing in a portfolio of

high yielding assets with a low correlation to most markets or

major asset classes.

In February of this year, the Company announced the completion

of an equity fundraise which was underwritten in its entirety by

Heirloom Investment Management LLC ("HIM"). The gross placing

amount for this fundraise was $1,750,000.

In line with its new amended investment strategy, the Company

then announced in April that it had invested USD500,000 in Heirloom

Investment Fund SPC - Heirloom Fixed Return Fund SP, managed by

HIM.

The new fund is geographically diverse with low correlation to

most markets or major asset classes, such as equities, fixed income

and real estate. Current themes include asset-backed lending,

equipment leasing, agriculture (farm business), niche real estate

(US single family rental), infrastructure, litigation finance and

music royalties.

An important element of transitioning the Company away from its

previous Asian focus is to actively seek buyers for its legacy

assets. In order to support this, the remuneration fee structure

for the Company's Investment Manager Harmony Capital has been

changed to comprise of a sharply reduced fixed annual management

fee of US$350k, alongside an incentive fee structure for asset

disposals. Incentive fees in this regard are only payable after a

minimum net sales value of US$6m has been reached.

Progress on asset disposals has inevitably been slow, given

their common characteristics of being essentially private equity in

nature. However, the Investment Management team have been working

closely with all our major assets with a view to finding suitable

exits, and I am hopeful that announcements on some core asset

disposals can be made during this year.

An equity fundraise of $1,050,000 was also completed in

September 2023 with new shares placed at a significant premium to

the Company's then share price.

Finally, on behalf of the board, I would like to extend my

thanks to all of our shareholders for your continued support.

The principal assets as of 30 June 2023 are detailed below:

Principal Effective Instrument Valuation Credit Cash Equity Fair Provision Valuation

assets interest type at 31 income receipts investment/ value US$ at 30

% December US$ US$ other adjustment million June

2022 million million movement US$ million 2023

US$ US$ million US$

million million

Future

Metal

Holdings Structured

Limited 84.8 Equity 5.3 0.3 - - - (0.3) 5.3

Meize Energy Redeemable

Industrial convertible

Holdings preference

Ltd 6.3 shares 8.8 - - - - - 8.8

DocDoc Convertible

Pte Ltd - Bond 2.8 0.1 - - - (0.1) 2.8

Infinity

Capital Secured

Group - Loan Notes 1.4 0.2 - - - (0.2) 1.4

Heirloom

Investments - - - 0.5 - - - 0.5

Project

Nicklaus - 1.8 - - - (0.1) - 1.7

Corporate

debt - (3.9) - - - - - (3.9)

Other

liabilities - (1.4) - - 0.2 - - (1.2)

Cash 0.3 - 1.7 (1.9) - - 0.1

Total N et Asset

Value 15.1 0.6 2.2 (1.7) (0.1) (0.6) 15.5

-------------------------- ------------ ---------- --------- --------- ------------ ------------ ---------- ----------

Future Metal Holdings Limited ("FMH")

Our largest asset by value is the dolomite quarry project

("Quarry") in China, Future Metal Holdings Limited ("FMHL"), which

was previously known as Hong Kong Mining Holdings. The Company has

an 85% shareholding in FMHL.

JADE has been exploring the option of a partial or full exit of

this investment by actively engaging with interested parties on the

ground in the Shanxi Province as well as with brokers in Mainland

China, Hong Kong and Singapore.

Including loan disbursements provided by the Company to FMHL and

its subsidiaries and accrued PIK interest, the estimated fair value

of the Company's investment is US$ 5.3 million as of 30 June 2023.

Due to the potential exit of this investment, in order to be

prudent, the company has decided to apply a 100% provision against

the income expected from FMHL.

Meize Energy Industries Holdings Limited ("Meize")

Swift Wealth Investments Limited, a 100% (2019: 100%) owned

subsidiary of the Company incorporated in the British Virgin

Islands, held a 7.2% stake in Meize through a redeemable preference

share structure.

Meize is a privately owned company that designs and manufactures

blades for both onshore and offshore wind turbines.

