TIDMPALM

RNS Number : 5354U

Panther Metals PLC

02 August 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA, THE REPUBLIC OF IRELAND, NEW ZEALAND OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN PANTHER METALS PLC OR ANY OTHER

ENTITY IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI

2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

FOR IMMEDIATE RELEASE

PANTHER METALS PLC

("Panther" or the "Company")

(Incorporated in the Isle of Man with company number

009753V)

2 August 2022

Conditional Placing to raise GBP1,148,000

Panther Metals plc (LSE:PALM) the company focused on mineral

exploration in Canada, announces the completion of conditional

placing, confirming it has placed 22,960,000 ordinary shares of no

par value (the "Placing Shares") at a price of 5.5 pence per

Placing Share (the "Placing Price") in a placing (the "Placing"),

raising gross proceeds of GBP1,148,000. The Placing is subject to

the publication of a prospectus and applications have been made to

the Financial Conduct Authority for admission of the Placing Shares

to the standard listing segment of the Official List and to the

London Stock Exchange (the "LSE") for admission to trading of the

Placing Shares on the LSE's Main Market for listed securities

(together "Admission"). It is expected that the prospectus will be

published on 15 August 2022 and Admission will take place at 8.00

a.m. on 17 August 2022, with dealings in the Placing Shares on the

LSE's Main Market for listed securities also commence at 8.00 a.m.

on 17 August 2022.

Each Placing Share will be issued with one warrant attached

entitling the holder to subscribe for one new ordinary share at a

price of 8.5 pence (the "Warrants"). The Warrants have a life of 36

months from the date of Admission and are subject to an accelerator

so that in the event that the Company's shares trade at a volume

weighted average price of 20 pence or more for five of more trading

days (the "Accelerator Target") the Company is obligated to give

notice to holders of the Warrants that any outstanding Warrants

must be exercised within 14 calendar days' and on 14 calendar days'

settlement terms. If the Accelerator Target is achieved, any

Warrants not so exercised will lapse.

The Placing Shares being issued will represent approximately

24.35% of the Company's enlarged Ordinary Share capital following

the Placing.

The Placing Price represents a 12% discount to the mid-market

closing price of the Company's shares on 1 August 2022, the date of

the arrangement of the Placing.

SI Capital Limited acted as sole placing agent in respect of the

Placing.

When issued, the Placing Shares will be credited as fully paid

and will rank pari passu in all respects with the existing Ordinary

Shares in the share capital of the Company, including the right to

receive all dividends and other distributions declared, made, or

paid on or in respect of such shares after the date of issue of the

Placing Shares.

The Company will seek convene a general meeting shortly to seek

new authorities to allot shares generally (given that the Placing

utilises the authorities taken at the last annual general meeting

in full) and for specific authority to allot a further 1,920,000

shares pursuant to the exercise of the Warrants to be issued in

connection with the Placing.

Use of the Placing Proceeds

The net Placing proceeds will primarily be used to fund

exploration drilling work in Canada with the primary focus on

diamond drilling (up to 3,000m total planned) at the Obonga Project

where current permits allow diamond drilling over five separate

high prospective multi-commodity targets.

The forthcoming Obonga Project 2022 Diamond Drilling Programme

will include the following permitted drilling targets:

Wishbone Prospect - 6 drillholes (up to 1,200m total) planned.

Targeting base metals. Drilling will follow-up on the successful

discovery of volcanogenic massive sulphide ("VMS") mineralisation

by the two hole diamond drilling campaign in the autumn of 2021 The

2021 drill hole intercepts included 27.3m of massive sulphide in

hole 1 and 51m of sulphide-dominated mineralisation in hole 2;

Awkward Prospect - 3 drillholes (up to 600m total) planned.

Targeting platinum group element ("PGE") and nickel mineralisation.

Awkward is a highly anomalous coincident magnetic and

electromagnetic ("EM") geophysics target interpreted to be a

layered mafic intrusion and magmatic conduit based on EM

plate-modelling commissioned by Panther. Historic sampling has

confirmed the presence of anomalous platinum and palladium values,

while historic drilling on the periphery of the target has

confirmed massive sulphide mineralisation hosted in coarse gabbro

and "marble cake' gabbro matching the description of the

varitexture gabbro ore zone at the Impala Lac des Iles PGE

mine;

Survey Prospect - 3 drillholes (up to 600m total) planned.

