TIDMPALM

RNS Number : 7197A

Panther Metals PLC

27 September 2022

Panther Metals Plc

Half Yearly Financial Report

For the six months ended 30 June 2022

Operational Highlights

Key operational milestones achieved during the six-month period

to 30 June 2022.

Canada

-- On 18 January 2022 the Company announced the discovery of a

volcanogenic massive sulphide ("VMS") mineral system on the Obonga

Project. This was a very significant development for Panther.

-- On 24 January 2022 the Company announced drill core assay

results from the diamond drill hole PD-DL21-01 at the 100% owned

Dotted Lake property in the Hemlo region, of Ontario. Subsequent

assay results show widely dispersed gold mineralisation to 172m

downhole depth, with subsequent assay results extending this gold

dispersal down to 391m.

-- On 22 March 2022 the Company announced the acquisition of

thirteen single cell mining claims to provide coverage for the

interpreted eastward strike extension side of the Awkward intrusive

conduit target at the Awkward Prospect the Obonga greenstone belt.

The Awkward Prospect is an upcoming drill target for Panther.

-- On 7 April 2022 the Company announced the signing of a sale

agreement (the "Agreement") for the transfer of 128 mining claims

("Claims"), constituting the Company's Big Bear Project ("Big

Bear") located on the Schreiber-Hemlo Greenstone Belt. Under the

terms of the agreement the Company's Canadian subsidiary Panther

Metals (Canada) Limited has agreed to transfer the Claims and

associated information to Fulcrum Metals (Canada) Ltd., the

Canadian subsidiary of Fulcrum Metals Limited ("Fulcrum") an Irish

registered company which is seeking an initial public offering

("IPO") on the AIM Market of the London Stock Exchange Group

PLC.

o As consideration for the sale upon Fulcrum IPO Panther will be

issued with; 20% of the entire issued share capital in Fulcrum as

Consideration Shares; a payment of GBP200,000 and the grant of a 2%

net smelter return ("NSR") royalty. The Agreement is conditional

upon, inter alia, Fulcrum being admitted to trading on the AIM

Market of the London Stock Exchange Group PLC. The longstop date of

the Agreement completion is 31 October 2022 which was subsequently

extended to 30 November 2022. If completion does not occur before

the longstop date Panther will be due a payment of 50,000 Euro from

Fulcrum.

o The sale will supplement Panther's Dotted Lake property

through indirect exposure to early-stage gold and base metal

exploration over a further four properties on the Schreiber-Hemlo

Greenstone Belt; with an additional two properties on the

Dayohessarah Lake Greenstone and the Michipicoten Greenstone Belt;

whilst diversifying commodity exposure through Fulcrum's two

uranium exploration properties in the vicinity of the Athabasca

Basin in Saskatchewan1.

-- On 7 April 2022 the Company announced that it had entered

into an option and sale and purchase agreement with Shear Gold

Exploration Corporation ("Shear Gold") to purchase a substantial

claim holding (the "Shear Gold Project" or "Project") including the

West Limb and Glass Reef gold properties, on the Eagle - Manitou

Lakes Greenstone Belt (the "Shear Gold Agreement").The Shear Gold

Project covers a total area of approximately 98km(2) and is located

within the gold endowed Kenora Mining District, approximately 300km

east of Thunder Bay and equidistant between the towns of Fort

Frances and Dryden in north-western Ontario, Canada. The terms of

the Shear Gold Agreement are set out below.

o A cash consideration of $11,325 Canadian dollars ("CAD$") has

been paid to Shear Gold Exploration Corporation in order to secure

the option and sale and purchase agreement.

o Panther has committed to a minimum spend commitment of

CAD$325,000 to be expended over years one and two; and a further

CAD$400,000 to be expended between the second and fourth annual

anniversaries of the Agreement. Any excess spend in years one and

two can be offset against expenditure in years three and four.

o Grant to Shear Gold a NSR royalty of 2% over the 32 multicell

mining claims (the "Shear Claims") covered in the Shear Gold

Agreement. Panther can elect to purchase 50% of the NSR (reducing

the remaining royalty to 1%) for the sum CAD$1M at any time.

o Panther Metals PLC can elect at any time to purchase the Shear

Claims outright through a payment of CAD$250,000 to Shear Gold.

-- On 21 April 2022 the Company announced the receipt of four

Exploration Permits for the Big Bear Project ("Big Bear") located

in the townships of Priske and Strey on the Schreiber-Hemlo

Greenstone Belt in northern Ontario. The Temporary Hold which had

been in place over Exploration Permit Applications had been lifted

allowing the permits to be awarded. The Exploration Permits allow

activities including diamond drilling, trenching, stripping, ground

geophysics, trail cutting, and exploration camp set-up and are

effective for a period of three years to 13 April 2025.

-- On 26 April 2022 the Company announced it had submitted an

Exploration Permit Application (PR-22-000116) for an additional

three drill prospects at the Company's Obonga Project located on

the Obonga Greenstone Belt in northern Ontario. The application

submitted in collaboration with Broken Rock Resources Ltd ("Broken

Rock") concerns planned work within 45 Single Cell Mining Claims

("Claims") in the Puddy Lake administrative area. The grant of

Exploration Permit PR-22-000116 was announced, post period on 21

July 2022, permitted activities include diamond core drilling of up

to 10 holes and associated down-hole electromagnetic geophysics

surveys spread across three named prospects: Silver Rim; Ottertooth

and Survey, which are respectively located in the north,

centre-east and centre-west of the Obonga Project area. The three

prospects are targeting VMS base metal mineralisation and intrusion

related nickel in association with compelling, coincident,

geophysical anomalies and historical work results.

Australia

-- On 28 February 2022, the Company announced, with Panther

Metals Limited ("Panther Australia"), the first drilling results of

a planned 6,000m reverse circulation ("RC") infill drilling

programme for the Coglia Nickel-Cobalt Project located

approximately 60km southeast of the town of Laverton in Western

Australia. The initial results from the first five RC drill holes

on the project included high-grade nickel and cobalt intercepts in

all holes. A new zone of mineralisation was discovered outside the

previous Exploration Target and additional drill holes were added

to the programme to test extensions to the new mineralised zone.

Further assay results for drill holes CGRC005 to CGRC005020 and

CGRC 031 to CGRC040 were announced 23 March 2022, with the final

and highest-grade batch of Coglia results announced 12 May

2022.

-- On 3 May 2022, the Company announced the completion of the

Panther Australia 38 hole, 2,500m, RC drilling programme at the

Eight Foot Well Gold Prospect and the drill rig was moving to the

Burtville East Gold Prospect. The completion of the Burtville East

Gold Project drilling programme was subsequently announced 12 May

2022, and post period, on 14 July 2022 the Company announced

Panther Australia had published the Burtville East assay results

which included a shallow high grade gold zone composite intercept

of 15m @ 53.94g/t Au from 27m downhole in RC drillhole BVE006.

