TIDMMPAC

RNS Number : 6367L

Mpac Group PLC

07 September 2023

7 September 2023

AIM: MPAC

Mpac Group plc

("Mpac", "the Company" or "the Group")

Half Year Results for the six months to 30 June 2023

Strong order intake and healthy prospects pipeline; remain

confident in long term prospects

Mpac Group (AIM: MPAC), the global packaging and automation

solutions Group, today announces its unaudited financial results

for the six months to 30 June 2023 (the "period").

Financial Highlights

-- Order intake of GBP62.4m (2022: GBP32.8m) contributing to a

closing order book of GBP77.5m (30 June 2022: GBP62.6m; 31 Dec

2022: GBP67.2m)

-- Group revenue of GBP52.8m, up 4% (2022: GBP50.6m)

-- Underlying* profit before tax of GBP1.9m (2022: GBP1.1m)

-- Statutory profit before tax of GBP0.2m (2022: loss of GBP0.4m)

-- Underlying* earnings per share of 6.5p (2022: 3.6p)

-- Basic loss per share of (2.2)p (2022: earnings per share of 3.6p)

-- Net cash of GBP2.2m (30 June 2022: GBP8.6m; 31 December 2022: Net borrowings of GBP4.7m)

*Underlying results are stated before pension related credits of

GBP0.3m (H1 2022: charges of GBP0.4m); amortisation of acquired

intangible assets of GBP0.8m (H1 2022: GBP0.8m); restructuring

costs of GBP1.1m (H1 2022: GBP0.1m) and other non-underlying items

of GBP0.1m (H1 2022: GBP0.3m).

Operational and Strategic Highlights

-- Shipment, installation, and commissioning of battery cell

assembly Customer Qualification Plant ("CQP") automation line to

FREYR Battery ("Freyr") progressing to schedule

-- Commenced pre-engineering work to define specification of Giga America for Freyr

-- Winning new customers in target sectors

-- Strong growth in Service business, delivering on strategic

focus to improve and sustain customer support

-- Reduction of working capital progressing to plan

-- Implementation of One Mpac business systems in our Cleveland, USA site

-- Strengthened leadership team with new appointments in UK and North America

-- Second year cohort joined Mpac Academy to develop future leaders and to retain talent

-- Strong pipeline of potential acquisitions for future strategic growth

Current trading and outlook

-- Current trading is in line with the Board's expectations and

full year market guidance remains unchanged. Margins are

normalising as anticipated and with a strong order book and

prospects pipeline, Mpac is well positioned to deliver on the

previously announced H2 weighting to the financial year, despite

the challenging trading environment.

Adam Holland, Chief Executive Officer, commented:

"I am delighted to report my first set of interim results as

Chief Executive Officer, which were in line with our expectations.

I am pleased to be able to report significant progress in the first

half of 2023, with increases in Original Equipment and Service

order intake and a closing order book significantly up on the prior

year. In addition, the prior year expansion of working capital has

unwound in line with expectations, and we close H1 in a positive

net cash position. We have a lot to do in the second half but are

anticipating normalising margins in the period and are focused on

delivering the strong order book for our customers. We have made

good progress in developing the leadership team and I am confident

that Mpac has the employee skillset to take advantage of the

attractive markets in which we operate and deliver on our strategic

objectives."

For further information, please contact:

Mpac Group plc Tel: +44 (0) 2476

Adam Holland, Chief Executive Officer 421100

Will Wilkins, Group Finance Director

Shore Capital (Nominated Adviser & Broker)

Advisory Tel: +44 (0) 20 7408

Patrick Castle 4050

Iain Sexton

Broking

Henry Willcocks

Hudson Sandler Tel: +44 (0) 20 7796

Nick Lyon / Nick Moore 4133

Notes to Editor

Mpac Group (AIM: MPAC) is a global leader in engineering and

technology, designing, precision engineering, manufacturing, and

supporting high-speed packaging equipment and solutions.

Mpac serves 80 countries across four key regions around the

world including the Americas, EMEA, APAC and the UK. The Company

operates in the attractive growth markets of Food & Beverage,

Healthcare and Clean Energy. These targeted markets boast

significant growth opportunities.

Through its three core product lines - Lambert, Langen and

Switchback - the Company provides full line Original Equipment and

Services for automated high-speed packaging, from assembly of

products through to case packing and palletising. Mpac's high

margin Service offering ensures a stable and recurring revenue

after the sale of Original Equipment.

Mpac is a people-driven business. It employs more than 500

colleagues around the world including 180 dedicated global

engineers & designers. The business is also underpinned by

innovation, as one of Mpac's key strategic pillars which remains

fundamental to the Company's long-term sustainable growth.

Mpac is headquartered in Tadcaster, UK and operates sites in the

US, Canada, the Netherlands and Singapore.

HALF-YEAR MANAGEMENT REPORT

Introduction

Mpac serves customers' needs for ingenious, innovative

automation and packaging machinery. We design, precision engineer,

manufacture and support high-speed automation and packaging

solutions, with embedded process monitoring systems.