In June 2022, the Company entered into a share purchase

agreement for 112,500 shares of the Series B Preferred Equity in

Meize for consideration of USD1.2 million. The transaction price

implies a valuation of USD10.0 million for the Company's investment

in Meize.

The partial divestment was completed by the end of August 2022.

The Company held approximately 6.3% interest in Meize post this

divestment.

As of 30 June 2023, the Company's interest in Meize had a fair

value of US$ 8.8 million based on an implied valuation following

the divestment of 112,500 shares.

DocDoc Pte Ltd. ("DocDoc")

DocDoc is a Singapore-headquartered online network of over

23,000 doctors, 600 clinics, and 100 hospitals serving a wide array

of specialities. It uses artificial intelligence, cutting-edge

clinical informatics, and proprietary data to connect patients to

doctors which fit their needs at an affordable price.

DocDoc pivoted its business model to become a "Neo Insurer" and

attempts to partner with insurance companies to enhance their

policy offerings. DocDoc is working to offer fully-digitised

insurance products to consumers or businesses, exclusively through

digital channels, with end-to-end digital service delivery. These

offerings will include quoting, binding, issuing of policies,

documentation, proof of insurance, electronic billing, payment and

real time policy management all digitally.

As of 30 June 2023, the carrying value of the Convertible Bond

was US$ 2.8 million. An annual coupon of 8% (4.0% cash and 4%

Payment-in-Kind was converted to 8% Payment-in-Kind).

In order to be prudent, the company has decided to apply a 100%

provision to the income expected from DocDoc.

Infinity Capital Group Limited ("ICG")

Ultimate Prosperity Limited, a 100% owned subsidiary of the

Company incorporated in the British Virgin Islands, holds a Secured

Loan to ICG.

ICG develops premium residential projects in Hirafu Village, a

world-class ski village in Niseko, Japan - one of the most popular

winter travel destinations in the world.

As the COVID-19 pandemic continues to impact Japan and the

Hokkaido region, ICG has been working closely with the local

management to monitor the domestic property market and the local

market's response to the pandemic, including construction project

planning and potential movements in property prices.

As of 30 June 2023, the carrying value of the Secured Loan was

US$ 1.4 million. The Company has decided to escalate its efforts to

ensure an exit from this position including taking legal action

while also pursuing consensual avenues. Due to the planned exit of

this investment, in order to be prudent, the company has decided to

apply a 100% provision against the income expected from ICG.

John Croft

Chairman

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Note US$000 US$000 US$000

Income from unquoted

financial assets 588 580 1,174

Finance income from

loans - 679 1,359

Gain on disposal - 300 300

Gross portfolio income 4 588 1,559 2,833

Fair value changes on

financial assets at

fair value through profit

or (loss) (101) 737 (47,409)

Investment provisions 4 (588) (3) (6,003)

------------ ----------- ------------

Net portfolio income/(loss) 4 (101) 2,293 (50,579)

Management fees 13 (376) (674) (1,200)

Incentive fees - - 158

Administrative expenses (639) (344) (763)

Operating profit/(loss) (1,116) 1,275 (52,384)

Finance expense (273) (259) (520)

Profit/(loss) before

taxation (1,389) 1,016 (52,904)

------------ ----------- ------------

Taxation 5 - - -

Profit/(loss) and total

comprehensive expense

for the period (1,389) 1,016 (52,904)

============ =========== ============

Earnings per share 7

(0.75) (45.89)

Basic cents 0.88 cents cents

============ =========== ============

(0.75) (45.89)

Diluted cents 0.76 cents cents

============ =========== ============

The results above relate to continuing operations.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Note US$000 US$000 US$000

----------------------------- ----- ----------- ------------ --------------

Assets

Unquoted financial assets

at fair value through

profit or loss 8 18,708 67,344 18,227

Loans and other receivables 9 1,721 6,347 1,769

Cash and cash equivalents 100 437 321

Total assets 20,529 74,128 20,317

----------- ------------ --------------

Liabilities

Other payables and accruals 1,209 1,257 1,334

Current liabilities 1,209 1,257 1,334

----------- ------------ --------------

Loans & borrowings 10 3,873 3,827 3,859

----------- ------------ --------------

Total liabilities 5,082 5,084 5,193

----------- ------------ --------------

Net assets 15,447 69,044 15,124

=========== ============ ==============

Equity and reserves

Share capital 11 150,615 148,903 148,903

Treasury share reserve 11 (615) (615) (615)