-- On 12 May 2022, the Company announced the final batch of

assay results from the Coglia drill programme, these included: 19m

at 1.19% Ni from 60m, including 8m at 2.10% Ni from 63m, with a new

highest peak intercept of 1m at 3.97% Ni from 64m, and 5m at

2,592ppm Co from 62m, including 2m at 5,105ppm Co from 64m, with an

extraordinary new highest peak of 1m at 7,900ppm Co from 64m (hole

CGRC054); and 24m at 0.92% Ni from 56m, including 1m at 1.20% Ni

from 62m, and 24m at 646ppm Co, including 7m at 1,260ppm Co from

59m, with a peak of 1m at 3,090ppm Co from 69m (hole CGRC041).

-- On 27 June 2022, following the completion of the 61-hole RC

infill drill programme Panther Australia published a JORC Code

(2012) compliant Inferred Mineral Resource estimate ("MRE") (Table

1) and revised Exploration Target (Table 2) for the Coglia

Nickel-Cobalt project. The MRE and revised Exploration Target was

based on the 2022 RC drilling results and on historical drilling

conducted between 2001-2003 and in 2018.

Table 1: Coglia Nickel-Cobalt Inferred Mineral Resource Estimate

at a 0.5% Nickel Grade Cut-Off (#)

0.5% Ni cut-off Tonnes Ni % Co ppm Ni tonnes Co tonnes

Domain North 25,800,000 0.7 360 186,000 9,300

------------- ------ -------- ---------- ----------

Domain South 44,800,000 0.6 510 290,000 22,900

------------- ------ -------- ---------- ----------

Total Inferred

Resources 70,600,000 0.7 460 476,000 32,200

------------- ------ -------- ---------- ----------

(#) See Panther Australia ASX announcement of 27 June 2022

Table 1 for further details. Some errors may occur due to

rounding.

Table 2: New Coglia Nickel-Cobalt Southern JORC Code (2012)

Exploration Target*

Tonnage Range Grade Range Grade Range

Nickel % Cobalt ppm

34,000,000 - 62,000,000 0.40 - 0.65 400 - 600

---------------- ----------------

* The potential quantity and grade of an Exploration Target

is conceptual in nature. There has been insufficient exploration

to estimate a Mineral Resource and there is no certainty

that further exploration work will result in the determination

of Mineral Resources.

Corporate and Financial Highlights

-- The start of 2022 has witnessed several corporate actions by

the Company as the business positions itself to exploit the

remarkable team and network it has developed. Panther now moves

into a period of development that will see a major upturn in work

across its entire portfolio of assets.

-- On 7 March 2022, the Company announced the placing of

4,500,000 ordinary shares raising gross proceeds of approximately

GBP360,000. Admission of the shares took place on 10 March

2022.

-- On 8 March 2022, the Company announced that it has received

notice of exercise of a total of 265,242 warrants with an exercise

price of 6p per share, raising GBP15,915 for the Company. Admission

of the shares took place on 11 March 2022.

-- On 29 April 2022, the Company published the audited Results

for the Year Ended 31 December 2021. A copy of the 2021 Annual

Report was submitted to the National Storage Mechanism and is

available to the public for inspection at:

ttps://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

-- The Annual General Meeting ("AGM") of the Company was held on

9 June 2022, at which all resolutions were duly passed.

-- Panther Metals Limited commenced trading on the Australian

Securities Exchange ('ASX') on 10 December 2021 following the

completion of its oversubscribed $5m IPO, which capitalised it at

$10.9m. Since listing the share price of Panther Metals Limited has

risen by 19% (as at 31 August 2022). The ASX listing has provided

the Australian projects with the necessary capital to advance

drill-ready targets focused on nickel and gold (within the Tier 1

Mining Districts of Laverton WA and in the NT).Panther Metals

Limited Annual Report for the year ended 31 December 2021 and post

year end trading updates are available on its website at

https://www.panthermetals.com.au

-- Post the six-monthly financials, on 18 August 2022, the

Company announced the Placing and admission of 20,872,726 ordinary

shares at a price of 5.5 pence, raising gross proceeds of

GBP1,148,000 .

Nicholas O'Reilly, Chairman, commented:

The first half of 2022 has been an exciting time for Panther.

Following the work and travel restrictions in Canada and Australia

imposed in response to the COVID-19 pandemic a busy last half of

2021 with two drill programmes and the initial public offering

("IPO") on the ASX of Panther's Australian interests culminated in

a great start to 2022.

With assay results coming in from the two Canadian diamond

drilling programmes at the Wishbone Prospect on the Obonga Project

and Dotted Lake Property in early January 2022, the year started

with much data analysis and interpretation work.

In a very significant development for the Company, these results

confirmed the discovery of a volcanogenic massive sulphide ("VMS")

mineral system at Wishbone. Importantly it is well known that VMS

type deposits typically occur in clusters, and a geological

analysis of the drill programme data in collaboration with academic

VMS specialists, confirmed the western part of the Obonga

Greenstone belt as a very favourable geological environmental, and

permissive tract, for the development of further volcanic

associated mineralising systems. Our partner Broken Rock presented

the results from Wishbone at the important Prospectors and

Developers Association of Canada ("PDAC") conference in Toronto,

generating significant interest from mining industry

practitioners.

Also, at Obonga, planning work for drilling the Awkward nickel

intrusive conduit prospect to the east of Wishbone saw Panther

agree the acquisition of the claims covering the eastward anomaly

in March. With five prospects now permitted for drilling at Obonga

Panther is confident of exciting times ahead.

Like Wishbone, the drill core assay results from Dotted Lake

also proved a significant development for Panther. The initial

objective of the drilling the single 402m deep diamond drill hole

was to understand the stratigraphy linked to the airborne

geophysics survey and trench sample anomalies. With the core assay

results delineating a total five gold intersections above 1g/t Au

and gold mineralisation widely dispersed between 47m and 391m, this

hole is considered very encouraging for follow-up investigation

especially given the structural setting and highly anomalous soil

survey results immediately along strike.

On 7 April the Company announced the signing of a sale agreement

for the transfer of the Big Bear Project ("Big Bear") to Fulcrum

Metals Ltd who are seeking an IPO on London's AIM Market. Upon

successful listing this deal should see Panther hold a 20% share in

Fulcrum together with cash and a royalty and will give Panther

exposure to a further 6 gold exploration properties and two uranium

exploration projects. In a balancing transaction, Panther entered

into an option and sale and purchase agreement with Shear Gold

Exploration Corporation to purchase a substantial claim holding

comprising the Manitou Lakes Project upon the Eagle - Manitou Lakes

Greenstone Belt in the gold endowed Kenora Mining District,

approximately 300km east of Thunder Bay in Ontario. This

underexplored region contains a number of historic gold mines and

has been yielding significant discoveries for neighbouring

explores.