The Group is focused on the high growth, resilient, Healthcare

and Food and Beverage markets and benefits from an exclusive

commercial framework agreement to supply a customer in the Clean

Energy storage market.

The opportunities for the Group are based on the following

fundamental strengths:

-- Robust long-term growth drivers in our target Healthcare and

Food and Beverage markets

-- Exciting opportunity to become a key supplier of automation

solutions for the Clean Energy storage market

-- Leadership in innovative, high-speed packaging machinery and automation solutions

-- Global reach with embedded local presence providing

exceptional service to our customers

-- A talented and engaged workforce

-- Extensive machine installed base to drive Service revenues

The Board believes that these fundamental strengths place Mpac

in a strong position for growth and that the Group continues to

make good progress towards achieving its long-term strategic

objectives.

Overview

2023 started with good revenue coverage from the opening order

book, but with a project mix impacted by 2022 supply chain

disruption. The effects of this have now largely cleared and

accordingly, second half trading is anticipated at normalising

margins, giving confidence to the second half earnings weighting

which we indicated earlier in the year.

Year to date order intake of GBP62.4m is significantly ahead of

the prior year (H1 2022: GBP32.8m) and the H1 2023 closing order

book of GBP77.5m is above the 2023 opening order book of GBP67.2m,

providing extensive coverage over forecast revenue for the

remainder of 2023. Furthermore, the focus on developing our

recurring, higher margin Service business continues with

significant growth in order intake and revenue.

The prior year expansion of working capital has begun to unwind

and is in line with expectations, and we closed the half year with

a strong balance sheet and positive net cash.

Beyond the challenging trading environment, the outlook for the

business remains positive. We carry forward a strong prospect

pipeline and order book, concentrated on companies in our core,

resilient, end markets of Healthcare and Food and Beverage. Our

strong balance sheet provides us with the ability to invest for

growth over the medium term and beyond.

FREYR progress

In 2022 Mpac signed a three-year exclusive commercial framework

agreement with FREYR, a developer of battery cell production

capacity, for the supply of casting and unit cell assembly

equipment. Mpac is completing the commissioning of the CQP line for

FREYR, which is progressing in line with the customer's planning

and expectations. We anticipate that the line will be fully

commissioned in H2 2023. In Q2 2023, we started work on the

pre-engineering activities for FREYR's first intended production

line order, Giga America, to define the specification and scoping.

If the customer proceeds to order production series cell assembly

units, Mpac is well positioned to be selected as the supplier of

these lines. There remains no certainty around the timing or

quantum of production line orders and Mpac remains focused on

delivering the projects within the order book.

Working capital reduction

Due to extended supplier lead times, resulting in longer build

times of Mpac equipment, there was a significant expansion of

working capital in 2022 which resulted in the Group drawing down

against its committed revolving credit facility and reporting net

debt at the 2022 year end. As anticipated, with the wider project

build portfolio from 2022 largely completing in H1 2023, working

capital has fallen in 2023 and we closed the half year with a net

cash position and a GBP7.3m reduction in working capital.

Strategic progress

Our focus in H1 2023 has been on our customers, deepening our

relationship with them to establish their longer term investment

plans and Service requirements. We have extended the bandwidth of

our commercial, field service and back-office teams to ensure that

Mpac continues to provide a long term sustainable, best in class,

service to all our customers and an improved response time. The

impact of this increased focus is already evident from the

increased order intake from both existing and new key accounts, and

improved Service performance in H1.

Continuing with our longer-term strategy to operate as a single

entity business, we have deployed our common business systems to

our site in Cleveland, USA to enhance operational leverage and we

have made considerable progress in developing a product selector

based customer website which will go live in Q3 2023.

Innovation remains one of Mpac's key strategic pillars and is

fundamental to the Group's long-term sustainable growth. We made

further progress in H1 2023 with the continued development of the

Mpac Cube, which incorporates innovations focused on improved

machine performance, digital enhancements plus further Industry 4.0

enabled technology. In addition, the next phase of product

development has been defined in an updated roadmap with deployment

commencing in H2 2023.

Financial results

The Group entered 2023 with a diverse and good quality order

book which, along with a strong H1 order intake resulted in sales

in the period of GBP52.8m (H1 2022: GBP50.6m), a 4% increase on

prior year. Gross profit margins increased to 23.9% (H1 2022:

21.1%), driven by a stronger product mix in the period. Order

intake in the period increased to GBP62.4m, 90% above the prior

year. We have a GBP77.5m order book going into the second half of

2023.

Underlying profit before tax was GBP1.9m (H1 2022: GBP1.1m).

After a net tax charge of GBP0.5m (H1 2022: GBP0.4m), underlying

profit after tax for the period was GBP1.4m (H1 2022: GBP0.7m).

Underlying earnings per share was 6.5p (H1 2022: 3.6p).

