TIDMJSE

RNS Number : 2266T

Jadestone Energy PLC

13 November 2023

Operational Update

13 November 2023 - Singapore: Jadestone Energy plc ("Jadestone",

the "Company" or the "Group") an independent upstream production

company focused on the Asia-Pacific region, is pleased to provide

the following operational update.

Group Production and Guidance

Recent production performance demonstrates the positive effect

of the Group's ongoing investment activity and recent acquisitions,

delivering a more balanced and diversified portfolio. Six assets

are now in production prior to the addition of the Akatara project

in Indonesia, which remains firmly on schedule for first gas during

H1 2024.

Since 1 April 2023, Group production has averaged c.14,400 boe/d

and has averaged c.13,100 boe/d year-to-date. Based on current

expectations for the remainder of 2023, production is now expected

to be towards the upper end of the April to December guidance range

of 13,500 - 15,000 boe/d (equivalent to an annual 2023 guidance

range of 12,600 - 13,700 boe/d), with the following highlights:

-- PM323 production in Malaysia has doubled, and is currently

c.5,300 bbls/d net to Jadestone, largely from the planned infill

drilling campaign on the East Belumut field which has delivered

results significantly ahead of expectations (see below for further

detail);

-- Montara has averaged c.5,700 bbls/d in recent months, with

good well performance offset by occasional brief interruptions

associated with offtake arrangements, including the replacement of

a short section of offload hose at the shuttle tanker;

-- Production from the CWLH fields continues to exceed the

Company's expectations, averaging c.2,300 bbls/d net in recent

months due to strong reservoir performance and high uptime at the

Okha FPSO; and

-- PM329 production in Malaysia, Sinphuhorm in Thailand and Stag

in Australia are all broadly on plan showing the benefits of

diversified production.

2023 guidance for capex (US$110-125 million) and operating

costs[1] are reiterated.

Akatara

The Akatara development project is currently 83% complete and

remains on schedule for commissioning activities in the first

quarter of 2024 and first gas before mid-2024. Approximately 1,450

workers are currently on site, with c.2.9 million safe manhours

worked to date on the Akatara project.

The Elang-1 rig is scheduled to mobilise to the Akatara

development at the end of November 2023 to workover five existing

wells which will provide the raw gas feed into the Akatara Gas

Processing Facility.

Malaysia

-- The first well in the East Belumut infill drilling campaign

on the PM323 PSC was, as previously reported, successfully drilled

and brought onstream in September 2023 and is currently producing

c.1,400 bbls/d.

-- The third well was successfully drilled and completed in late

October 2023, testing at a gross rate of c.3,100 bbls/d and was

subsequently brought onstream.

-- The fourth well in the programme has also been successfully

drilled and has been tested at a gross rate of c.1,700 bbls/d in

recent days.

-- As a result, the three wells drilled to date in the 2023

drilling programme are currently producing at a gross rate of

c.6,200 bbls/d, significantly exceeding the pre-drill gross rate

expectation for all four wells of 3,500 bbls/d. Consequently, gross

PM323 production has reached c.8,800 bbls/d in recent days, or

c.5,300 bbls/d net to Jadestone.

-- The Naga-2 rig will now complete the drilling of the second

well in the programme, which was temporarily suspended due to fluid

losses. The well is expected to reach total depth in the second

half of November.

-- The capex for the 2023 East Belumut drilling campaign is now

estimated at US$28 million net to Jadestone, or approximately US$7

million (net) more than pre-drill expectations, primarily due to

the extension required to complete the drilling of the second

infill well. This increase is reflected in the reiterated 2023

capex guidance above. The overall cost of the drilling campaign is

expected to be fully cost recovered by Q2 2024 due to the higher

rates of production seen from the wells drilled to date.

Liftings

The Company expects to lift approximately 1.6 million barrels

across November and December 2023, including a c.650,000 barrel

lifting from the CWLH fields and c.450,000 barrels from

Montara.

Paul Blakeley, President and CEO commented:

"Production has strengthened recently, with the stabilisation of

Montara, strong growth from the successful Malaysia infill drilling

campaign and solid performance from all other producing assets. The

planned diversification of the portfolio is working, providing

greater resilience to our business, and the addition of Akatara

production next year will further enhance this.