In Australia, the successful listing of Panther Metals Limited

("Panther Australia") on the ASX in December 2021, allowed the

planned 6,000m reverse circulation drilling programme to commence

at their Coglia Nickel-Cobalt Project in Western Australia. Assay

results received from the 61 holes through February, March and May

culminated in Panther Australia publishing a JORC Code (2012)

compliant Inferred Mineral Resource estimate ("MRE") of 70.6Mt @

0.7% Ni & 460ppm Co, for 476kt Ni and 32.2kt Co and an

additional revised Exploration Target on 27 June 2022. Drilling in

Australia also targeted gold with programmes Eight Foot Well Gold

Prospect and the Burtville East Gold Prospect competed to plan

during the period. Panther maintains a 36.61% holding in Panther

Australia.

The progress of the Company during the period has been

tremendous and with the successful completion of our fund raise,

post-period on 18 August, Panther are fully funded to continue to

drive through the exciting planned workstreams ahead.

I would like to take this opportunity thank and congratulate our

teams and partners in Canada and Australia for their hard work and

results and to state that we very much look forward to continuing

together.

Operational Review

Canada

The ongoing COVID-19 pandemic and related restrictions on travel

into Ontario continued to impact on exploration staffing,

permitting and logistics across the sector. However, with a growing

local network of contractors, Panther was able to progress work

across the Canadian properties.

Big Bear Gold Project

Overview

The acquisition of various prospects in 2018 and 2019

consolidated previously fragmented areas into the wider Big Bear

umbrella project, priming Panther Metals for extensive and

comprehensive exploration in the area. A total of 253 geophysical

anomalies have been identified, with 39 designated for priority

investigation. Gold in soil anomalies have been identified in five

areas, ranging up to 0.71g/t Au, extending up to 250m wide and open

along strike. Gold bearing quartz veins have been outlined within

seven separate areas (two with rock and vein samples grading 1g/t

to 5 g/t Au, four with quartz vein sample assays above 5g/t Au, and

two quartz samples collected at 50m separation on an east-west

trending vein open in both directions returning 105.5g/t Au and

112g/t Au respectively).

The Little Bear Lake and Schreiber prospects are of particular

interest to the Company: historic work programmes in 2010 and 2011

targeted an intense magnetic response from both. Assays yielded

from the 1.6km long gold trend included 6m at 1.5g/t Au, up to

53.7g/t Au and 19.25 g/t Ag in rock chip and 18.2g/t Au and 1.03g/t

Ag in soil. Historical bulk sampling reported 150t averaging

17.6g/t Au, while historical drill intersections include 0.55m at

19.2% Zn and 4.6% Cu from 15.2m depth.

Work conducted in 2022

No fieldwork was undertaken at Big Bear during the first half of

2022. Due to the winter snow cover and the Exploration Permit

Applications being put on Temporary Hold by the issuing

authorities, only desk based technical work was conducted. The

Temporary Hold order had been in place since the last two of

Exploration Permit Applications were lodged in May 2021, this order

was lifted in April and all four Exploration Permits Applications

were subsequently awarded (PR-21-000140, Big Duck Creek Project,

PR-20-000052 Big Bear North Project, PR-20-000054 Big Bear West

Project, and PR-20-000055 Big Bear East Project), as announced 21

April 2022.

The Exploration Permits allow activities including diamond

drilling, trenching, stripping, ground geophysics, trail cutting,

and exploration camp and are effective for a period of three years

to 13 April 2025 as summarised in .

Table 3: Permitted Activities for Big Bear Project Exploration

Permits Awarded April 2022

Exploration Project Name (claim Expiry Permitted Activities

Permit Number numbers included) Date

PR-21-000140 Big Duck Creek Project 13 April

2025 * Mechanised Drilling (up to 19 diamond core drill

( 546085, 566379) holes),

northern Big Bear

Project * Line Cutting (8,000m),

* Ground Geophysics (Electromagnetics ("EM"), Induced

Polarisation ("IP"), Resistivity) up to 15 line/km,

* Pitting and Trenching (up to 24 pits/trenches).

* Exploration camp for up to 10 persons.

----------------------- --------- -----------------------------------------------------------

PR-20-000052 Big Bear Project 13 April

- North 2025 * Mechanised Drilling (up to 5 diamond core drill

holes),

(546085, 566379,

571638)

* Mechanised stripping (125m(2) )

* Line Cutting (2,000m),

* Ground Geophysics ( IP),

* Pitting and Trenching (up to 5 pits/trenches).

* Exploration camp for up to 6 persons.

----------------------- --------- -----------------------------------------------------------

PR-20-000054 Big Bear Project 13 April

- West 2025 * Mechanised Drilling (up to 10 diamond core drill

holes),

(140258, 141544,

145842, 146218,

174809, 174810, * Mechanised stripping (500m(2) )

174811, 192267,

192268, 241122,

277831, 277832, * Line Cutting (10,000m),

288061, 308268,

315504, 327866,

336359, 554099, * Ground Geophysics (IP),

554100, 556514,

557198, 563083,

566293) * Pitting and Trenching (up to 15 pits/trenches).

* Exploration camp for up to 6 persons.

----------------------- --------- -----------------------------------------------------------

PR-20-000055 Big Bear Project 13 April

- East 2025 * Mechanised Drilling (up to 5 diamond core drill

holes),

(565926, 566292,

566390, 566391,

566392, 571621, * Mechanised stripping (200m(2) )

571637)

* Line Cutting (10,000m),

* Ground Geophysics ( IP),

* Pitting and Trenching (up to 10 pits/trenches).

* Exploration camp for up to 6 persons.

----------------------- --------- -----------------------------------------------------------

On 7 April 2022 the Company announced the signing of a sale

agreement (the "Agreement") for the transfer of 128 mining claims

("Claims") constituting the Big Bear Project. Under the terms of

the agreement the Company's Canadian subsidiary Panther Metals

(Canada) Limited has agreed to transfer the Claims and associated

information to Fulcrum Metals (Canada) Ltd., the Canadian

subsidiary of Fulcrum Metals Limited ("Fulcrum") an Irish

registered company which is seeking an initial public offering

("IPO") on the AIM Market of the London Stock Exchange Group

PLC.