The underlying results are stated before pension-related credits

of GBP0.3m (H1 2022: charges of GBP0.4m), comprising charges in

respect of administering the Group's defined benefit pension

schemes of GBP0.4m (H1 2022: GBP0.7m) and finance income on pension

scheme balances of GBP0.7m (H1 2022: GBP0.3m), amortisation of

acquired intangible assets of GBP0.8m (H1 2022: GBP0.8m) and

reorganisation costs of GBP1.2m (H1 2022: GBP0.2m),

On a statutory basis, the loss after tax for the period was

GBP0.4m (H1 2022: GBP0.7m). The basic loss per share amounted to

2.2p (H1 2022: 3.6p).

Operating performance

Overall revenue increased by 4% to GBP52.8m (H1 2022: GBP50.6m)

supported by strong order intake and execution of projects.

The Group manages the business in two parts, Original Equipment

(OE) and Service, and across three regions (Americas, EMEA and Asia

Pacific). Individual contracts received by the OE business can be

sizeable. Accordingly, one significant order can have a

disproportionate impact on the growth rates seen in individual

markets year on year.

Original Equipment ("OE")

OE order intake increased by 131% to GBP46.0m (H1 2022:

GBP19.9m). Our customers in the Healthcare and Food & Beverages

markets continue to demonstrate resilient performance despite

rising interest rates, fuelling demand for Mpac's products.

Revenue decreased by 12% to GBP35.2m (H1 2022: GBP39.8m) with

the reduction being primarily in the Americas and driven by the

timing of the orders received last year as customers sought

acceleration of capital investment into 2021, supported by

post-covid tax incentives.

OE revenue in the Americas decreased by 34% to GBP16.4m (H1

2022: GBP25.0m) while in EMEA OE revenue increased by 12% to

GBP14.5m (2022: GBP12.9m). Growth in EMEA was primarily due to a

stronger performance across our traditional markets in healthcare

and food & beverage, supported by the continuing development of

the customer qualification battery cell assembly line for

FREYR.

Revenue development in all regions is dependent upon the timing

of customers' investment cycles, with differing industries and

regions experiencing differing effects from global inflationary

pressures.

Service

Service order intake of GBP16.4m represents a 25% increase on

the prior year and has been driven mainly by order intake for

upgrades and spares as a result of the Group's focus on developing

the Service business.

Service revenue grew strongly, up 63% to GBP17.6m (H1 2022:

GBP10.8m) as our customers look to increase their productivity by

enhancing their existing machines and reducing downtime. Service

revenue represented approximately 33% of Group revenue in the

period, which demonstrates the success of Mpac's 'Make Service a

Business' strategy.

Finances

Gross cash at 30 June 2023 was GBP8.1m (30 June 2022: GBP9.5m;

31 December 2022: GBP4.2m) after utilisation of the Revolving

Credit Facility of GBP5.0m (30 June 2022: GBPnil, 31 December 2022:

GBP8.0m). Cash balances are impacted by the timing of project order

intake and associated working capital cycles.

Net cash inflow from operating activities in the first half of

the year was GBP9.4m, after a decrease in working capital levels of

GBP7.3m, due mainly to the timing of project execution, partially

offset by deficit recovery payments to the Group's defined benefit

pension schemes of GBP0.9m. Capital and product development

expenditure in the first half of the year was GBP1.1m (2022:

GBP0.6m).

The Group maintains bank facilities appropriate to its expected

needs including committed borrowing facilities with HSBC UK Bank

Plc of GBP20.0m. These facilities, which are committed until July

2025, are subject to covenants covering interest cover and adjusted

leverage and are both sterling and multi-currency denominated.

Dividend

Having considered the trading results to 30 June 2023, together

with the opportunities for investment in the growth of the Group,

the Board has decided that it is appropriate not to pay an interim

dividend in respect of the period. No dividends were paid in 2022.

Future dividend payments and the development of a new dividend

policy will be considered by the Board in the context of the

trading performance for 2023 and when the Board believes it is

prudent to do so.

Pension schemes

The Group is responsible for defined benefit pension schemes in

the UK and the USA in which there are no active members. The

Company is responsible for the payment of a statutory levy to the

Pension Protection Fund.

The IAS 19 valuation of the UK scheme as at 30 June 2023 shows a

surplus of GBP35.2m (GBP22.9m net of deferred tax), compared with a

surplus of GBP31.5m (GBP20.4m net of deferred tax) at 31 December

2022. The main driver of the increase in the surplus was the

increase in the discount rate required by IAS19, partially offset

by the effect of the liability matching programme on asset values

when discount rates rise and by increases in anticipated inflation

on future benefits.

The net valuation of the USA pension schemes at 30 June 2023,

with total assets of GBP7.9m, showed a deficit of GBP1.6m, a

decrease of GBP0.5m from 31 December 2022, caused entirely by

exchange rate movements.

The aggregate expense of administering the pension schemes was

GBP0.4m (H1 2022: GBP0.7m). The net financing income on pension

scheme balances was GBP0.7m (H1 2022: GBP0.3m).