Share based payment reserve 2,936 2,936 2,936

Accumulated losses (137,489) (82,180) (136,100)

----------- ------------ --------------

Total equity and reserves

attributable to owners

of the parent 15,447 69,044 15,124

=========== ============ ==============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share

Treasury based

Share share payment Accumulated

capital reserve reserve losses Total

US$000 US$'000 US$000 US$000 US$000

Group balance at 1

January 2022 148,903 (615) 2,936 (83,196) 68,028

Profit for the period - - - 1,016 1,016

Other comprehensive

income - - - - -

--------- --------- --------- ------------ ---------

Total comprehensive

income for the period - - - 1,016 1,016

Group balance at

30 June 2022 148,903 (615) 2,936 (82,180) 69,044

--------- --------- --------- ------------ ---------

Loss for the period - - - (53,920) (53,920)

Other comprehensive

income - - - - -

--------- --------- --------- ------------ ---------

Total comprehensive

income for the period - - - (53,920) (53,920)

Group balance at 31

December 2022 and

1 January 2023 148,903 (615) 2,936 (136,100) 15,124

--------- --------- --------- ------------ ---------

Loss and total comprehensive

expense for the period - - - (1,389) (1,389)

Total comprehensive

income for the period - - - (1,389) (1,389)

Issue of shares net

of issue costs 1,712 - - 1,712

Group balance at

30 June 2023 150,615 (615) 2,936 (137,489) 15,447

========= ========= ========= ============ =========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended Year ended

30-Jun 30-Jun 31 December

2023 2022 2022

Unaudited Unaudited Audited

US$'000 US$'000 US$'000

------------------------------------- ----------- ----------- ------------

Cash flow from operating activities

(Loss) / Profit before taxation (1,389) 1,016 (52,904)

Adjustments for:

Finance income - (679) (1,359)

Finance expense 273 259 520

Exchange loss 84 29 83

Fair value changes on unquoted

financial assets at fair value

through profit or loss 19 (2,043) 47,074

Share-based expenses - - -

Fair value changes on loans

and receivables at fair value

through profit or loss - 679 5,059

Realised (gain) on disposal

of investments - (300) (300)

Increase/(Decrease) in other

receivables (35) (21) 28

Increase/(Decrease) in other

payables and accruals (127) 247 325

----------- ----------- ------------

Net cash used in operating

activities (1,175) (812) (1,477)

----------- ----------- ------------

Cash flow from investing activities

Sale proceeds of unquoted financial

assets at fair value through

profit or loss - 400 1,200

Purchase of unquoted financial

assets at fair value through

profit and loss (500) - -

Net cash generated from investing

activities (500) 400 1,200

----------- ----------- ------------

Issue of Shares 1,712 - -

Payment of interest on loans

and borrowings (259) - (228)

----------- ----------- ------------

Net cash generated used in

financing activities 1,453 - (228)

----------- ----------- ------------

Net (decrease) in cash & cash

equivalents during the period (222) (412) (505)

Cash and cash equivalents and

net debt at the beginning of

the period 321 848 848

Foreign exchange on cash balances 1 1 (22)

Cash & cash equivalents and

net debt at the end of the

period 100 437 321

=========== =========== ============

NOTES TO THE FINANCIAL INFORMATION

1. CORPORATE INFORMATION

The Company is a limited company incorporated in the British

Virgin Islands ("BVI") under the BVI Business Companies Act 2004 on

18 January 2008. The address of the registered office is Commerce

House, Wickhams Cay 1, P.O. Box 3140, Road Town, Tortola, British

Virgin Islands VG 1110 and its principal place of business is

19/F., CMA Building, 64 Connaught Road Central, Central, Hong

Kong.

The Company is quoted on the AIM Market of the London Stock

Exchange (code: JADE) and the Quotation Board of the Open Market of

the Frankfurt Stock Exchange (code: 1CP1).