As consideration for the sale upon Fulcrum IPO Panther will be

issued with; 20% of the entire issued share capital in Fulcrum as

Consideration Shares; a payment of GBP200,000 and the grant of a 2%

net smelter return ("NSR") royalty. The Agreement is conditional

upon, inter alia, Fulcrum being admitted to trading on the AIM

Market of the London Stock Exchange Group PLC. The longstop date of

the Agreement completion is 31 October 2022, which was subsequently

extended to 30 November 2022 . If completion does not occur before

the longstop date Panther will be due a payment of 50,000 Euro from

Fulcrum.

The sale will supplement Panther's Dotted Lake property through

indirect exposure to early-stage gold and base metal exploration

over a further four properties on the Schreiber-Hemlo Greenstone

Belt; with an additional two properties on the Dayohessarah Lake

Greenstone and the Michipicoten Greenstone Belt; whilst

diversifying commodity exposure through Fulcrum's two uranium

exploration properties in the vicinity of the Athabasca Basin in

Saskatchewan.

Dotted Lake Project

Overview

Panther Metals acquired the Dotted Lake Project in July 2020, it

is situated approximately 16km from Barrick Gold's renowned Hemlo

Gold Mine. An extensive soil programme conducted in 2021 identified

numerous gold and base metal targets, all within the same

geological footprint as Hemlo. Following the reopening of a

historical trail providing direct access to the target location, an

initial drilling programme, consisting a single 402m deep hole

drilled in Autumn 2021 confirmed the presence of gold

mineralisation within this system with anomalous gold continuing

along strike and present within the surrounding area. The initial

objective of this drill hole was to build an understanding of the

stratigraphy linked to the Company's airborne geophysics survey and

trench sample anomalies, finding gold mineralisation widely

dispersed in this hole was considered very encouraging, given the

context of the wider prospective Hemlo region.

Work conducted in 2022

The first batch of encouraging assay results for the first 174m

of core from the Dotted Lake drill hole were announced on 24(th)

January 2022; showing in total eight separate intervals of gold

mineralisation, with four separate gold bearing intervals above

1.0g/t Au intersected between 47m and 158m down hole depth:

o Four sample intervals > 1g/t Au:

0.9m @ 1.73 g/t Au from 47.3m

1m @ 1.05 g/t Au from 122.2m

1m @ 1.59 g/t Au from 136.2m

1m @ 1.04 g/t Au from 158.2m

o Eight Intersections >0.57g/t Au, including two 2m wide

composites:

2m @ 0.87 g/t Au from 122.2m ( inc. 1m @ 1.05 g/t Au from

122.2m)

2m @ 0.96 g/t Au from 158.2m ( inc. 1m @ 1.04 g/t Au from

158.2m)

The remaining assay results were received during May 2022, a

single intersection of 1.1m @ 1.4 g/t Au from 228.3m (inc. 0.5m @

2.57 g/t Au from 228.3m) was noted, in addition to seven discrete

low level (0.11g/t Au to 0.31g/t Au) 1m wide gold intersections

between 200m to 391m downhole depth.

Preliminary analysis of the drill assay results points to an

orogenic gold signature with a strong correlation between zones of

shearing or strong foliation, alteration and sulphide bearing

quartz veinlets. Disseminated sulphides are also noted. Importantly

the results of the drilling tie in well with structures interpreted

from Panther's geophysics survey and with the highly anomalous

results of the soil geochemical survey to the west of the drill

collar.

Obonga Project

Panther Metals acquired the Obonga Greenstone Belt project in

July 2021 and have already identified four prospective primary

targets: Wishbone, Awkward, Survey and Ottertooth. A successful

Phase 1 drilling campaign at Wishbone in Autumn 2021 revealed the

presence of significant volcanogenic massive sulphide ("VMS") style

mineralised systems on the property - the first such discovery

across the entire greenstone belt. Intercepts include 27.3m of

massive sulphide in hole one, and 51m of sulphide-dominated

mineralisation in hole two. Both drill holes contained multiple

lenses. Anomalous high-grade copper in lake sediment close to the

target area has also been identified, increasing confidence in the

prospectivity of the location.

Awkward is a highly anomalous magnetic target, interpreted to be

a layered mafic intrusion and magmatic conduit based on mapped

geology and airborne geophysics. Historic sampling in the area

returned anomalous platinum and palladium (Pt, Pd) values, while

historic drilling on the periphery of the target intersected

non-assayed massive sulphide and copper (assumed to be

chalcopyrite), non-assayed disseminated pyrite and chalcopyrite in

coarse gabbro, and non-assayed 'marble cake' gabbro (matching the

description of the Lac des Iles Mine varitexture gabbro ore

zone).

Two additional named targets, Survey and Ottertooth, both

displays further coincident magnetic and electromagnetic anomalies

and are adjacent to the contact between intrusive and extrusive

mafic rocks. Historic drilling at Survey intersected several meters

of massive sulphides in multiple intersections (main parts of the

anomaly remain untested) while Ottertooth remains untested in its

entirety.

Work conducted in 2022

The highly successful Wishbone drilling results and the

discovery of a VMS mineral system summarised below were announced

on 18 January 2022.

Wishbone Phase 1 Technical Summary

Wishbone Phase 1 Drilling Programme results, with the discovery

of the first VMS system on the Obonga Greenstone Belt, show proof

of concept and validation of the exploration targeting and

modelling undertaken by Broken Rock Resources Ltd ("Broken Rock"),

Panther's exploration partner at Wishbone.

Two diamond core drill holes, totalling 600m, completed to

planned depths of

BBR21_WB_001 ("WB001"): 297m; BBR21_WB_002 ("WB002"): 303m. Core

diameter: 42mm.

Wide massive sulphide and semi-massive sulphide mineralisation

intersections in both drill holes:

o WB001: Three wide sulphide intersections:

-- 27.3m of massive sulphide from 106.2m ('Upper layer'), with fault at base;

-- 2.5m of massive sulphide from 234.8m ('Mid layer'; and

-- 1.4m of massive sulphide from 256.6m ('Lower layer')

o WB002: Wide zoned sulphide intersection:

-- 51m from 174m comprising a wide zone of sulphide dominated mineralisation, including:

--17m from 180m of massive sulphide ('Upper zone') and

--7m from 218m of semi-massive sulphide ('Lower zone')

An important characteristic of VMS deposits is that they

typically display a zonation of metals within the massive sulphide

body from Fe+Cu at the base to Zn+Fe+/-Pb+/-Ba at the top and

margins, related to differing temperature and chemical conditions

at mineral deposition. The major observed mineral component2 of the

Wishbone massive sulphide mineralisation is pyrrhotite with less

common pyrite and minor sphalerite and chalcopyrite in distinct

zones:

o WB001:

-- Upper layer: MS intersection includes a 7.5m wide zone of Fe

above/ close to 50% Fe upper detection limit, with pyrrhotite,

pyrite and magnetite identified in the core logging.