Survey is an anomalous magnetic and EM target adjacent to contact

between intrusive mafic rocks and extrusive mafic rocks. One

historic drill hole, despite only reaching a depth of 23.5m,

intersected several meters of massive sulphides in multiple

intersections, of which the main parts were not tested;

Ottertooth Prospect - 2 drillholes (up to 400m total) planned.

Targeting VMS style mineralisation including copper, lead, zinc,

silver and gold. Ottertooth is an anomalous magnetic and EM target

adjacent to the contact between intrusive mafic rocks and extrusive

mafic rocks and sharing distinctive geological similarities to the

Survey Prospect. Unlike the Survey Prospect, Ottertooth is entirely

untested historically or by the Company; and

Silver Rim Prospect - 1 hole (up to 200m) planned. Targeting

intrusion hosted nickel, copper and precious metals. Silver Rim is

an anomalous magnetic and EM geophysics target. Anomalous lithium

has been identified in lake sediment at the target, while silver

has been identified through soil sampling. No historic drilling has

been conducted and the area remains otherwise untested.

In addition to the planned diamond drilling at Obonga the

Placing proceeds will also be used to advance gold focussed

exploration work at the Dotted Lake Project and the Manitou Lakes

Project and in support of the Company's working capital

requirements.

Total Voting Rights

Following Admission, the Company's total issued share capital

consists of 94,301,339 Ordinary Shares. The Company does not hold

any Ordinary Shares in treasury.

Therefore, following Admission, the total number of voting

rights in Panther Metals plc is 94,301,339. This figure may be used

by shareholders as the denominator for the calculations by which

they will determine if they are required to notify their interest

in, or a change in their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules.

Darren Hazelwood, Chief Executive Officer, commented:

"In a challenging market explorers must face tough choices; at

Panther Metals we have studiously built the business during a time

of unprecedented upheaval. We now sit at a pivot point with

multiple permitted drill-ready targets, any one of which could

transform the Company and propel us onto the next level.

In committing to this financing, the Board was left with three

options: raise to "keep the lights on"; raise to drill a single

target that would likely see us quickly returning to the Market; or

raise to embark on one of the most audacious, cost effective,

discovery drilling campaigns ever conducted by a Canada-focussed

London listed junior. We chose the latter.

Dilutive events are an inevitability of investing in the

exploration sector and this raise is undoubtedly a painful one for

all our existing shareholders. However, this financing also

provides the greatest opportunity to transform Panther Metals.

We are embarking on a campaign that will see us drill fifteen

holes at five separate targets on the Obonga Greenstone Belt from

late summer into autumn, including at Wishbone, following our

discovery of a VMS system last autumn. Our targets are prospective

for Copper, Nickel, Platinum group metals, Lithium, Gold and

Silver.

Fully funded to conduct our campaign we enter the most exciting

period in our history and I look forward to updating the market as

we progress over the coming months."

For further information please contact:

Panther Metals PLC:

Darren Hazelwood, Chief Executive Officer: +44(0) 1462 429

743

+44(0) 7971 957 685

Mitchell Smith, Chief Operating Officer: +1(604) 209 6678

Broker:

SI Capital Limited

Nick Emerson +44(0) 1438 416 500

The person who arranged for the release of this announcement was

Darren Hazelwood, CEO of the Company.

Notes to Editors

Panther Metals PLC is an exploration company listed on the main

market of the London Stock Exchange. Panther is focussed on the

discovery of commercially viable mineral deposits. The Company's

operational focus is on established mining jurisdictions with the

capacity for project scalability. Drill targets are assessed

rapidly utilising a combination of advanced technologies and

extensive geological data to decipher potential commercial

viability and act accordingly. Panther's current geological

portfolio comprises of three highly prospective properties in

Ontario, Canada while the developing investment wing focuses on the

targeting of nickel and gold in Australia.

Obonga Project

Panther acquired the Obonga Greenstone Belt in July 2021 and

have already identified four prospective primary targets: Wishbone,

Awkward, Survey and Ottertooth. A successful Phase 1 drilling

campaign at Wishbone in Autumn 2021 revealed the presence of

significant VMS-style mineralised systems on the property - the

first such discovery across the entire greenstone belt. Intercepts

include 27.3m of massive sulphide in hole one, and 51m of

sulphide-dominated mineralisation in hole two. Both drill holes

contained multiple lenses. Anomalous high-grade copper in lake

sediment close to the target area has also been identified,

increasing confidence in the prospectivity of the location.