The principal activity of the Company is investment holding. The

Company is principally engaged in investing primarily in unlisted

assets in the areas of mining, power generation, health technology,

telecommunications, media and technology ("TMT"), and financial

services or listed assets driven by corporate events such as

mergers and acquisitions, pre-IPO, or re-structuring of state-owned

assets.

The condensed consolidated interim financial information was

approved for issue on 29 September 2023.

2. BASIS OF PREPARATION

The condensed consolidated interim financial information has

been prepared in accordance with International Accounting Standard

("IAS") 34 "Interim Financial Reporting" and presented in US

Dollars.

3. PRINCIPAL ACCOUNTING POLICIES

The condensed consolidated interim financial information has

been prepared on the historical cost convention, as modified by the

revaluation of certain financial assets and financial liabilities

at fair value through the income statement.

The accounting policies and methods of computation used in the

condensed consolidated financial information for the six months

ended 30 June 2023 are the same as those followed in the

preparation of the Group's annual financial statements for the year

ended 31 December 2022 and are those the Group expects to apply

into financial statements for the year ending 31 December 2023.

There was no impact on the Company's accounting policies as a

result of any new or amended standards which became applicable for

the current accounting period.

The seasonality or cyclicality of operations does not impact the

interim financial information.

4. SEGMENT INFORMATION

The operating segment has been determined and reviewed by the

Board to be used to make strategic decisions. The Board considers

there to be a single business segment, being that of investing

activity.

The reportable operating segment derives its revenue primarily

from debt investment in several companies and unquoted

investments.

The Board assesses the performance of the operating segments

based on a measure of adjusted Earnings Before Interest, Taxes,

Depreciation and Amortisation ("EBITDA"). This measurement basis

excludes the effects of non-recurring expenditure from the

operating segments such as restructuring costs. The measure also

excludes the effects of equity-settled share-based payments and

unrealised gains/losses on financial instruments.

The segment information provided to the Board for the reportable

segment for the periods are as follows:

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

Income on unquoted financial

assets 588 580 1,174

Financial income on loans

& receivables - 679 1,359

Gain on disposal - 300 300

Gross portfolio income 588 1,559 2,833

--------- -------- ------------

Expected credit loss

provision (588) (3) (6,003)

Foreign exchange (101) (84) (113)

Equity fair value adjustments - 821 (47,296)

Portfolio income through

profit or loss (101) 2,293 (50,579)

--------- -------- ------------

Net assets:

FMHL 5,252 50,666 5,270

Meize 8,800 8,801 8,801

Other - - -

DocDoc 2,806 2,696 2,806

ICG 1,335 1,515 1,335

Infinity TNP - 3,650 -

Heirloom Investment Fund 500 - -

Other 15 16 15

--------- -------- ------------

Unquoted assets at fair

value through profit

or loss 18,708 67,344 18,227

Loans and other receivables

at fair value through

the profit or loss (third

party) 1,721 6,347 1,769

Cash 100 437 321

Liabilities (5,082) (5,084) (5,193)

Net assets 15,447 69,044 15,124

The impact of fair value changes on the investments in the

portfolio are as follows:

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

Income on unquoted financial

assets through profit or

loss 588 580 1,174

Equity fair value adjustments:

* FMHL - (45,146)

* Meize - 1,500 1,500

* DocDoc - - -

* Infinity Capital Group - - -

* Infinity TNP - - (3,650)

--------- -------- ------------

- 1,500 (47,296)

--------- -------- ------------

Realised Gain - - 300

Expected credit loss provision:

- ICG (112) (3) (363)

- FMHL (300) - (581)

- DocDco (176) - -

Foreign exchange on unquoted

financial assets at fair

value through profit or

loss (19) (34) (8)

Total fair value changes

on financial assets at

fair value through profit

or loss (19) 2,043 (46,774)

========= ======== ============

5. TAXATION

The Company is incorporated in the BVI and Hong Kong. The

Company is not subject to any income tax in the BVI. The Company

does not engage in any business activities or generate income in

Hong Kong; therefore it is not subject to taxation in Hong

Kong.