-- Mid layer: Strongest zinc (sphalerite) intersection averages

0.5m @ 1.9% Zn (based on verification sampling) within a 1.5m @

1.1% Zn with 3.1g/t Ag from 235.5m.

-- Lower layer: geochemical correlation to the Mid layer with lower Zn & Ag.

o WB002:

-- Upper zone: displays 10x relative enrichment in Ag (1g/t)

over the Lower zone and similar mineralogical composition to

WB001.

Work is ongoing to follow-up the Phase 1 programme results in

combination with geophysical, structural and geological datasets to

determine next steps to specifically target the potential for

economic base metal zonation within and close to Wishbone.

The Wishbone assay result suite, including rare earth element

(REE) analyses, yields important geochemical information allowing

the classification of the mineralisation, alteration ratios and the

development of exploration vectors towards zones of potential

economic interest.

o Alteration and REE ratio markers in both drill holes correlate

well with established VMS exploration models.

o Zn+Pb and Cu ratios of the Wishbone massive sulphide layers

indicate the mineralisation is most likely a bi-modal type VMS

deposit. The deposits of the Sturgeon Lake/Mattabi VMS Camp

(consisting of 6 historic VMS mines) 75km west of Wishbone, has

been classified as a bimodal type deposits as have Canada's Kidd

Creek (Ontario) and Noranda (Quebec) VMS deposits.

Another important characteristic of VMS type deposits is that

they typically occur in clusters. The Company views that the

discovery of the Wishbone VMS system bodes very well for the

existence of further, as yet undiscovered VMS bodies in the

vicinity, as it confirms the western part of the Obonga Greenstone

belt as a favourable geological environmental, and permissive

tract, for the development of volcanic associated mineralising

systems.

Panther have retained the support of a post-doctoral academic

from a Canadian VMS centre of excellence and are working towards

forging university relationships which will see the Company

leverage all available knowledge and expertise to open up the

Obonga greenstone belt for further VMS exploration.

On 26 April 2022 the Company announced it had submitted an

Exploration Permit Application (PR-22-000116) for an additional

three drill prospects at the Company's Obonga Project located on

the Obonga Greenstone Belt in northern Ontario. The application

submitted in collaboration with Broken Rock concerns planned work

within 45 Single Cell Mining Claims in the Puddy Lake

administrative area. The subsequent grant of Exploration Permit

PR-22-000116 was announced, post period on 21 July 2022, permitted

activities include diamond core drilling of up to 10 holes and

associated down-hole electromagnetic geophysics surveys spread

across three named prospects: Silver Rim; Ottertooth and Survey,

which are respectively located in the north, centre-east and

centre-west of the Obonga Project area. The three prospects are

targeting VMS base metal mineralisation and intrusion related

nickel in association with compelling, coincident, geophysical

anomalies and historical work results. Further diamond core

drilling at Obonga is expected to commence during the second half

2022.

Manitou Lakes Project

On 7 April 2022, the Company announced that it had entered into

an option and sale and purchase agreement with Shear Gold

Exploration Corporation ("Shear Gold") to purchase a substantial

claim holding (the "Shear Gold Project") including the West Limb

and Glass Reef gold properties, on the Eagle - Manitou Lakes

Greenstone Belt. The Shear Gold Project covers a total area of

approximately 98km (2) and is located within the gold endowed

Kenora Mining District, approximately 300km east of Thunder Bay and

equidistant between the towns of Fort Frances and Dryden in

north-western Ontario, Canada. The terms of the Agreement include a

cash consideration of CAD$11,325 has been paid to Shear Gold

Exploration Corporation in order to secure the option and sale and

purchase agreement, under which Panther Metals has committed to a

minimum spend commitment of CAD$325,000 to be expended over years

one and two and a further CAD$400,000 to be expended between the

second and fourth annual anniversaries of the sale and purchase

agreement. Any excess spend in years one and two can be offset

against expenditure in years three and four; A NSR royalty of 2%

over the 32 multicell mining claims is granted to Shear Gold;

Panther Metals can elect to purchase 50% of the NSR (reducing the

remaining royalty to 1%) for the sum CAD$1M at any time; and

Panther Metals can elect at any time to purchase the 32 multicell

mining claims outright through a payment of CAD$250,000 to Shear

Gold.

The Manitou Lakes Project consists of three prospect areas:

Glass Reef , West Limb and Catwill.

-- Glass Reef

o 720ha

o Hosts the historic Glass Reef Gold Mine.

o Favourable structure and bedrock geology.

o Positive results from 2012 sampling programme.

-- West Limb

o 5km+ strike length on multiple gold bearing structures.

o 2000+ha of unexplored ground.

o Historic exploration focused on high grade visible gold,

ignoring low-grade mineralized wall rock.

o New mineralisation model proposed - Felsic intrusive related

in addition to shear zone hosted.

o Three current mineralisation styles: 1) gold bearing shear

zone hosted quartz veins; 2) auriferous shear zones; and 3)

Auriferous semi-massive sulphides infilling fissures.

-- Catwill

o Newly staked ground

o No exploration undertaken over claim area despite the presence

of gold anomalies

o Exploration work expected to begin in summer 2022.

Financial Review

The Group has reported an unaudited loss for the six months

ended 30 June 2022 of GBP65,793 (six months ended 30 June 2021 -

loss GBP97,599). The basic and diluted loss per share for the

period was 0.09p (six months ended 30 June 2021 - loss 0.17p).

The key performance indicators are set out below:

At At At

30-Jun-22 30-Jun-21 31-Dec-21

(unaudited) (unaudited) (audited)

GBP GBP GBP

Net asset value 2,631,492 1,728,043 2,411,075

The Directors are required to provide an Interim Management

Report in accordance with the Financial Conduct Authorities ("FCA")

Disclosure Guidance and Transparency Rules ("DTR"). The Directors

consider the Operational and Financial Review on pages 1 to 11 of

this Half Yearly Financial Report provides details of the important

events which have occurred during the period and their impact on

the financial statements as well as the outlook for the Company for

the remaining six months of the year ended 31 December 2022.

The following statement of the Principal Risks and

Uncertainties, the Related Party Transactions, the Statement of

Directors' Responsibilities and the Operational and Financial

Review constitute the Interim Management Report of the Company for

the six months ended 30 June 2022.

Principal Risks and Uncertainties

The principal risks and uncertainties of the Company are

detailed on page 22 of the Company's most recent Annual Report for

the year ended 31 December 2021 which can be found on the Company's

website at www.panthermetals.co.uk. The principal risks and

uncertainties facing the Company remain unchanged from those

disclosed in the Annual Report for the year ended 31 December 2021

and the Board are of the opinion that they will continue to remain

unchanged for the forthcoming six-month period.