Acquisition strategy

The Board continues to evaluate potential acquisition

opportunities that strategically fit the Group, and which will

enhance our global presence in packaging solutions serving the

Healthcare and Food and Beverage markets. Good progress was made

during the period in developing the pipeline of potential

acquisition opportunities. The Company will provide updates on

acquisitions whenever appropriate to do so.

Outlook

Current trading is in line with the Board's expectations and

full year market guidance remains unchanged. Margins are

normalising as anticipated and with a strong order book and

prospects pipeline, Mpac is well positioned to deliver on the

previously announced H2 weighting to the financial year despite the

challenging trading environment.

We continue to be focused on executing our long-term strategy of

delivering OE and Service growth, broadening our customer base, and

delivering on our exciting new product development roadmap.

Our balance sheet remains healthy and provides us with the

ability to invest in the Group for growth. Accordingly, the Board

remains confident in the Group's longer-term prospects.

Adam Holland

Chief Executive

6 September 2023

CONDENSED CONSOLIDATED INCOME STATEMENT

6 months to 30 June 6 months to 30 June 2022

2023 (unaudited) (unaudited)

----------------------------------------- -----------------------------------------

Non-underlying Non-underlying

(note (note 5)

Underlying 5) Total Underlying GBPm Total

Note GBPm GBPm GBPm GBPm GBPm

Revenue 4 52.8 - 52.8 50.6 - 50.6

Cost of sales (40.2) - (40.2) (39.9) - (39.9)

------------ ---------------- --------- ------------ ---------------- ---------

Gross profit 12.6 - 12.6 10.7 - 10.7

Distribution expenses (3.6) - (3.6) (3.4) - (3.4)

Administrative

expenses (6.2) (2.4) (8.6) (5.8) (1.8) (7.6)

Other operating

expenses (0.6) - (0.5) (0.3) - (0.3)

------------ ---------------- --------- ------------ ---------------- ---------

Operating profit/(loss) 4, 5 2.2 (2.4) (0.2) 1.2 (1.8) (0.6)

Financial income - 0.7 0.7 - 0.3 0.3

Financial expenses (0.3) - (0.3) (0.1) - (0.1)

------------ ---------------- --------- ------------ ---------------- ---------

Net financing

income/(expense) (0.3) 0.7 0.4 (0.1) 0.3 0.2

------------ ---------------- --------- ------------ ---------------- ---------

Profit/(loss) 4 1.9 (1.7) 0.2 1.1 (1.5) (0.4)

before tax

(0.5)

Taxation (0.1) (0.6) (0.4) 0.1 (0.3)

------------ ---------------- --------- ------------ ---------------- ---------

Profit/(loss)

for the period 1.4 (1.8) (0.4) 0.7 (1.4) (0.7)

============ ================ ========= ============ ================ =========

Earnings/(loss) per ordinary share

Basic 7 (2.2p) (3.6p)

Diluted 7 (2.2p) (3.6p)

============ ================ ========= ============ ================ =========

CONDENSED CONSOLIDATED INCOME STATEMENT (CONTINUED)

12 months to 31 December

2022 (audited)

-------------------------------------------

Non-underlying

Underlying (note Total

Notes GBPm 5) GBPm

GBPm

Revenue 4 97.7 - 97.7

Cost of sales (73.3) - (73.3)

------------- ----------------- ---------

Gross profit 24.4 - 24.4

Distribution expenses (8.0) - (8.0)

Administrative expenses (11.9) (3.9) (15.8)

Other operating expenses (0.5) - (0.5)

------------- ----------------- ---------

4,

Operating profit 5 3.9 (3.9) -

Financial income - 0.6 0.6

Financial expenses (0.4) - (0.4)

------------- ----------------- ---------

Net financing expense (0.4) 0.6 0.2

------------- ----------------- ---------

Profit before tax 4 3.5 (3.3) 0.2

Taxation (0.8) 0.2 (0.6)

------------- ----------------- ---------

Profit / (Loss) for

the period 2.7 (3.1) (0.4)

============= ================= =========

Earnings / (Loss) per ordinary share

Basic 7 (2.0p)

Diluted 7 (2.0p)

--------------------------- -------- ------------- ----------------- ---------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2023 (unaudited) 2022 (unaudited) 2022 (audited)

GBPm GBPm GBPm

Loss for the period (0.4) (0.7) (0.4)

------------------- ------------------- -----------------

Other comprehensive income/(expense)

Items that will not be reclassified

to profit or loss 2.9 23.5 (5.0)

Actuarial gains/(losses)

(1.2) (8.4) 1.3

Tax on items that will not be reclassified

to profit or loss

------------------- ------------------- -----------------

1.7 15.1 (3.7)

------------------- ------------------- -----------------

Items that may be reclassified subsequently

to profit or loss

Currency translation movements arising (1.0) 1.2 2.1

on foreign currency net investments

0.5 (1.0) (1.0)

Effective portion of changes in fair

value of cash flow hedges 0.3 (0.1) (0.3)

Reclassified to income statement from

hedge reserve

------------------- ------------------- -----------------

(0.2) (0.1) 0.8

------------------- ------------------- -----------------

Other comprehensive income for the

period 1.5 15.2 (2.9)