6. DIVID

The Board does not recommend the payment of an interim dividend

in respect of the six months ended 30 June 2023 (30 June 2022:

Nil).

7. EARNINGS PER SHARE

The calculation of the basic and diluted earnings per share

attributable to owners of the Group is based on the following:

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

Numerator

Basic/Diluted: Net (loss) / profit (1,389) 1,016 (52,904)

--------- -------- ------------

Number of shares

'000 '000 '000

Denominator

Basic: Weighted average shares 185,008 115,278 115,278

Dilutive effect of warrants - 17,568 -

Diluted: Adjusted weighted average shares 185,008 132,846 115,278

--------- -------- ------------

Earnings per share

Basic (cents) (0.75) 0.88 (45.89)

Diluted (cents) (0.75) 0.76 (45.89)

For the year ended 31 December 2022 and the period ending 30

June 2023, the warrants issued to the Investment Manager were

anti-dilutive and therefore there is no impact on the weighted

average shares in issue. 1,002,333 warrants were issued during the

current period ending 30 June 2023.

8. UNQUOTED FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

At the beginning of the period 18,227 66,202 66,202

Fair value changes through

profit and loss 569 2,045 (46,131)

Expected credit loss provision

through profit and loss (588) (3) (944)

Realised gain - - 300

Disposals - (900) (1,200)

Additional investment 500 - -

At the end of the period 18,708 67,344 18,227

======== ======== ============

On 5 April 2023, the Company invested $500,000 in Heirloom

Investment Fund SPC which provides a diversified portfolio of asset

backed and / or income producing investments target to deliver a

risk-adjusted return over the long term across geographically

diverse assets. The investment is expected to provide a fixed yield

of 6% per annum, contingent on the performance of the underlying

investments.

9. LOANS AND OTHER RECEIVABLES AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

At the beginning of the

period 1,769 5,556 5,556

Additions - Meize consideration - 800 -

Fair value changes through

profit and loss (48) (688) (87)

Expected credit loss provision

through profit and loss - - (5,059)

Finance income on loans - 679 1,359

At the end of the period 1,721 6,347 1,769

======== ======== ============

Note 30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

Due in respect of Meize - 800 -

divestment

Other receivables 1,721 5,547 1,769

Total loans and borrowings 1,721 6,347 1,769

======== ======== ============

Loans represent the Convertible Bond issued by Fook Lam Moon

Holdings plus accrued interest. The Group has assessed the

recoverability of Loans in accordance with its policy, and at

year-end 31 December 21 applied a 100% provision against this

investment such that the carrying value of the Convertible Bond was

US $0 .0m. The circumstances remain unchanged as at 30 June 2023.

No bond interest receivable has been recognised during the period

.

The breakdown of Loans is as follows:

30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

Loan principal 26,500 26,500 26,500

Accrued PIK interest 2,248 1,966 2,248

Accrued interest payable in

cash 3,070 2,672 3,070

Fair Value Adjustments - Principal (26,500) (26,500) (26,500)

Fair Value Adjustments - Accrued

Interest (5,318) (4,638) (5,318)

--------- --------- ------------

Net loans receivable - - -

========= ========= ============

10. LOANS AND BORROWINGS

30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

Corporate debt 3,873 3,827 3,859

Total loans and borrowings 3,873 3,827 3,859

======== ======== ============

The movement in loans and borrowings is as follows:

30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

Opening balance 3,859 3,568 3,568

Borrowing costs amortised - 31 52

Interest expense accrued 273 228 467

Payment of interest liability (259) - (228)

Closing balance 3,873 3,827 3,859

======== ======== ============

11. SHARE CAPITAL

Number

of Amount

Shares US$000

Issued share capital excluding treasure

shares at 31 December 2022 115,277,869 148,288

Shares issues in the period 201,996,350 1,712

------------ --------

Issued share capital excluding treasure

shares at 30 June 2023 317,274,219 150,000

------------ --------

Consisting of:

Authorised, called-up and fully paid

ordinary shares of no-par value each

at 30 June 2023 319,922,023 150,615

Authorised, called-up and fully paid

ordinary shares of no-par value held

as treasury shares by the Company at

30 June 2023 (2,647,804) (615)

(i) Under the BVI corporate laws and regulations, there is no

concept of "share premium", and all proceeds from the sale of

no-par value equity shares are deemed to be share capital of the

Company.

