PHSC Plc Commencement of Further Share Buyback Programme

15 Agosto 2023 - 1:00AM

UK Regulatory

TIDMPHSC

15 August 2023

PHSC PLC

("PHSC" or the "Company")

Commencement of Further Share Buyback Programme

PHSC (AIM: PHSC), a leading provider of health, safety, hygiene and

environmental consultancy services and security solutions to the public and

private sectors, further to the recent announcement of its final results for the

year ended 31 March 2023, is pleased to announce the commencement of a further

share buyback programme in respect of ordinary shares of 10p each in the capital

of the Company ("Ordinary Shares") up to a maximum of 1,184,701 Ordinary Shares

or such number of Ordinary Shares as may be acquired for a gross amount of

£200,000, whichever is the lower (the "Buyback Programme"). The Buyback

Programme forms part of the Company's broader strategy to deliver returns to its

shareholders and the Company intends to buy Ordinary Shares in the market as

well as any larger parcels of Ordinary Shares, to the extent they become

available.

The Company's board of directors (the "Board") has decided to effect the Buyback

Programme in light of the Company's previous successful buyback programmes

conducted in 2021 and 2022 and the fact that PHSC's closing middle market share

price as at 14 August 2023, being the latest practicable date prior to this

announcement, of 18.5p represents a significant discount to the last disclosed

net asset value per share of approximately 30.7p per the Company's audited final

results for the year ended 31 March 2023. The Board believes that the Buyback

Programme will enable the Company to further optimise its capital structure.

The Buyback Programme will be managed by Novum Securities Limited ("Novum"), the

Company's broker. The Buyback Programme will be implemented in accordance with

the terms of the Company's pre-existing authority to make market purchases of

its Ordinary Shares (the "Authority"), as granted at the Company's annual

general meeting held on 29 September 2022 and will be conducted within certain

set parameters.

Pursuant to the Authority, the maximum price to be paid per Ordinary Share is to

be no more than 105 per cent. of the average middle market closing price of an

Ordinary Share over the five business days preceding the date of purchase. The

Buyback Programme will commence today and will continue, subject to not being

completed earlier, until close of business on 27 September 2023, being the last

business day prior to the Company's 2023 Annual General Meeting at which the

buyback authority is scheduled to be replenished whereupon the programme's

efficacy will be reviewed and a further announcement made as appropriate.

Any shareholders wishing to sell Ordinary Shares pursuant to the Buyback

Programme should contact Novum on the telephone number set out below. Any

repurchases shall be at the sole discretion of the directors of the Company

(other than the Concert Party Directors, as defined below) and shall be effected

in such manner and on such terms as they may from time to time determine in line

with the Authority.

Any Ordinary Shares acquired by the Company pursuant to the Buyback Programme

will be announced to the market and will initially be held in treasury and may

be cancelled at a later date.

Due to the limited liquidity in the issued Ordinary Shares, any buyback of

Ordinary Shares pursuant to the Authority on any trading day may represent a

significant proportion of the daily trading volume in the Ordinary Shares on AIM

and may exceed 25 per cent. of the average daily trading volume, being the limit

laid down under Article 5(1) of the Market Abuse Regulation (EU) No. 596/2014 as

it forms part of United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended, and, in such circumstances, the Company will

not benefit from the exemption contained in that Article.

The Company's current cash position (as at 14 August 2023) is approximately

£734,074.

The Company confirms that it currently has no unpublished price sensitive

information other than that which has been disclosed above.

City Code Considerations, Concert Party and Related Party Transaction

The Board notes that certain of the Company's directors, namely Stephen King

(Chairman and CEO) and Nicola Coote (Deputy Chairman and Deputy CEO), co

-founders and longstanding executive directors of the Company, are deemed, along

with their respective spouses and close relatives, to be members of a concert

party in respect of the Company as defined in the City Code on Takeovers and

Mergers (the "City Code") (the "Concert Party"). The Concert Party is currently

interested, in aggregate, in 5,142,104 Ordinary Shares representing

approximately 43.40 per cent. of the Company's existing issued share capital.

The City Code, which is issued and administered by The Panel on Takeovers and

Mergers (the "Panel"), applies to the Company, as an AIM quoted company with a

UK registered office, and, as such, the Company's shareholders are entitled to

the protections afforded by the City Code. As the Buyback Programme may result

in an increase in the proportionate voting interests of each Shareholder who

retains an unaltered shareholding following any share purchases effected by the

Company, it gives rise to certain considerations under the City Code.