------------------- ------------------- -----------------

Total comprehensive income for the

period 1.1 14.5 (3.3)

=================== =================== =================

All income for the period was derived from continuing

operations

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital

Share Share Translation redemption Hedging Retained Total

capital premium reserve reserve reserve earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

6 months to 30 June

2023

Balance at 1 January

2023 5.1 26.0 2.4 3.9 (1.8) 26.6 62.2

---------- ---------- -------------- ------------ ---------- ----------- ---------

Profit for the period

Other comprehensive - - - - - (0.4) (0.4)

(expense) / income

for the period - - (1.0) - 0.8 1.7 1.5

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total comprehensive

(expense) / income

for the period - - (1.0) - 0.8 1.3 1.1

---------- ---------- -------------- ------------ ---------- ----------- ---------

Equity-settled share-based - - - - - - -

transactions

Purchase of own shares - - - - - - -

Total transactions

with owners, recorded - - - - - - -

directly in equity

---------- ---------- -------------- ------------ ---------- ----------- ---------

Balance at 30 June

2023 5.1 26.0 1.4 3.9 (1.0) 27.9 63.3

========== ========== ============== ============ ========== =========== =========

6 months to 30 June

2022

Balance at 1 January

2022 5.0 26.0 0.3 3.9 (0.5) 30.7 65.4

---------- ---------- -------------- ------------ ---------- ----------- ---------

Profit for the period

Other comprehensive - - - - - (0.7) (0.7)

(expense) / income

for the period - - 1.2 - (1.1) 15.1 15.2

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total comprehensive

(expense) / income

for the period - - 1.2 - (1.1) 14.4 14.5

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total transactions

with owners, recorded

directly in equity - - - - - 0.2 0.2

---------- ---------- -------------- ------------ ---------- ----------- ---------

Balance at 30 June

2022 5.0 26.0 1.5 3.9 (1.6) 45.3 80.1

========== ========== ============== ============ ========== =========== =========

12 months to 31 December

2022

Balance at 1 January

2022 5.0 26.0 0.3 3.9 (0.5) 30.7 65.4

---------- ---------- -------------- ------------ ---------- ----------- ---------

Profit for the period

- - - - - (0.4) (0.4)

Other comprehensive

(expense) / income

for the period - - 2.1 - (1.3) (3.7) (2.9)

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total comprehensive

(expense) / income

for the period - - 2.1 - (1.3) (4.1) (3.3)

---------- ---------- -------------- ------------ ---------- ----------- ---------

Equity-settled share-based

transactions - - - - - 0.1 0.1

Purchase of own shares 0.1 - - - - (0.1) -

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total transactions

with owners, recorded

directly in equity 0.1 - - - - - 0.1

---------- ---------- -------------- ------------ ---------- ----------- ---------

Balance at 31 December

2022 5.1 26.0 2.4 3.9 (1.8) 26.6 62.2

========== ========== ============== ============ ========== =========== =========

CONDSENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 31 Dec

Note 2023 (unaudited) 2022 (audited)

GBPm GBPm

Non-current assets

Intangible assets 24.3 25.4

Property, plant and equipment 4.0 4.0

Investment property 0.8 0.8

Right of use assets 4.5 5.0

Employee benefits 6 35.2 31.5

Deferred tax assets 1.0 1.3

------------------ ----------------

69.8 68.0

------------------ ----------------

Current assets

Inventories 10.2 9.6

Trade and other receivables 44.0 47.3

Current tax assets 0.8 0.6

Cash and cash equivalents 8.1 4.2

------------------ ----------------

63.1 61.7

Current liabilities

Lease liabilities (1.3) (1.4)

Trade and other payables (43.6) (39.0)

Current tax liabilities (0.3) (0.1)

Provisions (1.0) (1.0)

Interest-bearing loans and borrowings (5.0) (8.0)

------------------ ----------------

(51.2) (49.5)

------------------ ----------------

Net current assets 11.9 12.2

------------------ ----------------

Total assets less current liabilities 81.7 80.2

------------------ ----------------

Non-current liabilities

Interest-bearing loans and borrowings (0.9) (0.9)

Employee benefits 6 (1.7) (2.1)

Deferred tax liabilities (12.4) (11.1)

Lease liabilities (3.4) (3.9)

------------------ ----------------

(18.4) (18.0)

------------------ ----------------

Net assets 63.3 62.2

================== ================

Equity

Issued capital 5.1 5.1

Share premium 26.0 26.0

Reserves 2.9 2.1

Retained earnings 29.3 29.0

------------------ ----------------

Total equity 63.3 62.2

================== ================

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

6 months 6 months 12 months

to 30 to 30 June to 31 Dec

June

2023 2022 2022

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Operating activities Operating loss