The principal risks and uncertainties facing the Company are as

follows:

-- Adverse foreign exchange fluctuations;

-- If the Group is unable to raise additional capital when

needed or on suitable terms it could force a delay, reduce or

eliminate its exploration development and production plans and

efforts; and

-- There are significant risks associated with any discovery and

the ability of the Company to then generate any operational

cashflows.

The Board has also reviewed emerging risks which may impact the

forthcoming six-month period and the main risk facing the Company

is the ongoing impact of the COVID-19 pandemic.

Related Party Transactions

There have been no material changes to the related party

transactions described in the Annual Report that could influence

the financial position or performance of the Company.

Going Concern

As at 30 June 2022 the Group had total cash reserves of

GBP71,517 (31 December 2021: GBP100,586). The directors are aware

of the reliance on fundraising within the next 12 months and having

reviewed the Group's working capital forecasts they believe the

Group is well placed to manage its business risks successfully

providing future fundraisings are successful. The interim financial

statements have been prepared on a going concern basis and do not

include adjustments that would result if the Group was unable to

continue in operation. The Company successfully raised GBP1.148m

through the placing and admission of its shares to the Main Market

of the London Stock Exchange in August 2022. As a junior

exploration company, the Directors are aware that the Company must

go to the marketplace to raise significant funds in the next 12

months to meet its investment and exploration plans and to maintain

its listing status.

For and on behalf of the Board of Directors

Darren Hazelwood

Chief Executive Officer

27 September 2022

The Directors confirm to the best of their knowledge:

-- The interim financial statements have been prepared in

accordance with International Accounting Standard 34, Interim

Financial Reporting, as adopted by the EU;

-- Give a true and fair view of the assets and liabilities,

financial position and the loss of the Group

-- The interim report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

interim financial information, and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

-- The interim financial information includes a fair review of

the information required by DTR 4.2.8R of the Disclosure and

Transparency Rules, being information required on related party

transactions.

For and on behalf of the Board of Directors

Darren Hazelwood

Chief Executive Officer

27 September 2022

Notes Period

ended Period ended

30 June 30 June

2022 2021

GBP GBP

Unaudited Unaudited

Revenue - -

Cost of sales - -

Gross profit - -

Administrative expenses (264,337) (222,629)

Share-based payment charge 6 89,705 134,164

Operating loss (174,632) (88,465)

Finance income - -

Loss before taxation (174,632) (88,465)

Taxation - -

Loss for the period (174,632) (88,465)

Other comprehensive income

Translation of foreign currency transactions 107,245 (9,094)

Gain on retained investment in Panther Australia 1,594 -

Total comprehensive loss for the period (65,793) (97,559)

Loss attributable to:

Equity holders of the company: (65,793) (97,559)

(65,793) (97,559)

Basic and diluted loss per share (pence) 3(0.09)p (0.17)p

As at As at As at

30 June 30 June 31 December

Notes 2022 2021 2021

GBP GBP GBP

Unaudited Unaudited Audited

Non-current assets

Goodwill - 553,656 -

Exploration and evaluation

assets 1,631,359 913,254 1,334,994

Investments 2 1,166,942 - 1,165,347

Total non-current assets 2,798,301 1,466,910 2,500,341

Current assets

Receivables 67,741 73,931 72,758

Cash at bank and in hand 71,517 275,021 100,586

Total current assets 139,258 348,952 173,344

Total assets 2,937,559 1,815,862 2,673,685

Current liabilities

Trade and other payables (95,049) (87,819) (60,592)

Net current assets 44,209 261,133 112,752

Non-current liabilities

Provision for deferred

consideration (211,018) - (202,018)

Total liabilities (306,067) (87,819) (262,610)

Net assets 2,631,492 1,728,043 2,411,075

Capital and reserves

Called up share capital 5 5,163,780 4,053,396 4,781,917

Equity attributable to

the parent 2 - 142,536 -

Share-based payment reserve 6 214,610 164,292 310,263

Retained losses (2,746,898) (2,652,395) (2,681,105)

Total equity attributable

to equity shareholders 2,631,492 1,707,829 2,411,075

Non-controlling interest 2 - 20,214 -

Total equity 2,631,492 1,728,043 2,411,075

As at As at As at

30 June 30 June 31 December

Notes 2022 2021 2021

GBP GBP GBP

Unaudited Unaudited Audited

Cash flows from operating

activities

Loss for the financial

year (65,793) (97,559) (126,269)

Adjusted for:

Interest received - - -

Foreign exchange (107,245) 9,094 (41,786)

Share-based payment charge (89,705) (134,164) 15,224

(Increase)/decrease in

receivables 5,017 (1,860) 21,164

(Decrease)/increase in

payables 35,161 (19,603) (74,024)

Net gain on change in ownership

of Panther Metals Limited (1,594) - (514,528)

Non cash costs of Panther

Metals Ltd - - 163,474

Net cash (used in)/generated

from operating activities (224,159) (244,092) (556,745)

Investing activities

Cash spent on exploration

activities (180,825) (176,687) (523,863)

Net cash generated from

investing activities (180,825) (176,687) (523,863)

Financing activities

Proceeds from issuing shares 5 360,000 200,000 830,000

Proceeds from exercising

warrants 5 15,915 79,100 110,000

Proceeds from shares issued

by subsidiary 2 - 165,506 -

Proceeds received in advance - 10,000 -

Net cash generated from

financing activities 375,915 454,606 940,000

Net increase in cash and

cash equivalents (29,069) 33,827 (140,608)

Cash and cash equivalents

at beginning of period 100,586 241,194 241,194

Cash and cash equivalents

at end of period 71,517 275,021 100,586

Group

Share

Share based payment Retained

Notes capital reserve losses Total

GBP GBP GBP GBP

Balance at 1 January 2021 3,675,421 397,331 (2,554,836) 1,517,916

Loss for the year - - (126,269) (126,269)

Total comprehensive loss

for the year - - (126,269) (126,269)

Transactions with owners

of the company

Shares issued 5 830,000 - - 830,000

Shares issued to acquire

exploration and evaluation

assets 5 31,191 - - 31,191

861,191 - - 861,191

Other transactions

Placing warrants issued 5 - 143,978 - 143,978

Shares issued upon exercise

of warrants 5 245,305 (166,139) - 79,166

Options issued/charged 6 - 48,668 - 48,668

Forfeited options 6 - (113,575) - (113,575)

Balance at 31 December

2021 4,781,917 310,263 (2,681,105) 2,411,075

Balance at 1 January 2022 4,781,917 310,263 (2,681,105) 2,411,075

Loss for the year - - (65,793) (65,793)

Total comprehensive loss

for the year - - (65,793) (65,793)

Transactions with owners

of the company

Shares issued 5 360,000 - - 360,000

360,000 - - 360,000

Other transactions

Shares issued upon exercise

of warrants 5 21,863 (6,819) - 15,044

Options issued/charged 6 - 21,697 - 21,697

Forfeited options 6 - (110,531) - (110,531)

Balance at 30 June 2022 5,163,780 214,610 (2,746,898) 2,631,492

1 Accounting policies

1.1. Half-yearly report

This interim financial information for the six months ended 30

June 2022 and 30 June 2021 is unaudited and does not constitute

statutory financial statements within the meaning of the Companies

Act 1982 (Isle of Man). The Board of Directors approved it on 27

September 2022.