12. FINANCIAL INSTRUMENTS

Financial assets

As at As at As at

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unquoted financial assets

at fair value 18,708 67,344 18,227

Other receivables at fair

value 1,659 6,291 1,738

Cash and cash equivalents

at amortised cost 100 437 321

--------- --------- -------------

Financial assets 20,467 74,073 20,286

========= ========= =============

Financial liabilities

As at As at As at

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Other payables and accruals

at amortised cost 1,209 1,257 1,334

Corporate debt at amortised

cost 3,873 3,827 3,859

--------- --------- -------------

Financial liabilities 5,082 5,084 5,193

========= ========= =============

The corporate debt reached maturity in October 2022. The Company

has not yet realized sufficient funds from its current program of

legacy asset disposals to redeem these bonds. In December 2022 the

Company agreed an extended maturity of the loan notes issued to 31

December 2023 and an increased interest rate of 15% from December

2022. The interest rate payable on the principal amount of the loan

notes will increase to 16% per annum where US$1.8m or more of the

principal amount remains outstanding by 30 June 2023. The interest

payment due on 30 June 2023 was not made and the Company agreed

with bondholders to increase the interest rate between 1 July 2023

and 14 August 2023 to 18%. As the interest payment was not made by

14 August 2023, the interest rate will continue at 18% until such

payment is made.

Financial assets at fair value through profit or loss

The following table provides an analysis of financial

instruments that are measured subsequent to initial recognition at

fair value, grouped into Level 1, 2 or 3 based on the degree to

which the fair value is observable:

Note As at As at As at

30 June 30 June 31 December

2023 2022 2022

US$000 US$000 US$000

Level 3

Unquoted financial assets

at fair value 8 18,708 67,344 18,227

Other receivables at fair

value 9,14 1,721 6,291 1,769

20,429 73,635 19,996

There is no transfer between levels in the current period.

Carrying values of all financial assets and liabilities are

approximate to fair values. The value of level 3 investments has

been determined using the yield capitalisation (discounted cash

flow) method.

13. RELATED PARTY TRANSACTIONS

During the period under review, the Group entered into the

following transactions with related parties and connected

parties:

30 June 30 June 31 December

2023 2022 2022

Notes US$000 US$000 US$000

Remuneration payable to Directors 183 117 260

Harmony Capital

Management fee (i) 376 674 1,200

Incentive fee - - (158)

Amount due to Harmony Capital at period end 910 1,089 1,234

(i) Harmony Capital has been appointed as the Investment Manager

of the Group. In prior years the management fee. was calculated and

paid bi-annually in advance calculated at a rate of 0.875% of the

net asset value of the Company's portfolio of assets at 30 June and

31 December in each calendar year. A new management fee was agreed

in April 2023 reducing the annual management fee to $350,000 per

annum and amending the incentive structure to encourage an orderly

realization of value from the Company's existing portfolio.

14. EVENTS AFTER THE REPORTING PERIOD

On 26 July 2023 agreement was reached with the bondholders to

waive rights to accelerate the US$10,000,000 12.5% fixed secured

bond instrument resulting from the non-payment of interest due on

Friday 14 July 2023. Interest will accrue on the bonds at an

interest rate between 1 July 2023 and 14 August 2023 to 18%. As the

interest payment was not made by 14 August 2023, the interest rate

will continue at 18% until such payment is made.

15. COPIES OF THE INTERIM REPORT

The interim report is available for download from

www.jaderoadinvestments.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EASNNALFDEEA

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

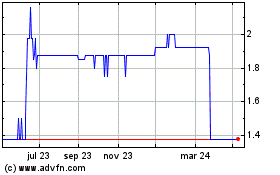

Jade Road Investments (LSE:JADE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

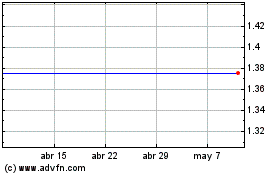

Jade Road Investments (LSE:JADE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024