Non-underlying items included in operating

profit / (loss) (0.2) (0.6) -

Amortisation Depreciation Other non-cash 2.4 1.8 3.9

items Pension payments Working capital 0.3 0.3 0.9

movements: - increase in inventories 0.9 1.0 2.0

- decrease / (increase) in trade and - 0.4 0.2

other receivables - increase in contract (0.9) (1.1) (2.1)

assets - increase in trade and other

payables - increase / (decrease) in (0.8) (0.5) (2.2)

contract liabilities - increase/(decrease) 3.7 6.1 (6.3)

in provisions (0.6) (4.7) (5.9)

1.7 1.5 1.7

3.4 (7.6) (4.0)

(0.1) 0.1 0.5

--------------- -------------- ------------

Cash flows from continuing operations 9.8 (3.3) (12.8)

before reorganisation Acquisition

and reorganisation costs paid (0.4) - (0.8)

--------------- -------------- ------------

Cash flows from operations Taxation 9.4 (3.3) (13.6)

paid

(0.3) (0.2) (0.4)

--------------- -------------- ------------

Cash flows (used in) / from operating

activities 9.1 (3.5) (14.0)

--------------- -------------- ------------

Investing activities Proceeds from

sale of property, plant and equipment

Acquisition of property, plant and

equipment Capitalised development

expenditure Payment of deferred consideration

- 0.1 -

(0.5) (0.6) (1.4)

(0.6) (0.1) (1.0)

- - (0.8)

--------------- -------------- ------------

Cash flows from investing activities (1.1) (0.6) (3.2)

--------------- -------------- ------------

Financing activities Interest paid

Purchase of own shares (0.3) (0.1) (0.3)

Proceeds from borrowings - - (0.2)

Principal elements of lease payments (3.0) - 8.0

(0.4) (0.6) (1.1)

--------------- -------------- ------------

Cash flows from financing activities (3.7) (0.7) 6.6

--------------- -------------- ------------

Net increase/(decrease) in cash and 4.3 (4.8) (10.6)

cash equivalents

Cash and cash equivalents at 1 January 4.2 14.5 14.5

Effect of exchange rate fluctuations (0.4) (0.2) 0.3

on cash held

--------------- -------------- ------------

Cash and cash equivalents at period

end 8.1 9.5 4.2

=============== ============== ============

NOTES TO ANNOUNCEMENT

1. General information

The half-year results for the current and comparative period are

unaudited but have been reviewed by the auditors, PKF Littlejohn

LLP, and their report is set out after the notes. The comparative

information for the year ended 31 December 2022 does not constitute

statutory accounts as defined in section 434 of the Companies Act

2006. The Group's statutory accounts have been reported on by the

Group's auditor and delivered to the Registrar of Companies. The

report of the auditor was (i) unqualified, (ii) did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying its report, and (iii) did not

contain a statement under section 498(2) or (3) of the Companies

Act 2006. The Group's statutory accounts for the year ended 31

December 2022 are available from the Company's registered office at

Station Estate, Station Road, Tadcaster, North Yorkshire, LS24 9SG

or from the Group's website at www.mpac-group.com .

The Directors have considered the trading outlook of the Group

for an 18-month period ending 31 December 2024, its financial

position, including its cash resources and access to borrowings,

and its continuing obligations, including to its defined benefit

pension schemes. Having made appropriate enquiries, the Directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future.

For this reason, they continue to adopt the going concern basis in

preparing the condensed set of financial statements.

The condensed set of interim financial statements was approved

by the Board of directors on 6 September 2023.

2. Basis of preparation

(a) Statement of compliance

The condensed set of interim financial statements for the 6

months ended 30 June 2023 has been prepared in accordance with

UK-adopted international accounting standards, and in particular

IAS 34 Interim financial reporting. It does not include all the

information required for full annual financial statements and

should be read in conjunction with the financial statements of the

Group for the year ended 31 December 2022.

(b) Judgements and estimates

The preparation of the condensed set of interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

reported amounts of assets and liabilities, income and expense.

Actual results may differ from these estimates.

In preparing the condensed set of financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were of the same type as those that applied to the financial

statements for the year ended 31 December 2022.

Mpac is subject to a number of risks which could have a serious

impact on the performance of the business. The Board regularly

considers the principal risks that the Group faces and how to

mitigate their potential impact. The key risks to which the

business is exposed are set out on pages 17 to 21 of the Group's

2022 Annual Report and Accounts.

3. Significant accounting policies

The accounting policies, presentation and methods of computation

applied by the Group in this condensed set of interim financial

statements are the same as those applied in the Group's latest

audited financial statements. No new accounting standards have been

applied for the first time in these condensed interim financial

statements.

4. Operating segments

It is the Group's strategic intention to develop "One Mpac",

accordingly segmental reporting reflects the split of sales by both

Original Equipment (OE) and Service together with the regional

split, Americas, EMEA and Asia. The Group's operating segments

reflect the basis of the Group's management and internal reporting

structure.

Unallocated costs include distribution and administrative

expenditure. Further details in respect of the Group structure and

performance of the segments are set out in the half-year management

report.