The figures for the year ended 31 December 2021 have been

extracted from the statutory financial statements which have been

prepared in accordance with International Financial Reporting

Standards, as adopted by the European Union, ("IFRS") and which

have been reported on by the company's auditor. The auditor's

report on those financial statements was unqualified.

The condensed interim financial statements have not been

reviewed by the Company's auditors.

1.2. Basis of accounting

The condensed interim financial information has been prepared in

accordance with the requirements of IAS 34 "Interim Financial

Reporting".

The interim financial information does not include all notes of

the type normally included in the annual financial report and

therefore cannot be expected to provide as full an understanding of

the financial performance, financial position and financing and

investing activities of the group as the full financial report.

The financial information has been prepared on the historical

cost basis. The accounting policies and methods of computation

adopted in the Company's preparation of the condensed interim

financial information are consistent with those adopted and

disclosed in the financial statements for the year ended 31

December 2021 and those expected to be used for the year ending 31

December 2022.

The Company will report again in full for the year ending 31

December 2022.

1.3. Accounting policies

The accounting policies are unchanged from those used in the

last published annual financial statements for the year ended 31

December 2021.

2. Investments

On 10(th) December 2021, the Company announced that Panther

Metals Limited has successfully listed on the Australian Securities

Exchange raising AUD$5,000,000, thus diluting Panther Metals PLC to

a holding of 36.6%.

As this constituted a loss of control, Panther Australia was

consolidated to 10 December 2021, the disposal of the subsidiary

was then accounted for and then the investment in a company in

which Panther Metals PLC has significant influence has been

accounted for under the equity method of IAS 28 Investments in

Associates and Joint Ventures. The goodwill on acquisition of

GBP553,656 was fully derecognised as part of the disposal

calculation in the year ended 31 December 2021.

As at 30 June 2022 the market value of Panther Metals Limited

with reference to its Australian Securities Exchange registration

amounted to AUD$12.94m or GBP7.34m. The summarised financial

information of Panther Metals Limited as at 30 June 2022, its

interim reporting date, is as follows:

AUD$

Aggregated Assets 5,909,430

Aggregated Liabilities (288,848)

Total net assets 5,620,582

, Revenues -

Loss for the period 379,468

There are no significant restrictions on the ability of

associates to transfer funds to Panther Metals PLC in the form of

cash dividends in the case they are declared.

3. Loss per share

The basic loss per share for the interim period to 30 June 2022

is 0.09p (2021: - 0.17p) and has been calculated by dividing the

loss for the period by the weighted average number of ordinary

shares in issue of 68,346,112 (2021: 58,792,331).

Shares issued in the period to 30 June 2022 are detailed in note

5.

There are 4,600,000 potentially issuable shares which relate to

share options issued to Directors and management under option (see

note 6) and warrants issued as part of various placings totalling

78,696,112 (2021: 73,289,000). Due to the losses for the period the

diluted loss per share is anti-dilutive and therefore has been kept

the same as the basic loss per share of 0.09p per share.

4. Provision for Deferred Consideration

As at As at As at

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Current Liabilities

payable within 1 year

Amount due to Broken

Rock 18,055 - 17,285

Amount due to Aki Siltamaki 6,018 - 5,762

24,073 - 23,047

Non-Current Liabilities

Amounts due to Broken

Rock 199,119 - 190,626

Amount due to Aki Siltamaki 11,899 - 11,392

211,018 - 202,018

On 2 August 2021, the Company announced the acquisition of 1,128

claims, constituting an almost exclusive exploration holding over

the Obonga Greenstone Belt located approximately 80km north of the

Lac Des Iles Mine and 160km north of Thunder Bay in the Province of

Ontario Canada. The acquisition of claims, consolidating Panther

Canada's new Obonga Project, results from an agreement with Broken

Rock Resources Ltd and Panther's own claim staking strategy which

provides the Company with control of an important mineral belt with

identified and permitted high prospectivity drill-ready base and

precious metal targets. The acquisition agreement for the 80 claims

held by Broken Rock Resources Ltd, together with associated

exploration data and permits, entails Panther delivering combined

cash and stock consideration together with a right to an additional

deferred consideration and a net smelter return ("NSR") royalty. In

addition, as part of the agreement, Panther has made an exploration

commitment which will be directed towards drilling and associated

exploration works and will designate the 1,084 claims it has staked

directly into the Obonga Project.

Consideration for the Broken Rock transaction consisted of

CAD$50,000 in cash, 228,925 Panther shares credited as fully paid,

the right to receive deferred consideration comprising four

tranches of CAD$30,000 in cash each payable within 30 days of the

annual anniversary of the acquisition agreement, followed by a

final payment of CAD$250,000 in cash payable within 30 days of the

fifth anniversary of the date of the acquisition agreement and 1.5%

NSR royalty (which has provision for Panther to reduce the royalty

to 1.0% NSR through a CAD$3,000,000 buy-back). As part of the

transaction Panther also awarded 500,000 share options with an

exercise price of 13p per share and a life of five years.

In November 2021 the Company agreed a deal with Aki Siltamaki to

take an option on four further properties on the Obonga greenstone

belt to supplement its landholding in the area. The headline

consideration was CAD$30,000.00 upfront and an ongoing payment of

CAD $10,000.00 per year for the three consecutive years of the

agreement and the final payment of CAD $200,000. The final payment

is contingent on success in the ground.

The change in deferred consideration from the position at 31

December 2021 relates to the foreign exchange difference on

conversion of the Canadian dollar balances to sterling at 30 June

2022.