Under Rule 9 of the City Code, where any person acquires, whether by a series of

transactions over a period of time or not, an interest (as defined in the City

Code) in shares which (taken together with shares in which such person is

already interested and in which persons acting in concert with such person are

interested) carry not less than 30 per cent. but does not hold more than 50 per

cent. of the total voting rights of a company which is subject to the City Code,

that person, and any person(s) acting in concert with them, is normally required

by the Panel to make a general offer in cash to all of the remaining

shareholders to acquire the remaining shares in that company not held by it

and/or its concert parties (a "Rule 9 Offer"). Rule 37.1 of the City Code

further provides that when a company redeems or purchases its own shares, any

resulting increase in the percentage of shares carrying voting rights in which a

person or group of persons acting in concert is interested will be treated as an

acquisition for the purposes of Rule 9 of the City Code.

Accordingly, certain members of the Concert Party, namely Stephen King and

Nicola Coote (the "Concert Party Directors"), have agreed, prior to any share

purchases occurring pursuant to the Buyback Programme, to enter into irrevocable

undertakings in respect of the Buyback Programme (the "Irrevocables"). Pursuant

to the terms of the Irrevocables, the Concert Party Directors will irrevocably

and unconditionally agree to sell (in the case of Stephen King, via his SIPP

provider, the entity which holds the majority of his interest in the Ordinary

Shares) to the Company such number of Ordinary Shares as is required to ensure

that the existing aggregate percentage holding of the Concert Party does not

increase at any time as a result of the implementation of the Buyback Programme.

Any such disposals shall be conducted at the same time and on the same terms as

the third-party trade(s) under the Buyback Programme triggering the requirement,

and it is intended that such trades be effected so as to broadly maintain

Stephen King's and Nicola Coote's existing respective percentage holdings. The

Irrevocables shall ensure that the Concert Party's existing aggregate interest

of approximately 43.40 per cent. in the Company's existing issued share capital

does not increase as a result of the Buyback Programme and, accordingly, that no

mandatory Rule 9 Offer shall be triggered or be required in connection with the

Buyback Programme under the City Code. The Concert Party Directors shall also

undertake pursuant to the terms of the Irrevocables not to otherwise participate

in the Buyback Programme.

Entry into the Irrevocables by the Concert Party Directors is deemed to

constitute a related party transaction for the purposes of Rule 13 of the AIM

Rules for Companies. Accordingly, the Board (excluding the Concert Party

Directors, who are not deemed to be independent) (the "Independent Directors")

consider, having consulted with the Company's nominated adviser, Strand Hanson

Limited, that the terms of the Irrevocables are fair and reasonable insofar as

the Company's shareholders are concerned.

For further information please contact:

PHSC plc

Stephen KingTel: 01622 717 700

Stephen.king@phsc.co.uk (https://www.investegate.co.uk/phsc-plc--phsc

-/prn/trading-update/20170526111953P8859/null)

www.phsc.plc.uk

Strand Hanson Limited (Nominated Adviser)Tel: 020 7409 3494

James Bellman / Matthew Chandler

Novum Securities Limited (Broker)Tel: 020 7399 9427

Colin Rowbury

About PHSC

PHSC, through its trading subsidiaries, Personnel Health & Safety Consultants

Ltd, RSA Environmental Health Ltd, QCS International Ltd, Inspection Services

(UK) Ltd and Quality Leisure Management Ltd, provides a range of health, safety,

hygiene, environmental and quality systems consultancy and training services to

organisations across the UK. In addition, B2BSG Solutions Ltd offers innovative

security solutions including tagging, labelling and CCTV.

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulation

(EU) No. 596/2014 as it forms part of United Kingdom domestic law by virtue of

the European Union (Withdrawal) Act 2018, as amended by virtue of the Market

Abuse (Amendment) (EU Exit) Regulations 2019.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

August 15, 2023 02:00 ET (06:00 GMT)

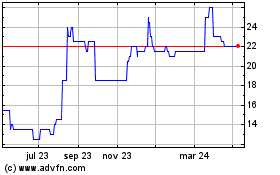

Phsc (LSE:PHSC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

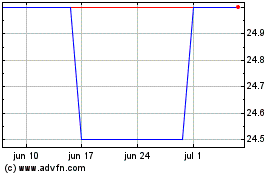

Phsc (LSE:PHSC)

Gráfica de Acción Histórica

De May 2023 a May 2024