6 months to 6 months to 30 12 months to 31

30 Jun 2023 Jun 2022 Dec 2022

OE Service Total OE Service Total OE Service Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------- -------- ------------- ------- -------- ---------- ------- -------- -----------

Revenue

Americas 16.1 8.3 24.4 25.0 5.1 30.1 40.9 11.9 52.8

EMEA 14.9 8.3 23.2 12.9 5.1 18.0 27.8 9.7 37.5

Asia Pacific 4.2 1.0 5.2 1.9 0.6 2.5 5.9 1.5 7.4

-------- -------- ------------- ------- -------- ---------- ------- -------- -----------

Total 35.2 17.6 52.8 39.8 10.8 50.6 74.6 23.1 97.7

======== ======== ============= ======= ======== ========== ======= ======== ===========

Gross profit 12.6 10.7 24.4

Selling,

distribution

& administration (10.4) (9.5) (20.5)

------------- ---------- -----------

Underlying 2.2 1.2 3.9

operating

profit

(2.4) (1.8) (3.9)

Unallocated

non-underlying

items included

in operating

profit

------------- ---------- -----------

Operating profit

Net financing (0.2) (0.6) -

income /

(expense) 0.4 0.2 0.2

------------- ---------- -----------

Profit before

tax 0.2 (0.4) 0.2

============= ========== ===========

5. Non-underlying items and alternative performance measures

Non-underlying items merit separate presentation in the

consolidated income statement to allow a better understanding of

the Group's financial performance, by facilitating comparisons with

prior periods and assessments of trends in financial performance.

Pension administration charges and interest, significant

reorganisation costs, acquisition or disposal costs, amortisation

of acquired intangible assets, profits or losses arising on

discontinued operations, significant impairments of tangible and

intangible assets and related taxation are considered

non-underlying items as they are not representative of the core

trading activities of the Group and are not included in the

underlying profit measure reviewed by key stakeholders.

The Group elects to include costs relating to the defined

benefit pension scheme in non-underlying as the costs would be

immaterial to the Group should the scheme not exist.

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2023 2022 2022

GBPm GBPm GBPm

Defined benefit pension scheme administration (0.4) (0.7) (1.1)

costs (note 6)

Reorganisation costs (1.2) (0.1) (0.6)

Amortisation of intangibles from business (0.8) (0.8) (1.6)

combinations

Acquisition costs - (0.2) (0.3)

Total non-underlying operating expenditure (2.4) (1.8) (3.6)

Net financing income on pension scheme

balances

0.7 0.3 0.3

-------------- -------------- -------------

Total non-underlying expense before

tax (1.7) (1.5) (3.3)

============== ============== =============

The Group uses alternative performance measures (APM's), in

addition to those reported under IFRS, as management believe these

measures enable the users of financial statements to better assess

the underlying trading performance of the business. The APM's used

include underlying operating profit, underlying profit before tax

and underlying earnings per share. These measures are calculated

using the relevant IFRS measure as adjusted for non-underlying

income/(expenditure) listed above.

6. Employee benefits

The Group accounts for pensions under IAS 19 Employee benefits.

The most recent formal valuation of the UK defined benefit pension

scheme (Fund) was completed as at 30 June 2021, which identified a

deficit of GBP28.4m. The deficit funding agreement focusses the

scheme on achieving risk transfer to an alternative arrangement

which the company would not be liable for the performance of. The

principal terms of the deficit funding agreement, which is

effective until 31 December 2035 and is subject to reassessment

every 3 years, are as follows:

-- the Company will continue to pay a sum of GBP2.0m per annum

to the Fund (increasing at 2.1% per annum) in deficit recovery

payments;

-- Once the funding level on a technical provisions basis

exceeds 103% (based upon an annual test), contributions will be

redirected to an escrow account which can only be used to either

enable risk transfer, remedy a deficit arising or be returned to

the Group should risk transfer be achieved without the funds being

required; and

-- Should the funding level (including the escrow account) reach

110% on a technical provisions basis (based upon an annual test),

contributions will cease.

Formal valuations of the USA defined benefit schemes were

carried out as at 1 January 2022, and their assumptions, updated to

reflect actual experience and conditions at 31 December 2022 and

modified as appropriate for the purposes of IAS 19, have been

applied in this set of financial statements.

Profit before tax includes charges in respect of the defined

benefit pension schemes' administration costs of GBP0.4m (2022:

GBP0.7m) and a net financing income on pension scheme balances of

GBP0.7m (2022: GBP0.3m). In respect of the UK scheme, the Group

paid deficit recovery contributions of GBP0.9m (2022: GBP1.0m).

Contributions to the US scheme totalled GBP0.1m (2022: GBP0.1m)

Employee benefits include the net pension asset of the UK

defined benefit pension scheme of GBP35.2m (2022: GBP59.7m) and the

net pension liability of the USA defined benefit pension schemes of

GBP1.0m (2022: GBP2.8m), all figures before tax.