Awkward is a highly anomalous magnetic target, interpreted to be

a layered mafic intrusion and magmatic conduit based on mapped

geology and airborne geophysics. Historic sampling in the area

returned anomalous platinum and palladium (Pt, Pd) values, while

historic drilling on the periphery of the target intersected

non-assayed massive sulphide and copper (assumed to be

chalcopyrite), non-assayed disseminated pyrite and chalcopyrite in

coarse gabbro, and non-assayed 'marble cake' gabbro (matching the

description of the Lac des Iles Mine varitexture gabbro ore

zone).

Two additional named targets, Survey and Ottertooth, both

displays further coincident magnetic and electromagnetic anomalies

and are adjacent to the contact between intrusive and extrusive

mafic rocks. Historic drilling at Survey intersected several meters

of massive sulphides in multiple intersections (main parts of the

anomaly remain untested) while Ottertooth remains untested in its

entirety.

Dotted Lake Project

Panther acquired the Dotted Lake Project in July 2020, it is

situated approximately 16km from Barrick Gold's renowned Hemlo Gold

Mine. An extensive soil programme conducted in 2021 identified

numerous gold and base metal targets, all within the same

geological footprint. Following the installation of a new trail

providing direct access to the target location, an initial drilling

programme in Autumn 2021 confirmed the presence of gold

mineralisation within this system with anomalous gold continuing

along strike and present within the surrounding area.

Big Bear Project

The acquisition of various prospects in 2018 and 2019

consolidated previously fragmented areas into the wider Big Bear

umbrella project, priming Panther for extensive and comprehensive

exploration in the area. A total of 253 geophysical anomalies have

been identified, with 39 designated for priority investigation.

Gold in soil anomalies in have been identified in five areas,

ranging up to 0.71g/t, extending up to 250m wide and open along

strike. Gold bearing quartz veins have been outlined within seven

separate areas (two with rock and vein samples grading 1 to 5 g/t

Au, four with quartz vein sample assays above 5g/t Au, and two

quartz samples collected at 50m separation on an E-W trending vein

open in both directions returning 105.5g/t Au and 112g/t Au

respectively).

The Little Bear Lake and Schreiber prospects are of particular

interest to the company: historic work programmes in 2010 and 2011

targeted an intense magnetic response from both. Assays yielded

from the 1.6km long gold trend included 6m at 1.5g/t Au, up to

53.7g/t Au and 19.25 g/t Ag in rock chip and 18.2g/t Au and 1.03g/t

Ag in soil. Historical bulk sampling reported 150t averaging

17.6g/t Au, while historical drill intersections include 0.55m at

19.2% Zn and 4.6% Cu from 15.2m depth.

Panther Metals Australia

Following the listing of Panther Metals' Australian assets on

the Australian Securities Exchange ("ASX") in December 2021, the

valuation of the Company's 36.6% holding in the business has risen

by over 30% to a valuation of almost GBP3m. The ASX listing has

provided the Australian projects with the necessary capital to

advance drill-ready targets focused on nickel and gold (within the

Tier 1 Mining Districts of Laverton WA and in the NT). Through this

spin-out Panther holds an attractive investment prospect, without

any disruption to the Company's capital structure and without any

financial obligations.

Conclusion

Panther understand that the commercial realities of building an

exploration company requires expertise in geology, finance, and the

markets within which they operate. The Company's extensive network

of industry leaders allows it to meet these objectives. Ultimately

however, drilling success is the only route to discovery: the

fundamental objective of any exploration company. Once Panther's

world-class geological team identify the anomalies, they work hard

to get drilling. The drill hole is the only place where substantial

and sustained capital growth originates and it's with that

operational focus Panther will continue to advance.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFZGGRZMFGZZZ

(END) Dow Jones Newswires

August 02, 2022 02:00 ET (06:00 GMT)

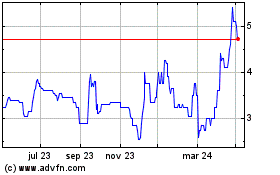

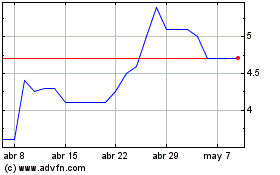

Panther Metals (LSE:PALM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Panther Metals (LSE:PALM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024