5. Share capital

Number of

new Ordinary Share

shares Capital

No GBP

Allotted, issued and fully paid:

As at 1 January 2021 57,862,419 3,675,421

Share issue on 23 April 2021 1,666,666 200,000

Share issue upon exercising Subscription

warrants 17 May 1,318,331 177,975

Share issue upon exercising Subscription

warrants 9 July 333,334 44,167

Share issue upon exercising Subscription

warrants 29 July 181,667 23,163

Shares issued as consideration for

Obonga transaction 228,925 31,191

Share issue on 22 September 2021 5,250,000 630,000

As at 31 December 2021 66,841,342 4,781,917

As at 1 January 2022 66,841,342 4,781,917

Placing on 7 March 2022 4,500,000 360,000

Shares issued upon exercising Subscription

warrants 265,242 21,863

As at 30 June 2022 71,606,584 5,163,780

On 21 April 2021, the Company announced the completion of a

private placing for a total of 1,666,666 ordinary shares at a price

of 12p raising a total of GBP200,000. The admission of those shares

took place on 23 April 2021.

On 17 May 2021, the Company announced that it has received

notice of exercise of a total of 1,318,331 warrants with an

exercise price of 6p per share, raising GBP79,100 for the Company.

The admission of those shares took place on 20 May 2021.

On 9 July 2021, the Company announced that it has received

notice of exercise of a total of 333,334 warrants with an exercise

price of 6p per share, raising GBP20,000 for the Company. The

admission of those shares took place on 14 July 2021.

On 29 July 2021, the Company announced that it has received

notice of exercise of a total of 181,667 warrants with an exercise

price of 6p per share, raising GBP10,900 for the Company. The

admission of those shares took place on 3 August 2021.

On 2 August 2021, the Company announced the acquisition of 1,128

claims over the Obonga Greenstone Belt located approximately 80km

north of the Lac Des Iles Mine and 160km north of Thunder Bay in

the Province of Ontario Canada. Part of the consideration for the

transaction was 228,925 Panther shares credited as fully paid. The

admission of those shares took place on 5 August 2021.

5 Share capital (continued)

On 22 September 2021 the Company announced completion of a

capital raise for a total of 5,250,000 ordinary shares of no par

value (the "Placing Shares"), raising GBP630,000 before expenses,

at a price of 12p per Placing Share. Each Placing Share will be

issued with a one-for-one warrant attached. The warrants have an

exercise price of 18p and a 24-month life. The warrants are subject

to an accelerator, shortening the exercise period, if the volume

weighted average price of the Company's shares exceeds 30p for five

consecutive trading days. The admission of those shares took place

on 29 September 2021.

O n 7 March 2022, the Company raised GBP360,000 through a

placing of 4,500,000 Ordinary Shares at a price of 8p per share.

The admission of those shares took place on 10 March 2022.

On 8 March 2022, 265,242 Ordinary Shares were issued upon the

exercise of 265,242 warrants at a price of 6p per share. The

admission of those shares took place on 11 March 2022.

6. Share based payment transactions

Equity settled share based payments

Options issued, cancelled and outstanding at 30 June 2022

At 1 At Weighted

January 30 June average

2022 2022 exercise

No of No of price

options Issued Forfeited Exercised options (pence)

Bookrunner

Warrants 265,000 - (265,000) - -

Placing Warrants-

Jan 20 13,716,666 - (13,716,666)- - - -

Obonga options 500,000 - - 500,000 0.13

Management

options 4,600,000 4,600,000 0.15

Placing Warrants-

Sept 2021 5,250,000 - - 5,250,000 0.18

24,331,666 - (13,716,666) (265,000) 10,350,000 0.64

On 20 December 2021 the Company announced the extension of the

expiry date of the 6p Bookrunner Warrants and the 12p Placing

Warrants from 8 January 2022 to 8 March 2022.

On 8 March 2022, the Company announced that it has received

notice of exercise of a total of 265,000 warrants with an exercise

price of 6p per share, raising GBP15,915 for the Company. Admission

of the shares took place on 11 March 2022.

On 8 March 2022 the Company had not received notice of exercise

of any of the January 2020 Placing Warrants and therefore these

13,716,666 warrants expired at this date and were forfeited.

6 Share based payment transactions (continued)

Options and warrants outstanding and exercisable at the interim

period end

No of Exercise Weighted

options, price (p) average

vested contractual

and exercisable life Expiry date

(years)

Obonga options 500,000 13 4.09 2 August 2026

Management options 4,600,000 15 4.15 22 August 2026

Placing Warrants-

Sept 2021 5,250,000 18 2.23 22 September 2024

A Black-Scholes model has been used to determine the fair value

of the share options and warrants on the date of grant. The model

assesses several factors in calculating the fair value. These

include the market price on the date of grant, the exercise price

of the share options, the expected share price volatility of the

Company's share price, the expected life of the options, the

risk-free rate of interest and the expected level of dividends in

future periods.

For those options granted where IFRS 2 "Share-Based Payment" is

applicable, the fair values were calculated using the Black-Scholes

model. The inputs into the model were as follows:

Date of grant Risk free Share price Expected Share price

rate volatility life at grant date

Obonga options-

August 2021 0.66% 55% 5 years 0.1363

Management options-

August 2021 0.77% 55% 5 years 0.1175

Placing Warrants-

Sept 2021 0.77% 55% 2 years 0.1325

The total charge/(credit) to the consolidated statement of

comprehensive income for the period to 30 June 2022 was a credit of

GBP89,705 (2021: credit of GBP134,164). The transactions from

exercising share options are shown within the statement of changes

in equity.

7. Conditional Disposal of the Big Bear Project

On 7 April 2022, the Company announced the conditional disposal

of the Big Bear Project to Fulcrum Metals (Canada) Limited for a

consideration equal to GBP200,000 and consideration shares equal to

20% of the share capital of Fulcrum Metals Limited (the parent

company of Fulcrum Metals (Canada) Limited. The transaction is

conditional on the share capital of Fulcrum Metals Limited being

admitted to trading on AIM not later than 31 October 2022, which

was subsequently extended to 30 November 2022. If completion does

not occur before the longstop date Panther will be due a payment of

50,000 Euro from Fulcrum.

8. Subsequent events

Placing

On 18 August 2022, the Company announced the Placing and

admission of 20,872,726 ordinary shares at a price of 5.5 pence per

Placing Share in raising gross proceeds of GBP1,148,000 . The total

number of ordinary shares in issue on Admission of these Placing

shares was 92,214,065.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFFFARIRFIF

(END) Dow Jones Newswires

September 27, 2022 02:01 ET (06:01 GMT)

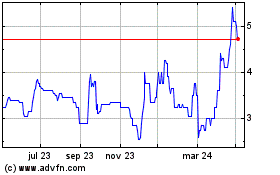

Panther Metals (LSE:PALM)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

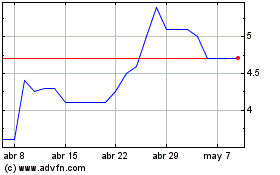

Panther Metals (LSE:PALM)

Gráfica de Acción Histórica

De May 2023 a May 2024