Employee benefits as shown in the condensed consolidated

statement of financial position were:

30 June 31 Dec

2023 2022

GBPm GBPm

UK scheme

Fair value of assets 295.8 311.1

Present value of defined benefit obligations (260.6) (279.7)

---------- ---------

Defined benefit asset 35.2 31.5

---------- ---------

USA schemes

Fair value of assets 7.9 8.1

Present value of defined benefit obligations (9.5) (10.2)

---------- ---------

Defined benefit liability (1.6) (2.1)

---------- ---------

Total net defined benefit asset 33.6 29.4

========== =========

7. Earnings per share

Basic earnings per ordinary share is calculated by dividing the

profit or loss attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue during the

period excluding shares held by the employee trust in respect of

the Company's long-term incentive arrangements. For diluted

earnings per ordinary share, the weighted average number of shares

includes the diluting effect, if any, of own shares held by the

employee trust and the effect of the Company's long-term incentive

arrangements.

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2023 2022 2022

Basic - weighted average number of ordinary

shares 20,474,424 20,035,439 20,261,505

Diluting effect of shares held by the

employee trust - 261,568 41,304

Effect of shares conditionally granted

under the LTIP 94,849 - -

----------------------- ---------------------- ---------------------

Diluted - weighted average number of

ordinary shares 20,569,273 20,297,007 20,302,809

======================= ====================== =====================

Underlying earnings per share, which is calculated on the

earnings before non-underlying items, for the 6 months to 30 June

2023 amounted to 6.5p (6 months to 30 June 2022: 3.6p; 12 months to

31 December 2022: 13.3p).

In the 6 months to 30 June 2023 and 30 June 2022 the effect of

dilution was nil pence per share. The effect of the dilution at 31

December 2022 was nil pence per share.

8. Financial risk management

The Group's financial risk management objectives and policies

are consistent with those disclosed in the financial statements for

the year ended 31 December 2022.

The Group enters forward foreign exchange contracts solely for

the purpose of minimising currency exposures on sale and purchase

transactions. The Group has classified its forward foreign exchange

contracts used for hedging as cash flow hedges and states them at

fair value.

9. Related parties

The Group has related party relationships with its directors and

with the UK and USA defined benefit pension schemes. There has been

no material change in the nature of the related party transactions

described in note 31 of the 2022 Annual Report and Accounts.

10. Dividends

Having considered the trading results to 30 June 2023, together

with the opportunities for investment in the growth of the Company,

the Board has decided that it is appropriate not to pay an interim

dividend. No dividends were paid in 2022. Future dividend payments

and the development of a new dividend policy will be considered by

the Board in the context of 2023 trading performance and when the

Board believes it is prudent to do so.

11. Half-year report

A copy of this announcement will be made available to

shareholders from 7 September 2023 on the Group's website at

www.mpac-group.com . This announcement will not be made available

in printed form.

12. Future accounting policies

There are no changes anticipated to the Group's accounting

policies in the foreseeable future.

INDEPENDENT REVIEW REPORT TO MPAC GROUP PLC

Conclusion

We have been engaged by the group to review the condensed set of

financial statements in the half-yearly financial report for the

six months ended 30 June 2023 which comprise the Condensed

Consolidated Income Statement, the Condensed Consolidated Statement

of Changes in Equity, the Condensed Consolidated Statement of

Financial Position, the Condensed Consolidated Statement of Cash

Flows and related notes. We have read the other information

contained in the half-yearly financial report and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of

financial statements.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with UK adopted International Accounting Standard 34 and the AIM

Rules for Companies.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity", issued for use in the United Kingdom. A review of interim

financial information consists of making enquiries, primarily of

persons responsible for financial and accounting matters, and

applying analytical and other review procedures. A review is

substantially less in scope than an audit conducted in accordance

with International Standards on Auditing (UK) and consequently does

not enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 2a, the annual financial statements of the

group are prepared in accordance with UK adopted IASs. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with UK adopted

International Accounting Standard 34, "Interim Financial

Reporting".

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that management have inappropriately adopted

the going concern basis of accounting or that management have

identified material uncertainties relating to going concern that

are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the AIM Rules for

Companies.

In preparing the half-yearly financial report, the directors are

responsible for assessing the group's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the group or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the group a conclusion on the condensed set of

financial statements in the half-yearly financial report. Our

conclusion, including our Conclusions relating to going concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for conclusion paragraph of

this report.

Use of our report

This report is made solely to the company's directors, as a

body, in accordance with the terms of our engagement letter dated 8

August 2023. Our review has been undertaken so that we might state

to the company's directors those matters we have agreed to state to

them in a reviewer's report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume

responsibility to anyone, other than the company and the company's

directors as a body, for our work, for this report, or for the

conclusions we have formed.

PKF Littlejohn LLP 15 Westferry Circus

Statutory Auditor Canary Wharf

London E14 4HD

6(th) September 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UNARROAUKRUR

(END) Dow Jones Newswires

September 07, 2023 02:00 ET (06:00 GMT)

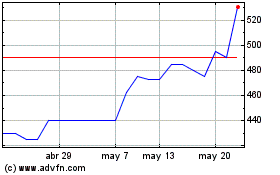

Mpac (LSE:MPAC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Mpac (LSE:MPAC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024