Progress at Akatara remains on schedule and, at 83% complete,

first gas has been substantially de-risked, with pre-commissioning

of certain key systems expected to commence shortly. The drilling

programme at East Belumut has been very successful, supporting

near-term growth, and the results provide encouragement for further

drilling within the field with another four well campaign already

being considered."

-ends-

For further information, please contact:

Jadestone Energy plc

Paul Blakeley, President and CEO +65 6324 0359 (Singapore)

Bert-Jaap Dijkstra, CFO

Phil Corbett, Investor Relations Manager +44 (0) 7713 687467 (UK)

ir@jadestone-energy.com

Stifel Nicolaus Europe Limited (Nomad, +44 (0) 20 7710 7600 (UK)

Joint Broker)

Callum Stewart

Jason Grossman

Ashton Clanfield

Jefferies International Limited (Joint +44 (0) 20 7029 8000 (UK)

Broker)

Will Soutar

Cameron Jones

Camarco (Public Relations Advisor) +44 (0) 203 757 4980 (UK)

Billy Clegg jse@camarco.co.uk

Andrew Turner

Elfie Kent

About Jadestone Energy

Jadestone Energy plc is an independent oil and gas company

focused on the Asia-Pacific region. It has a balanced and

increasingly diversified portfolio of production and development

assets in Australia, Malaysia, Indonesia, Thailand and Vietnam, all

stable jurisdictions with a positive upstream investment

climate.

Led by an experienced management team with a track record of

delivery, who were core to the successful growth of Talisman

Energy's business in Asia-Pacific, the Company is pursuing a

strategy to grow and diversify the Company's production base both

organically, through developments such at Akatara in Indonesia and

Nam Du/U Minh in Vietnam, as well as through acquisitions that fit

within Jadestone's financial framework and play to the Company's

strengths in managing maturing oil assets. Jadestone delivers value

in its acquisition strategy by enhancing returns through operating

efficiencies, cost reductions and increased production through

further investment.

Jadestone is a responsible operator and well positioned for the

energy transition through its increasing gas production, by

maximising recovery from existing brownfield developments and

through its Net Zero pledge on Scope 1 & 2 GHG emissions from

operated assets by 2040. This strategy is aligned with the IEA Net

Zero by 2050 scenario, which stresses the necessity of continued

investment in existing upstream assets to avoid an energy crisis

and meet demand for oil and gas through the energy transition.

Jadestone Energy plc (LEI: 21380076GWJ8XDYKVQ37) is listed on

the AIM market of the London Stock Exchange (AIM: JSE). The Company

is headquartered in Singapore. For further information on the

Company please visit www.jadestone-energy.com .

This announcement may contain certain forward-looking statements

with respect to the Company's expectations and plans, strategy,

management's objectives, future performance, production, reserves,

costs, revenues and other trend information. These statements are

made by the Company in good faith based on the information

available at the time of this announcement, but such statements

should be treated with caution due to inherent risks and

uncertainties. These statements and forecasts involve risk and

uncertainty because they relate to events and depend upon

circumstances that may occur in the future. There are a number of

factors which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements and forecasts. The statements have been made with

reference to forecast price changes, economic conditions and the

current regulatory environment. Nothing in this announcement should

be construed as a profit forecast. Past share performance cannot be

relied upon as a guide to future performance. The Company does not

assume any obligation to publicly update the information, except as

may be required pursuant to applicable laws.

This announcement does not include inside information.

[1] Underlying operating cost guidance is US$180-210 million.

Underlying operating cost guidance excludes non-recurring items and

certain costs such as workovers, transportation, and expenditure

associated with non-producing assets offshore Malaysia. These

excluded items are included in the reported production costs in the

Group's statement of profit or loss, and are expected to total

US$65-75 million in 2023.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAKFDFSPDFEA

(END) Dow Jones Newswires

November 13, 2023 02:00 ET (07:00 GMT)

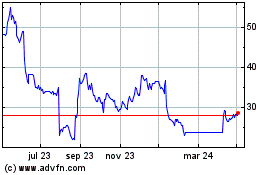

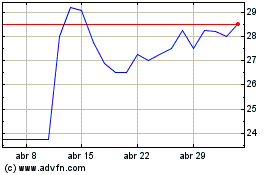

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024